According to the Federal Reserve Board’s November 2023 Senior Loan Officer Opinion Survey (SLOOS), lending standards tightened for all commercial real estate (CRE) loan categories and most residential real estate (RRE) categories in the third quarter of 2023. Moreover, demand for RRE and CRE loans weakened across all categories over the quarter.

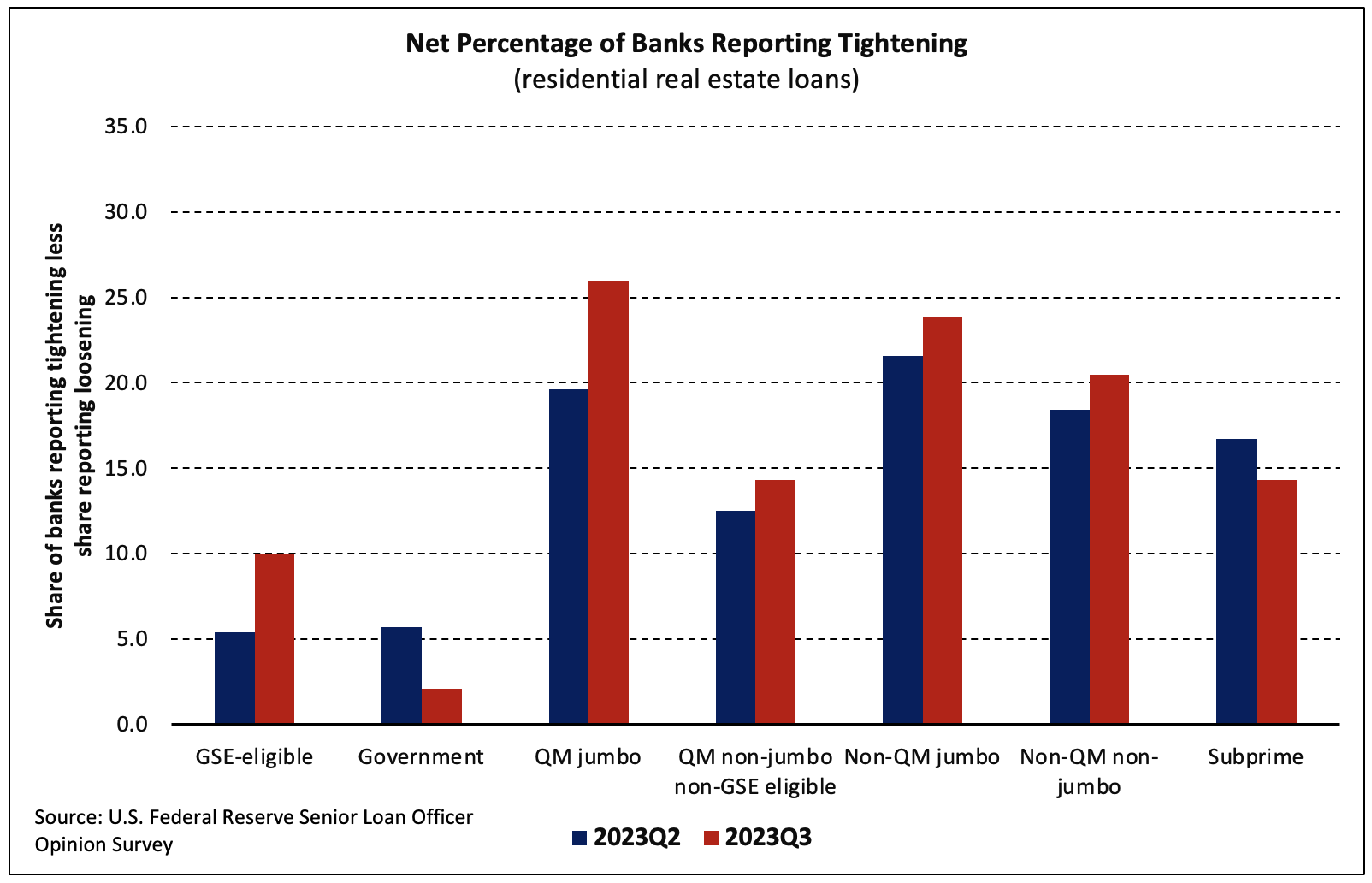

A higher net percentage of banks reported tighter residential mortgage lending standards in Q3 compared to Q2 across all categories of RRE loans except government and subprime. The net share of banks that tightened standards for subprime loans fell to 14.3% while just 2.1% of banks, on net, reported stricter standards for government loans.

In contrast, the share increased from 19.6% to 26.0% for QM jumbo. The remaining loan categories all saw relatively modest increases.

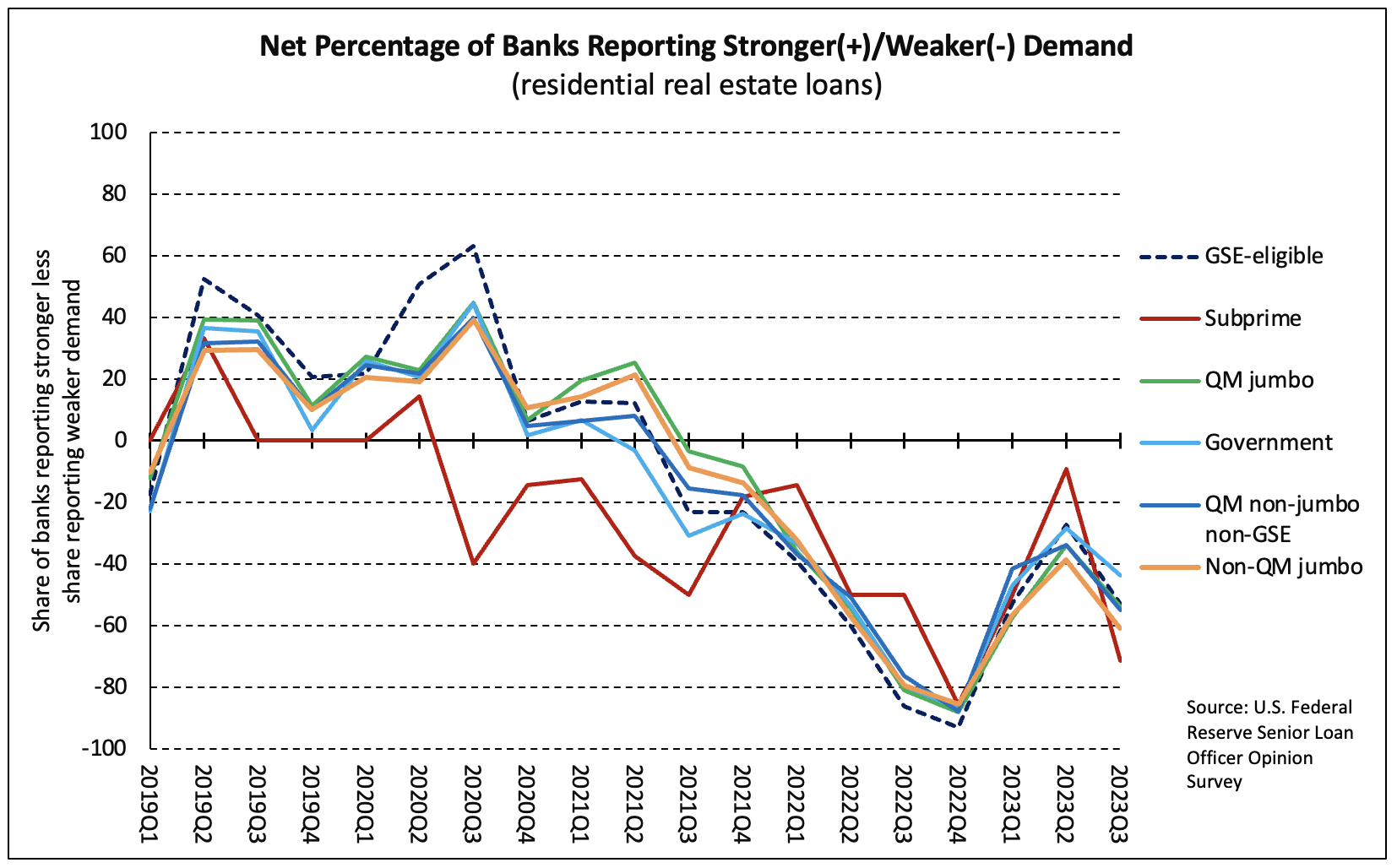

Whereas tightening relaxed for two RRE loan categories, no category was spared from declining demand in Q3. The net share of banks reporting weaker demand for all RRE loans nearly doubled over the quarter, climbing from 30.9% to 56.8%. Declining demand was most widespread for subprime loans as 71.4% banks reported weaker demand, on net, up from 9.1% in Q2 2023.

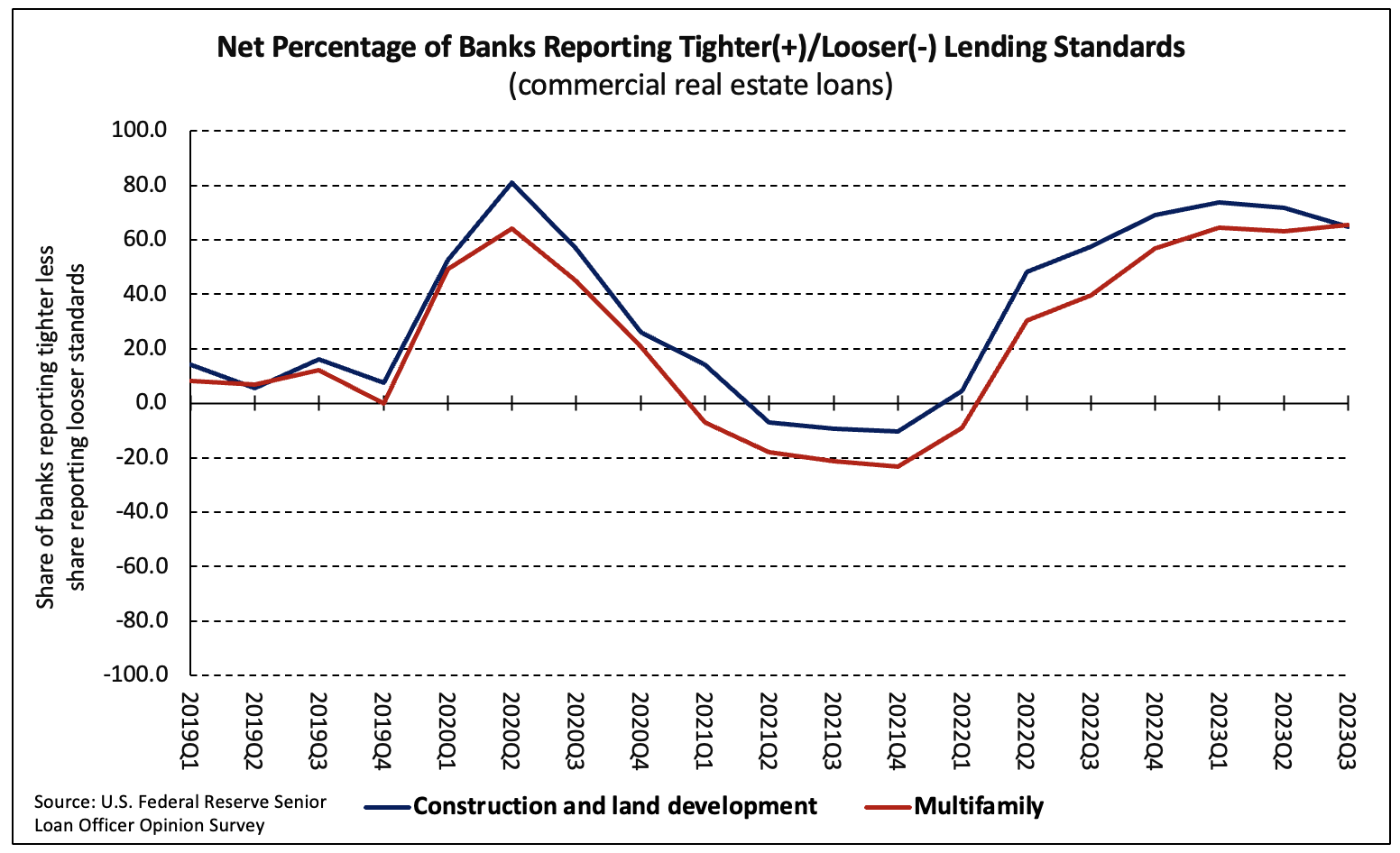

Roughly two-thirds of banks reported tightened standards for both multifamily loans as well as all CRE construction and development loans, on net, in Q3 relative to Q2.

Major shares (greater than 50%) of banks reported weaker demand for construction and development (52.6%) and loans secured by multifamily properties (55.2%) in the third quarter. Those shares were little changed over the quarter but are higher than they were one year ago.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.