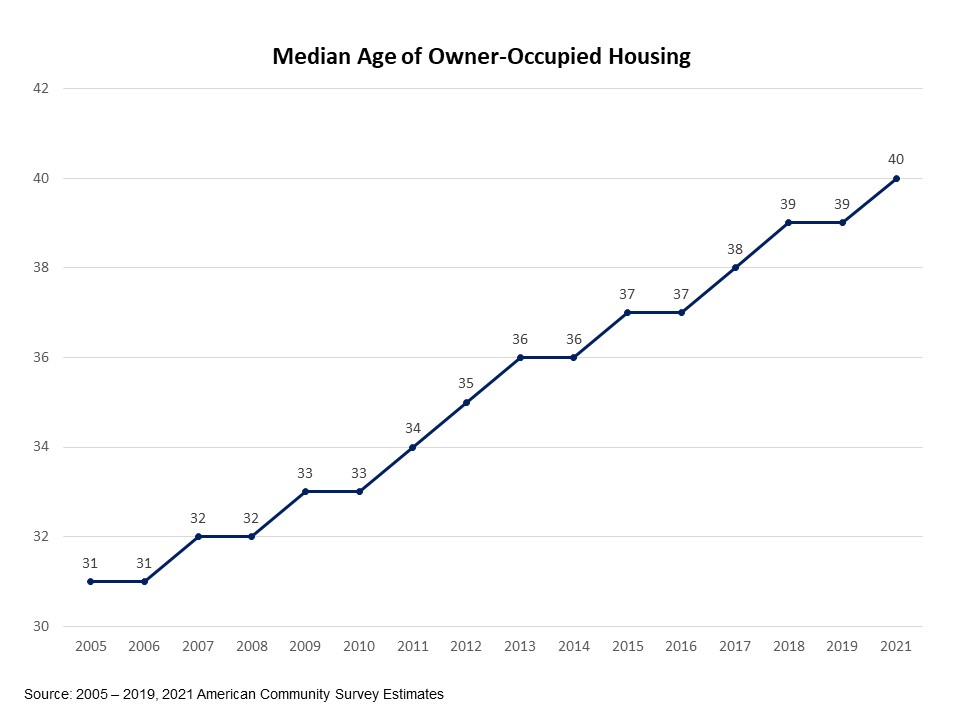

The median age of owner-occupied homes is 40 years, according to the latest data from the 2021 American Community Survey[1]. The U.S. owner-occupied housing stock is aging rapidly especially after the Great Recession, as the residential construction continues to fall behind in the number of new homes built. With a lack of sufficient supply of new construction, the aging housing stock signals a growing remodeling market, as old structures need to add new amenities or repair/replace old components. Rising home prices also encourage homeowners to spend more on home improvement. Over the long run, the aging of the housing stock implies that remodeling may grow faster than new construction.

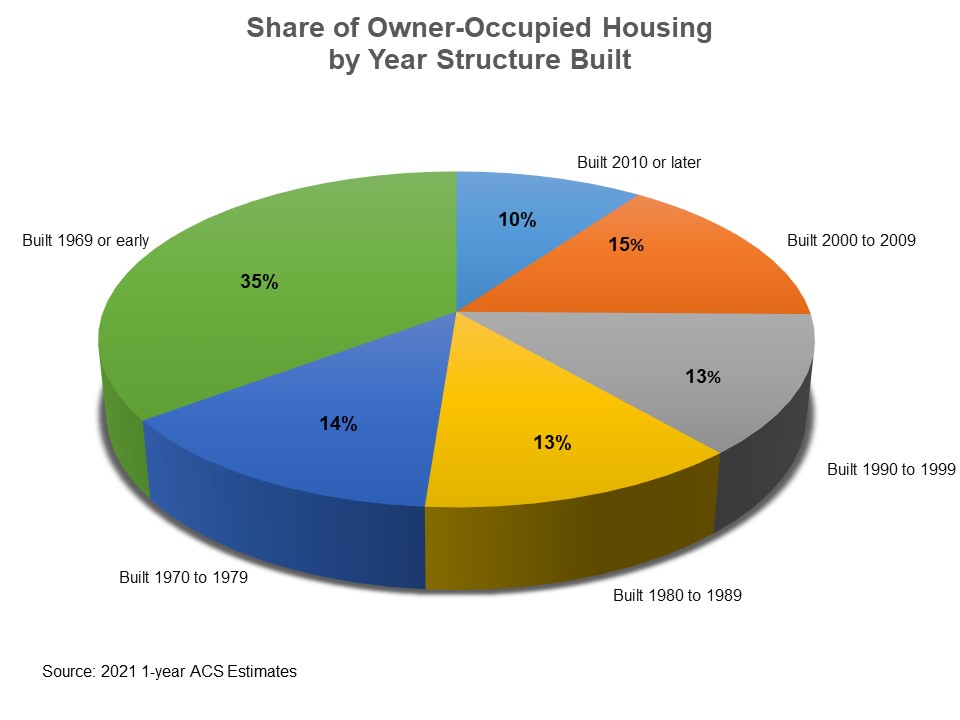

A little less than half of the owner-occupied homes was built before 1980, with around 35% built before 1970. New construction added nearly 8.3 million units to the national stock from 2010 to 2021, accounting for only 10% of owner-occupied housing stock in 2021. Owner-occupied homes constructed between 2000 and 2009 make up 15% of the housing stock.

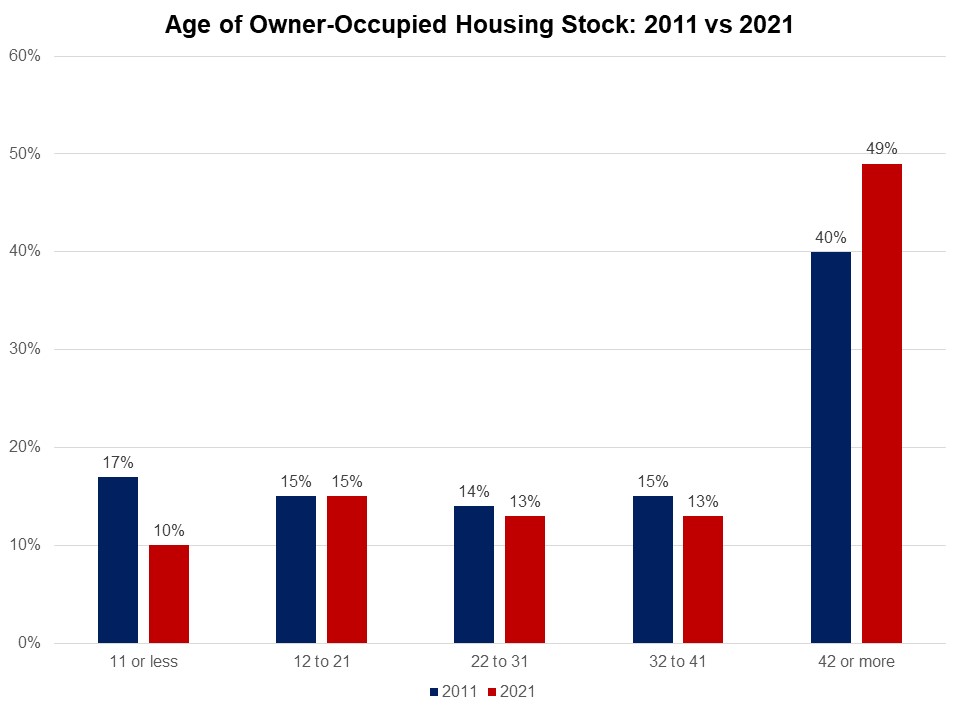

Due to modest supply of housing construction, the share of new construction built within past 11 years declined greatly, from 17% in 2011 to only 10% in 2021. Meanwhile, the share of housing stock at least 42 years old experienced a significant increase over the 10 years ago. The share in 2021 was 49% compared to 40% in 2011.

[1] : Census Bureau did not release the standard 2020 1-year American Community Survey (ACS) due to the data collection disruptions experienced during the COVID-19 pandemic. The data quality issues for some topics remain in the experimental estimates of the 2020 data[1]. To be cautious, the 2020 experimental data is not included in the analysis.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

“Multi-family construction” housing in the US is the elephant in the room, now (2024) making up nearly 95% of all new construction starts, and are almost entirely rental units (over 96%), so they aren’t even being discussed by this article, which covers owner-occupied housing stock.

No one in America wants to still be renting when they’re 35+ and have a family, they aspire to single family zoned owner-occupied housing. What is sorely needed is a better, more incentivized (perhaps US government subsidized) system of helping people in older, increasingly decaying and obsolescent housing stock (the majority now over 40 and thus over the designed lifespan of the major systems in the structure, from plumbing to electrical, concrete to roofing) obtain low cost funding to rehab, remodel, replace, and repair. Once a structure has been neglected sufficiently it becomes more cost effective to tear it down and replace.