In 2005, Congress established several energy-efficiency tax incentives related to housing that benefit new-home buyers and remodeling homeowners. These policies included the tax code section 25C credit for retrofitting/remodeling existing homes, and the 25D credit for the installation of power production property in new and existing homes. Taxpayers claim these residential energy credits using Form 5695.

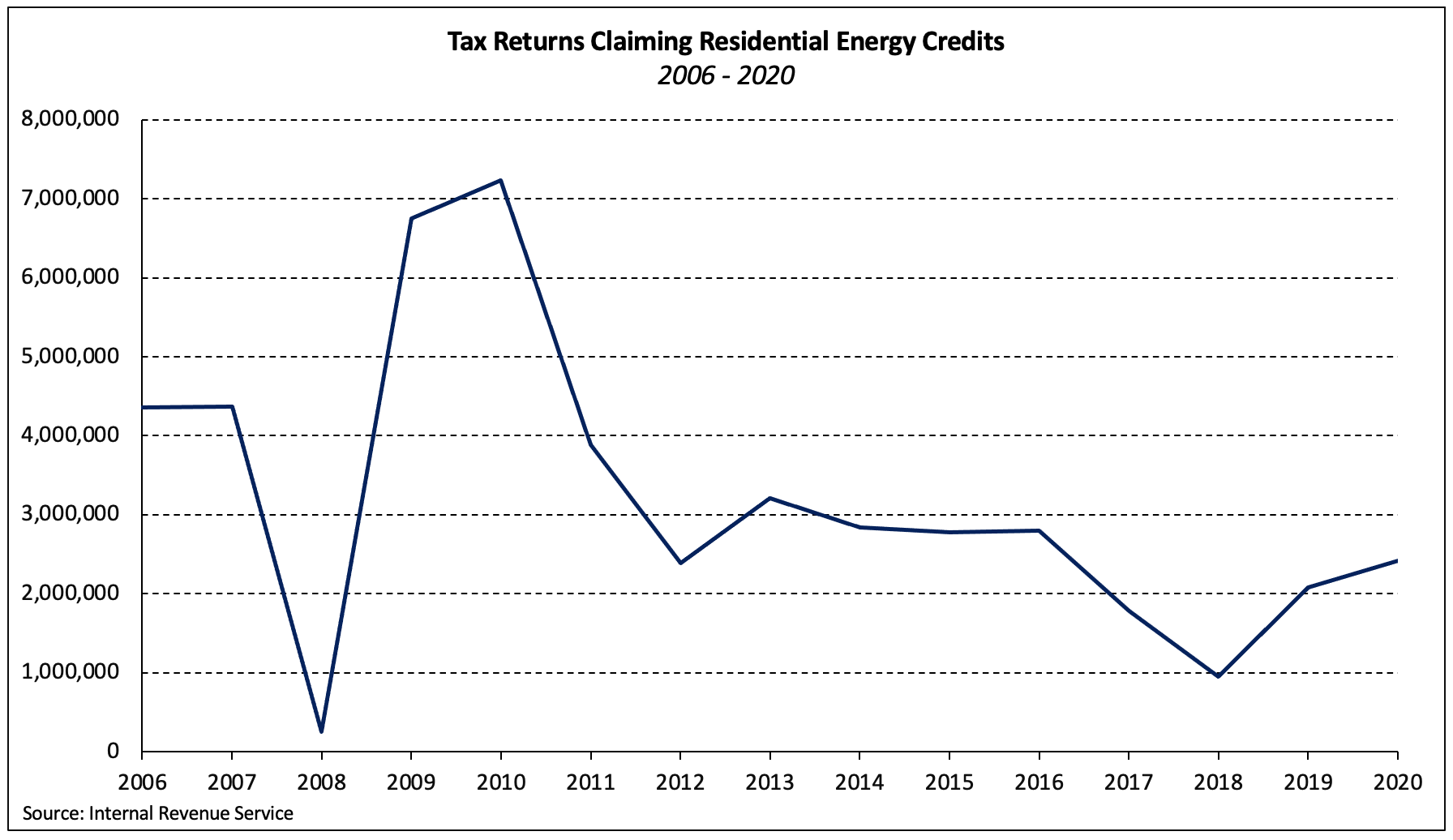

Including carryforwards from 2019, 2.4 million taxpayers claimed at least one residential energy credit for tax year 2020 (the most recent data available). This represents a 16.2% increase over 2019 and is more than twice the number of returns filed for 2018.

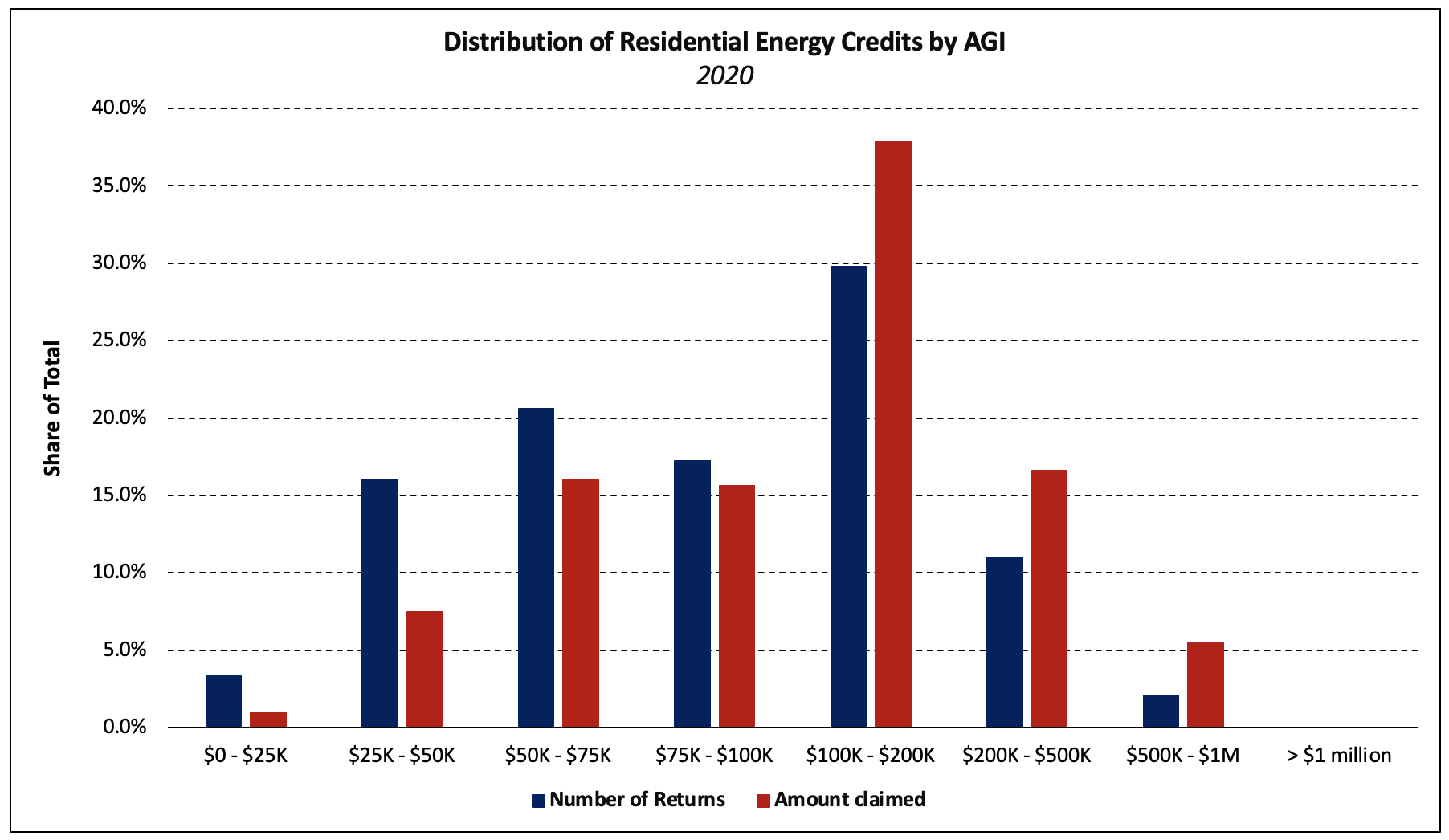

Although IRS income distribution data for these credits is not given for each line item, distribution data is published for total residential energy credits claimed on Form 5695. For tax year 2020, 86.9% of the tax returns claiming 25(c) and/or 25(d) were filed by taxpayers with an adjusted gross income (AGI) of less than $200,000. More than half of these returns—and roughly 40% of the total claimed—were filed by taxpayers with AGI less than $100,000.

25C: Credit for Nonbusiness Energy Property

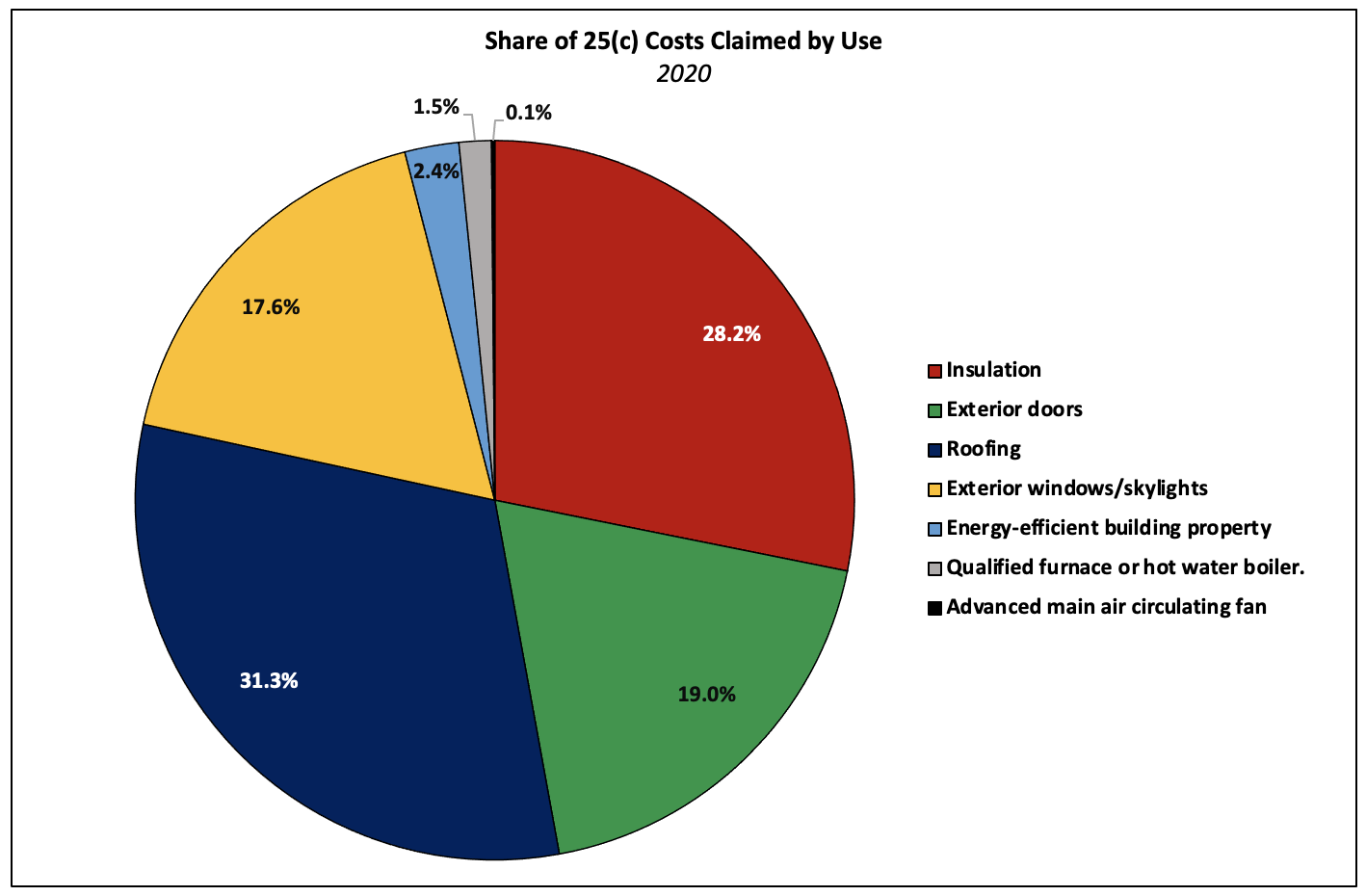

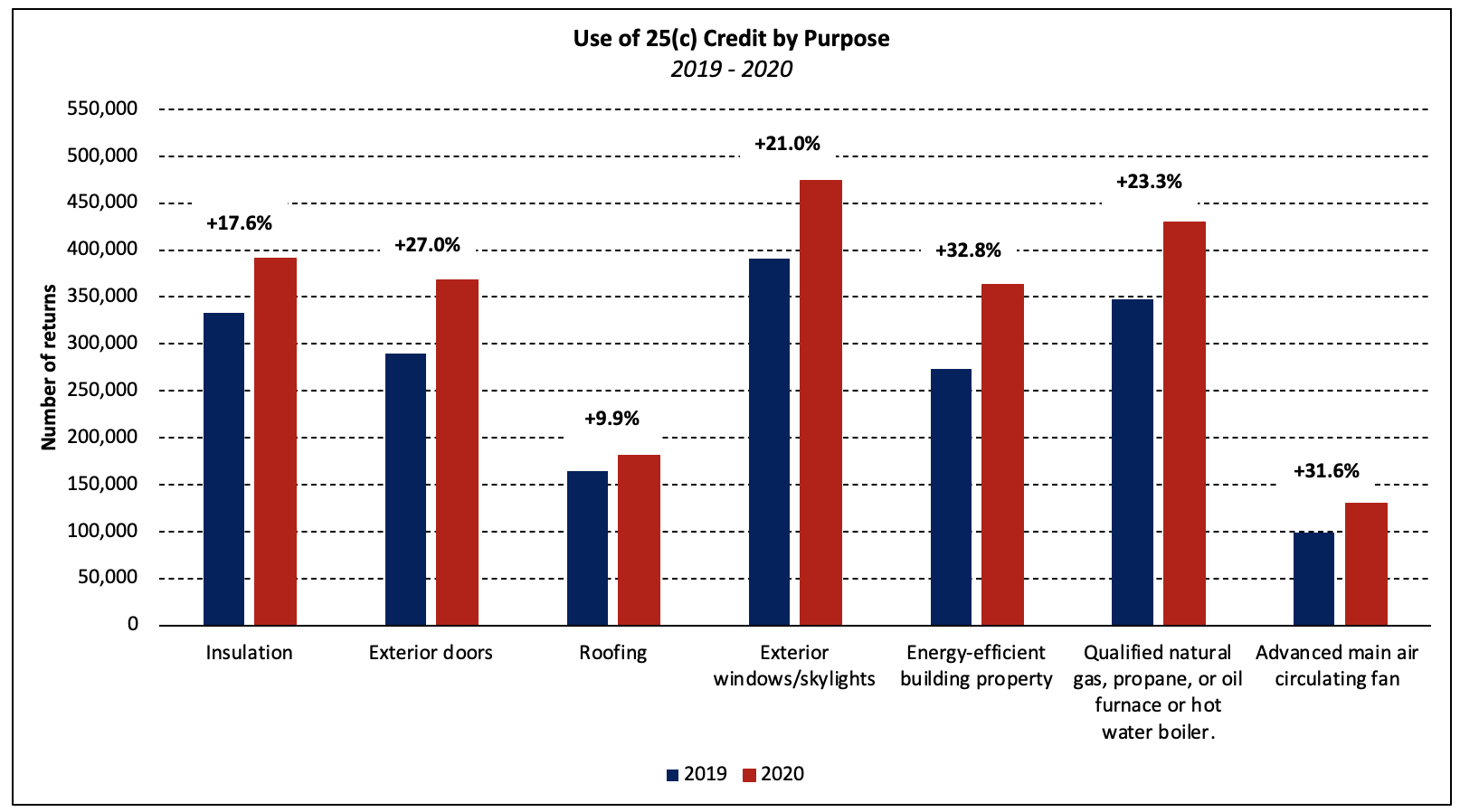

As in prior years, exterior window installation was the most prevalent use of the 25C credit in 2020. This was followed by (in descending order of the number of returns) furnace/hot water boiler, insulation, exterior doors, energy efficient building property, roofing, and advanced main air circulating fan.

In terms of costs claimed, however, qualified roofing and insulation improvements accounted for nearly 60% of the total in 2020. More than 180,000 taxpayers claimed the credit for energy-efficient roof upgrades totaling $1.4 billion while $1.3 billion was claimed by 391,000 taxpayers for qualified insulation improvements.

Nearly half a million taxpayers claimed a 25C credit for window upgrades totaling $778 million. All categories of improvements saw increases in 2020 in both the total amount claimed as well as the number of returns filed.

25D: Energy Efficient Property Credit

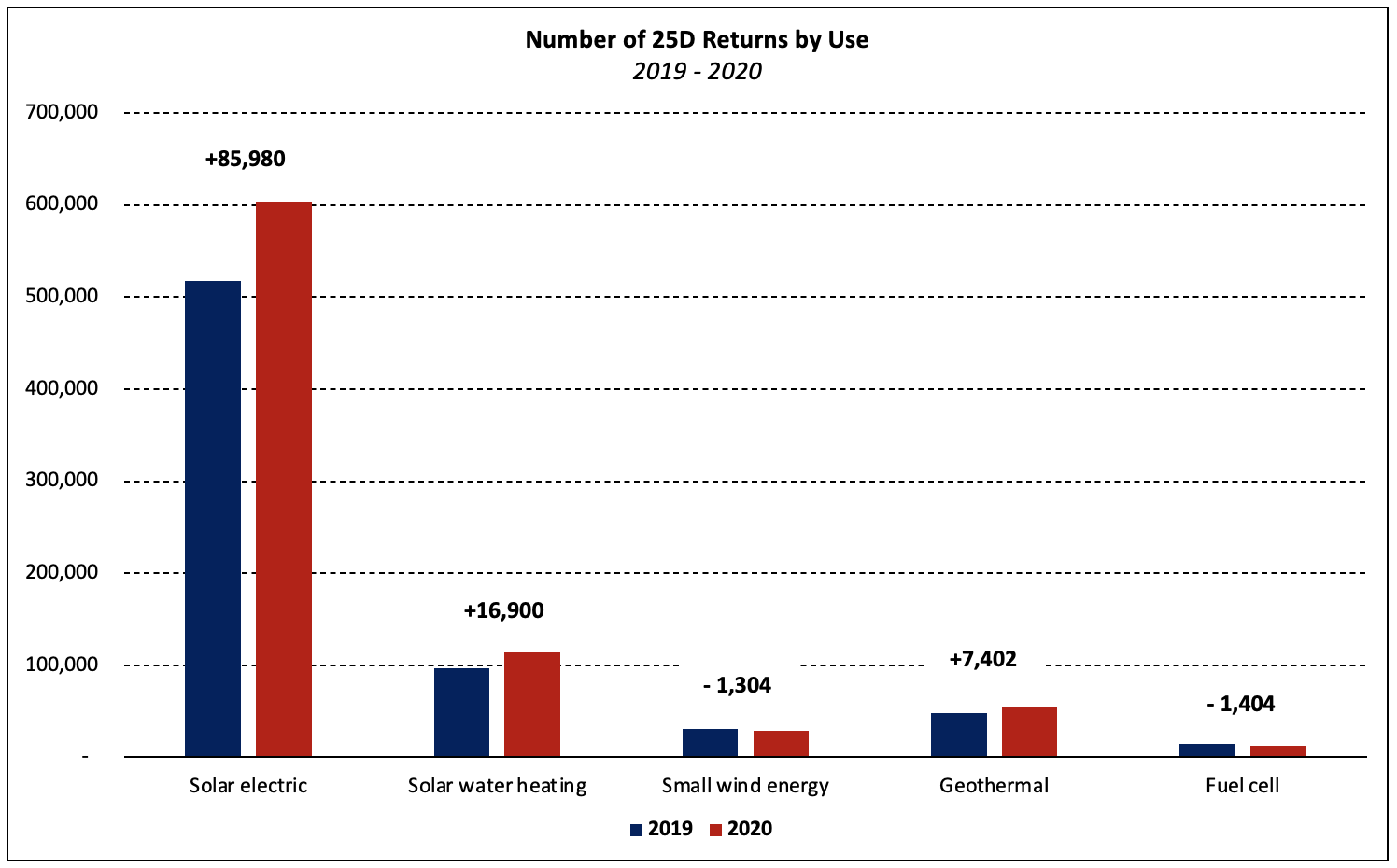

The story of 25D is more mixed. While claims related to solar electric, solar water heating, and geothermal heat pump property costs increased in 2020, those for costs related to small wind energy and fuel cell property declined. From 2019 to 2020, claims associated with solar electric power grew by 86,000 taxpayers and $2.1 billion. Conversely, during the same period, 25D claims related to small wind energy and fuel cells fell by 2,700 taxpayers and $123 million, declines of 0.6% and 8.0%, respectively.

Including 367,000 returns using carryforwards of unused credits, a total of 898,000 taxpayers claimed 25D credits amounting to $3.5 billion.

The most claimed qualifying activity for the 25D credit in 2020 was the installation of solar electric property. More than 600,000 taxpayers claimed the credit for a total of almost $12.6 billion in qualifying costs of installation. The second most common installation in 2020 was for solar water heating property, which was claimed by 114,000 homeowners and totaled almost $627 million in installation costs.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Why is there no data for current years…2021-2022-?

Data lag for IRS publication.

Hi, What’s the source for this data? Where can I access this myself?