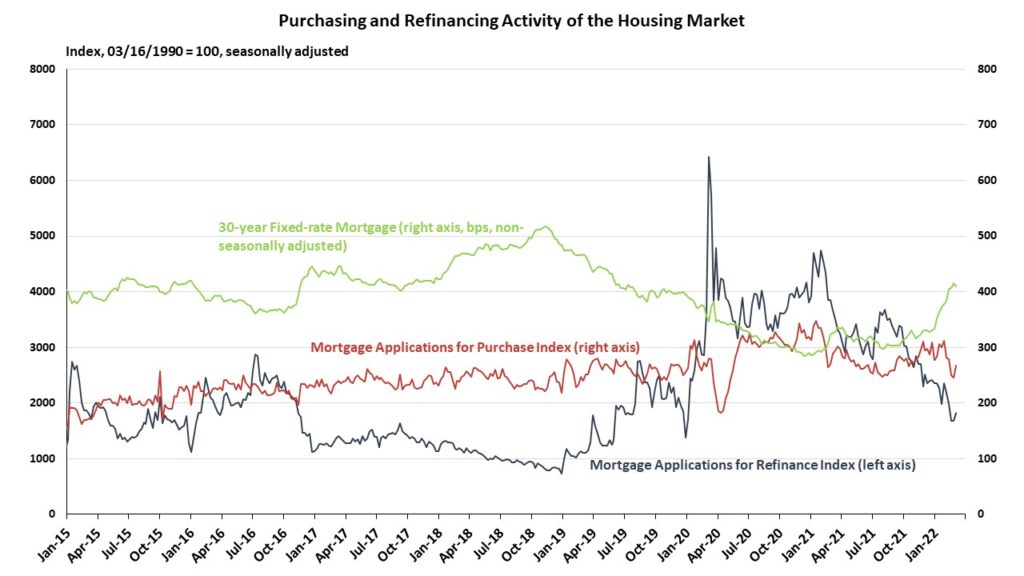

In the past month, total mortgage activity, as measured by the Mortgage Bankers Association’s (MBA) Market Composite Index, underwent a series of weekly declines, but increased in the latest week by 8.5 percent. The latest week’s survey is for the week ending March 4. The latest week’s activity consisted of an 8.6 percent increase in purchasing and an 8.5 percent increase in refinancing, with larger gains of refinancing in government loans.

The current month’s 30-year fixed-rate mortgage rates averaged 4.1 percent, compared to 3.7 percent in the previous month. The latest weekly rate of 4.09 percent was 6 basis points lower than the week before. Due to the Ukraine war, investors reduced their equity holdings and increased their long-term investments in safer assets such as bonds. U.S. Treasury yields, as a result, slipped to their lowest levels since January and mortgage rates followed suit.

Interest rate volatility is expected at this time, due to countervailing effects of inflation and international developments disrupting oil and other commodity flows.

On an unadjusted basis, the Purchasing Index showed a year-over-year decline of 7 percent on a year-over-year basis, i.e., compared to the same week one year ago. For the same comparison period, the Refinancing Index showed a 50 percent decline.

The refinance share of mortgage activity decreased to 49.5 percent of total applications from 49.9 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 5.2 percent of total applications.

Average loan sizes remained close to record highs, with higher loan balances continuing to take up most of purchasing activity.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.