High mortgage rates that approached 8% earlier this month continue to hammer builder confidence, but recent economic data suggest housing conditions may improve in the coming months.

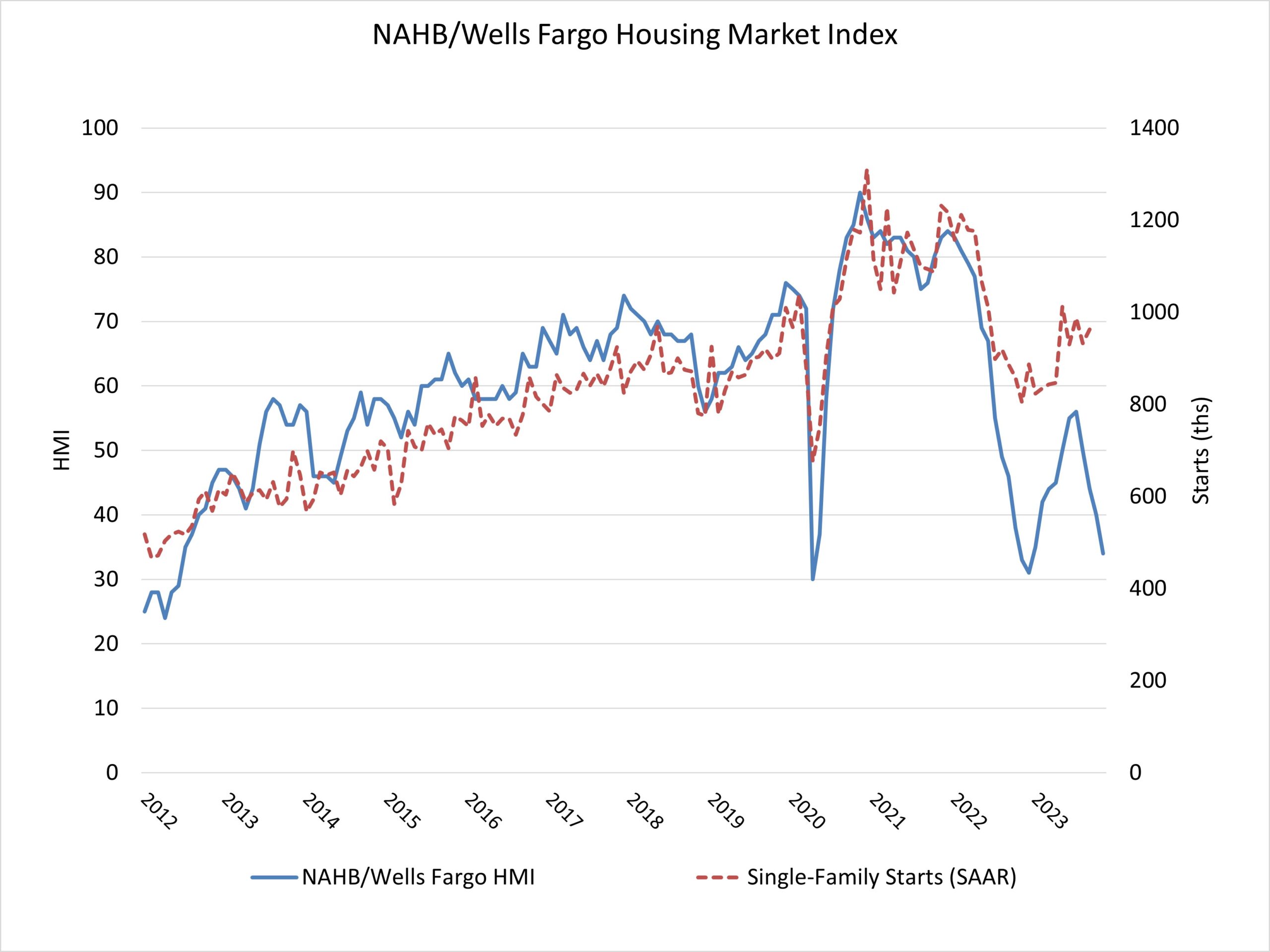

Builder confidence in the market for newly built single-family homes in November fell six points to 34 in November, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This is the fourth consecutive monthly drop in builder confidence, as sentiment levels have declined 22 points since July and are at their lowest level since December 2022. Also of note, nearly the entire HMI data for November was collected before the latest Consumer Price Index was released and showed that inflation is moderating.

The rise in interest rates since the end of August has dampened builder views of market conditions, as a large number of prospective buyers were priced out of the market. Moreover, higher short-term interest rates have increased the cost of financing for home builders and land developers, adding another headwind for housing supply in a market low on resale inventory. While the Federal Reserve is fighting inflation, state and local policymakers could also help by reducing the regulatory burdens on the cost of land development and home building, thereby allowing more attainable housing supply to the market.

While builder sentiment was down again in November, recent macroeconomic data point to improving conditions for home construction in the coming months. In particular, the 10-year Treasury rate moved back to the 4.5% range for the first time since late September, which will help bring mortgage rates close to or below 7.5%. Given the lack of existing home inventory, somewhat lower mortgage rates will price-in housing demand and likely set the stage for improved builder views of market conditions in December.

NAHB is forecasting approximately a 5% increase for single-family starts in 2024 as financial conditions ease with improving inflation data in the months ahead.

But with mortgage rates running above 7% since mid-August, per Freddie Mac data, many builders continue to reduce home prices to boost sales. In November, 36% of builders reported cutting home prices, up from 32% in the previous two months. This is the highest share of builders cutting prices during this cycle, tying the previous high point set in November 2022. The average price reduction in November remained at 6%, unchanged from the previous month. Meanwhile, 60% of builders provided sales incentives of all forms in November, down slightly from 62% in October.

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three major HMI indices posted declines in November. The HMI index gauging current sales conditions fell six points to 40, the component charting sales expectations in the next six months dropped five points to 39 and the gauge measuring traffic of prospective buyers dipped five points to 21.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 49, the Midwest dropped three points to 36, the South fell seven points to 42 and the West posted a six-point decline to 35.

The HMI tables can be found at nahb.org/hmi.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Great reporting Robert! It looks like the worst may be behind us at this point. In early 2023 many were saying we would be in a deep recession by now, but clearly that has been avoided despite the headwinds.