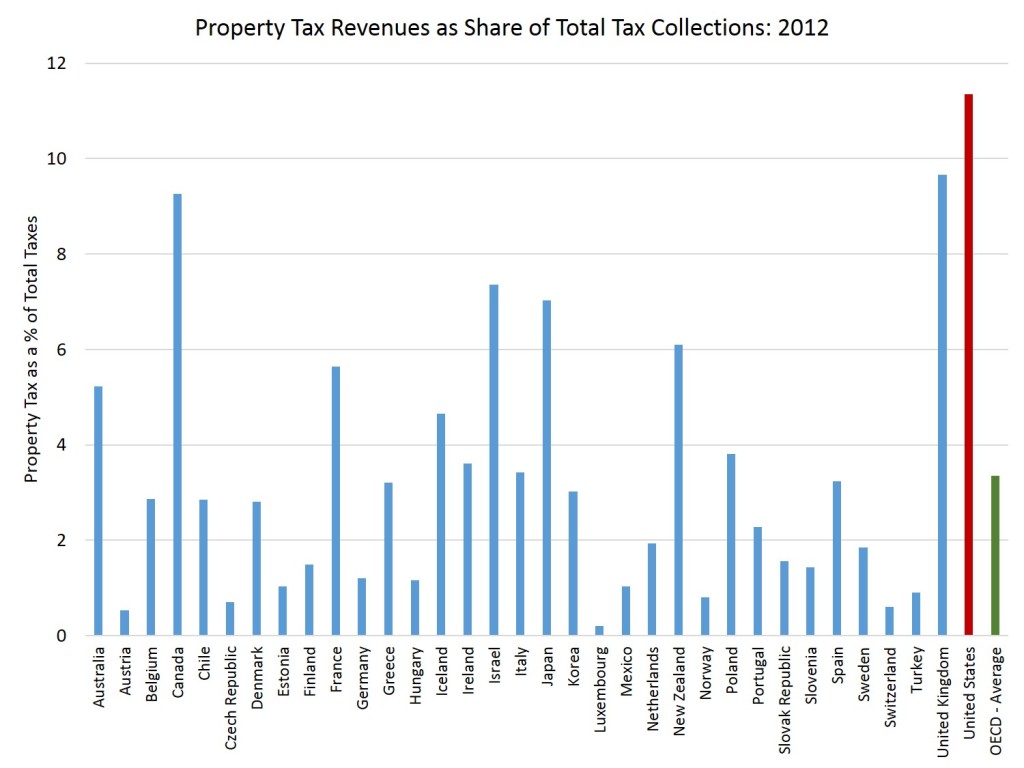

As a share of total taxes collected, real estate property taxes in the United States are responsible for a relatively high share of total government revenues.

According to statistics produced by the Organisation for Economic Cooperation and Development (OECD), the average share of total government tax collections due to real estate property taxes (recurrent taxes on immovable property) was 3.347%. In contrast, for the United States, the OECD data reflect an 11.35% share.

The OECD data become less detailed when narrowing down to just residential real estate property taxes, with some nations having limited estimates (including the U.S.). Nonetheless, I estimate that property taxes for owner-occupied housing totaled just under $200 billion and accounted for 4.64% of U.S. tax receipts in 2011 (the residential data are more complete for 2011 than 2012). According to the OECD, the average share for residential property taxes for reporting nations was just 1.035% for 2011.

These estimates make clear the degree to which the U.S. relies on property tax collections more than other nations. There are many reasons for this, including the fact that U.S. property taxes are collected by state/local governments. The U.S. also has an overall lower tax burden than other nations. According to the same OECD data, taxes from all sources made up 24.4% of GDP in the U.S., compared to 33.7% average for all OECD nations.

These numbers are important to keep in mind when some policy analysts make the claim that real estate is undertaxed. Such arguments, usually made as part of income tax debates, typically ignore the large degree to which state and local government revenues depend on property tax collections (just under 40% of state and local tax collections among major sources at the start of 2015).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.