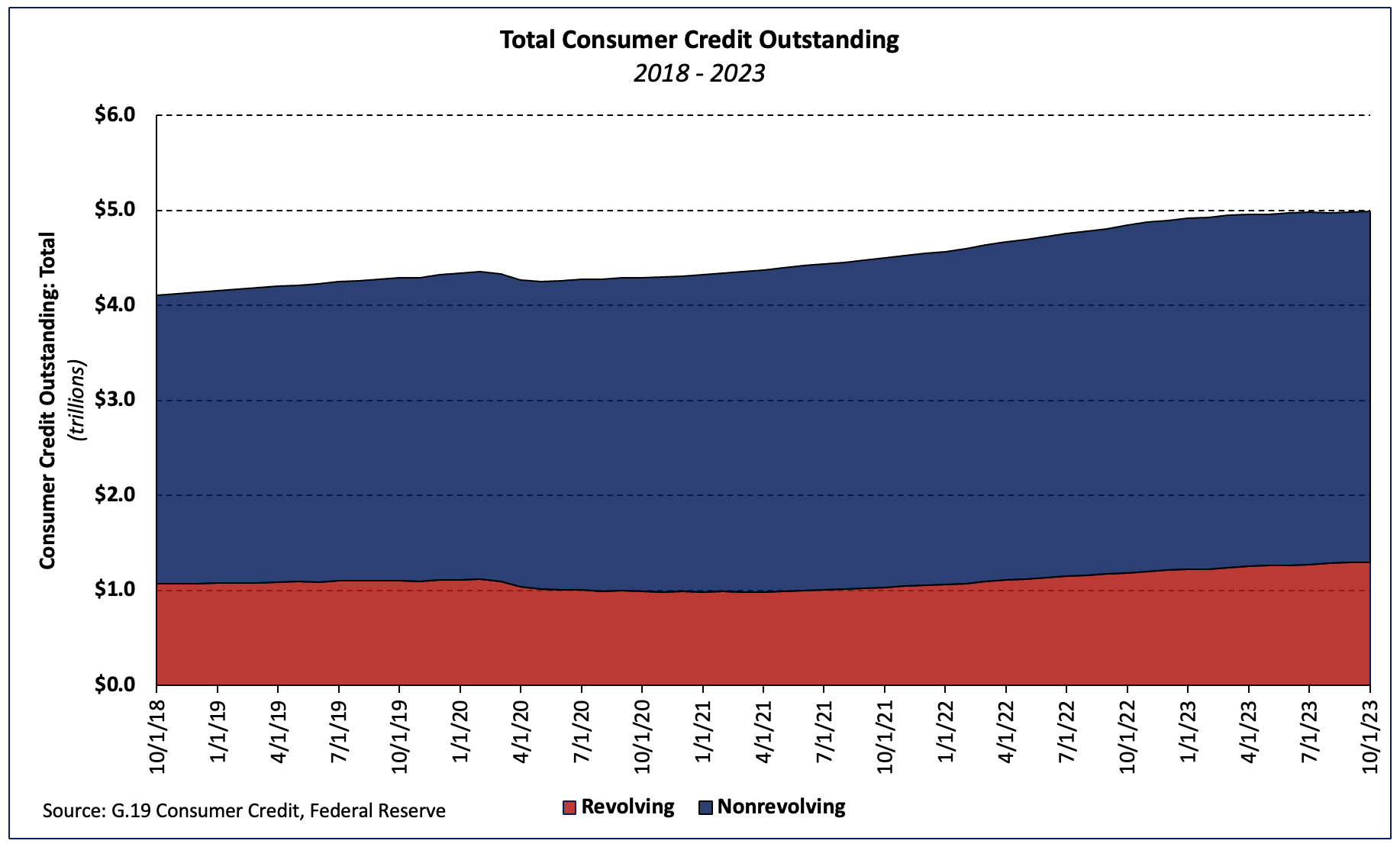

According to the Federal Reserve’s latest G.19 Consumer Credit report, total consumer credit outstanding totaled $4.99 trillion (seasonally adjusted annual rate) in October, an increase of $5.1 billion over the month and $146.7 billion—or 3.0%–higher than October 2022. The monthly increase resulted from revolving and nonrevolving credit outstanding gaining 0.2% and 0.1%, respectively.

The level of revolving debt—primarily credit card debt—rose $2.9 billion over the month and $109.9 billion over the year (SAAR). Revolving debt outstanding has increased each of the past four months, although growth slowed in September and October.

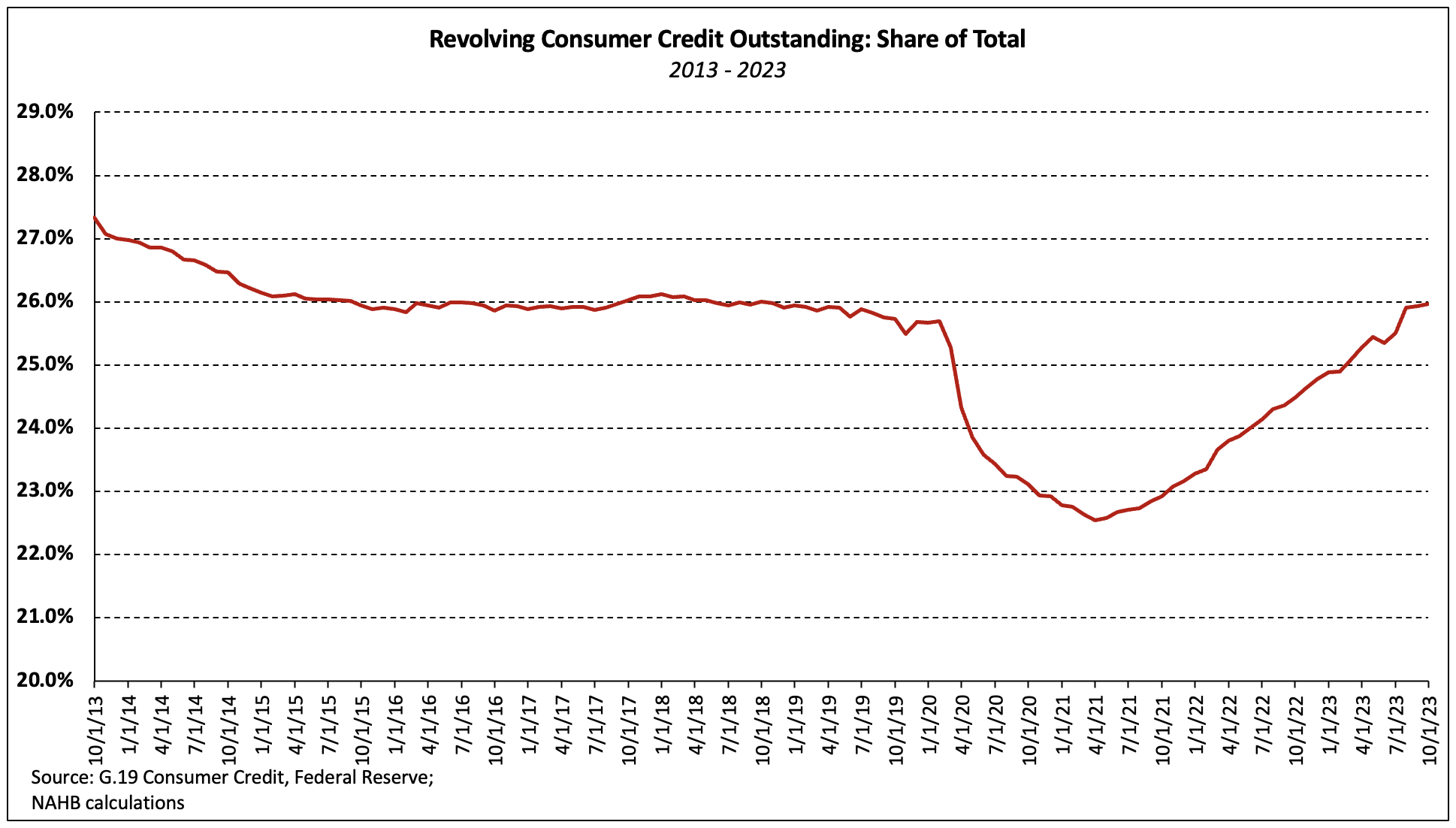

Revolving and nonrevolving debt accounted for 26.0% and 74.0% of total consumer debt, respectively. Although it reached a 32-year low in April 2021, revolving consumer credit as a share of the total has slowly risen to its highest level since November 2018.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.