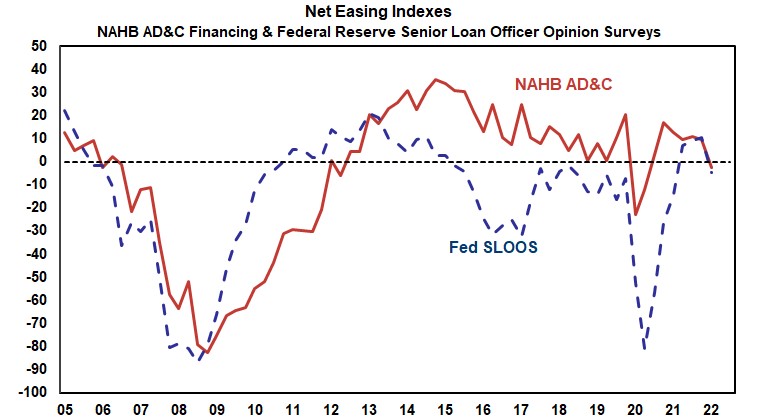

During the first quarter of 2022, credit became tighter on loans for Acquisition, Development & Construction (AD&C) according to NAHB’s Survey on AD&C Financing. The NAHB survey produces a net easing index that summarizes the change in credit conditions, similar to the net easing index constructed from the Federal Reserve’s survey of senior loan officers (SLOOS). In the first quarter of 2022, both the NAHB and Fed indices were negative, indicating tightening credit conditions. The NAHB index stood at -2.3 while the Fed index was -4.7, compared to +9.7 and +10.3, respectively, in the fourth quarter of 2021. This is the first time that both measures show tightening credit conditions since mid-2020.

The NAHB net easing index uses information from questions that ask builders and developers if availability of credit has gotten better, worse, or stayed the same since the previous quarter. In the first quarter of 2022, 6 percent of the NAHB builders said availability of credit for land acquisition had gotten better, while 9 percent said it had gotten worse. For land development, 3 percent said credit conditions improved, while 14 percent of the respondents indicated that it had gotten worse. Finally, 11 percent of builders reported that the availability of credit for single-family construction had improved, compared to only 4 percent who said it had gotten worse.

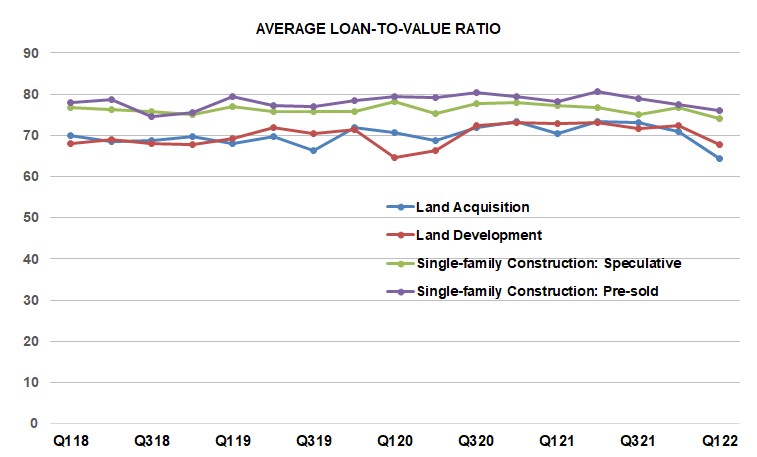

One way lenders reduced availability of credit in the first quarter of 2022 was by lowering Loan-to-Value (LTV) and Loan-to-Cost (LTC) ratios. In the NAHB survey, the average LTV on all four categories of AD&C loans declined between the fourth quarter of 2021 and the first quarter of 2021: from 70.9 to 64.4 percent on loans for land acquisition, from 72.4 to 67.7 percent on loans for land development, from 76.7 to 74.1 percent on loans for speculative single-family construction, and from 77.4 to 76.0 percent on loans for pre-sold single-family construction.

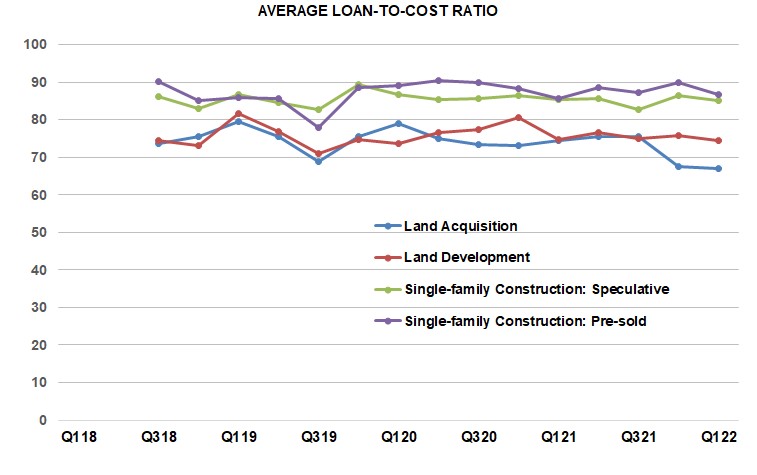

Similarly, the average LTC declined from 67.6 to 66.9 percent on loans for land acquisition, from 75.9 to 74.5 percent on loans for land development, from 86.3 to 85.0 percent on loans for speculative single-family construction, and from 90.0 to 86.7 percent on loans for pre-sold single-family construction.

As of the first quarter, rising interest rates recently reported on other types of loans were not yet consistently evident in the NAHB AD&C survey. The average effective rate (based on rate of return to the lender over the assumed life of the loan taking both the contract interest rate and initial fee into account) decreased from 6.43 in the fourth quarter of 2021 to 6.32 percent in the first quarter of 2022 on loans for land acquisition, but increased from 7.14 to 7.85 percent on loans for land development. For pre-sold single-family construction, the average effective rate decreased from 7.94 to 7.38 percent and from 8.10 to 7.90 percent on loans for speculative single-family construction.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.