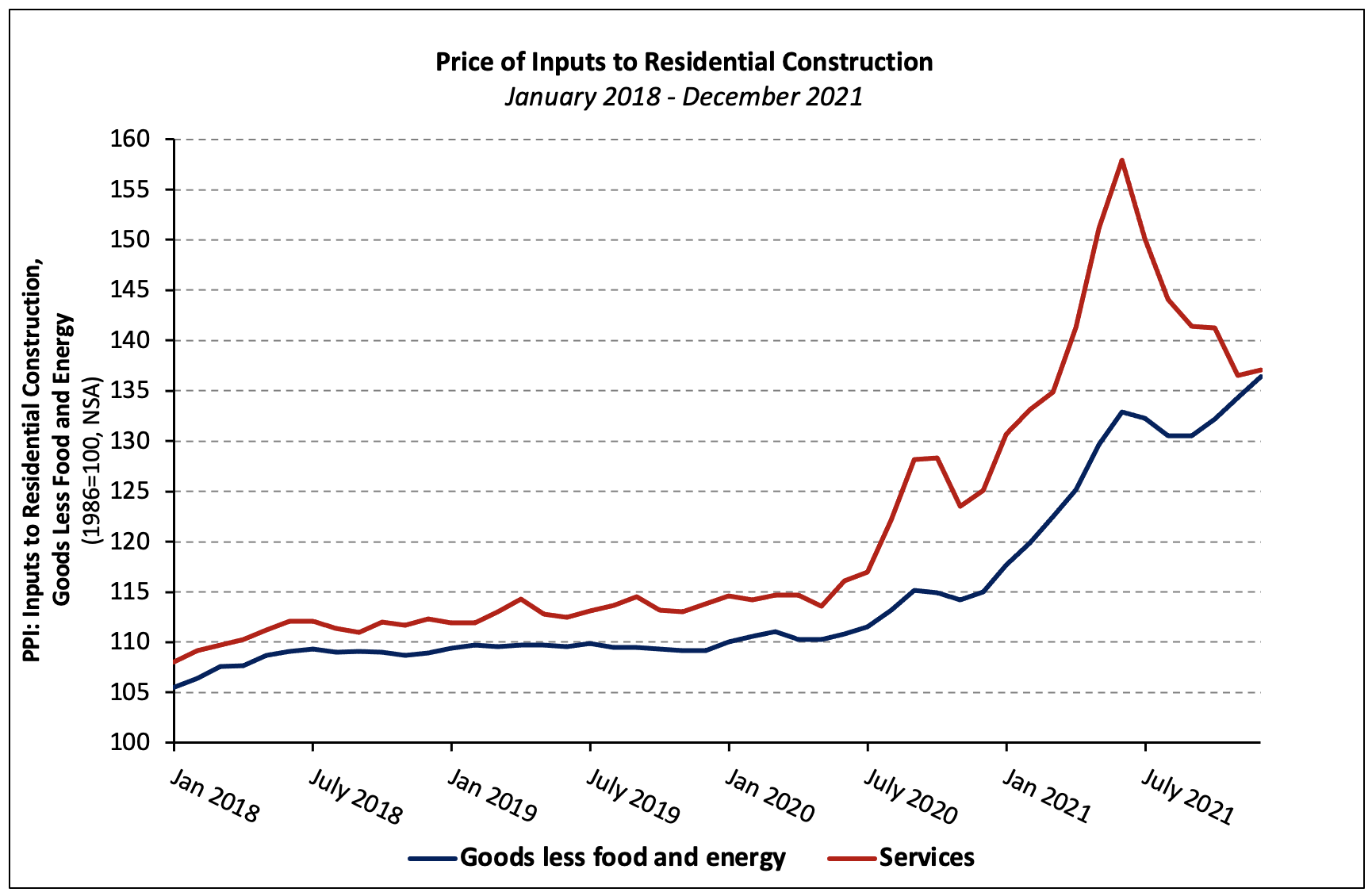

The prices of goods used in residential construction ex-energy climbed 1.5% in December (not seasonally adjusted), according to the latest Producer Price Index (PPI) report released by the Bureau of Labor Statistics. The index was driven higher by large price increases for wood products.

Building materials prices increased 15.9% in 2021 and have risen 18.6% since December 2020. Since declining 1.8% between July and August 2021, the index has climbed 4.5%.

The price index of services inputs to residential construction increased 0.4% in December following a five-month period over which the index declined 13.6%. The index is 9.6% higher than it was 12 months prior and 19.6% higher than the January 2020 reading.

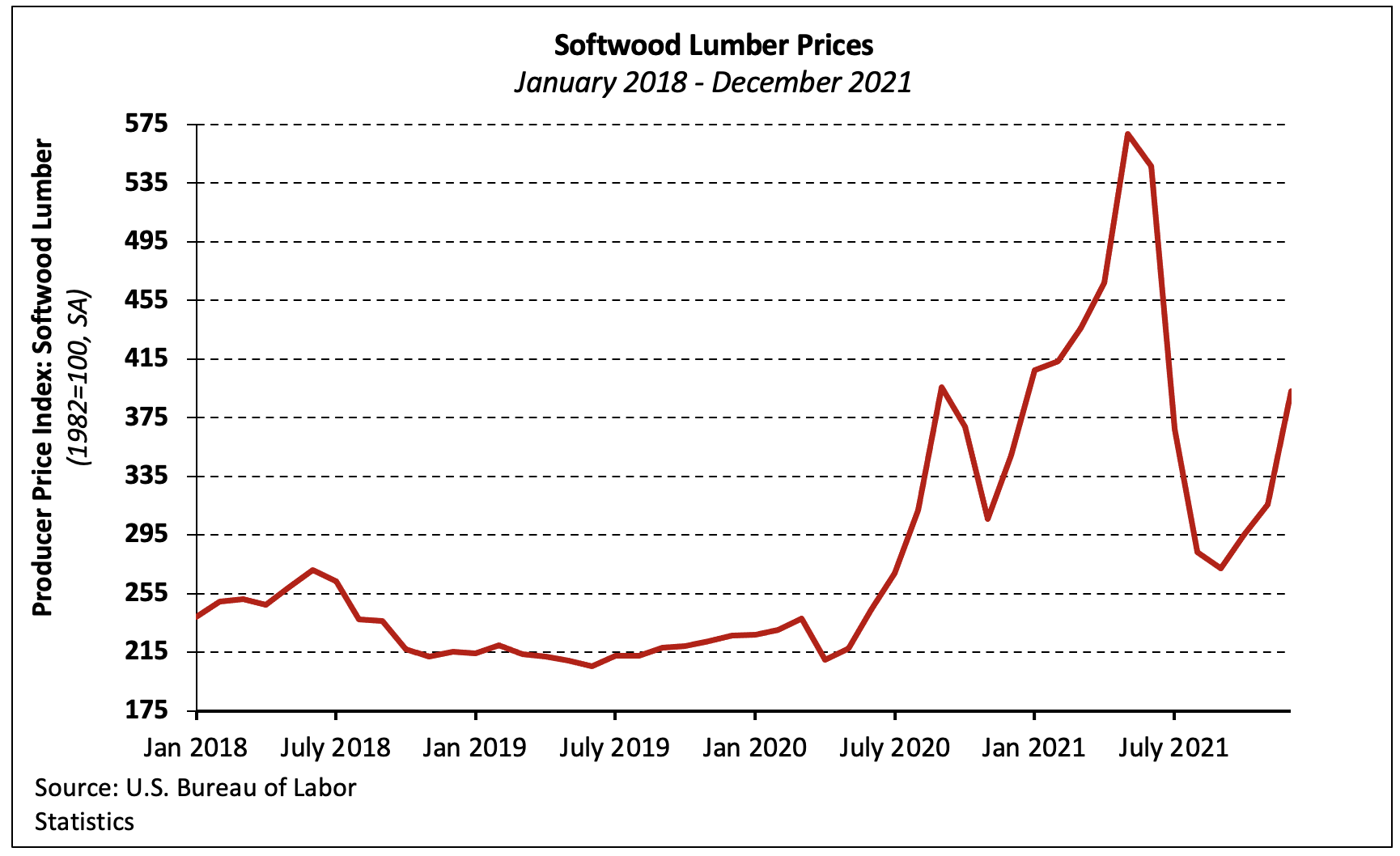

Softwood Lumber

The PPI for softwood lumber (seasonally adjusted) increased 24.4% in December and has gained 44.5% since September. According to Random Lengths data, the “mill price” of framing lumber has roughly tripled since late August.

The PPI of most durable goods for a given month is largely based on prices paid for goods shipped, not ordered, in the survey month. This can result in lags relative to cash market prices, suggesting another sizable increase in the softwood lumber producer price index may be in the next PPI report.

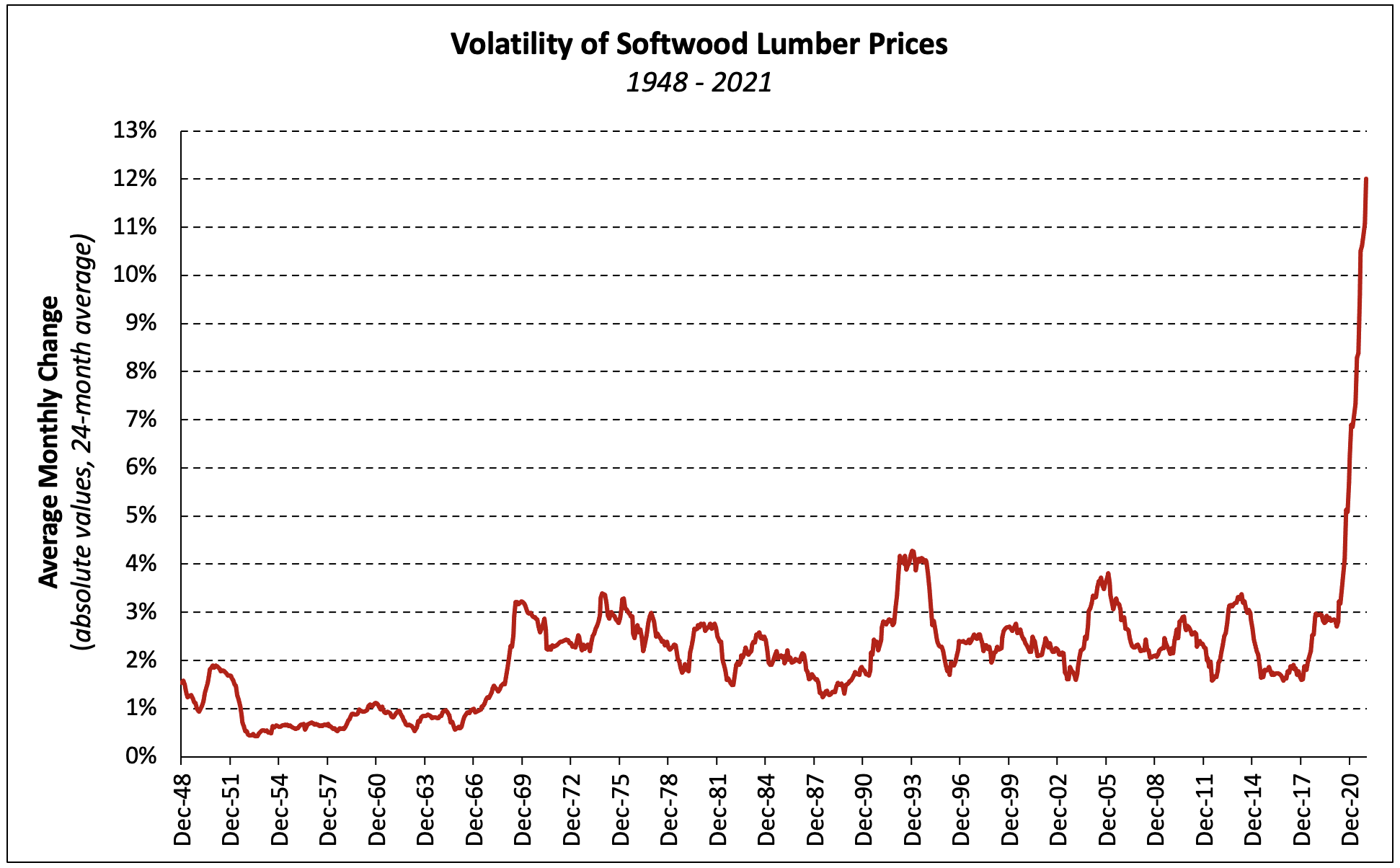

Record-high volatility of softwood lumber prices continues to be as problematic as high prices. The monthly change in softwood lumber prices averaged 0.3% between 1947 and 2019. In contrast, the percent change of the index has averaged 12.0% since January 2020—the highest 24-month average since data first became available 1947 and nearly triple the previous record.

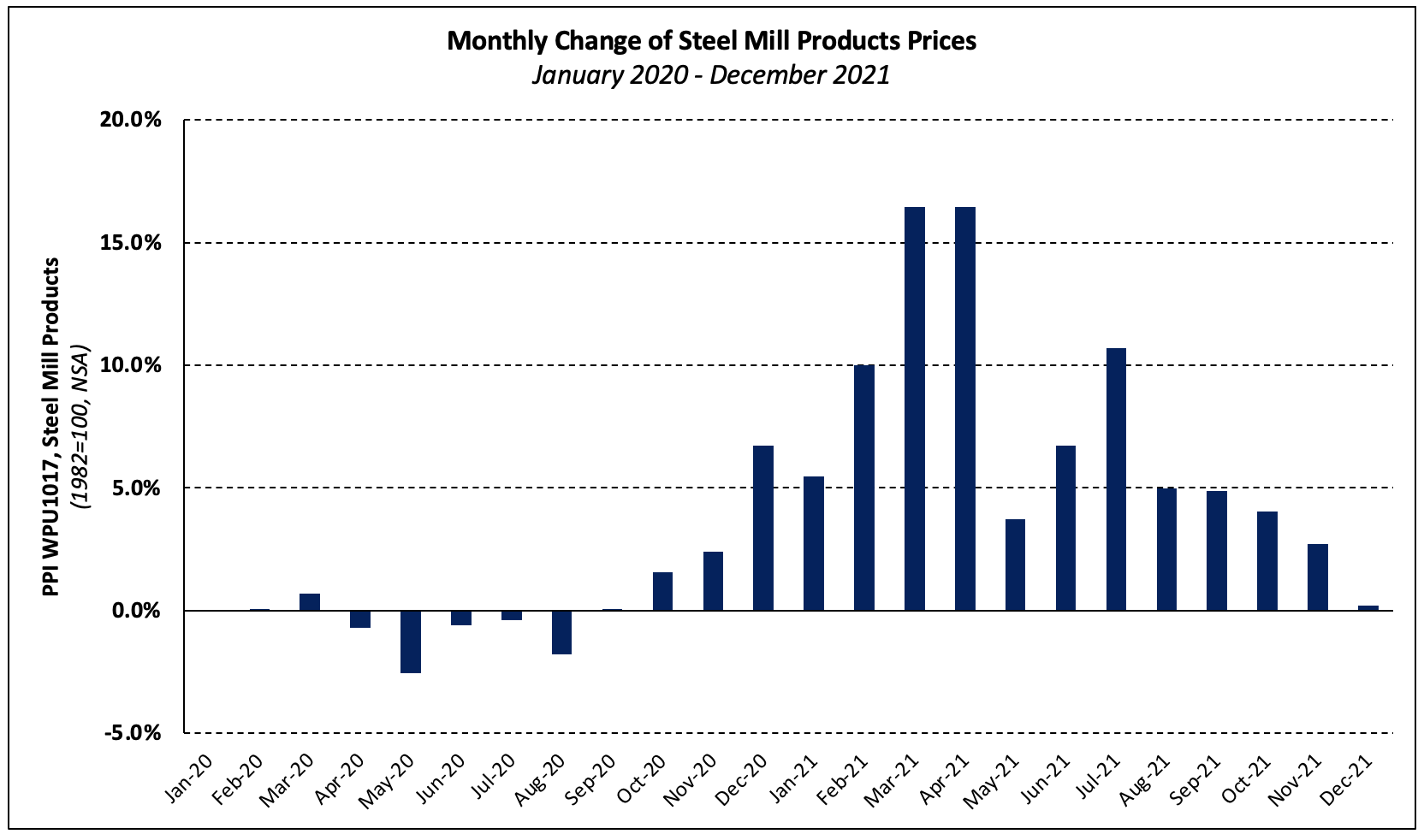

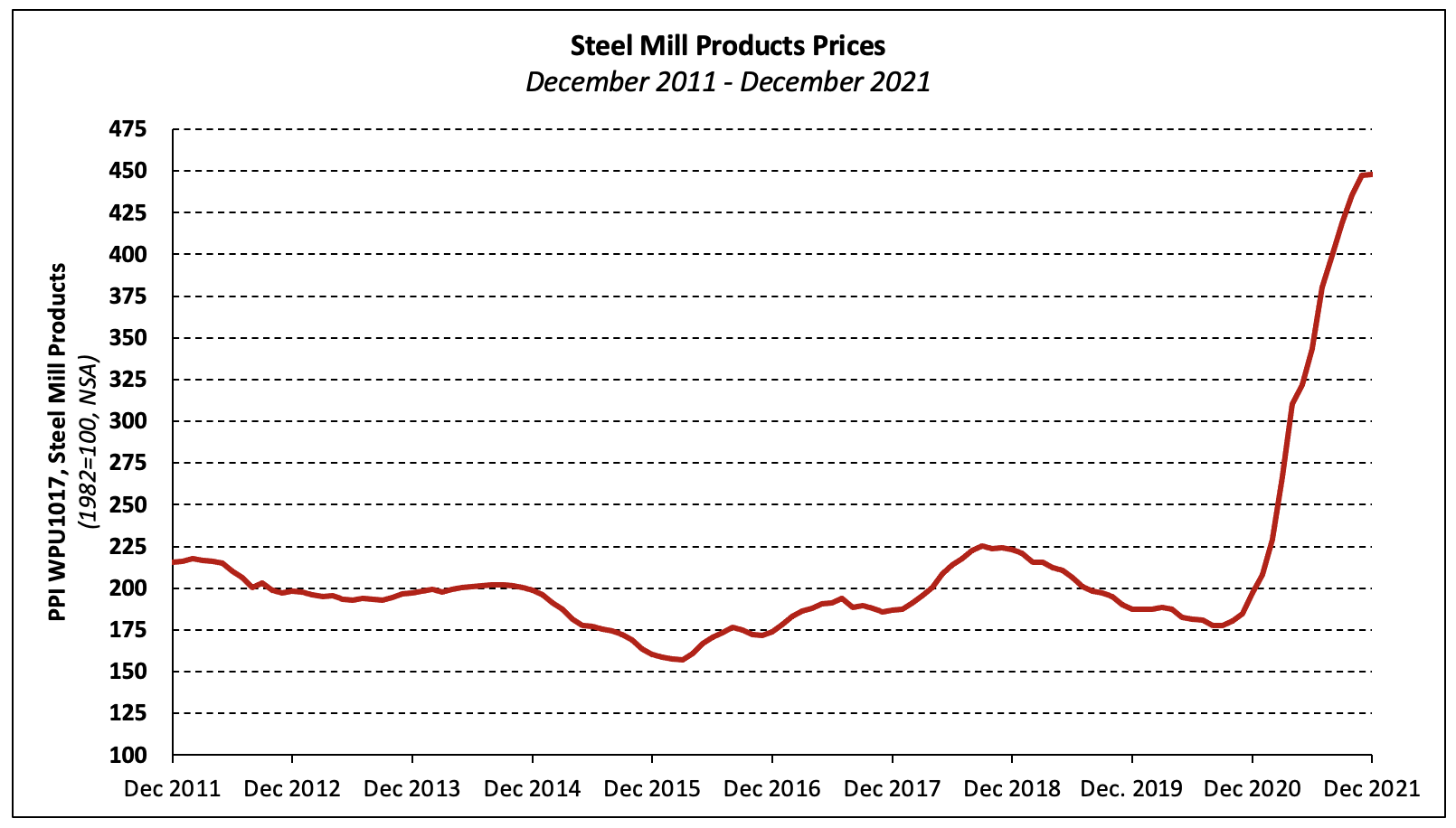

Steel Products

Steel mill products prices rose 0.2% in December, the smallest monthly increase since September 2020. Monthly price increases have slowed in each of the past five months.

The last monthly price decrease in steel mill products occurred in August 2020, and the index has climbed 152.2% in the months since–with more than 80% of that increase taking place in 2021.

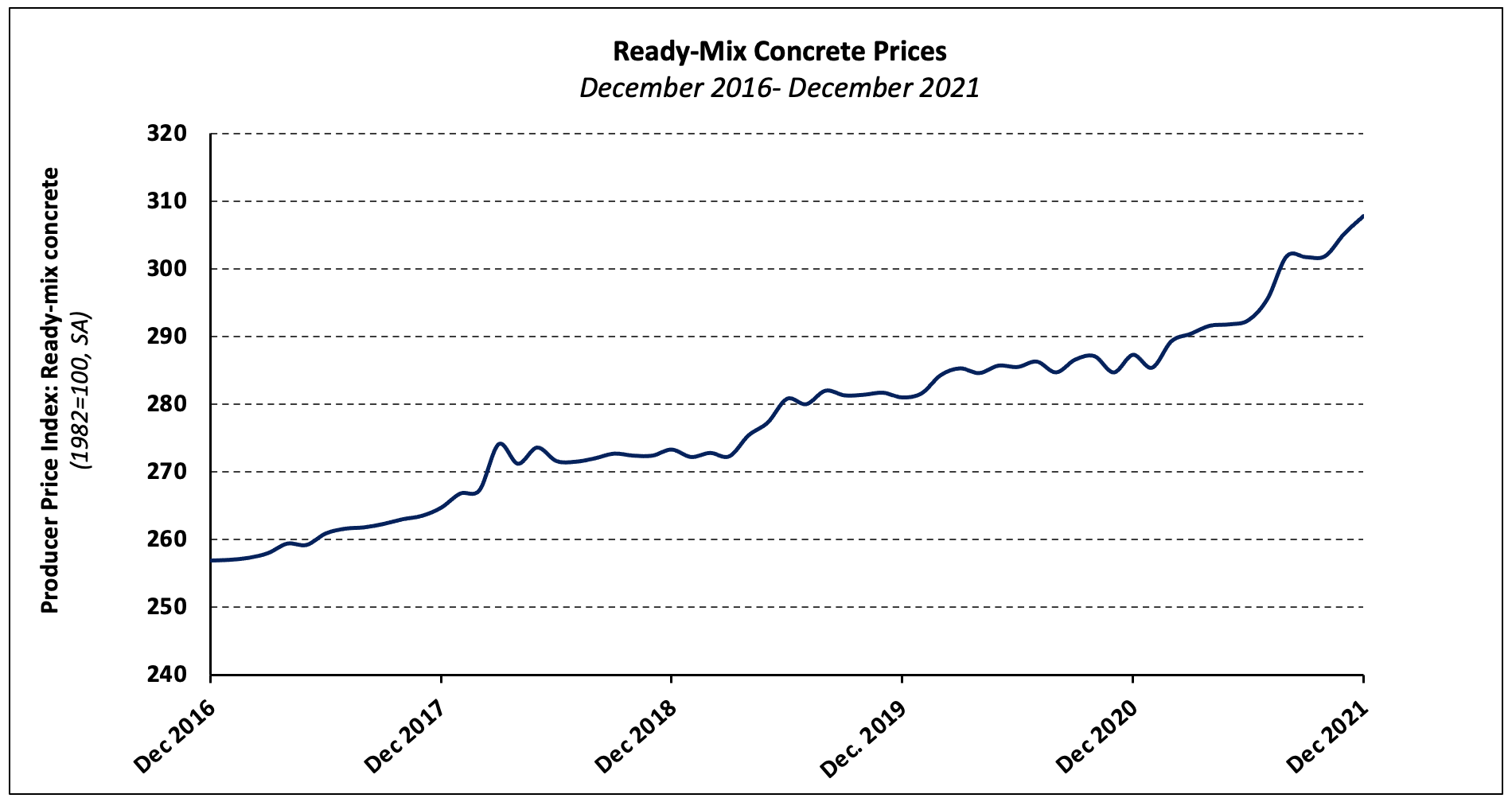

Ready-Mix Concrete

The PPI for ready-mix concrete (RMC) gained 0.9% in December after increasing 1.1% in November. The index for RMC increased 6.5% between January and December 2021 and is 9.3% higher than the January 2020 level.

At the regional level, prices increased in the South (+1.0%) and West (+1.1%) as prices declined in the Midwest (-0.1%). The price of RMC held steady in the Northeast.

Gypsum Products

In December, the PPI for gypsum products decreased 0.5%–the second consecutive monthly decline. Gypsum products prices ended the year 18.2% higher than they were in January.

Paint

The PPIs for exterior architectural coatings (i.e., paint) increased 1.6% in December while the price of interior paint was unchanged. Neither index has declined since January 2021 and the January-to-December price increases of architectural coatings is unprecedented–exterior and interior paint prices climbed 19.8% and 10.9%, respectively, in 2021.

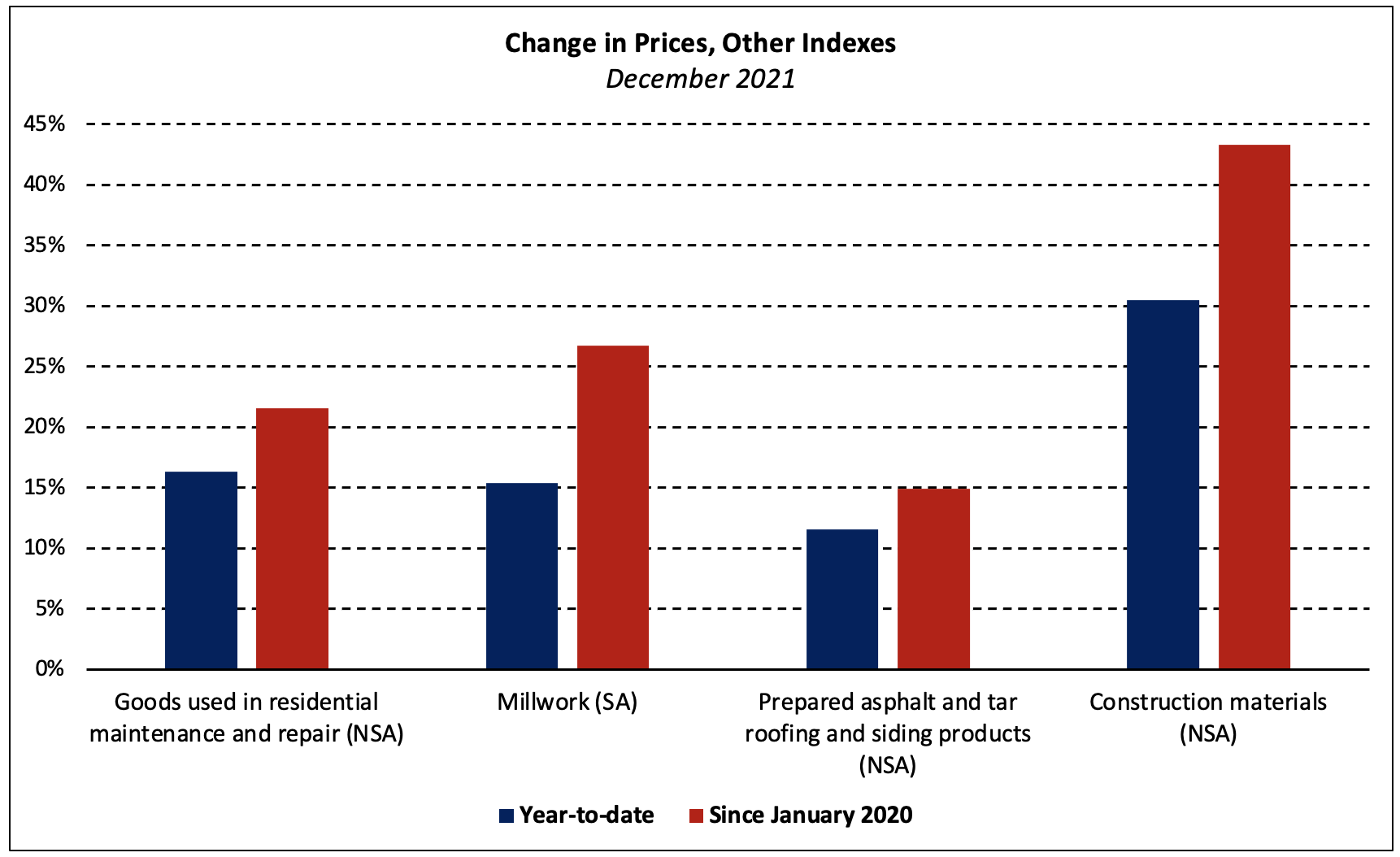

Other Building Materials

The chart below shows the 12-month and year-to-date price changes of other price indices relevant to the residential construction industry.

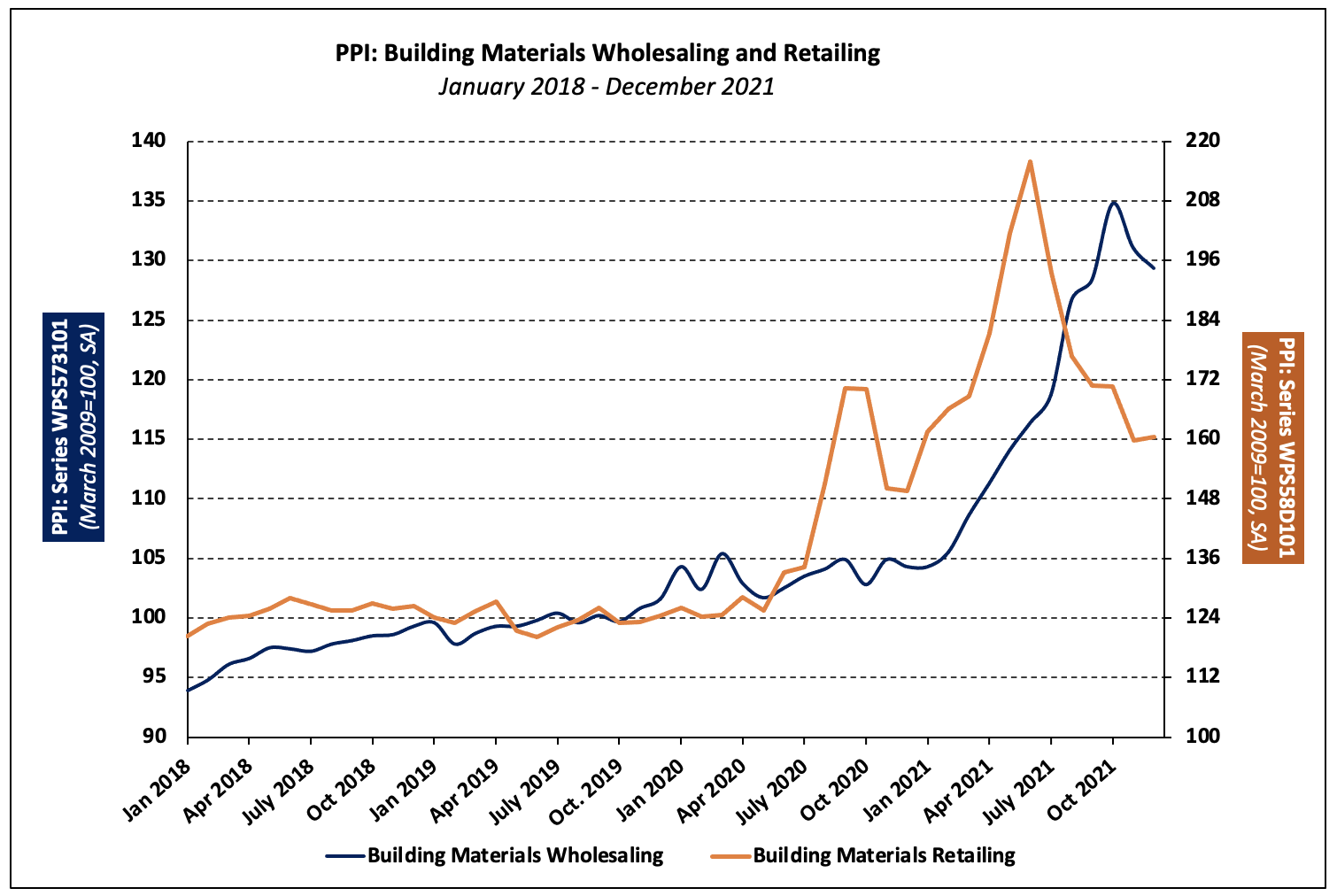

Building Materials Wholesaling and Retailing

In contrast to the PPI for building materials retailing—which increased 0.4% in December—the Producer Price Index for building materials wholesaling decreased 1.3% over the month. The wholesale and retail services indices measure changes in the nominal gross margins for goods sold by retailers and wholesalers. Gross profit margins of retailers, in dollar terms, have declined 25.7% since reaching an all-time high in June 2021 but remain 27.3% higher than the January 2020 level.

Building materials wholesale and retail indexes account for roughly two-thirds of the PPI for “inputs to residential construction, services.”

Professional Services

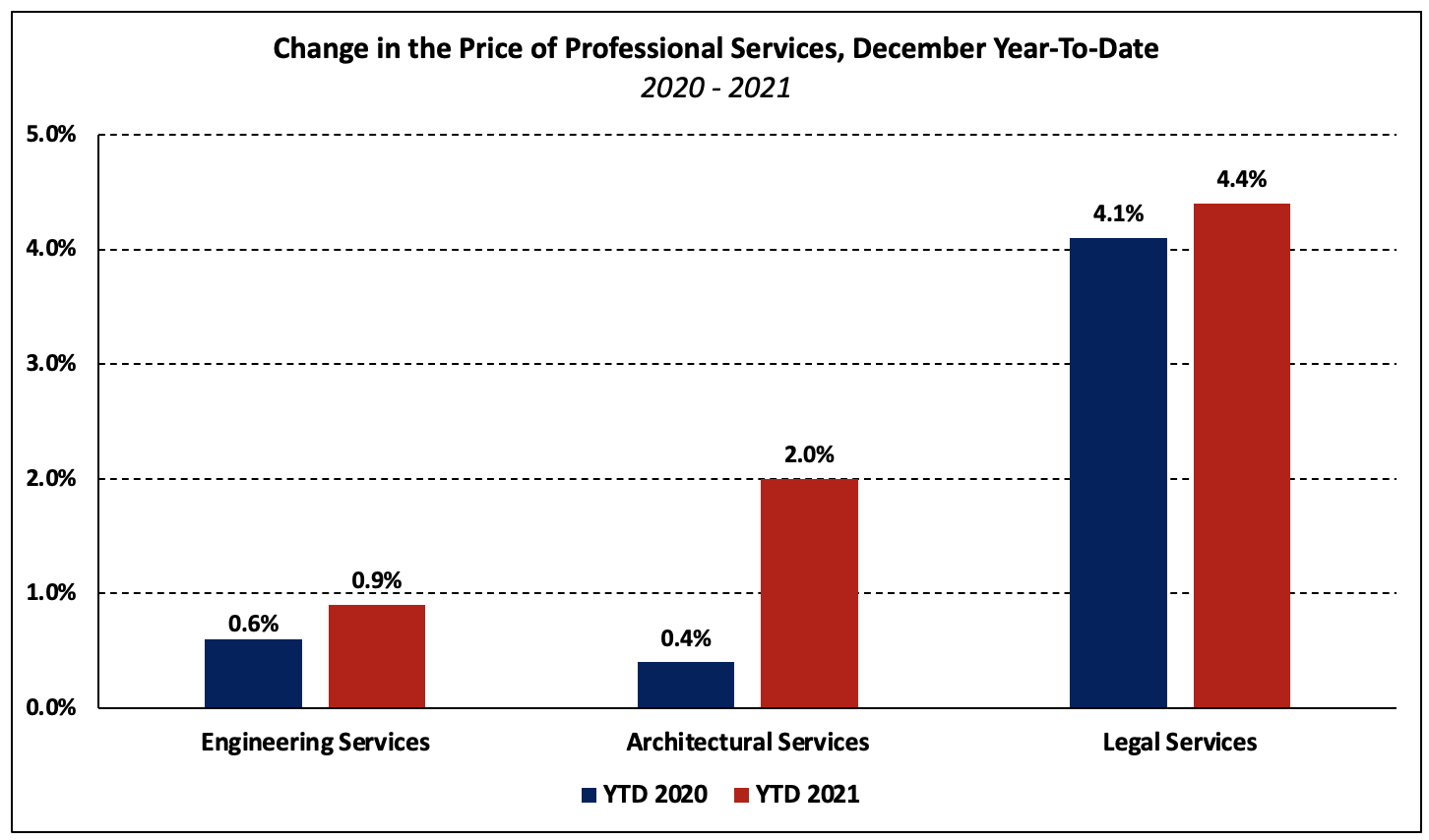

The category of professional services carries the third most weight among those that make up the service inputs to residential construction PPI. The prices of legal, architectural, and engineering services changed 0.5%, 0.0%, and -0.1%, respectively, in December. Although the year-to-date increase in prices of professional services used in residential construction are quite modest compared to that of materials, prices have increased more in 2021 than they had by December 2020; the difference is especially striking for architectural services.

Though the difference in price changes for legal services is small, the percentage increases are large relative to engineering and architectural. This follows with a trend in recent years. Since December 2018, the price of legal services has risen 13.6%–much more than the three-year increase in architectural (+1.1%) and engineering services (+5.8%).

Metal Treatment Services

Prices of metal treatment services increased 1.2%, on average, in December. The subset of these services used to calculate the services inputs to residential construction includes plating and polishing, coating and allied services, and heat treating.

Metal coating and allied services increased the most over the course of 2021 (+14.9%, NSA). Metal heat treating and plating and polishing services climbed 6.2% and 3.8%, respectively, between January and December. The average monthly price increase of the three services was just 0.1% over the course of 2020.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Question: what should be the takeaway from the divergence since mid-2021 in retail vs wholesale PPI? Are retail prices experiencing more pressure from consumers than retailers themselves are applying to wholesale prices (at least until the recent decline in wholesale PPI)? If that is the case, does price pressure usually work through the system directionally from retail to wholesale to manufacturer?