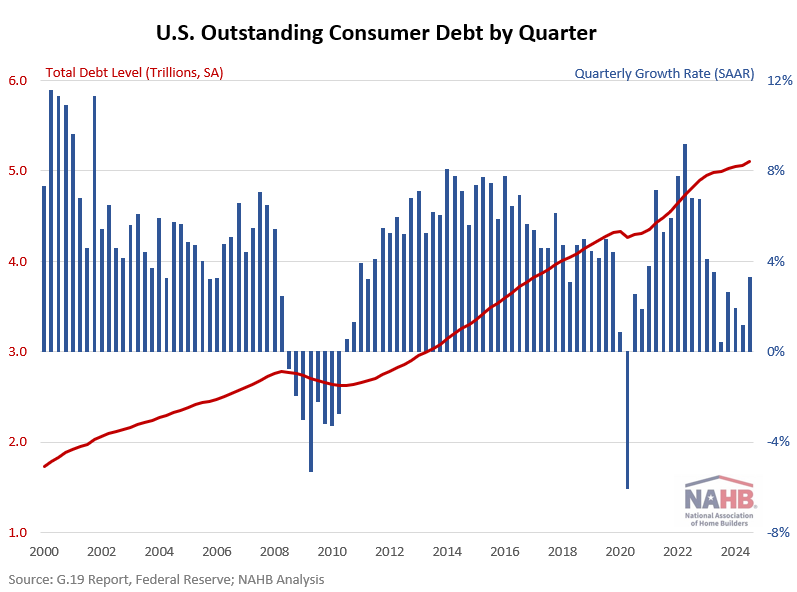

Total outstanding U.S. consumer debt stood at $5.10 trillion for the third quarter of 2024, increasing at an annualized rate of 3.28% (seasonally adjusted), according to the Federal Reserve’s G.19 Consumer Credit Report. In general, consumer debt has been slowing over the past two years, peaking at a high rate of 9.16% in the second quarter of 2022. However, the third quarter of 2024 experienced an uptick in growth from the previous quarter’s rate of 1.14%.

The G.19 report excludes mortgage loans, so the data primarily reflects consumer debt in the form of student loans, auto loans, and credit card debt. As consumer spending has outpaced personal income, savings rates have been declining and consumer debt has increased. Previously, consumer debt growth had been slowing, as high inflation and rising interest rates led people to reduce their borrowing. However, the growth rate ticked up in the latest quarter, possibly reflecting expectations of rate cuts that took place at the quarter’s end.

Nonrevolving Debt

Nonrevolving debt, largely driven by student and auto loans, reached $3.75 trillion (SA) in the third quarter of 2024, marking a 3.46% increase at a seasonally adjusted annual rate (SAAR). This growth rate is notably higher than in the previous six quarters, all of which remained below 2.5%.

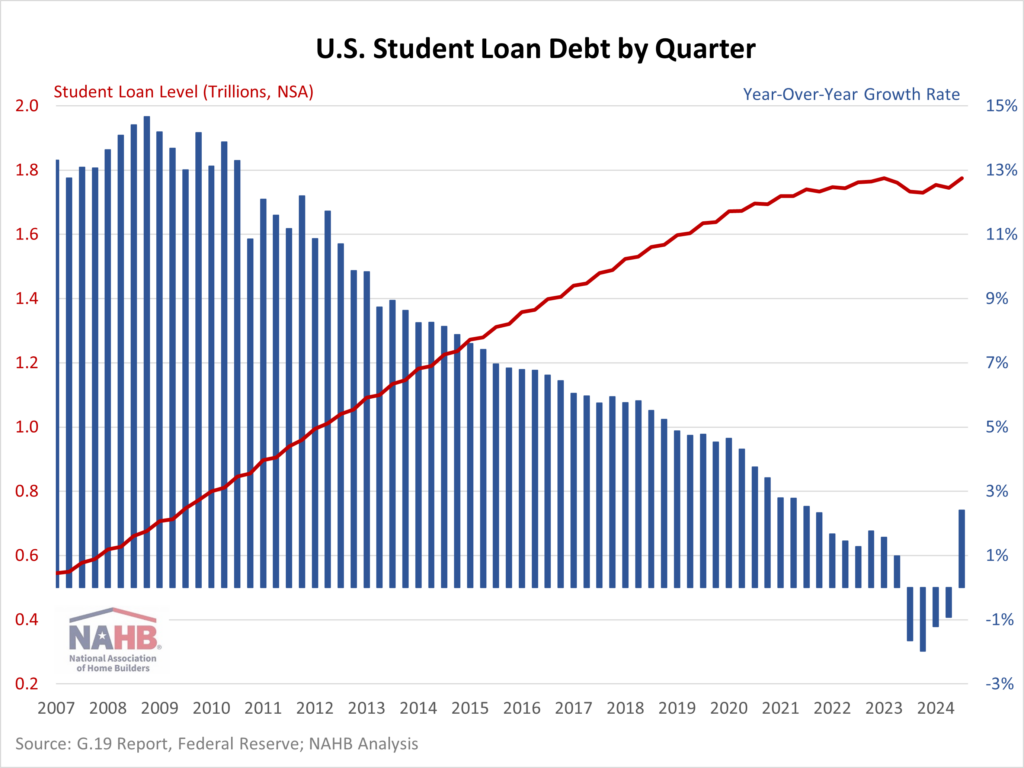

Student loan debt balances stood at $1.77 trillion (NSA) for the third quarter of 2024. Year-over-year, student loan debt rose 2.41%, the largest yearly increase since the third quarter of 2021. This shift partially reflects the expiration of the COVID-19 Emergency Relief for student loans’ 0-interest payment pause that ended September 1, 2023.

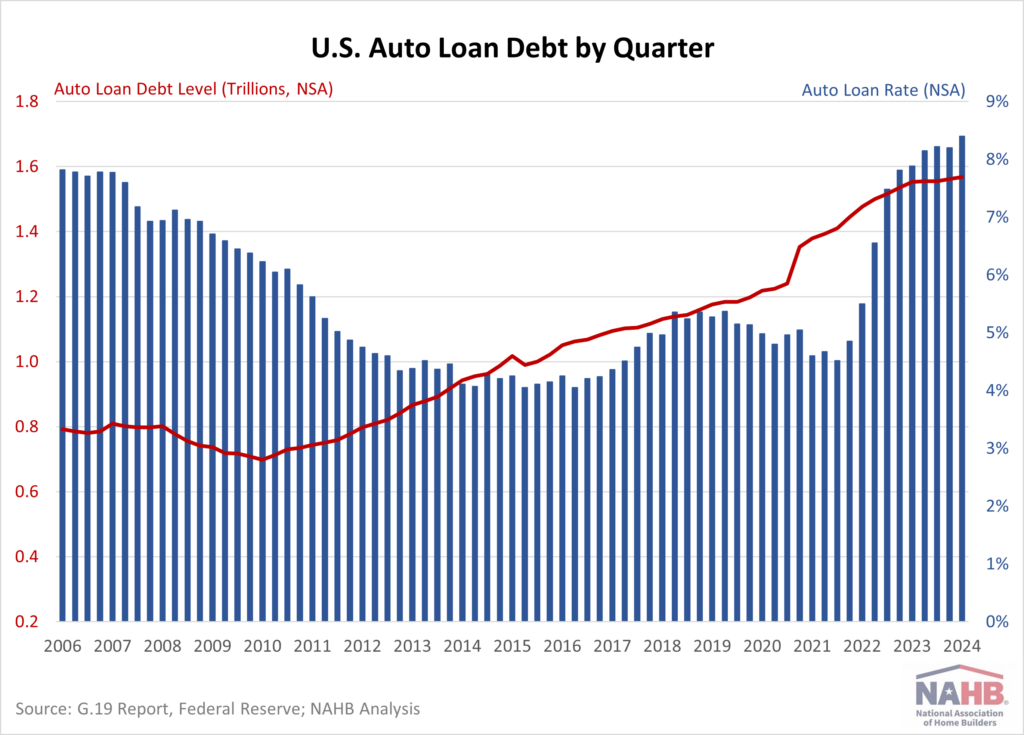

Auto loans, meanwhile, totaled $1.57 trillion, with a year-over-year increase of only 0.96%—the slowest rate since 2010. This deceleration can be attributed to multiple factors, including tighter lending standards, higher loan rates, and overall inflation. Auto loan interest rates reached 8.40% (for a 60-month new car) in the third quarter of 2024, marking the highest rate since the data series began. Although the Federal Reserve has begun cutting rates, auto loan rates tend to respond more slowly and are less directly influenced by these cuts.

Revolving Debt

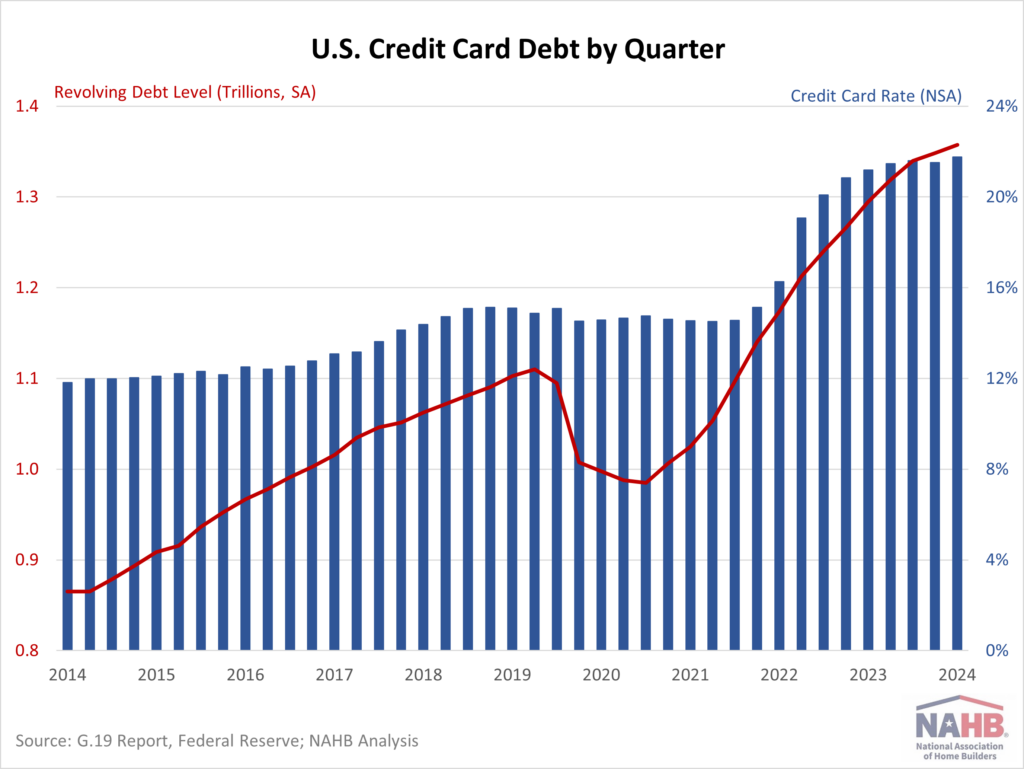

Revolving debt, primarily credit card debt, reached $1.36 trillion (SA) in the third quarter, rising at an annualized rate of 2.79%. This marked a slight increase from the second quarter’s 2.58% rate but was notably down from the peak growth rate of 17.58% seen in the first quarter of 2022. The surge in credit card balances in early 2022 was accompanied by an increase in credit card rates which climbed by 4.51 percentage points over 2022. This was an exceptionally steep increase, as no other year in the past two decades had seen a rate jump of more than two percentage points.

Comparatively, so far in 2024 the credit card rate increased 0.17 percentage points. For the third quarter of 2024, the average credit card rate held by commercial banks (NSA) reached a historic high (since data has been recorded) of 21.76%, an increase from 21.51% last quarter.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Increasing government debt, increasing personal debt and declining savings does not bode well for a consumer economy.