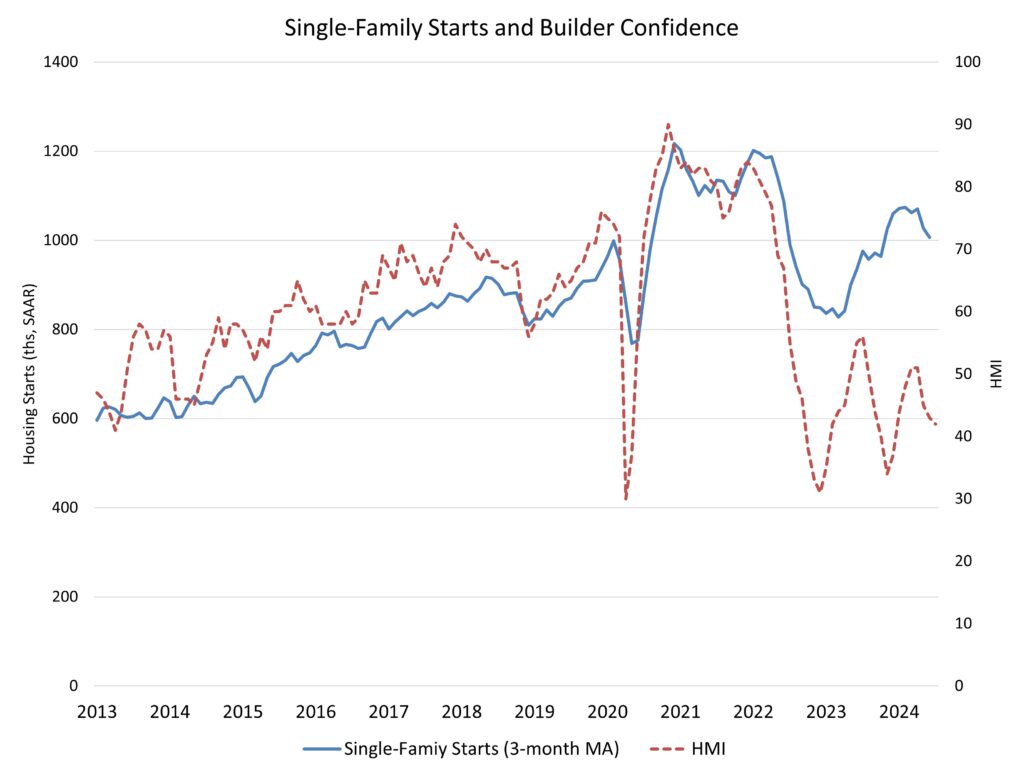

Elevated interest rates for home mortgages and construction and development loans kept single-family production and demand in check during June.

Overall housing starts increased 3.0% in June to a seasonally adjusted annual rate of 1.35 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

The June reading of 1.35 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts decreased 2.2% from an upwardly reviewed May figure to a 980,000 seasonally adjusted annual rate. However, on a year-to-date basis, single-family starts are up 16.1% thus far in 2024.

Lower single-family starts are in line with our latest industry surveys, which show that builders are concerned about the current high interest rate environment. With better inflation data, the Federal Reserve is expected to begin rate reductions later this year. An improving interest rate environment will help buyers as well as builders and developers who are contending with tight lending conditions and high interest rates. And with total (new and existing) home inventory at a relatively low 4.4 months’ supply, builders are prepared to increase production in the months ahead. Indeed, NAHB survey data of forward-looking builder sales expectations saw a gain in July.

The volatile multifamily sector, which includes apartment buildings and condos, increased 19.6% in June to an annualized 373,000 pace. The general trend for apartment construction is lower however. The pace of multifamily 5-plus unit starts are down 23.4% from a year ago. And on a year-to-date basis, multifamily 5-plus unit starts are down 36.3%.

On a regional and year-to-date basis, combined single-family and multifamily starts 9.9% lower in the Northeast, 3.4% lower in the Midwest, 3.5% lower in the South and 0.7% higher in the West.

Overall permits increased 3.4% to a 1.45 million unit annualized rate in June. Single-family permits decreased 2.3% to a 934,000 unit rate. Multifamily permits increased 15.6% to an annualized 512,000 pace.

Looking at regional data on a year-to-date basis, permits are 0.8% lower in the Northeast, 3.0% higher in the Midwest, 0.7% lower in the South and 3.8% lower in the West.

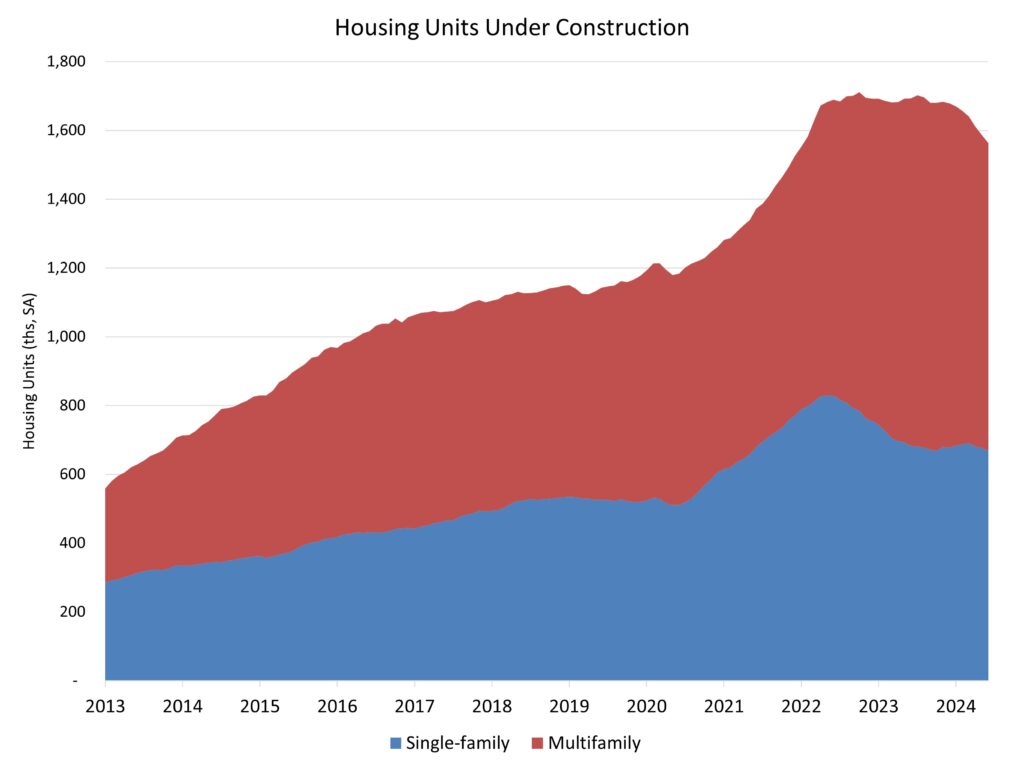

The total number of single-family homes and apartments under construction was 1.56 million in June. This is the lowest total since January 2022.

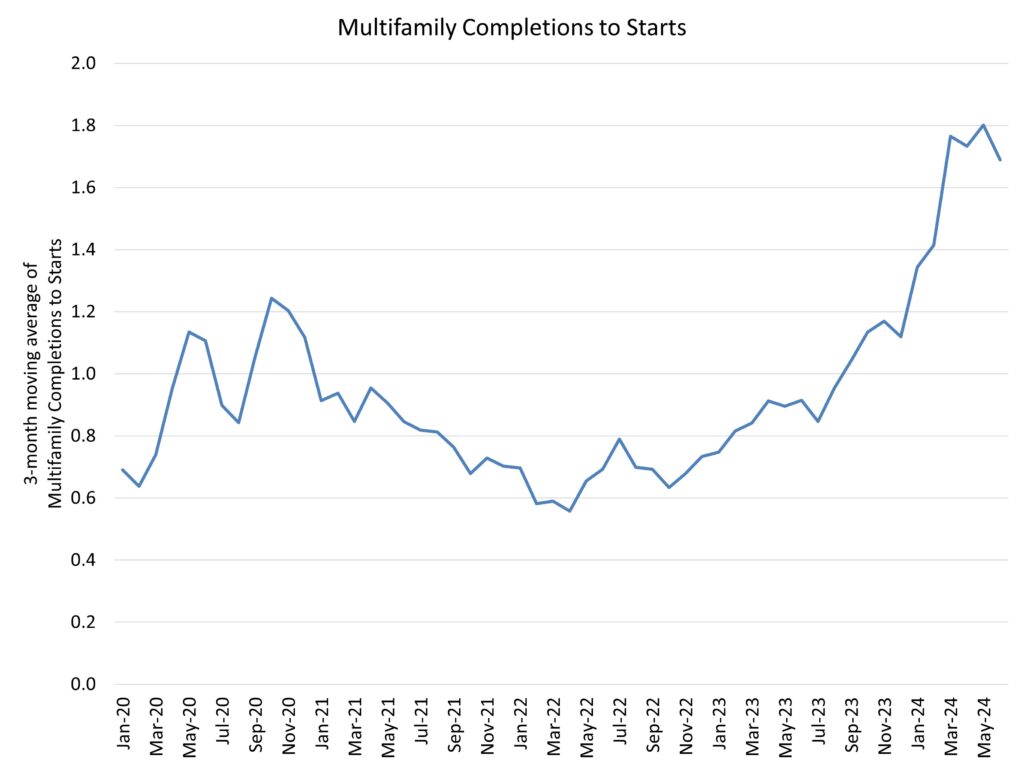

Single-family homes under construction fell back 1.3%, to a count of 668,000—down 2.2% from a year ago. The number of multifamily units under construction continues to fall, declining 1.6% to an 895,000 count—down 11.4% from a year ago. The number of multifamily units under construction is now the lowest since August 2022. This count will continue to fall. On a 3-month moving average basis, there are currently 1.7 apartments completing construction for every 1 that is beginning construction.

Multifamily completions reached a 673,000 seasonally adjusted annual rate in June. This is the fastest pace for apartment completions since May of 1986. This additional supply will provide some added relief for shelter inflation and provide confidence for the Fed to begin cutting interest rates this year.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.