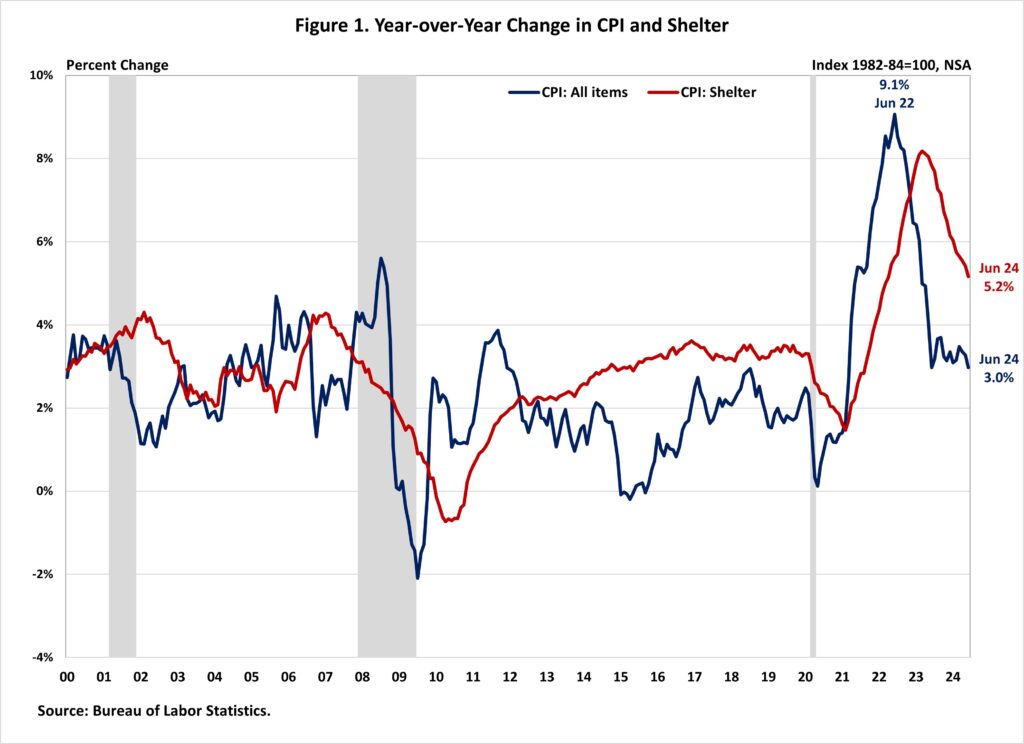

Both overall and core inflation continued to slow in June, as a decline in gasoline prices offset the increase in shelter costs. This is another dovish signal for future monetary policy, following a significant downward revision to the job report.

Despite a slowdown in the year-over-year increase, shelter costs continue to put upward pressure on inflation, accounting for over 60% of the total increase in core inflation. While this report indicates signs of softening prices, the Federal Reserve will require further data to confirm a consistent disinflation trend toward their 2% target before considering rate cuts.

The Fed’s ability to address rising housing costs is limited because increases are driven by a lack of affordable supply and increasing development costs. Additional housing supply is the primary solution to tame housing inflation. However, the Fed’s tools for promoting housing supply are constrained.

In fact, further tightening of monetary policy would hurt housing supply because it would increase the cost of AD&C financing. This can be seen on the graph below, as shelter costs continue to rise despite Fed policy tightening. Nonetheless, the NAHB forecast expects to see shelter costs decline further in the coming months. This is supported by real-time data from private data providers that indicate a cooling in rent growth.

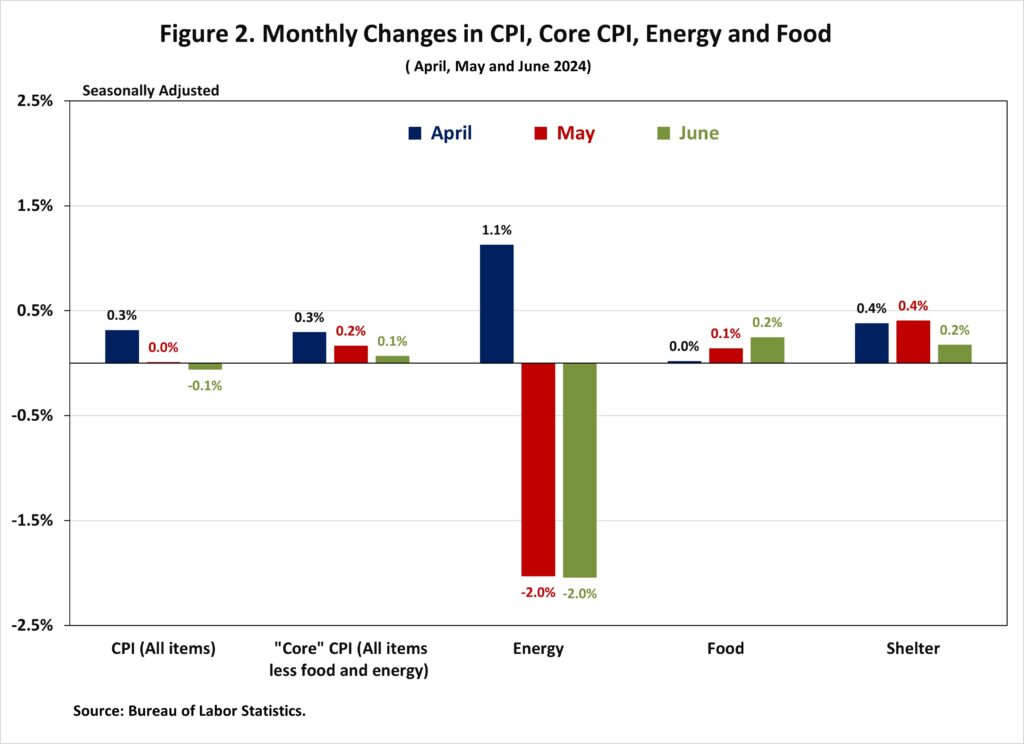

The Bureau of Labor Statistics reported that the Consumer Price Index (CPI) fell by 0.1% in June on a seasonally adjusted basis, after being unchanged in May. This was the first monthly decline since May 2020. Excluding the volatile food and energy components, the “core” CPI increased by 0.1% in June, after a 0.2% increase in May.

The price index for a broad set of energy sources fell by 2.0% in June, led by a 3.8% decrease in the gasoline index. Other energy indexes such as electricity and fuel oil declined 0.7% and 2.4%, respectively, while the natural gas index increased by 2.4%. Meanwhile, the food index rose 0.2%, after a 0.1% increase in May. The index for food away from home increased by 0.4% and the index for food at home rose 0.1%.

In June, the index for shelter (+0.2%) continued to be the largest contributor to the monthly increase in the core CPI. Among other top contributors that rose in June include indexes for motor vehicle insurance (+0.9%), household furnishings and operations (+0.5%), and medical care (+0.2%). Meanwhile, the top contributors that experienced a decline in June include indexes for airline fares (-5.0%), used cars and trucks (-1.5%) and communication (-0.2%).

The index for shelter makes up more than 40% of the “core” CPI. The shelter index rose by 0.2% and remained the largest factor in the monthly increase in the index for core inflation. Both the indexes for owners’ equivalent rent (OER) and rent of primary residence (RPR) increased by 0.3% over the month, the smallest monthly increases since August 2021. These gains have been the largest contributors to headline inflation in recent months.

During the past twelve months, on a non-seasonally adjusted basis, the CPI rose by 3.0% in June, following a 3.3% increase in May. The “core” CPI increased by 3.3% over the past twelve months, following a 3.4% increase in May. This was the slowest annual gain since April 2021. Over the past twelve months, the food index rose by 2.2%, and the energy index increased by 1.0%. This marks the fourth consecutive month of year-over-year increases for the energy index since February 2023.

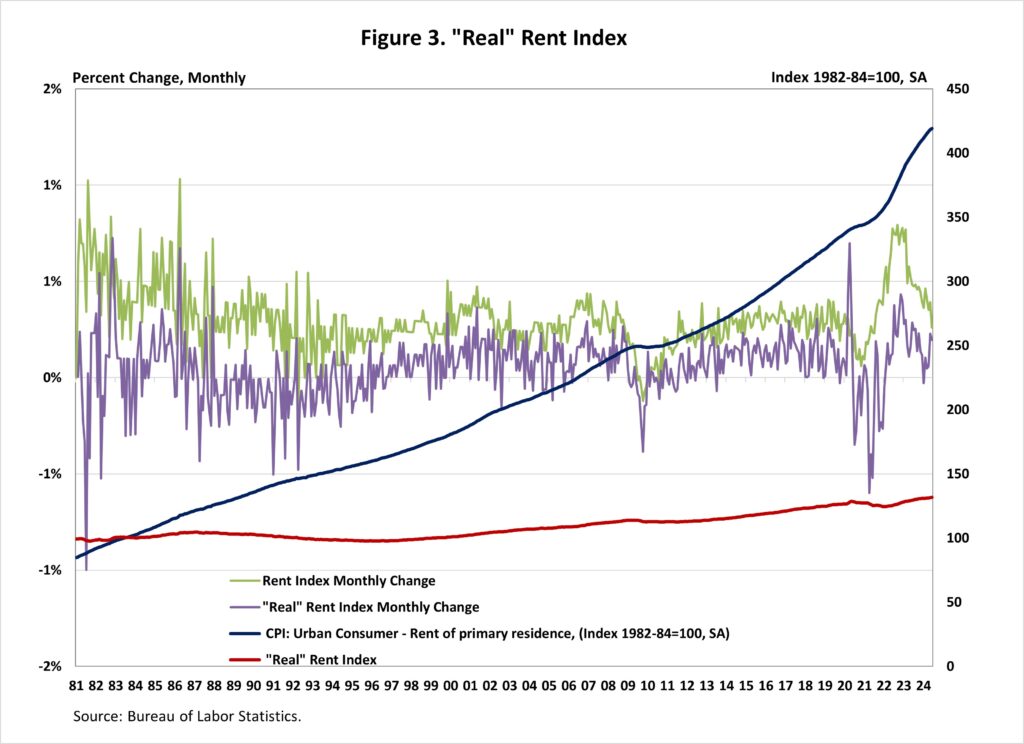

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than overall inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster than overall inflation, the real rent index rises and vice versa. The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components).

In June, the Real Rent Index rose by 0.2%, after a 0.2% increase in May. Over the first six months of 2024, the monthly growth rate of the Real Rent Index averaged 0.1%, slower than the average of 0.2% in 2023.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.