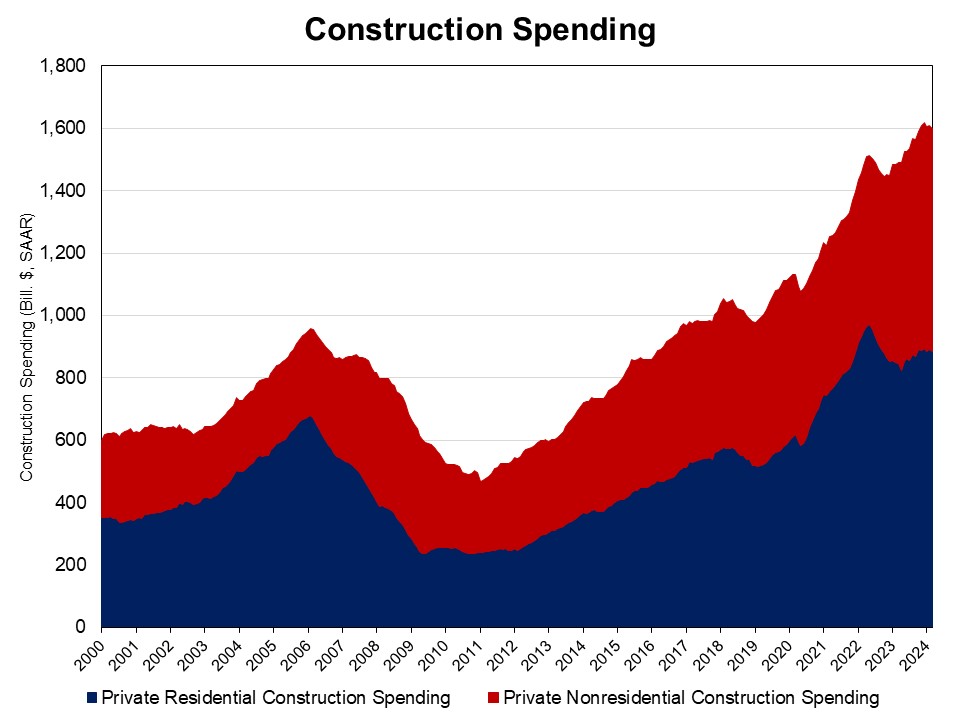

NAHB analysis of Census data shows that private residential construction spending was down 0.7% in March, after increasing 0.7% in February. It stood at a seasonally adjusted annual pace of $884.3 billion.

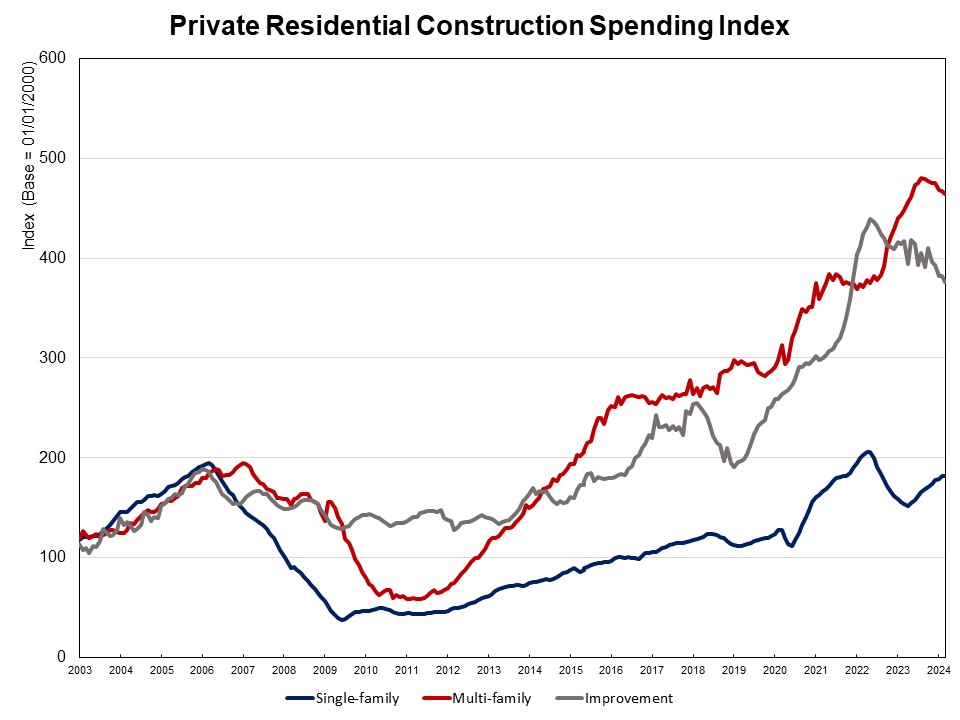

Spending on single-family construction dropped 0.2% in March. This is the first monthly decline after ten straight months of gains, as elevated mortgage interest rates have cooled the housing market. Compared to a year ago, spending on single-family construction was 18.3% higher.

Multifamily construction spending declined 0.6% in March after a dip of 0.3% in February. However, spending on multifamily construction was 3.5% higher than a year ago, as a large stock of multifamily housing is under construction. Nonetheless, multifamily construction spending will decline in the quarters ahead after an elevated level of apartments under construction is completed. Private residential improvement spending fell 1.6% in March after staying flat in February. It was 9.9% lower compared to a year ago.

The NAHB construction spending index is shown in the graph below (the base is March 2000). The index illustrates how spending on single-family construction experienced solid growth since May 2023 under the pressure of supply-chain issues and elevated interest rates. Multifamily construction spending growth was almost unchanged in the last three months, while improvement spending has slowed since mid-2022.

Spending on private nonresidential construction was up 11.1% over a year ago. The annual private nonresidential spending increase was mainly due to higher spending for the class of manufacturing ($45.6 billion), followed by the power category ($0.6 billion).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.