Using the Bureau of Economic Analysis most recent release of county level personal income per capita data and Census Bureau’s county level permit data, new NAHB analysis finds that single-family and multifamily construction takes place more often in areas where incomes are higher.

Counties were grouped into five quintiles by the personal incomes per capita for each county. The high quintile consists of counties where the personal income per capita is greater than $62,212. High-middle level counties are areas with less than $62,212 but greater than or equal to $53,771. The middle quintile consists of counties where personal income per capita is less than $53,771 but greater than or equal to $48,159. The middle-low income quintile consists of counties with less than $48,159 but greater than $43,533. The low-income quintile is counties where personal income per capita is less than $43,533. The highest income areas are frequently near larger cities and along the Pacific and Atlantic coasts. The lowest income counties tend to be concentrated in the southeastern portion of the US.

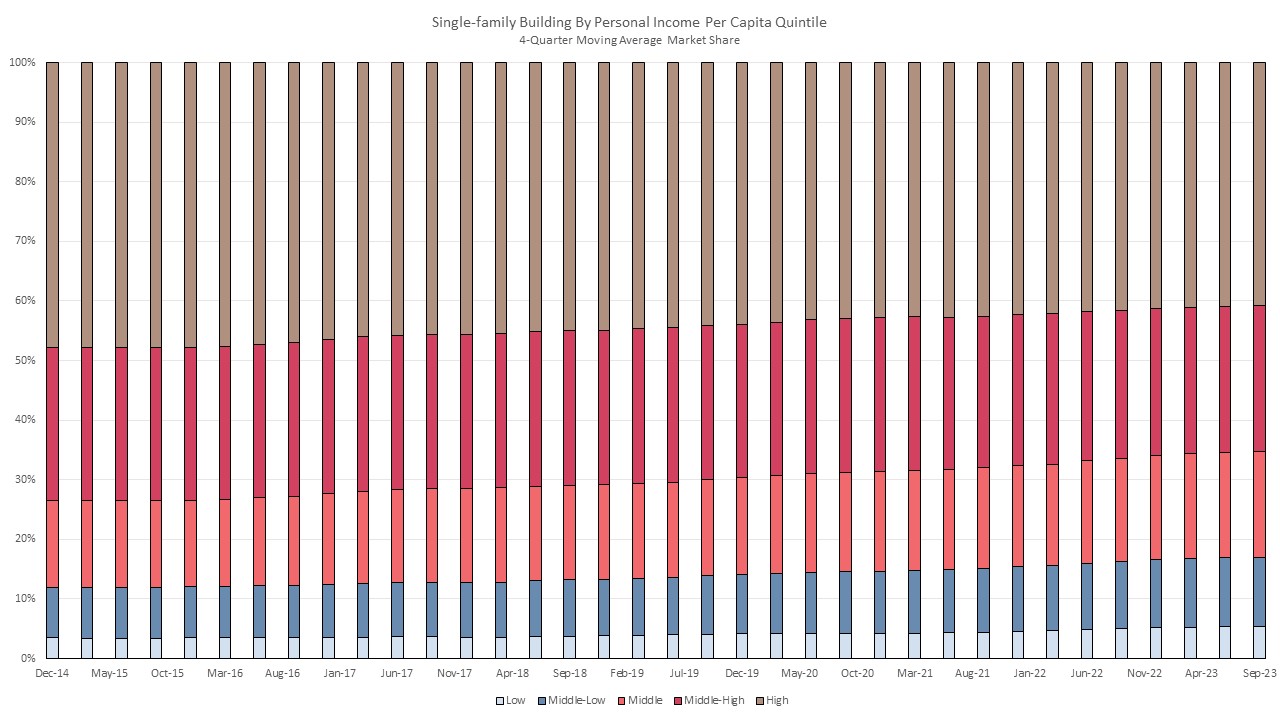

The market shares of single-family home building for the quintiles of personal income per capita have been changing over the past five years. The highest income counties have lost 4.2 percentage points in market share, falling from 45.0% in the third quarter of 2018 to 40.8% in the third quarter of 2023. The middle-high income counties market share was the only other area to lose market share, losing 1.5 percentage points over the same time period. Both the middle and middle-low income areas gained 2.0 percentage points while the low income area gained 1.6 percentage points over the past five years.

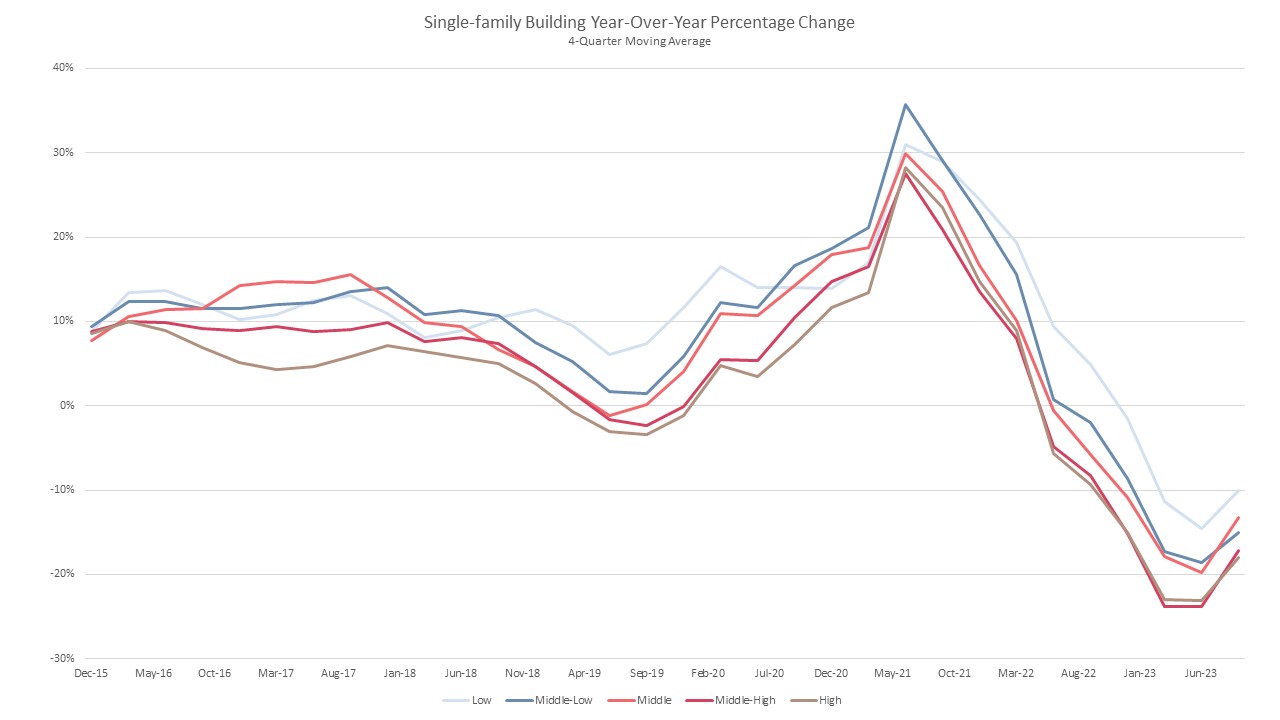

As was seen with the HBGI released last week, single-family construction has slowed across the county. All personal income per capita quintiles had a negative percentage change for the fourth consecutive quarter. The biggest decline occurred in the same quintiles that have lost market share with the high quintile declining 17.9% over the year and middle-high declining 17.1%. The low income quintile declined the least, dropping 10.0% in the third quarter of 2023.

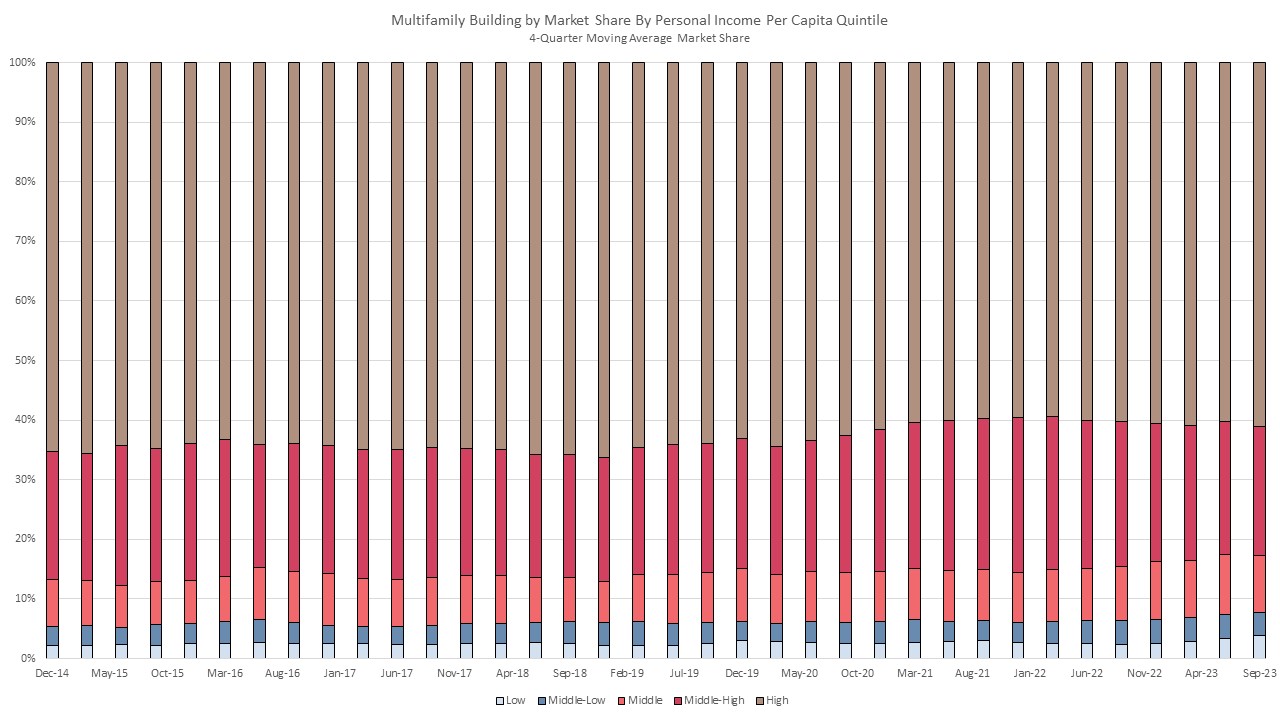

The multifamily market follows a similar story as single-family. High income areas have well above a 50% market share but have seen a decline over the past couple of years. Since the third quarter of 2018, the market share for the high-income quintile has fallen 4.8 percentage points from 65.8% to 61.0% in the third quarter of 2023. No other income quintile lost market share over this same period as the middle-income quintile gained the most percentage points in market share. The middle-income quintile market share rose 2.2 percentage points from 7.5% to 9.7% between the third quarters of 2018 and 2023.

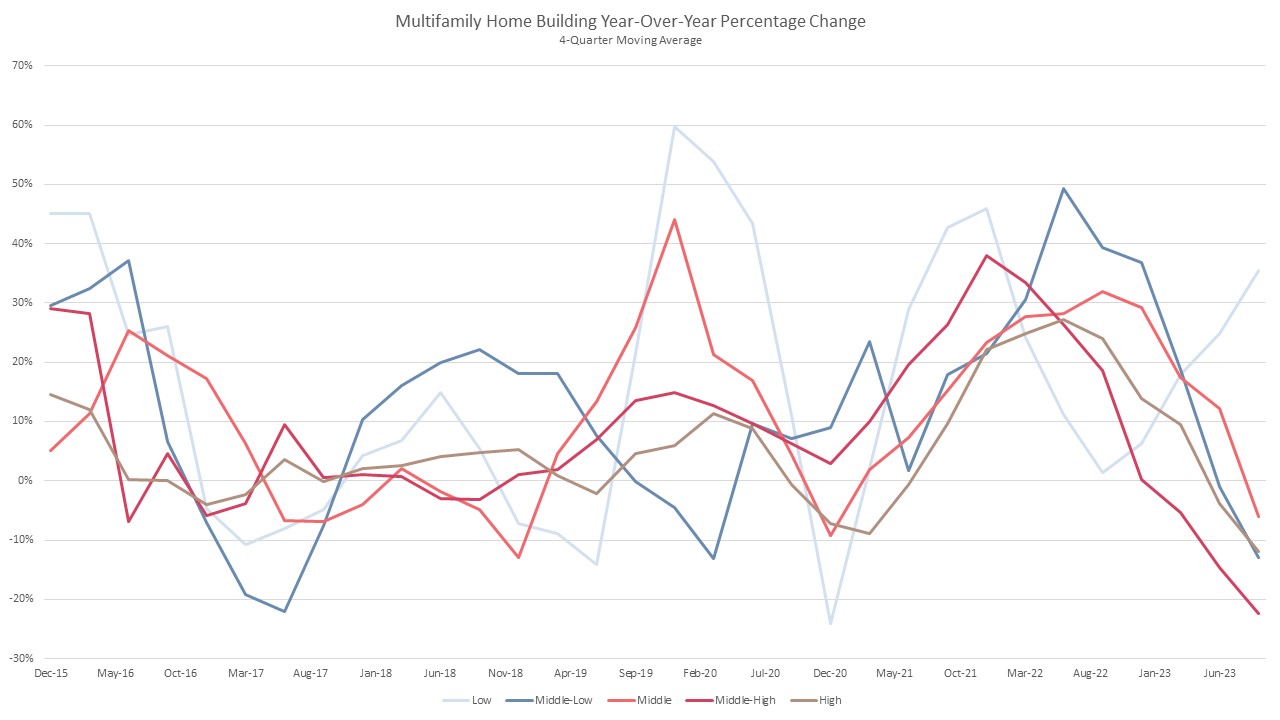

Multifamily construction declined in four of the five quintiles with the lowest quintile being the only to post growth at 35.4%. This was the eleventh consecutive quarter where the lowest income quintile had growth of multifamily construction. The middle-high personal income quintile had the largest building decline as it posted a 22.5% drop.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.