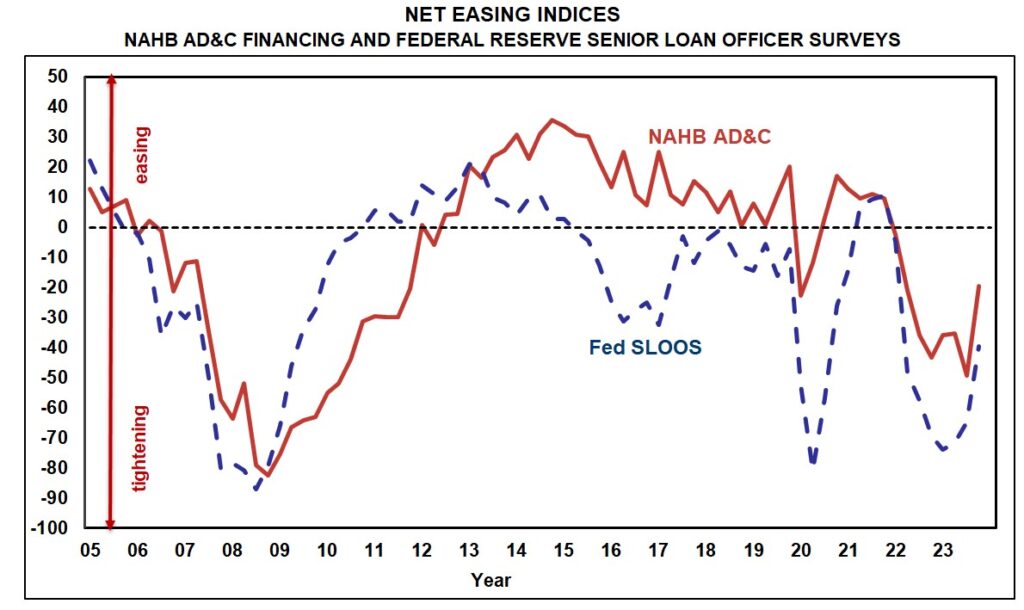

During the fourth quarter of 2023, credit for residential Land Acquisition, Development & Construction (AD&C) remained tight, according to both NAHB’s survey on AD&C Financing and the Federal Reserve’s . However, the tightening was not as widespread as it was in recent quarters. The net easing indices derived from both surveys were negative once again in the fourth quarter, indicating net tightening of credit, but not as negative as they were in the third quarter. The NAHB index posted a reading of -19.7, compared to -49.3 in the third quarter, while the Fed’s index posted a reading of -39.7 compared to -64.9 in the third quarter. Although both the NAHB and Fed indices have been in negative territory for eight consecutive quarters, the fourth quarter 2023 readings were as close to positive as either index has been since the first quarter of 2022.

According to the NAHB survey, the most common ways in which lenders tightened in the fourth quarter were by reducing the amount they are willing to lend (cited by 73% of the builders and developers who reported tighter credit conditions), increasing the interest rate on the loans (69%), and lowering the allowable Loan-to-Value or Loan-to-Cost ratio (65%).

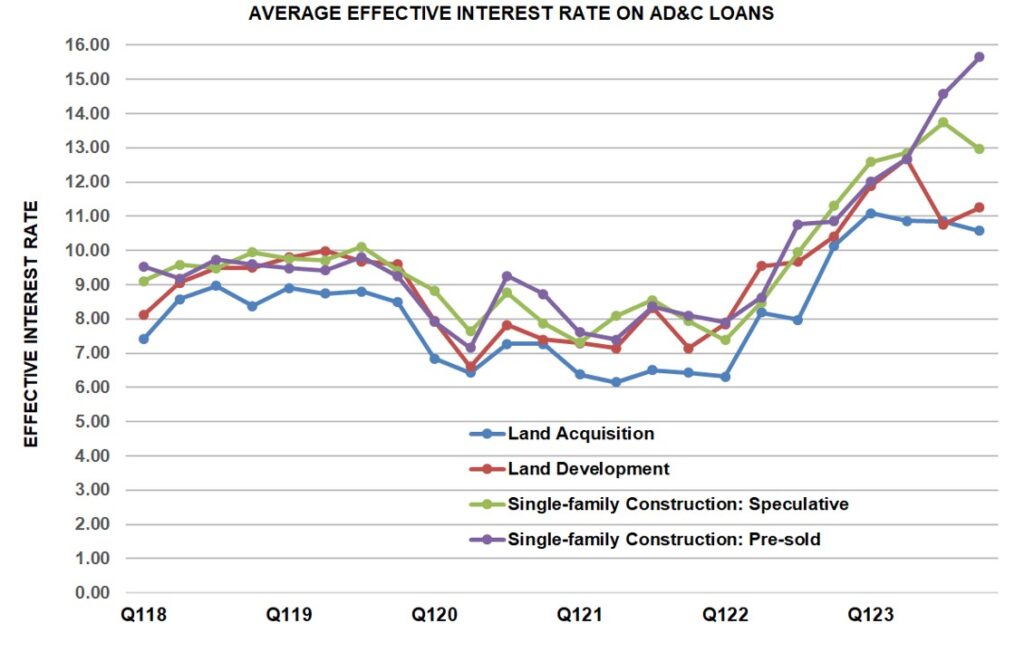

Meanwhile, results from the NAHB survey on the cost of the credit were mixed. Quarter-over-quarter, the average contract rate remained the same on loans for land acquisition at 8.31% but increased from 7.78% to 8.12% on loans for land development, and from 8.37% to 8.40% on loans for pre-sold single-family construction. In contrast, the average contract rate declined from 8.66% to 8.41% on loans for speculative single-family construction.

The average initial points paid on the loans declined from 0.86% to 0.71% on loans for land acquisition and from 0.93% to 0.73% on loans for speculative single-family construction but increased from 0.58% to 0.60% on loans for land development, and from 0.86% to 1.08% on loans for pre-sold single-family construction that are tracked in the NAHB AD&C survey.

The above changes caused the average effective interest rates (rate of return to the lender over the assumed life of the loan, taking both the contract interest rate and initial points into account) to move in different directions. There was a relatively small decline (from 10.85% to 10.58%) on loans for land acquisition, and a more substantial decline (from 13.74% to 12.96%) on loans for speculative single-family construction. On the other hand, the average effective rate increased from 10.76% to 11.25% on loans for land development, and from 14.57% to 15.65% on loans for pre-sold single-family construction.

More detail on credit conditions for builders and developers is available on NAHB’s AD&C Financing Survey web page.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

While the tightening is less widespread, lenders must still be proactive in offering financing solutions tailored to builders’ needs. Strategic partnerships and innovative loan structures can help address credit constraints and support sustainable growth in the construction sector.