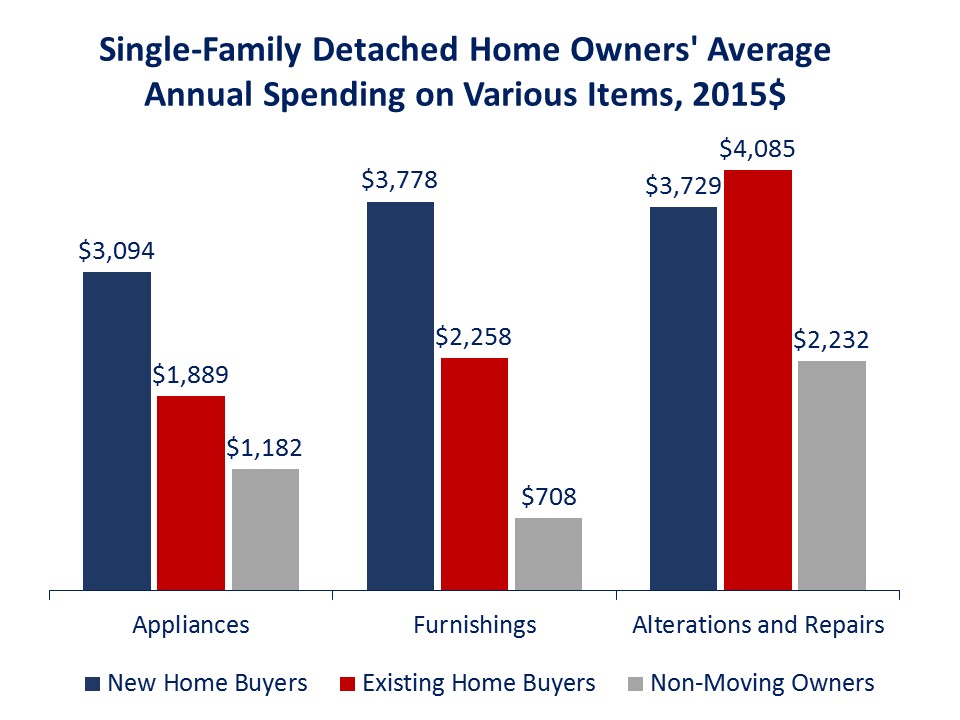

In a prior recent post we discussed NAHB research showing how during the first year after closing on a home sale, home buyers tend to spend considerably more money on furnishings, appliances and remodeling compared to non-moving owners. Buyers of new homes spend most, outspending non-movers by a factor of 2.6. Buyers of existing homes spend twice as much as non-moving owners. This post reveals particular items that are most popular with home buyers and help explain changes in their spending behavior triggered by a house purchase.

The NAHB analysis of the Consumer Expenditure Survey (CES) data from the Bureau of Labor Statistics shows that the biggest outlay in the budget of new home buyers is furnishings. They spend $3,778 on furnishings outspending old home buyers 70 percent and non-moving owners 5.3 times. Average spending is estimated for all households in the group regardless whether they purchased a certain item or not. Thus, higher averages may point to larger and/or more frequent spending by the group.

Compared to non-moving owners, new home buyers spend more on every single item the CES counts as furnishings with the exception of infants furniture and other furnishings. They also outspend existing home buyers on nearly all furnishing items with the exception of office furniture, dinnerware, and infants equipment.

A home purchase, especially when it is a new home, has a particularly large effect on expenditures on living room chairs/tables and dining room/kitchen furniture. During the first year after moving, new home buyers spend $687 on living room chairs and tables outspending non-moving owners and existing home buyers 12 and 5 times respectively. The average spending by new home buyers on dining room and kitchen furniture is $345. This is 12 times higher than the amount spent by non-moving owners and exceeds the respective spending of existing home buyers 9 times.

The differences in spending patterns are similarly large when comparing spending on window coverings. New home buyers outspend non-moving owners 10 times ($215 compared to $21), while existing home buyers (with an average annual spending on window covering of $78) outspend non-moving owners 4 times.

The biggest ticket item for new home buyers is sofas, with an average spending exceeding $700 during the first year after moving. This is 60 percent higher than the amount spent by buyers of existing homes and 6.4 times higher than what non-moving owners typically spend on sofas per year.

New home buyers also spend more on appliances – $3,094, compared with $1,889 for existing home buyers and $1,182 for non-moving owners. The biggest outlay in the appliance budget of new home buyers are clothes washers/dryers, lawnmowers/other yard equipment, and computer hardware/systems. Coincidentally, new home buyers outspend existing home buyers and non-moving owners on all these appliances. They also outspend non-moving owners on such big-ticket items as refrigerators/home freezers and televisions.

The high level of spending by new home buyers may seem surprising considering that many new homes come with installed appliances, but suggests that these purchases are nevertheless more frequent among these households. The Builder Practices Survey conducted by the Home Innovation Research Labs has insightful data on why some appliances are more likely to be purchased by new home buyers. It shows that two-thirds of new homes built in 2015 came with no clothes washers and dryers and 36 percent had no installed refrigerators. At the same time, virtually all new homes came with cooking stoves, ranges, or ovens.

Somewhat unexpectedly, new home buyers spend almost as much ($3,729) as buyers of existing homes ($4,085) and outspend non-moving owners ($2,232) on property alterations and repairs. However, the specific types of remodeling projects are quite different across the groups. As anticipated, buyers of existing homes and non-moving owners spend more on various repairs and replacements. They also outspend new home buyers on kitchen/bathroom addition or remodeling, and purchasing and installing new items such as HVAC, electrical and security systems, paneling, flooring, siding, windows and doors. Average spending of new home buyers on most of these items is close to nothing, suggesting that new home buyers rarely spend on these items during the first year after moving. However, when it comes to outside additions and alterations, including a new driveway, walk, or fence, new home buyers outspend existing home buyers and non-moving owners by far.

Even though, during the first year after closing on the house, home buyers tend to spend on furnishings, appliances, and property alterations considerably more compared to non-moving owners, most of the demand for appliances, furnishings, and remodeling projects in a given year is generated by non-moving home owners, because they outnumber home buyers by such a wide margin.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Very interesting. I always thought that new home buyers would buy appliances first more than anything else .