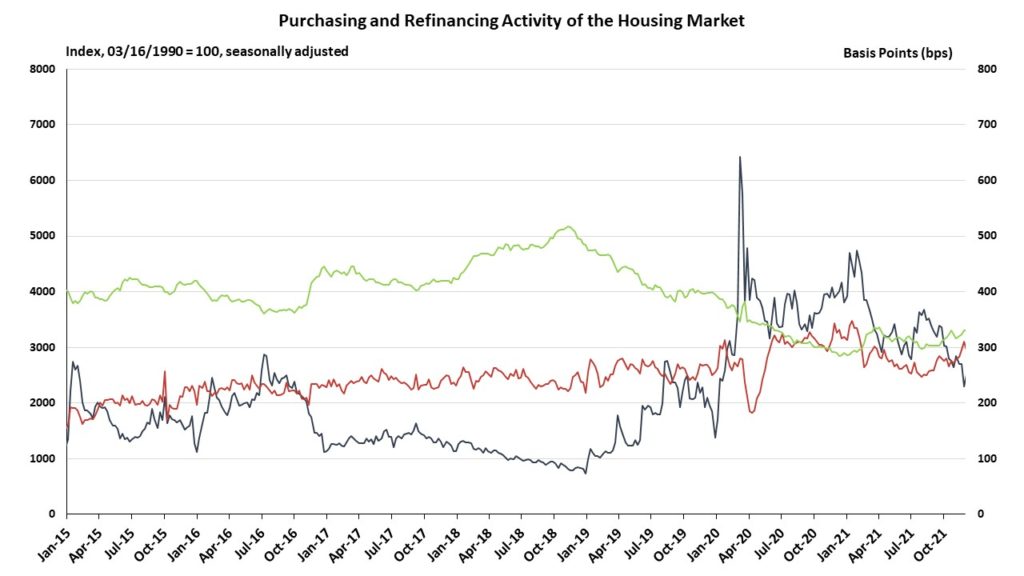

The latest Mortgage Bankers Association’s (MBA) weekly application surveys shows a decline for refinancing and an increase in mortgage purchasing.

The 30-year fixed-rate mortgage rate increased, averaging close to 3.4 percent for the month and was 3.52 percent in the latest week, the week ending January 7th. In the latest week, total mortgage applications, as proxied by the MBA’s Market Composite Index, increased by 1.4 percent from the prior week, an anemic gain amid the overall decline of mortgage activity of the last month. The seasonally adjusted Purchase Index increased 2 percent from one week earlier.

The latest mortgage rate marked the highest level since March 2020, i.e., when the pandemic in the U.S. first started. Mortgage rates were pushed up by increases in the U.S. 10-year-Treasury rate, which, in turn, reacted to the Federal Reserve’s signaling of tighter policy ahead.

Meanwhile, refinancing continued moving downward from a month prior, though the latest week’s weakening in activity, a decline of 0.1 percent, was not as strong a reaction to the increase in rates as might be expected.

On an unadjusted basis, the Purchasing Index in the latest week was 17 percent lower than what it was one year ago (year-over-year percent change for the same week) and its refinancing counterpart was 50 percent lower.

The refinance share of mortgage activity decreased to 64.1 percent of total applications from 65.4 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 3.1 percent of total applications.

The refinance share of mortgage activity decreased to 65.2 percent of total applications from 63.3 percent the previous week, an anemic gain given the data of the prior month. The adjustable-rate mortgage (ARM) share of activity remained unchanged at 3.4 percent of total applications.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.