The Market Composite Index, a measure of mortgage loan application volume by Mortgage Bankers Association’s (MBA) weekly survey, has been hovering around 200 since October 2022 as higher mortgage rates and low resale inventory continue to hamper potential buyers.

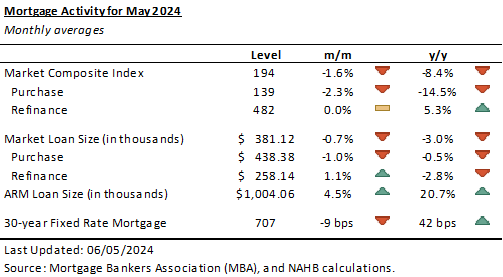

On a week-over-week change, total mortgage, purchasing, and refinancing activities decreased 5.2%, 4.4% and 6.8%, respectively, on a seasonally adjusted basis. However, when comparing the overall market index for this month, May decreased by 8.4% from last year, reflecting current housing affordability issues. Further highlighting these challenges, the Purchase Index has also declined by 14.5% while the Refinance Index increased 5.3% from last May.

Higher mortgage rates are a key factor behind the slowdown in mortgage activity with the 30-year fixed mortgage (FRM) rate for the week ending May 31 at 707 basis points (bps), 16 bps higher than the rate same time last year.

Despite these higher rates, May’s average loan sizes for purchasing and refinancing have remained stable compared to last year at around $438,000 and $258,000 respectively. This indicates fewer buyers are entering the market due to many being priced out, while those who are purchasing homes are buying them at a higher price. In contrast, the average loan size for an adjustable-rate mortgage (ARM) increased by 20.7%, from $831,600 to $1 million.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.