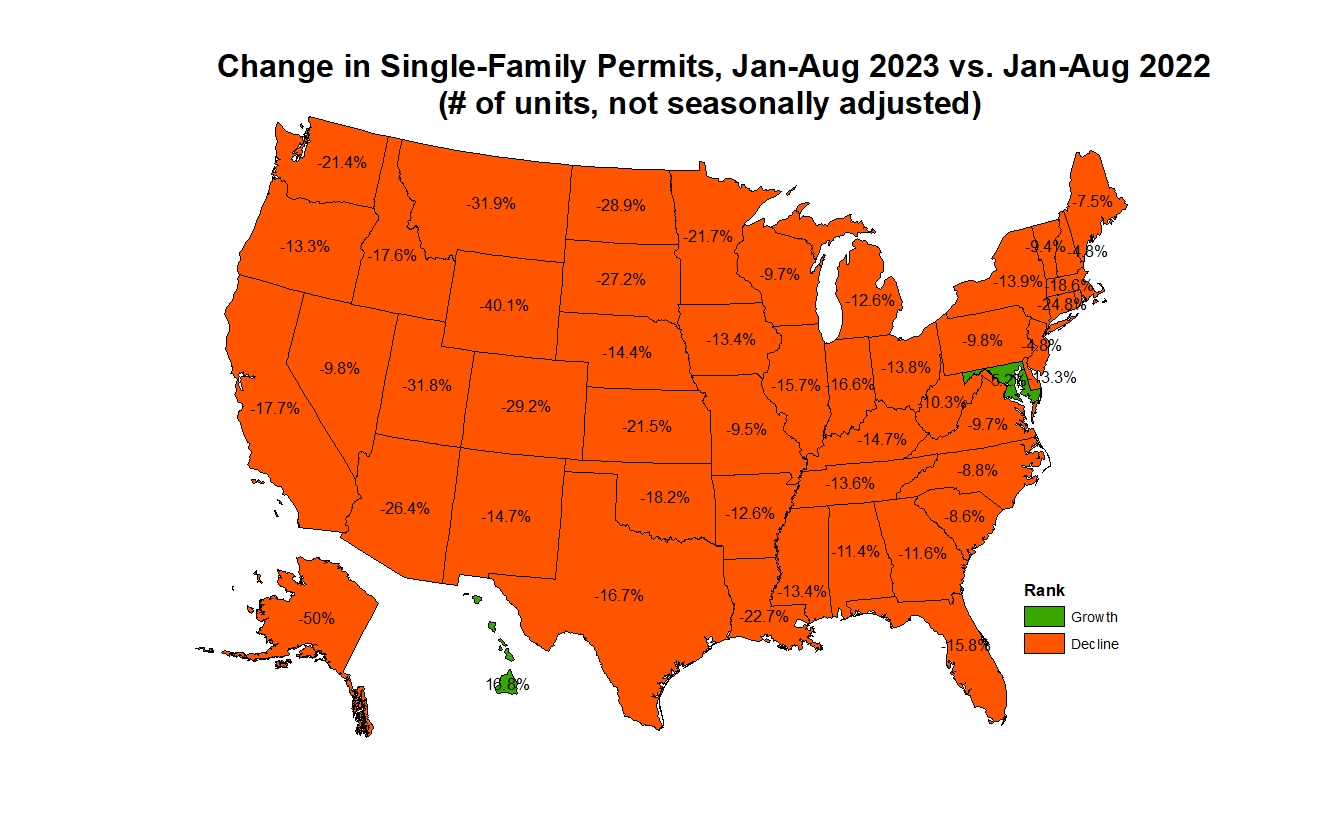

Over the first eight months of 2023, the total number of single-family permits issued year-to-date (YTD) nationwide reached 615,453. On a year-over-year (YoY) basis, this is 15.6% below the August 2022 level of 728,866.

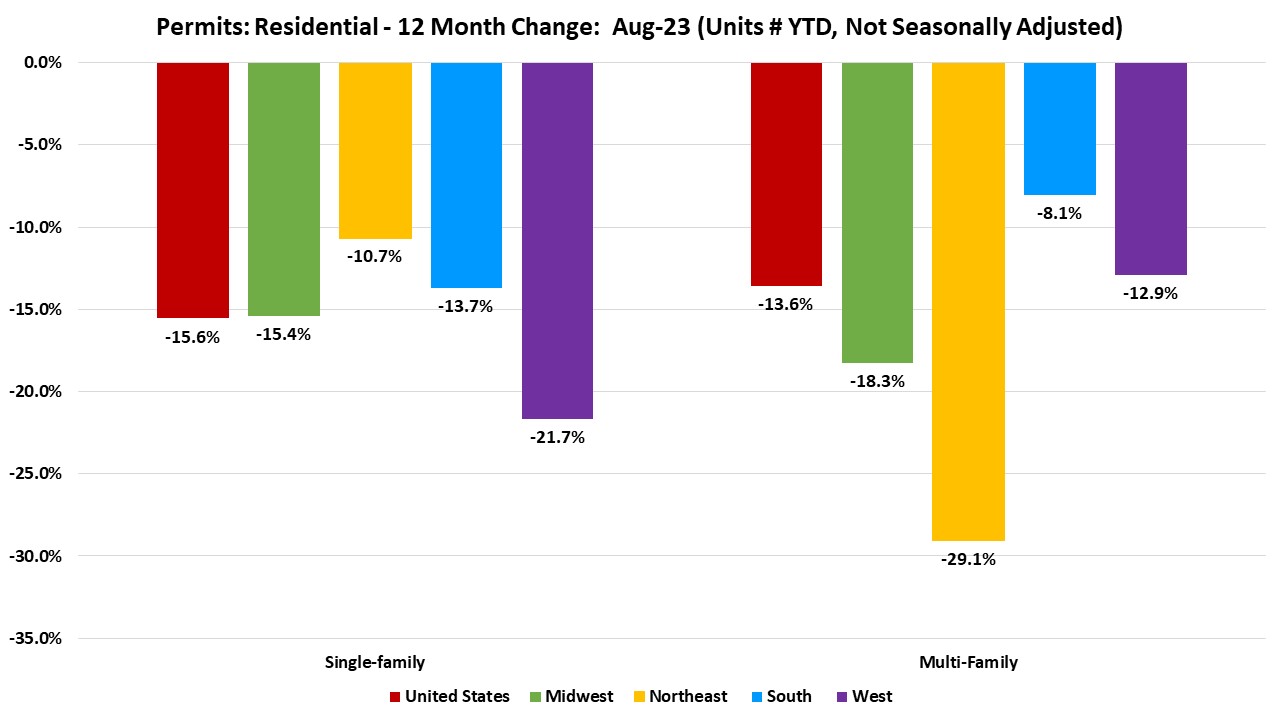

Year-to-date ending in August, single-family permits declined in all four regions. The range of permit decline spanned 10.7% in the Northeast to 21.7% in the West. The South declined by 13.7% and the Midwest declined by 15.4% in single-family permits during this time. For multifamily permits, the percentage decline spanned 8.1% in the South region to 29.1% in the Northeast. The West declined by 12.9% and the Midwest declined by 18.3% in multifamily permits during this time.

Between August 2022 YTD and August 2023 YTD, except for Hawaii (+16.8%) and Maryland (+5.2%), all the other states and the District of Columbia reported declines in single-family permits. The range of declines spanned 4.8% in New Jersey to 50.0% in Alaska. The ten states issuing the highest number of single-family permits combined accounted for 63.9% of the total single-family permits issued. Texas, the state with the highest number of single-family permits issued, declined 16.7% in the past 12 months while the next two highest states, Florida and North Carolina declined by 15.8% and 8.8% respectively.

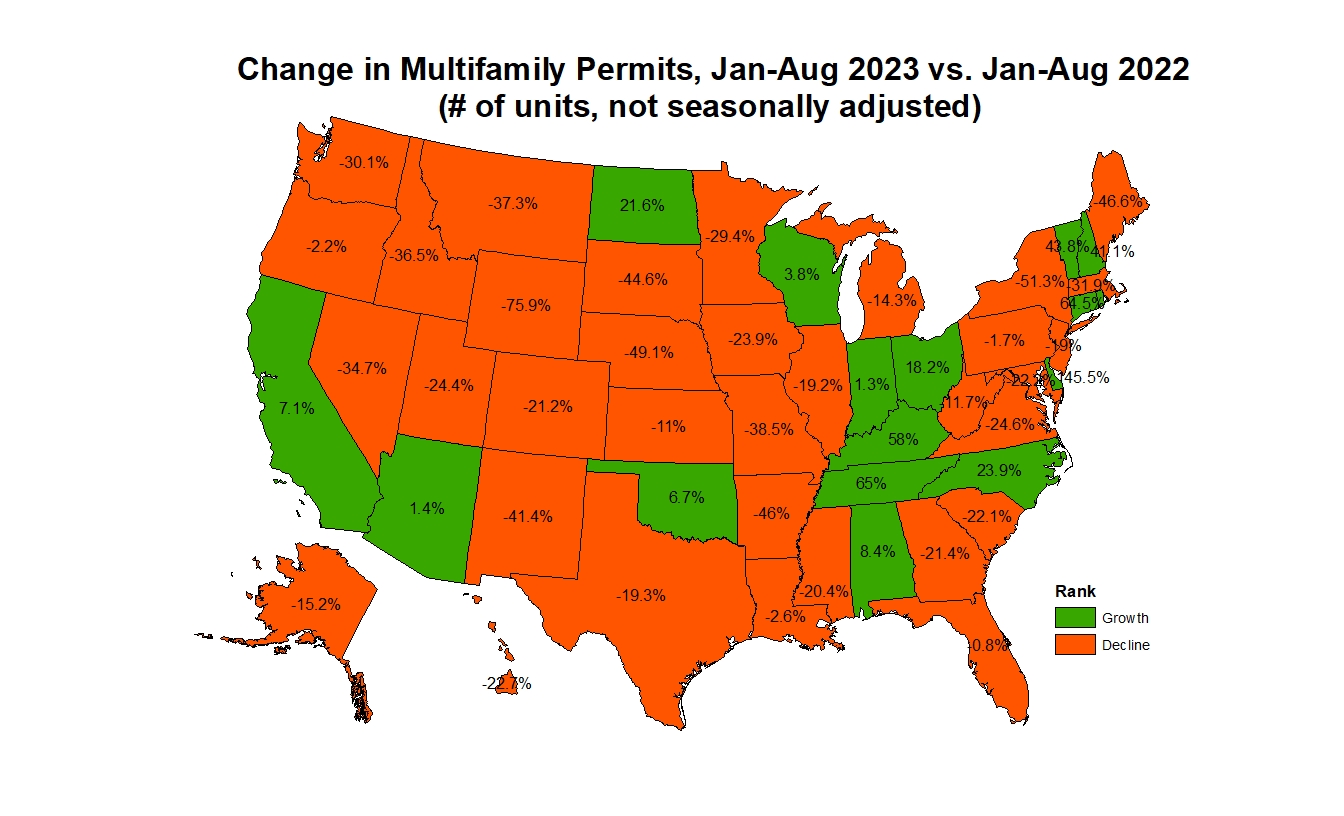

Year-to-date, ending in August, the total number of multifamily permits issued nationwide reached 394,257. This is 13.6% below the August 2022 level of 456,244.

Between August 2022 YTD and August 2023 YTD, 16 states recorded growth, while 34 states and the District of Columbia recorded a decline in multifamily permits. Delaware (+145.5%) led the way with a sharp rise in multifamily permits from 220 to 540 while Wyoming had the largest decline of 75.9% from 519 to 125. The ten states issuing the highest number of multifamily permits combined accounted for 64.1% of the multifamily permits issued. Texas, the state with the highest number of multifamily permits issued, declined 19.3% in the past 12 months while the next two highest states, Florida declined by 0.8% and California increased by 7.1%.

At the local level, below are the top ten metro areas that issued the highest number of single-family permits.

| Top 10 Largest SF Markets | Aug-23 (# of units YTD, NSA) | YTD % Change (compared to Aug-22) |

| Houston-The Woodlands-Sugar Land, TX | 34,841 | -3% |

| Dallas-Fort Worth-Arlington, TX | 28,282 | -15% |

| Atlanta-Sandy Springs-Roswell, GA | 16,894 | -14% |

| Phoenix-Mesa-Scottsdale, AZ | 15,889 | -27% |

| Charlotte-Concord-Gastonia, NC-SC | 12,956 | -9% |

| Orlando-Kissimmee-Sanford, FL | 11,734 | -3% |

| Austin-Round Rock, TX | 10,925 | -35% |

| Nashville-Davidson–Murfreesboro–Franklin, TN | 9,897 | -14% |

| Tampa-St. Petersburg-Clearwater, FL | 9,578 | -17% |

| Raleigh, NC | 8,726 | -8% |

For multifamily permits, below are the top ten local areas that issued the highest number of permits.

| Top 10 Largest MF Markets | Aug-23 (# of units YTD, NSA) | YTD % Change (compared to Aug-22) |

| New York-Newark-Jersey City, NY-NJ-PA | 21,605 | -40% |

| Dallas-Fort Worth-Arlington, TX | 17,291 | -23% |

| Houston-The Woodlands-Sugar Land, TX | 14,057 | -22% |

| Austin-Round Rock, TX | 13,999 | -18% |

| Los Angeles-Long Beach-Anaheim, CA | 13,324 | -1% |

| Phoenix-Mesa-Scottsdale, AZ | 12,688 | 4% |

| Miami-Fort Lauderdale-West Palm Beach, FL | 12,685 | 41% |

| Atlanta-Sandy Springs-Roswell, GA | 11,583 | -12% |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 8,669 | -31% |

| Nashville-Davidson–Murfreesboro–Franklin, TN | 8,388 | 191% |

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This trend might influence the construction loan sector, leading to decreased demand for financing in the single-family home construction market. Lenders could adjust their offerings based on this reduced demand, potentially making construction loans more competitive for builders aiming to stimulate activity in the face of declining permits. Builders might find an opportune time to secure construction financing, taking advantage of potentially favorable terms amid reduced market competition.