New NAHB Economics research shows that the share of young adults ages 18 to 34 living with parents or parents-in-law increased sharply in the late 2000s. According to the most recent American Community Survey (ACS), one in three young adults ages 18 to 34, or more than 24 million, lived in homes of their parents or parents-in-law in 2012. By comparison, the 1990 and 2000 Censuses reported that only one in four young adults ages 18 to 34 lived with parents at that time.

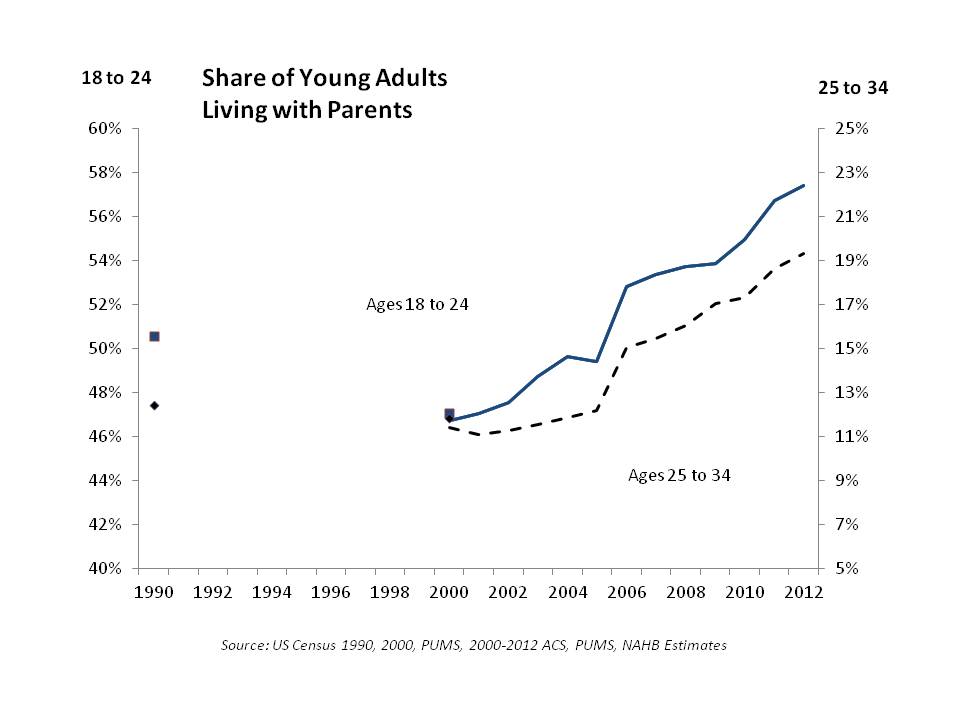

The NAHB analysis shows that the biggest shift in the preferences of young adults to live with parents happened after 2005. This is particularly true for older young adults, ages 25 to 34, whose share living with parents was fluctuating around 12 percent from 1990 through 2005 and then quickly rose to exceed 19 percent in 2012 (see figure below). The younger cohort, ages 18 to 24, was more likely to live with parents in 1990, when more than half of these adults lived with parents, than in the early 2000s. However, by 2006 this share exceeded 50 percent again and grew to more than 57 percent in 2012.

Rising college enrollment among younger adults ages 18 to 24 helps explain their increased preferences for not leaving parental homes. The majority of adults in this age group, 52 percent, attended school or college in 2012, compared to 45 percent in 2000 and 43 percent in 1990. College attendance plays a less important role in the decision of older adults, ages 25 to 34, to stay at parents’ home. Less than 14 percent of adults in this older cohort were still in college or school in 2012, the comparable share in 1990 and 2000 was just slightly below, close to 12 percent.

For older, more experienced and better educated adults ages 25 to 34, the ability to find stable, higher-paying jobs plays an increasing role. As unemployment rates kept increasing in the late 2000s so did the shares of young adults living with parents. In 2000, the shares of unemployed in this age group were 7 percent among young adults living with parents and 4 percent among those living independently. By 2012, these shares reached 14 percent among adults living with parents and 6 percent among same age adults living independently.

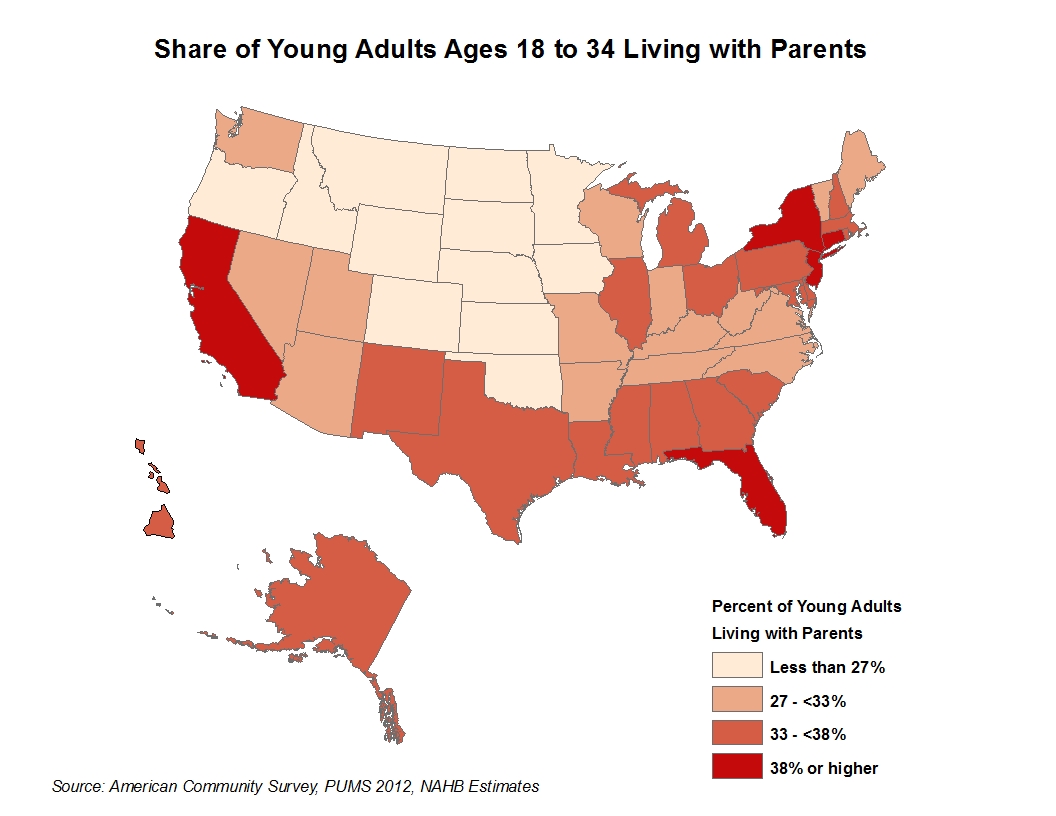

The NAHB report also analyzes state unemployment rates and finds that, on average, states with larger increases in unemployment rates among young adults registered larger gains in percent of young adults living with parents. Even though unemployment rates started to decline in most states in 2011, shares of young adults living with parents remain stubbornly high and even increased in some states, suggesting that it takes longer for young adults to overcome the overall sense of economic instability, gain confidence and financial independence before leaving parents’ homes. This is particularly true for states hardest hit by the housing boom and bust, such as California and Florida, where percent of young adults living with parents continued to rise through 2012 despite improving job markets.

As of 2012, three Northeast states – New Jersey, Connecticut, and New York – register the nation’s highest shares of young adults ages 18 to 34 living with parents or parents-in-law – 45, 42 and 41 percent, respectively (see the map above). California and Florida – two of the states hardest hit by the housing boom and bust – follow with their shares just slightly under 40 percent. At the opposite end of the spectrum are the District of Columbia known for its relatively stable job market and North Dakota known for its oil booming economy – both registering shares under 20 percent.

Young adults ages 25 to 34 traditionally represent about half of all first-time home buyers. Their delayed willingness and ability to leave parental homes and strike out on their own undoubtedly contributed to suppressing housing demand further during the Great Recession. Declining shares of young adults living with parents in some states – Rhode Island, Montana, Wyoming, Maine, Delaware and New Mexico among others – could be one of the early signs that pent-up housing demand may finally start turning into realized housing demand.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

The rate of living at home for young adults in California, as compared to other states, is likely boosted by the high cost of rental housing in major metropolitan markets, especially the Bay Area but also large parts of Creater LA and San Diego County. The same is probably true of New York State where high cost NYC accounts for about 43% of the statewide population.

This is more evidence of how current national housing policy is hurting first-time homebuyers and further delaying a recovery in the housing market. Now that HUD has priced FHA financing out of the market in order to improve is financial posture, it would be a good bet that the percentage of your adults living with their parents will only increase. Also adding to the problem is the fact that about 50% of recent college graduates are either unemployed or under-employed. There is little hope of turning this evidence of pent up demand into action demand until someone in Washington wises up, looks back to see that FHA financing was one of the principal drivers of past housing recoveries, and reverse what has been done since 2008.