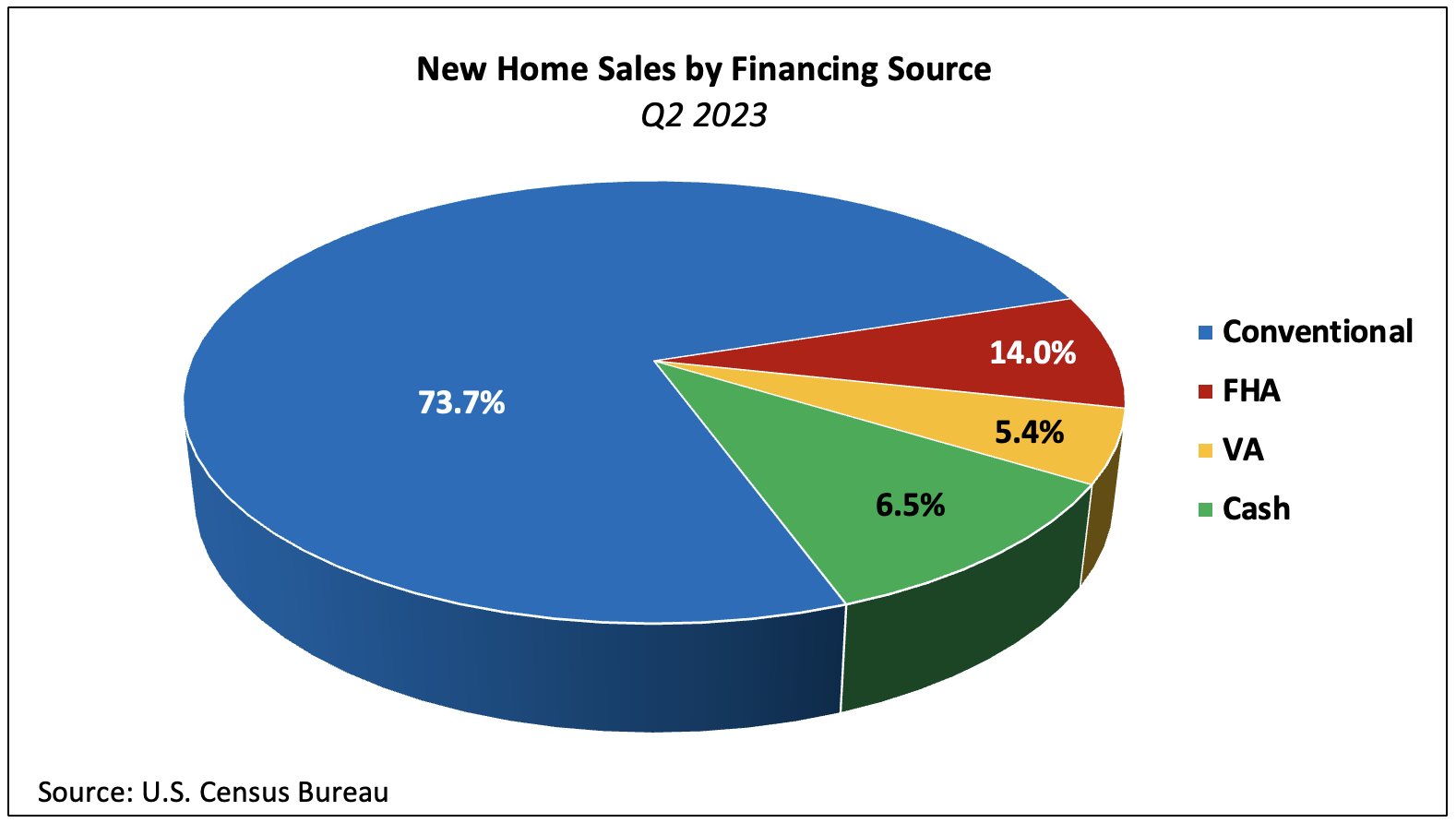

NAHB analysis of the most recent Quarterly Sales by Price and Financing report reveals that the share of new home sales backed by FHA loans climbed from 12.1% (revised) to 14.0% in the second quarter of 2023. It is the largest share since Q1 2021 but roughly three percentage points lower than the post-Great Recession average.

Conventional loans financed 73.7% of new home sales, down one percentage point over the quarter and 2.7ppt, year-over-year. The share of VA-backed sales edged up from 5.2% to 5.4%, a 0.8 ppt decline over the past year.

Cash purchases made up 6.5% of new home sales in the second quarter of 2023. The share has declined each of the past two quarters and is down 4.2 ppt over that period. The share of cash purchases has decreased 2.9 percentage points over the past year and has ranged from 4.1% to 10.7% since Q2 2020.

Although cash sales make up a small portion of new home sales, they constitute a larger share of existing home sales. According to estimates from the National Association of Realtors, 26% of existing home transactions were all-cash sales in June 2023, up from 25.0% in May and June 2022.

Price by Type of Financing

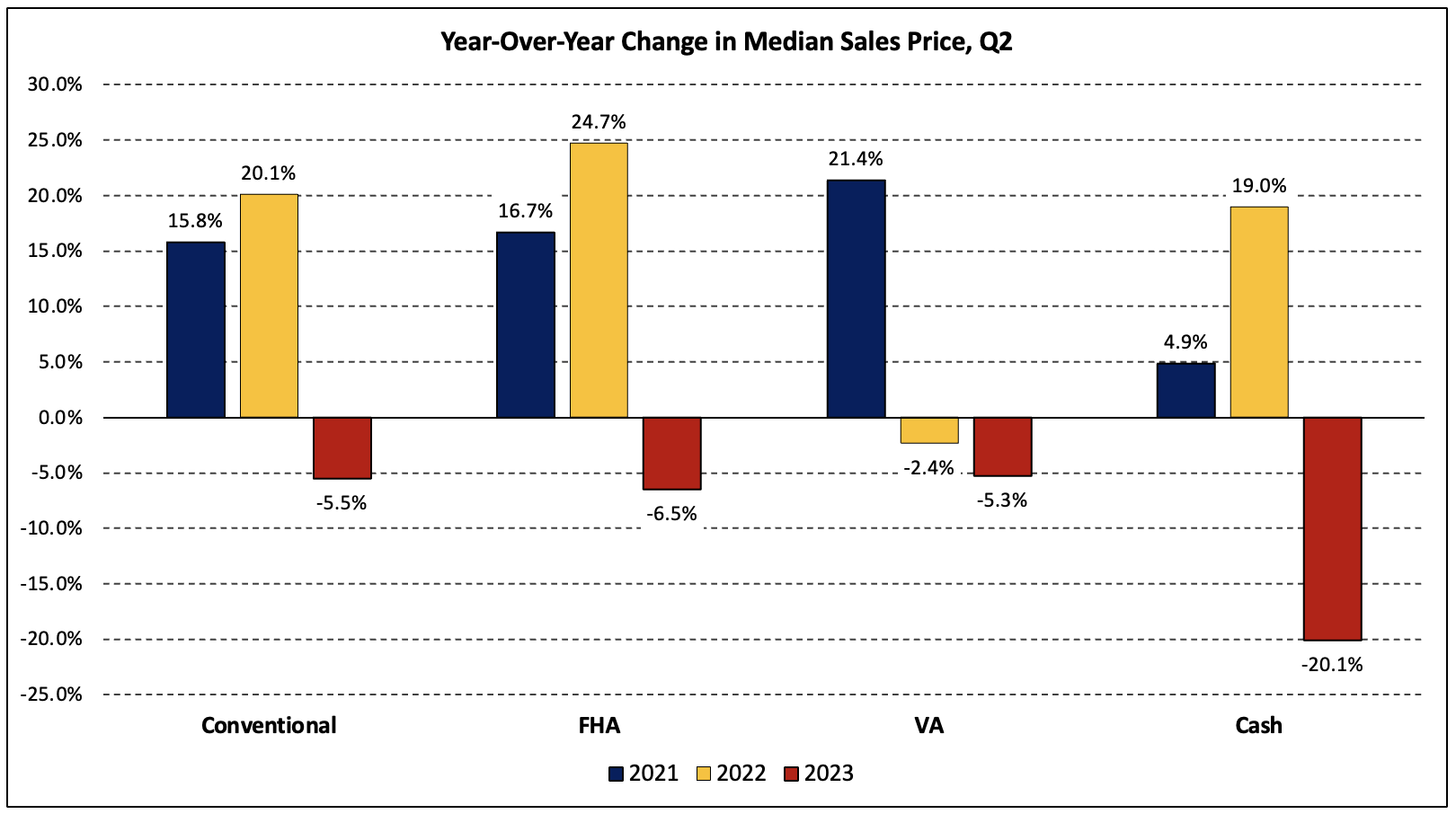

Different sources of financing also serve distinct market segments, which is revealed in part by the median new home price associated with each. In the second quarter, the national median sales price of a new home was $416,100. Split by types of financing, the median prices of new homes financed with conventional loans, FHA loans, VA loans, and cash were $458,100, $346,500, $392,600, and $364,800, respectively.

The purchase price of new homes declined over the past year, regardless of means of financing. The largest drop occurred in cash sales prices which fell 20.1% over the year. This is in stark contrast to year-over-year price changes in the second quarter of 2021 and 2022 (see below).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article’s observation of the growing use of FHA loans for new home sales highlights the significance of accessible financing. Construction loans, similarly, play a vital role in enabling aspiring homeowners to fund the creation of their dream homes while maintaining affordability and promoting housing market growth.