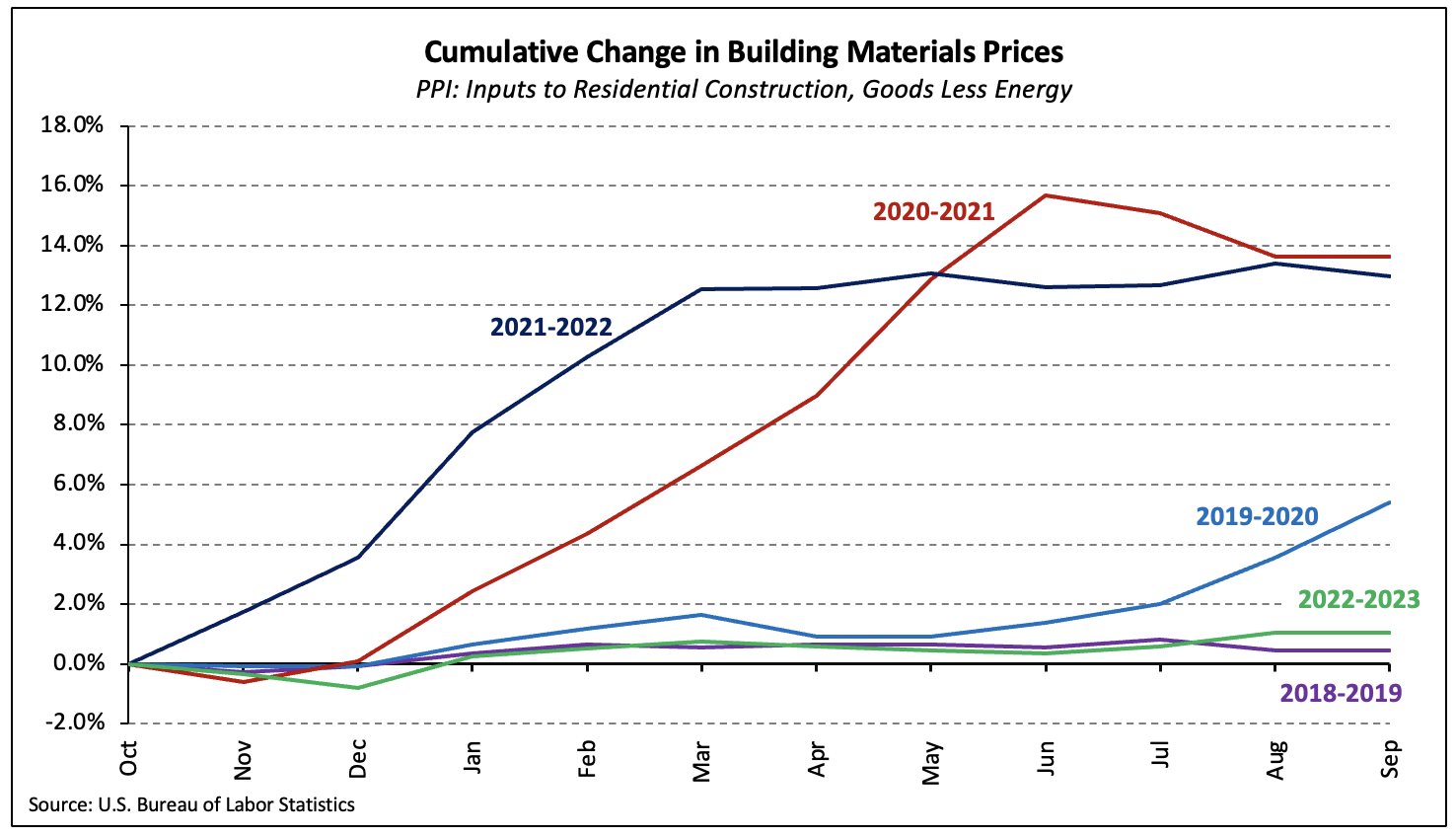

According to the latest Producer Price Index report, the price level of inputs to residential construction less energy (i.e., building materials) was unchanged in September (not seasonally adjusted) after climbing 0.4% in August. Prices have increased 0.8%, year-to-date, the smallest YTD gain through September since 2019.

The Producer Price Index for all final demand goods rose 0.9% in September after increasing 2.0% in August. The increase was driven by a 3.3% surge in energy prices. Monthly increases in unleaded gasoline (+5.4%) and diesel (+2.5%)—which account for nearly one-third of the PPI for final demand energy—fueled the gain.

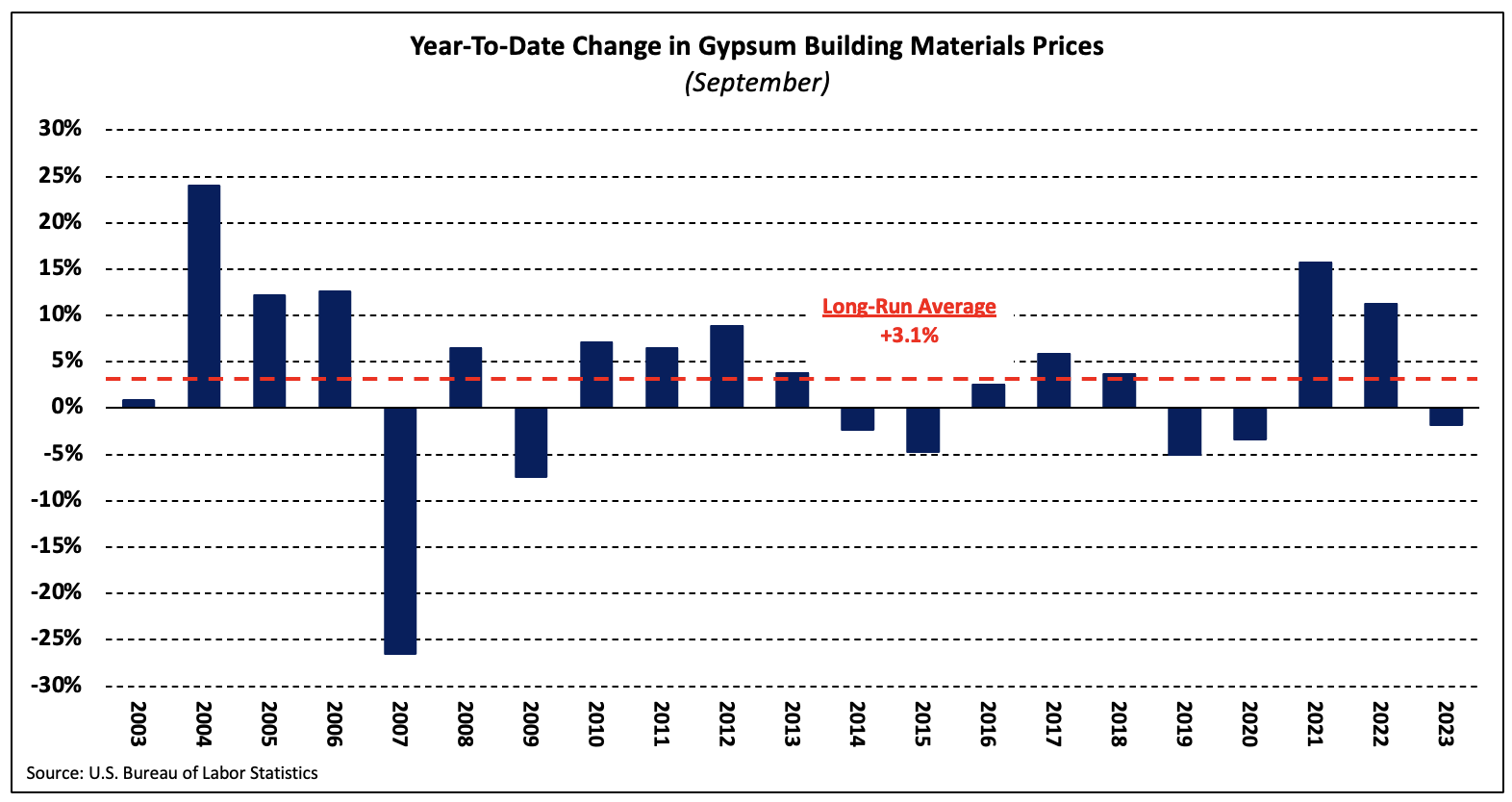

Gypsum Building Materials

The PPI for gypsum building materials declined 0.7% in September, the sixth consecutive monthly decrease. Prices are down 2.0% over the past 12 months, but 95% of the decrease has taken place in 2023.

Year-to-date through September, the index for gypsum building materials has fallen 1.9%. In contrast, the index surged 11.3% and 15.7% through September 2022 and 2021, respectively—YTD increases much larger than the long-run average and exceeded only in the “boom” years of the 2000s.

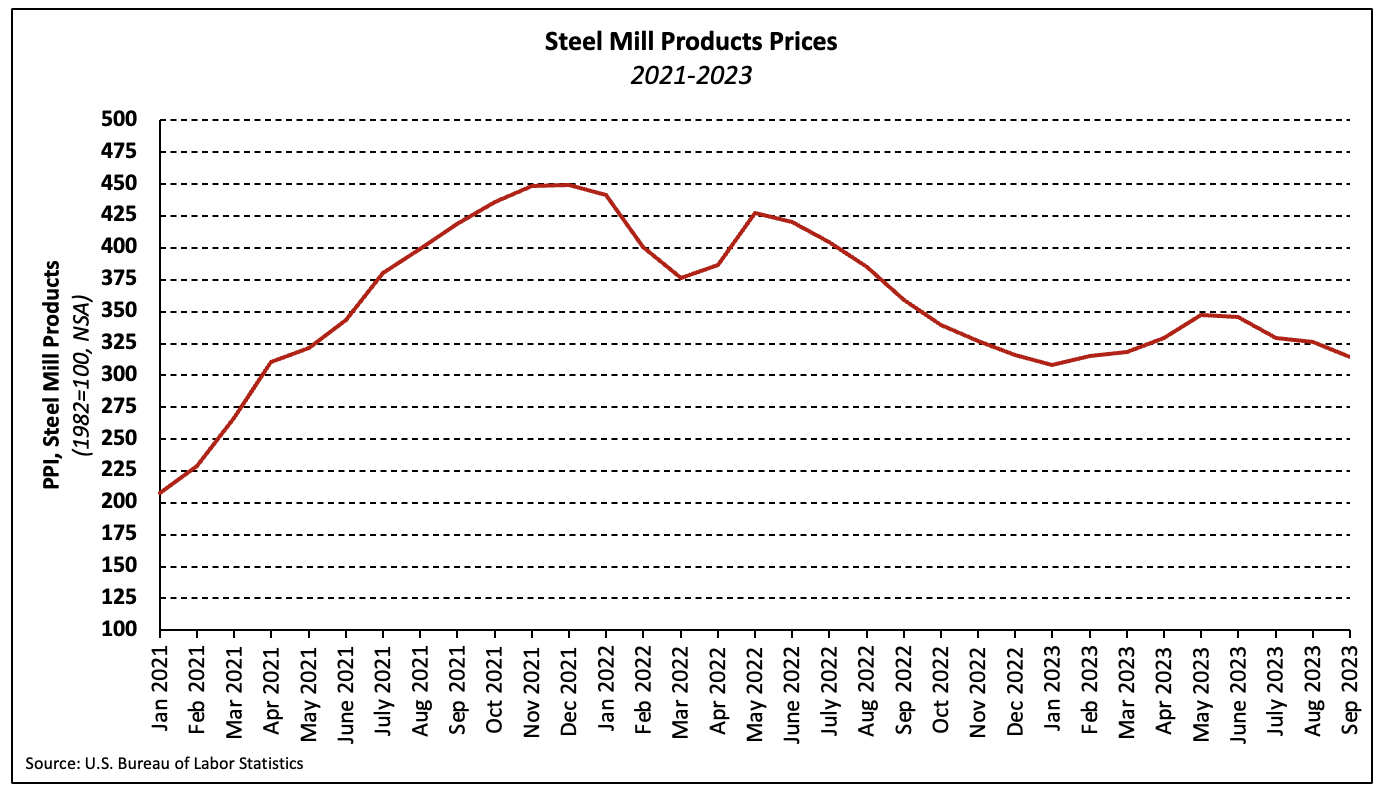

Steel Mill Products

The price of steel mill products (i.e., the raw materials used to make intermediate and finished steel goods) fell 3.7% in September—a steeper decline than August, as expected. Since climbing 12.4% between January and May, prices have declined each of the past four months by a total of 9.5%.

The index is 12.5% lower than it stood one year ago and has decreased by nearly one-third since doubling over the course of 2021.

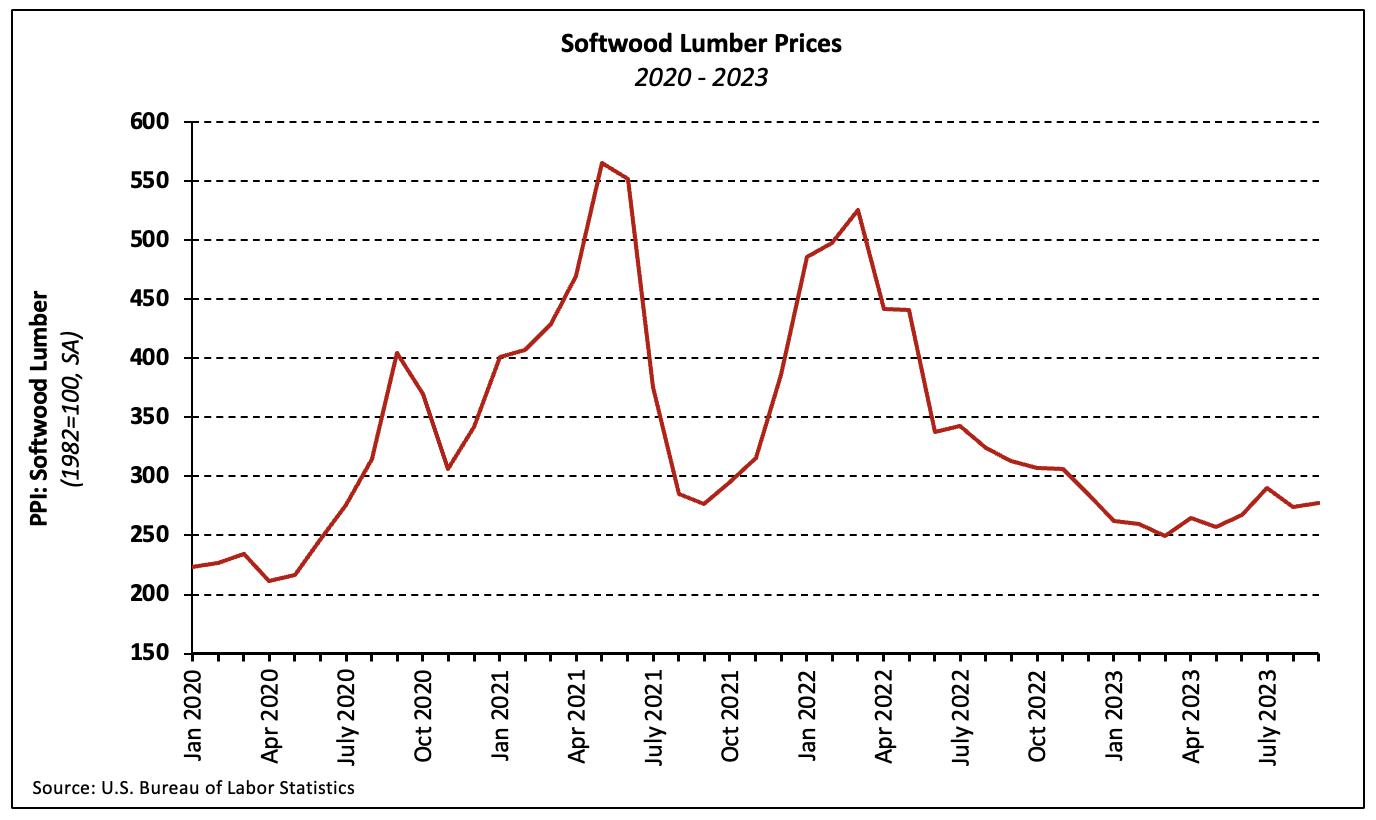

Softwood Lumber

The PPI for softwood lumber (seasonally adjusted) increased 1.3% in September, following a 5.3% decline in August. The index has fallen 11.2% over the last year and by nearly half over the past 18 months.

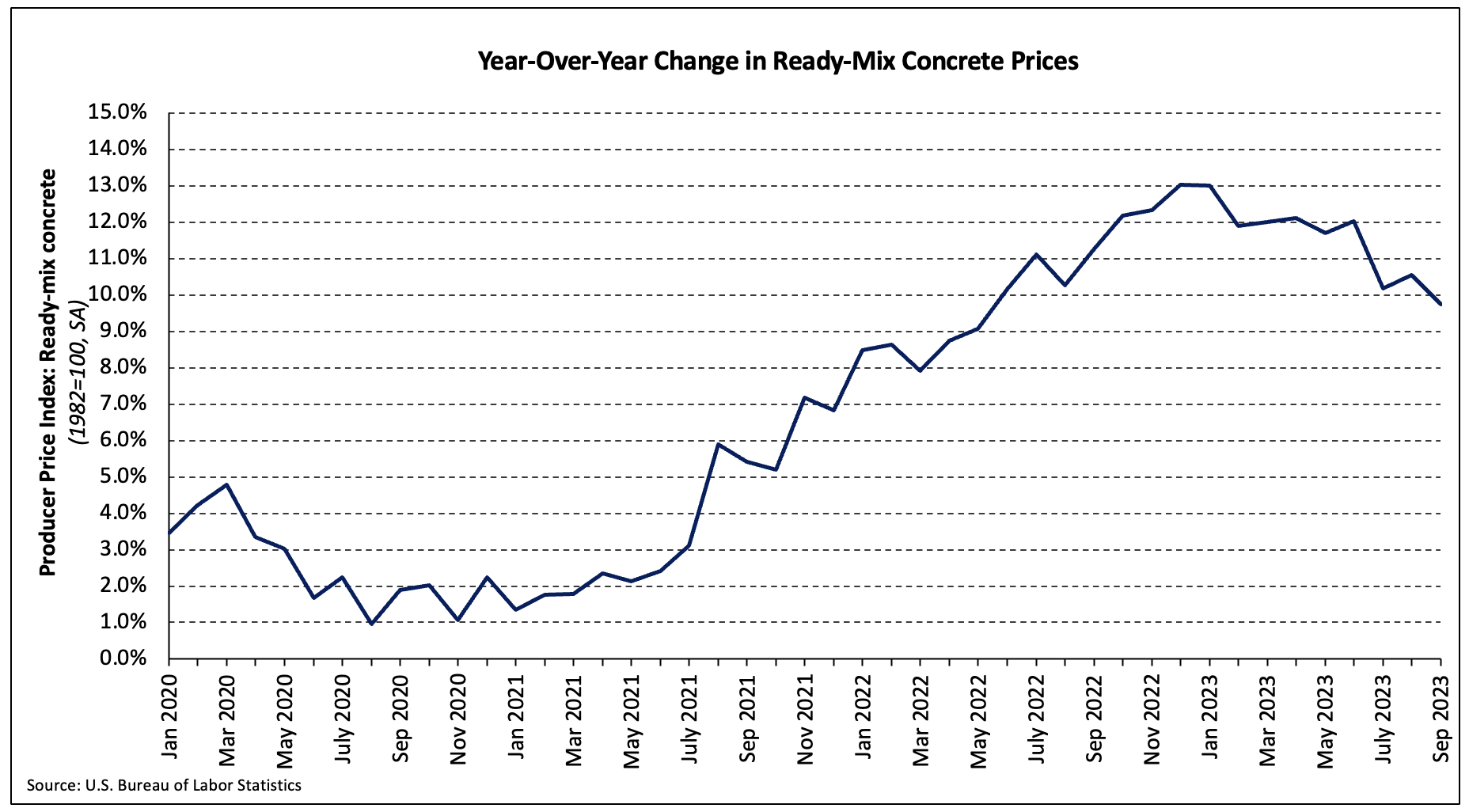

Ready-Mix Concrete

Ready-mix concrete (RMC) prices gained 0.3% in September after an upwardly revised 1.7% increase in August. With a year-over-year increase of 9.7%, September was the first month since May 2022 in which the 12-month gain has been less than 10%.

Services

The price index of services inputs (excluding labor) to residential construction increased 0.9% in September after edging 0.4% higher in August.

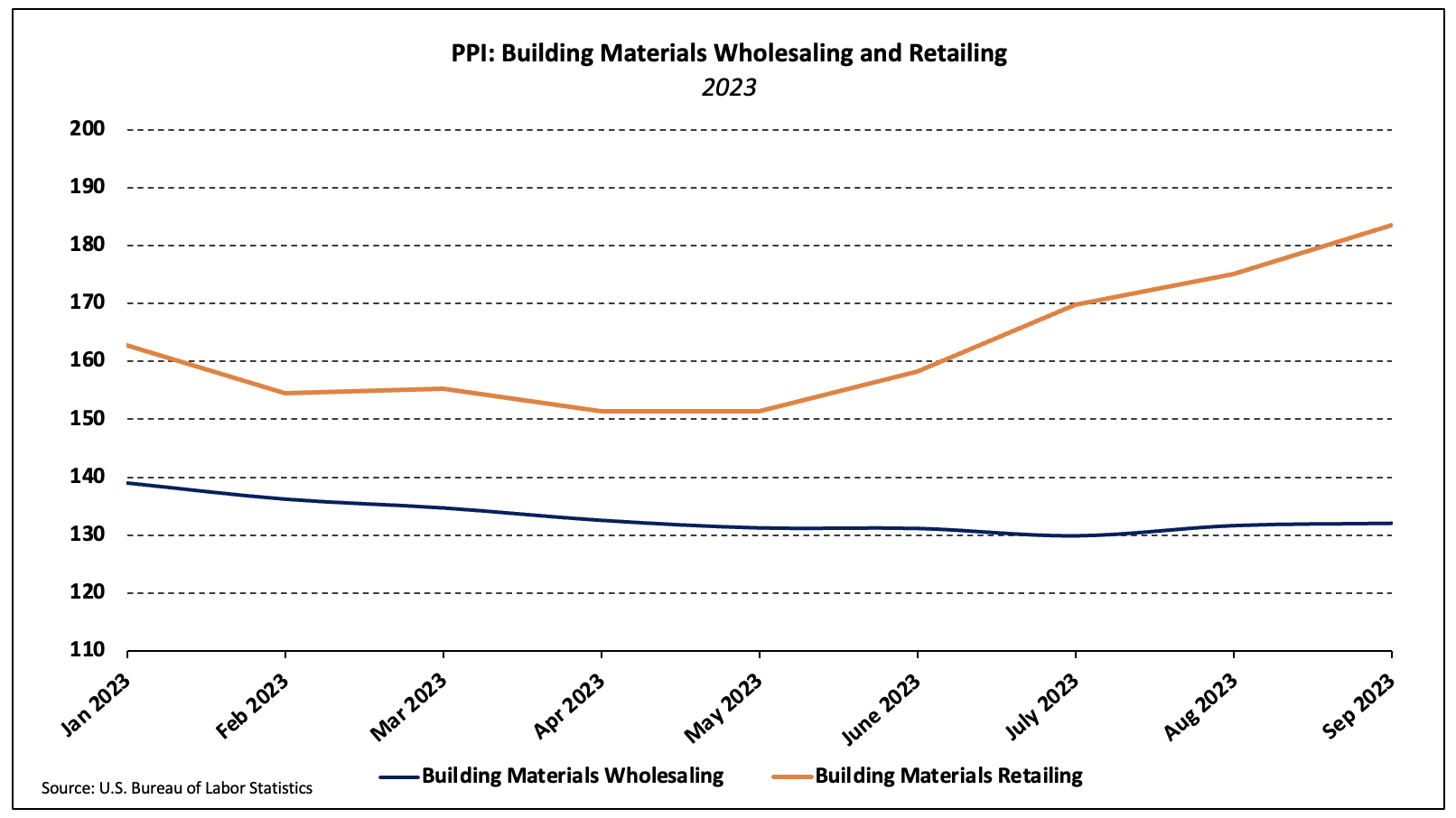

Building Materials Retailers and Wholesalers

A 4.8% increase in building materials retailers’ gross margins drove the services inputs index higher as retail margins account for nearly one-third of the index. The PPI for wholesalers’ margins—which makes up another 6.6% of the index for services inputs to residential construction—ticked up 0.3%. Over the past year, the PPI for building materials retailers has risen 11.1% while the index for wholesalers has fallen 5.5%.

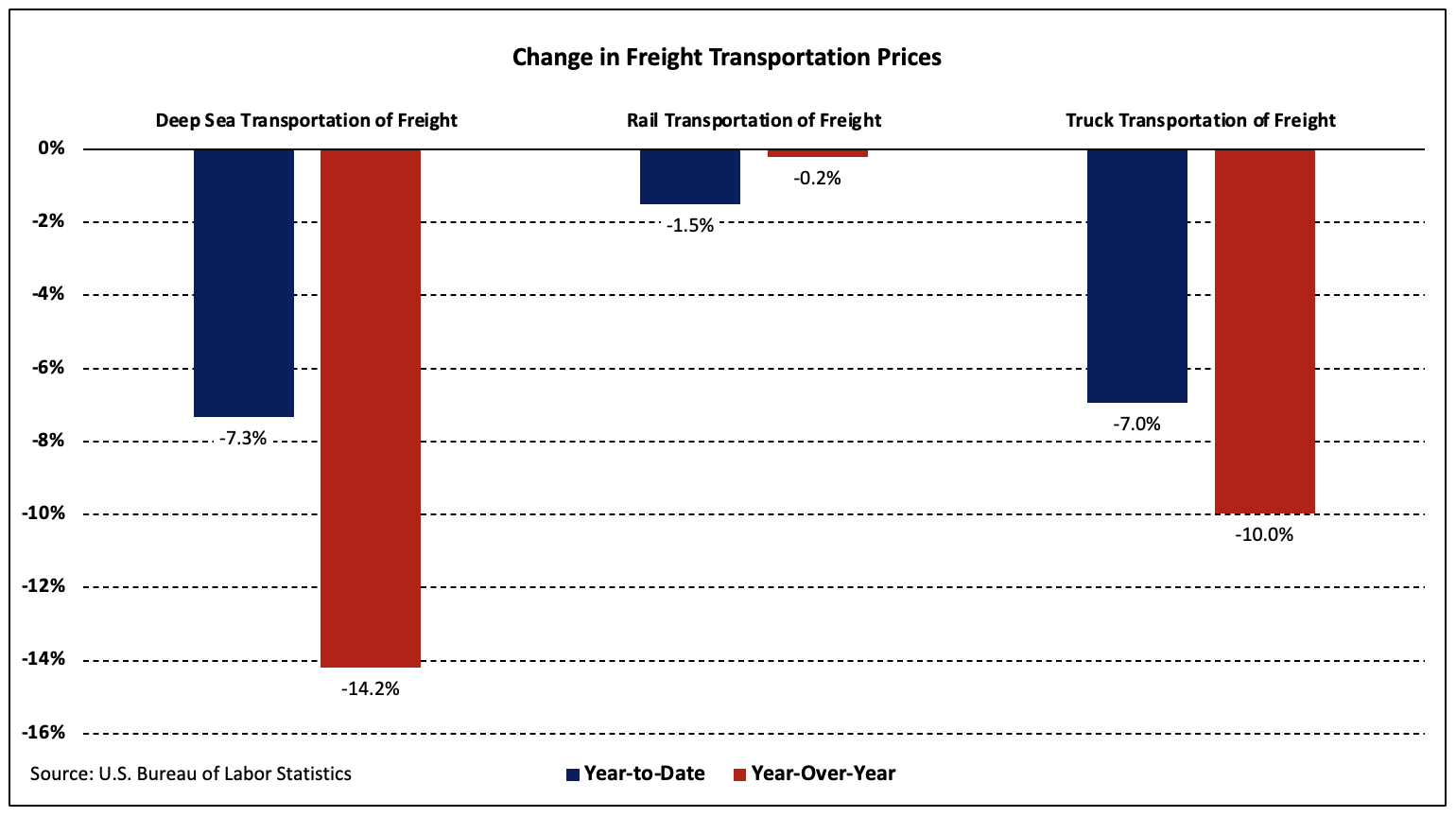

Freight Prices

Changes in producer prices for the transportation of freight were mixed in September. The prices of rail and deep-sea (i.e., ocean) transportation of freight rose 0.6% and 0.1%, respectively. The PPI for long-distance freight trucking also increased (+0.3%), but the price of local truck transportation of freight declined 0.5%.

Year-to-date, the prices of rail, truck, and deep-sea transportation of freight have fallen 1.5%, 7.0%, and 7.3%, respectively.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

There is something missing in the first paragraph of this article

According to the latest Producer Price Index report, the price level of inputs to residential construction less energy (i.e., building materials) was in September (not seasonally adjusted) after climbing 0.4% in August. Prices have increased 0.8%, year-to-date, the smallest YTD gain through September since 2019.

Was what ? not seasonally adjusted in September????

Fixed and thank you

Stable material costs can provide relief for developers and builders, potentially making construction projects more financially viable. Lenders might respond favorably to this trend, offering construction loans with relatively predictable costs. This stability could encourage more construction activity, with builders facing fewer financial uncertainties, ultimately driving growth in the construction loan market.