The labor market may not be as strong as previously estimated, according to the Bureau of Labor Statistics’ preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to full population counts of employment for the month of March. It improves the accuracy of the CES all-employee series and provides an early look at adjustments to employment data.

According to the preliminary estimate of the benchmark revision, total payroll employment for the period from April 2023 to March 2024 (12 months) was lowered by 818,000, about 0.5% less than previously estimated. If the final benchmark revision is not far off the preliminary one, this preliminary estimate of the upcoming annual benchmark revision would be the largest downward revision since March of 2009 (the 2009 revision was a reduction of 902,000 estimated jobs).

Additionally, while the CES data show that 2.9 million jobs were added from April 2023 to March 2024, the preliminary estimate of the benchmark revision suggests that job growth was overstated by about 40%. On a monthly basis, there were about 68,000 fewer jobs on average in the 12-month period through March 2024.

Among major industry sectors, five sectors saw an upward revision in employment, led by private education and health services (+87,000) and transportation and warehousing (+56,400). Meanwhile, professional and business services had the largest downward revision of 358,000 jobs, followed by leisure and hospitality shedding 150,000 jobs.

Closer to housing, construction employment was revised down by 45,000, 0.6% less than the initially reported 8.2 million jobs in place. The average monthly job gains for the construction sector were revised down by 17% to 18,000 jobs in the 12-month period through March 2024.

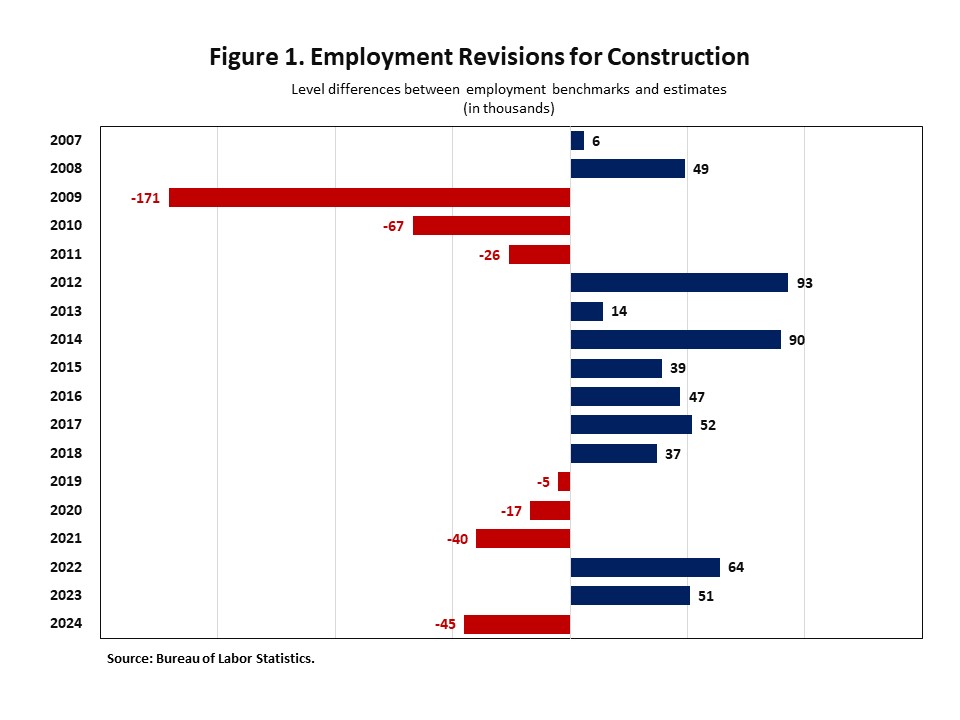

Figure 1 shows the level difference between revised employment data and previous estimates for the construction sector from 2007 to 2024. The red bars mark the downward revisions, while the blue bars present the upward revisions. From top to bottom, there are three consecutive red bars from 2009 to 2011, another three red bars from 2019 to 2021, and the last one in 2024.

During the period of the 2008 recession and the COVID-19 pandemic, construction employment was overestimated for three straight years, respectively. The current preliminary benchmark revision for the construction sector is the largest downward revision since March 2010.

Note: The existing employment data will not be updated with the release of the preliminary benchmark estimate. The data for all CES series will be updated when the final benchmark revision is issued in February 2025.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.