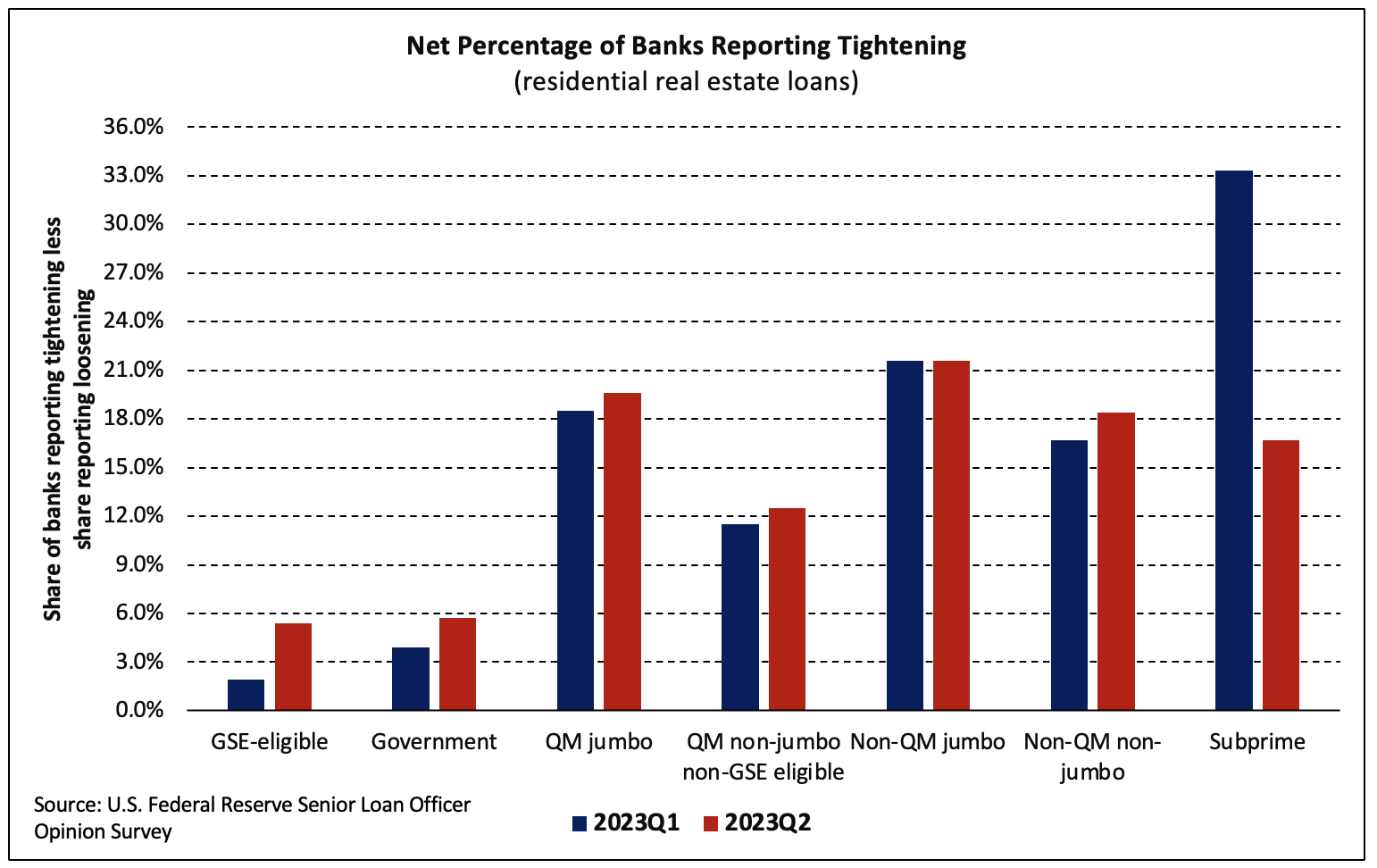

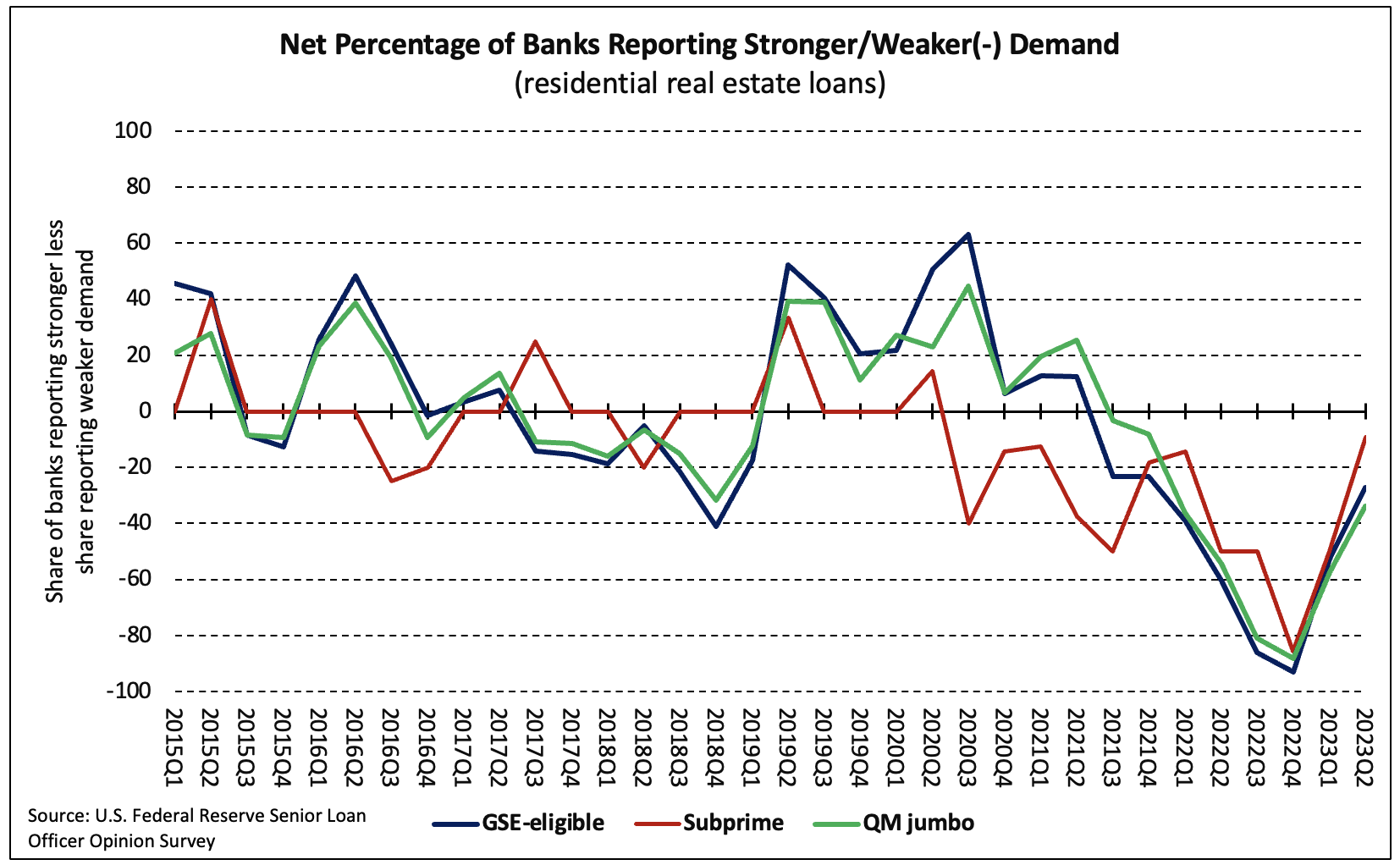

According to the Federal Reserve Board’s July 2023 Senior Loan Officer Opinion Survey (SLOOS)—conducted for bank lending activity over the second quarter of 2023—banks reported that lending standards tightened for all residential real estate (RRE) and commercial real estate (CRE) loan categories. Demand for RRE and CRE loans weakened across all categories over the quarter.

Moreover, banks expect their lending standards across all loan categories to tighten further over the second half of 2023. Expectations of more tightening were fueled by increased economic uncertainty and an expected deterioration of collateral values and credit quality of existing loans according to respondents. However, the net shares of banks expecting to tighten declined relative to Q1 2023 for each loan category.

A higher net percentage of banks reported tighter residential mortgage lending standards in Q2 across all categories except subprime loans. The share of banks that tightened standards for subprime loans fell to 16.7% after more than doubling to 33.3% in Q1 2023.

In contrast, that share nearly tripled for GSE-eligible RRE loans. Although the 3.5 percentage point increase was small in nominal terms, it was the largest of any loan category and brought the net share to the highest on record outside the second and third quarter of 2020.

As standards for all RRE loan categories tightened, banks also reported weaker demand for all RRE loan categories. The net share of banks reporting weaker demand averaged 38.9% across loan categories—a large improvement from the 50.8% and 87.4% averages in Q4 2022 and Q1 2023, respectively.

However, these may be “in name only” improvements. As demand weakens as significantly as it did in Q4 2022, the marginal declines each quarter thereafter are likely to become smaller if some lower bound on demand exists given prevailing economic conditions.

Like the results for RRE, banks reported both tightened standards as well as weaker demand for all categories of commercial real estate loans, on net. Major shares (greater than 50%) of banks tightened standards for construction and land development loans (71.7%) and loans secured by multifamily properties (63.3%) in the second quarter. Additionally, roughly half of respondents indicated weaker demand for these loans in Q2 relative to Q1.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

As traditional options tighten, construction loans could provide a lifeline for those seeking to build or renovate homes, stimulating the housing market and offering borrowers more flexibility. Check us out at builderloans.net for your construction financing needs