Residential remodeling companies, just like any other private enterprise in a capitalist economy, exist to satisfy the demand of consumers for specific products or services in exchange for a rate of profit commensurate with the risk taken. Companies control when they enter or exit the industry, but their financial performance is intrinsically linked to external factors, such as the number and size of their competitors, ease and availability of credit and inputs, or the bargaining power of their customers and suppliers. Given this reality, companies must regularly evaluate their financial performance vis-à-vis the industry as a whole in order to improve processes, set individual and collective goals, and ultimately remain successful businesses.

For this reason, the National Association of Home Builders periodically conducts the Remodelers’ Cost of Doing Business Study – a nationwide survey of residential remodeling companies designed to produce profitability benchmarks for that segment of the construction industry. The latest study collected information for fiscal year 2021 and compares findings to fiscal years 2015 and 2018.

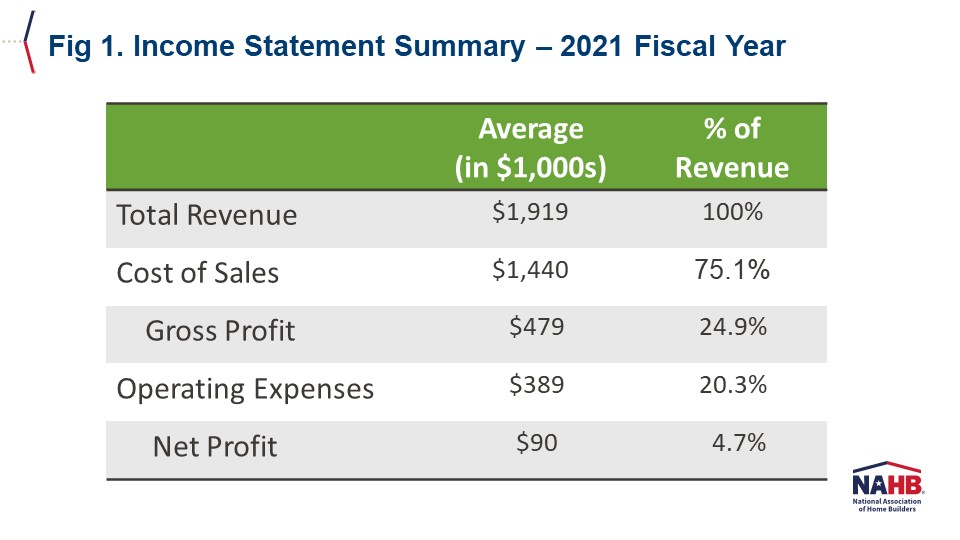

The 2023 edition of the study shows remodelers’ gross and net profit margins both dropping between 2018 and 2021. On average, they reported $1.9 million in revenue for fiscal year 2021, of which $1.4 million (75.1%) was spent on cost of sales (e.g., labor, material, and trade contractor costs as well as direct costs for single-family construction) and another $389,000 (20.3%) on operating expenses (e.g., general and administrative, finance, and S&M expenses, owner’s compensation). As a result, remodelers’ average gross profit margin for 2021 was 24.9%, with a net margin before taxes of 4.7% (Fig. 1).

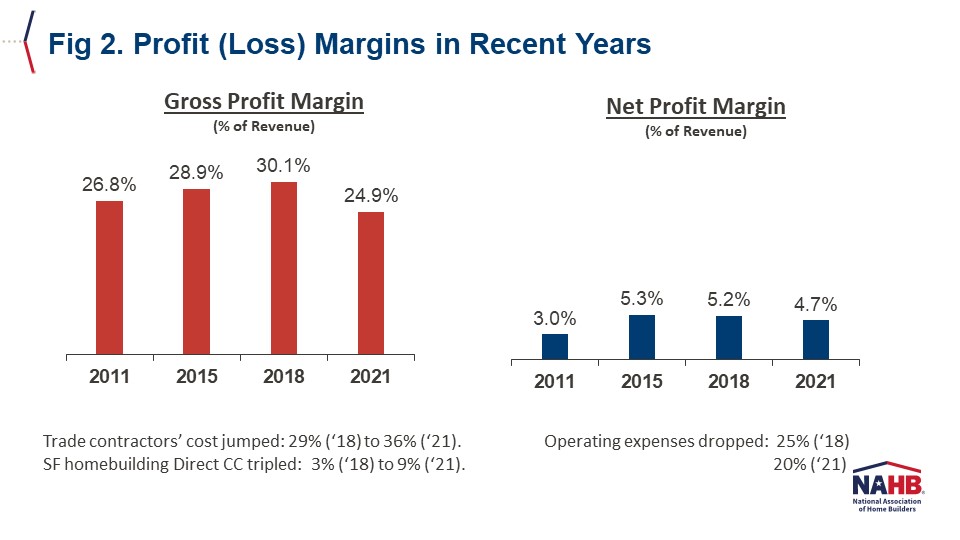

Figure 2 puts these margins in historical context. Remodelers’ average gross profit margin grew steadily from 2011 (26.8%) through 2018 (30.1%) before dropping in 2021 (24.9%). The decline was driven by significant increases in the share of revenue spent on two cost lines: trade contractors’ costs, which rose from 29% in 2018 to 36% in 2021, and direct costs for single-family homebuilding, which went from 3% to 9%[1]. In the end, remodelers averaged a net profit margin before taxes of 4.7% in 2021, only slightly lower than in 2018 (5.2%). Notably, a significant reduction in operating expenses between 2018 and 2021 (from 25% to 20%) prevented deeper net losses.

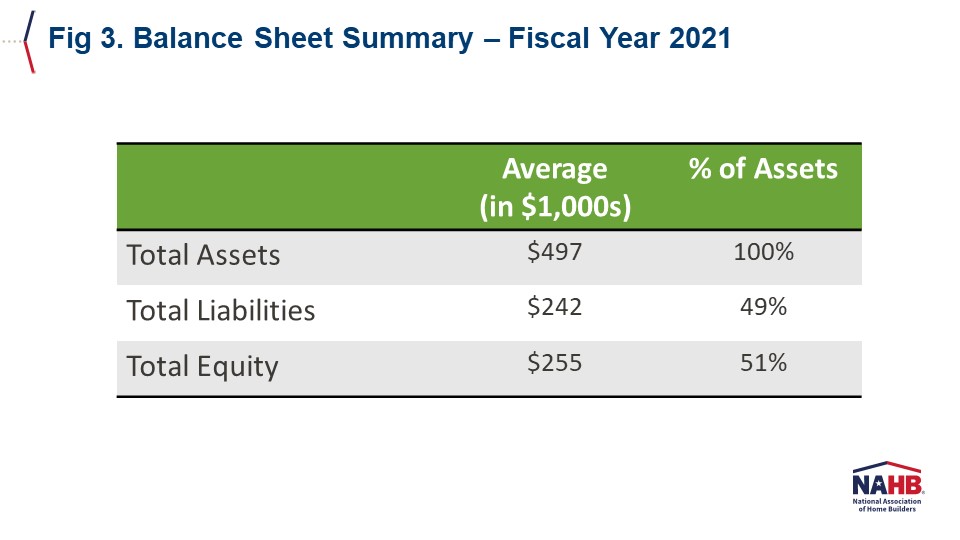

In terms of the balance sheet, residential remodelers reported an average of $497,000 in total assets for fiscal year 2021. Of that, $242,000 (49%) was owed as either current or long-term liabilities, and the remaining $255,000 (51%) was owned free and clear by the remodelers (Fig. 3).

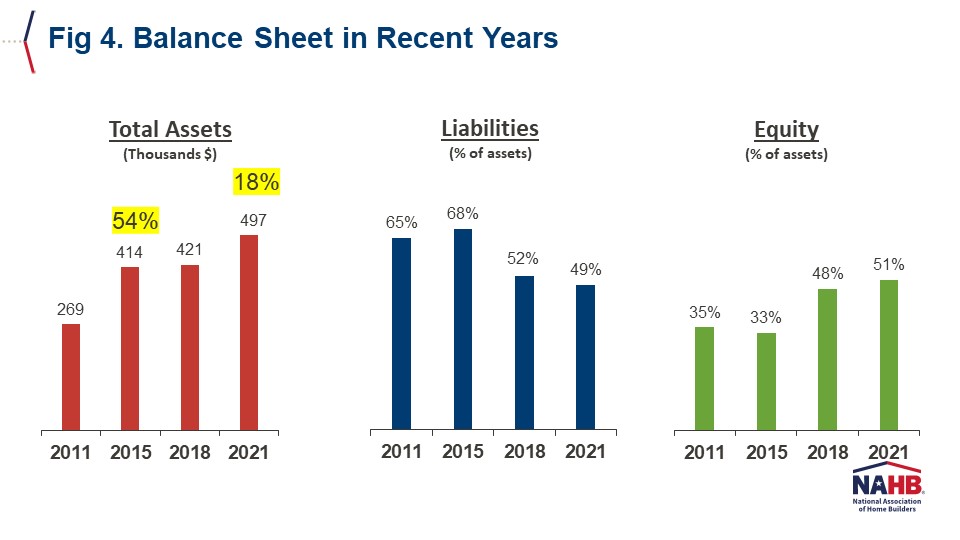

Figure 4 shows that remodelers’ average total assets increased significantly between 2011 and 2015 (up 54% to $414,000) but were essentially flat between 2015 and 2018 (up 2% to $421,000). By 2021, however, remodelers managed to strengthen their balance sheets again, with assets rising 18% to $497,000.

Looking at liabilities as a share of assets over the last 10 years shows that remodelers have deleveraged significantly. In 2011 and 2015, at least 65% of their assets were backed up by debt. By 2018, that share had dropped to 52%; and by 2021, it was 49%. Meanwhile, the share of assets financed through equity went from roughly one-third in 2011 and 2015, to almost half (48%) in 2015, and to more than half (51%) in 2021. This is the first time in this series that remodelers have run their businesses relying more on their own capital than on liabilities.

[1] Residential remodelers were significantly more likely to be involved in single-family home building in 2021 than in 2018. In fact, in 2018, only about 6% of their total revenue was derived from single-family construction. In 2021, the share was 11.0%.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.