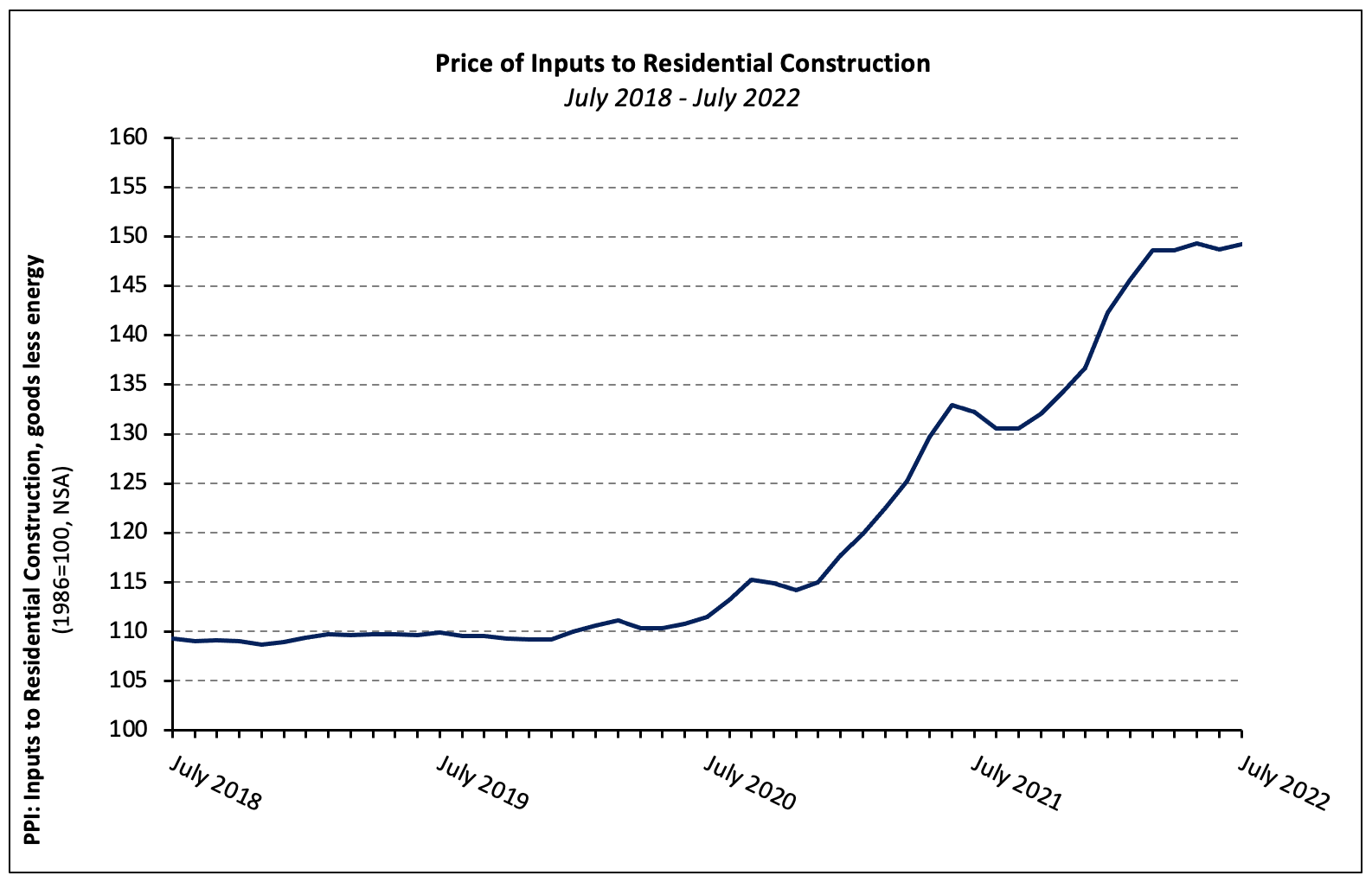

The prices of building materials rose 0.4% in July (not seasonally adjusted) even as softwood lumber prices increased 2.3%, according to the latest Producer Price Index (PPI) report. Prices have surged 35.7% since January 2020, although 80% of the increase has occurred since January 2021. The PPI for goods inputs to residential construction, including energy, decreased 1.2% as the prices of #2 diesel and unleaded gasoline fell 16.6% and 16.7%, respectively.

The price index of services inputs to residential construction was driven 1.4% lower in July—the third consecutive monthly decline—by a 3.8% decrease in the building materials retail index. The services PPI is 3.0% higher than it was 12 months prior and 34.9% higher than its pre-pandemic level.

Concrete Products

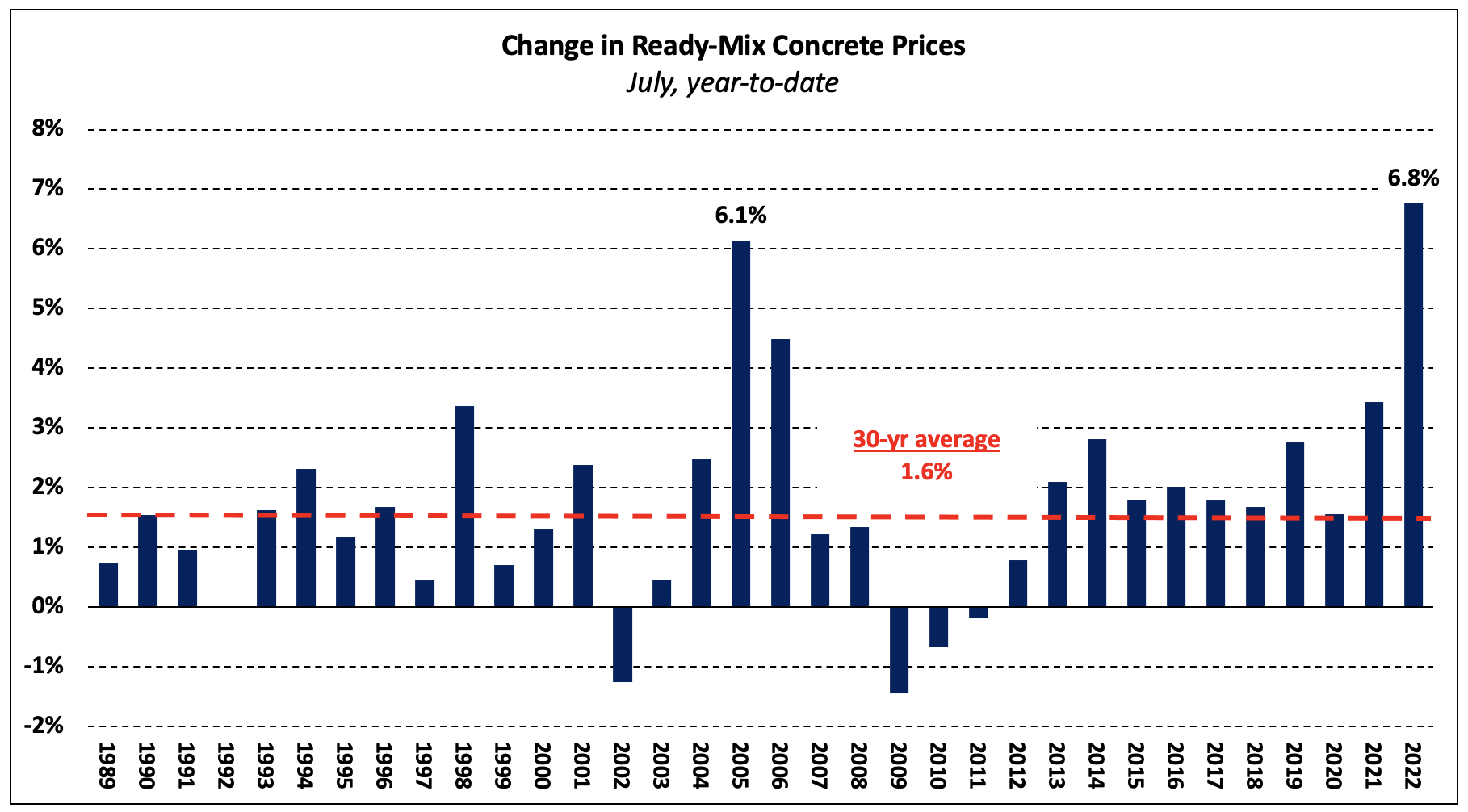

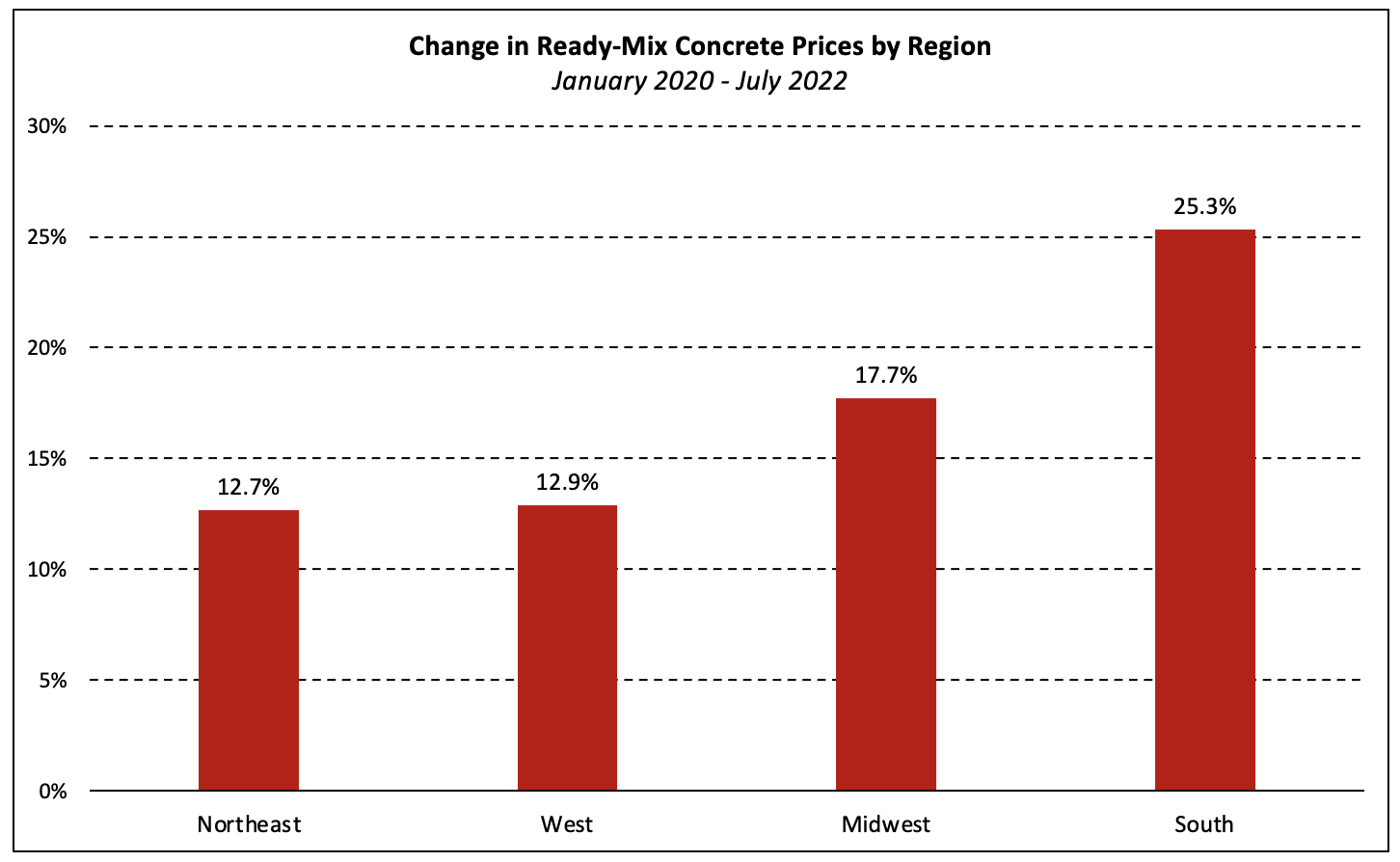

The PPI for ready-mix concrete (RMC) gained 2.5% in July and has increased in 17 of the last 18 months. The latest increase is the largest since prices climbed 3.7% in March 2006. The index has climbed 6.8%, year-to-date, the largest YTD July increase in the series’ 34-year history.

Price changes were broad based geographically but increased the most in the South where they gained 3.5%, not seasonally adjusted. Prices increased 2.9%, 1.6%, and 1.2% in the Midwest, West, and Northeast regions, respectively.

Ready-mix concrete is just one type of concrete good the price of which has surged recently. The PPI for finished concrete products has climbed 14.4% over the past 12 months and the price of structural concrete block is up 12.9% over the same period. Similarly, concrete pipe and prestressed concrete products prices have climbed 21.0% and 29.9%, respectively, since July 2021.

Softwood Lumber

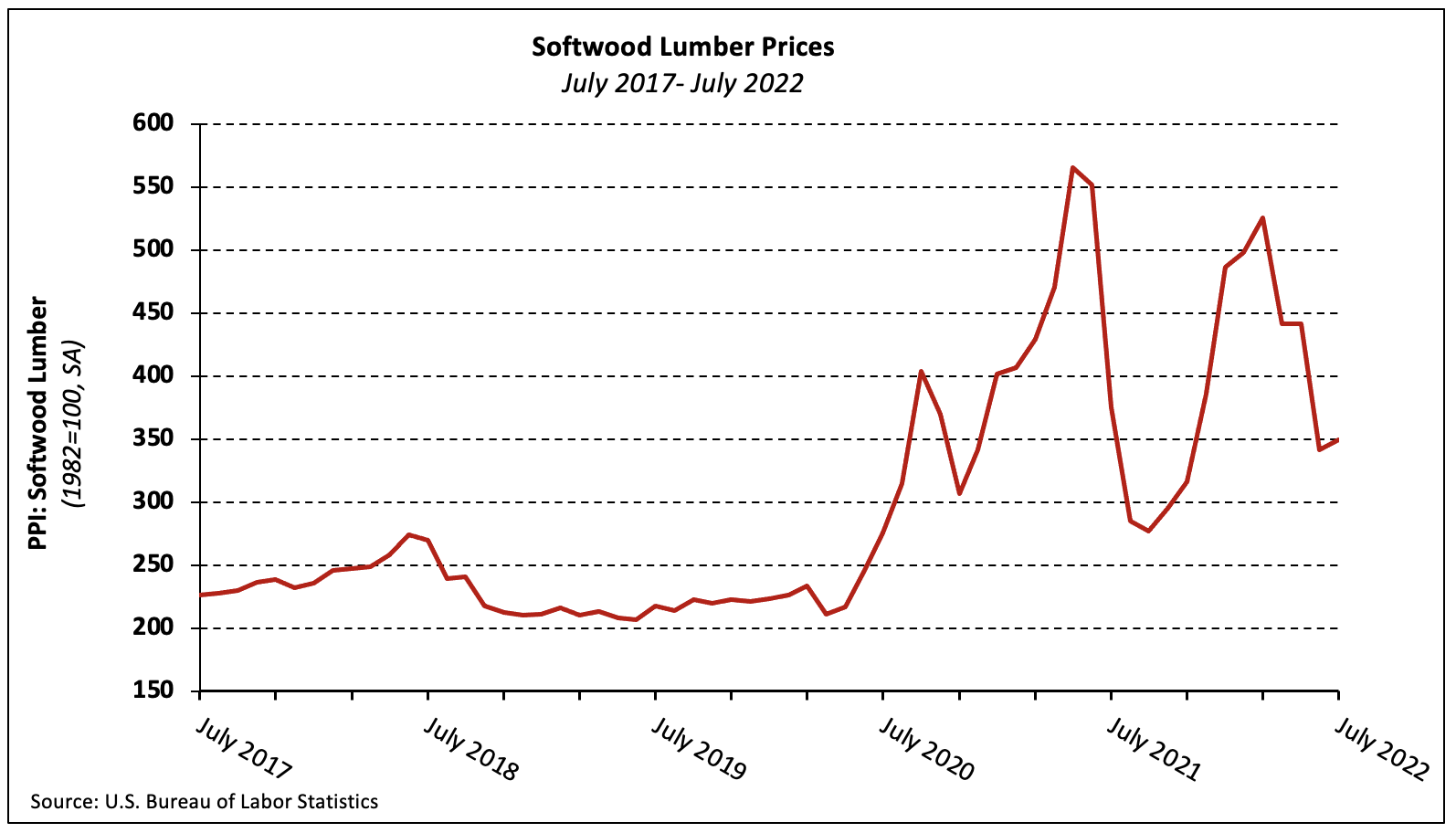

The PPI for softwood lumber (seasonally adjusted) saw a modest increase (+2.3%) in July, its first increase in four months. Prices have fallen 28.2% year-to-date, although the extent to which the decrease has reached home builders and remodelers is unclear.

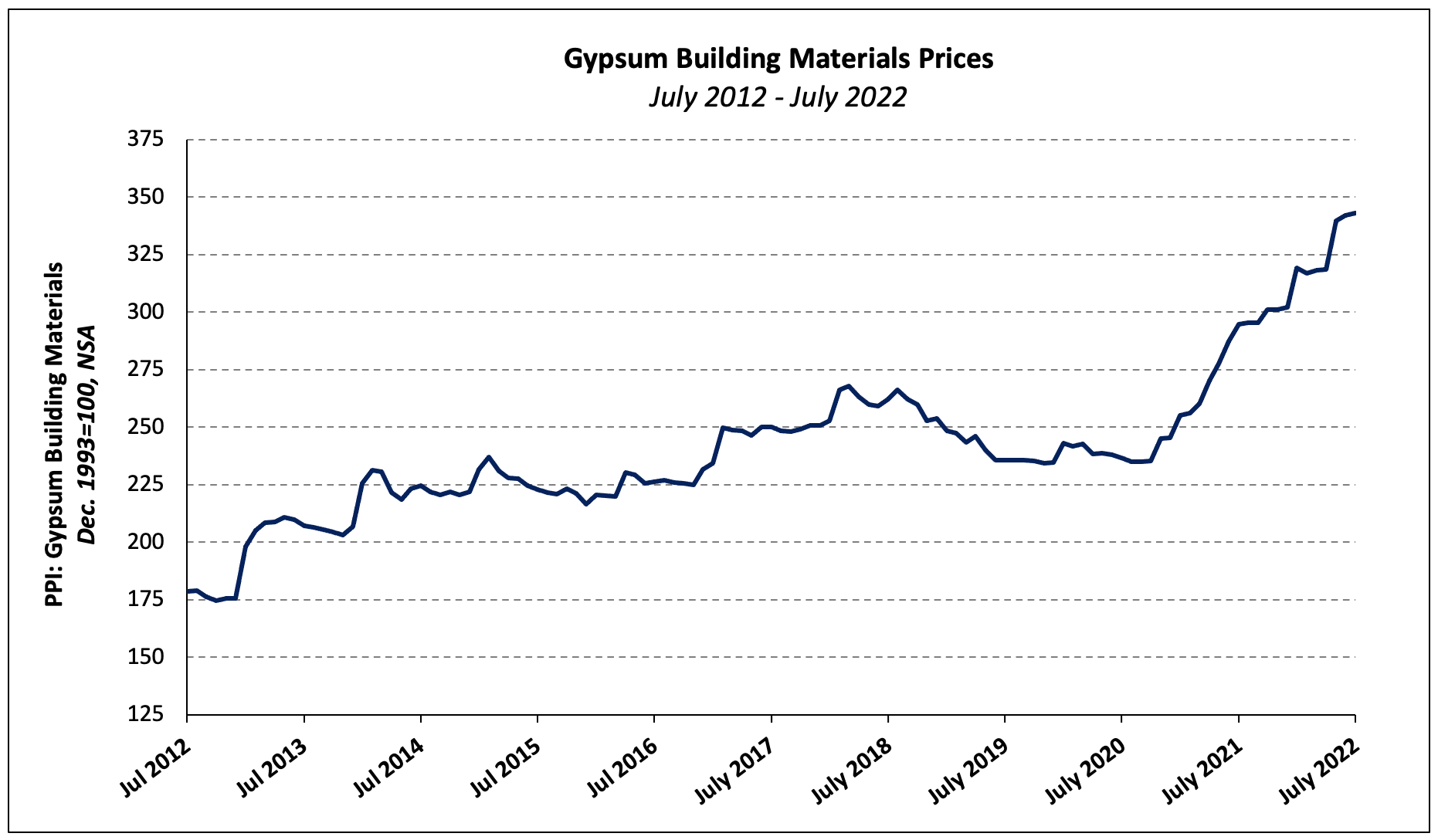

Gypsum Building Products

The PPI for gypsum products held steady in July after increasing 0.1% in June and 7.1% in May. and has soared 22.6% over the past year. After a quiet 2020, the price of gypsum products climbed 23.0% in 2021 and is up 7.6% through the first half of 2022.

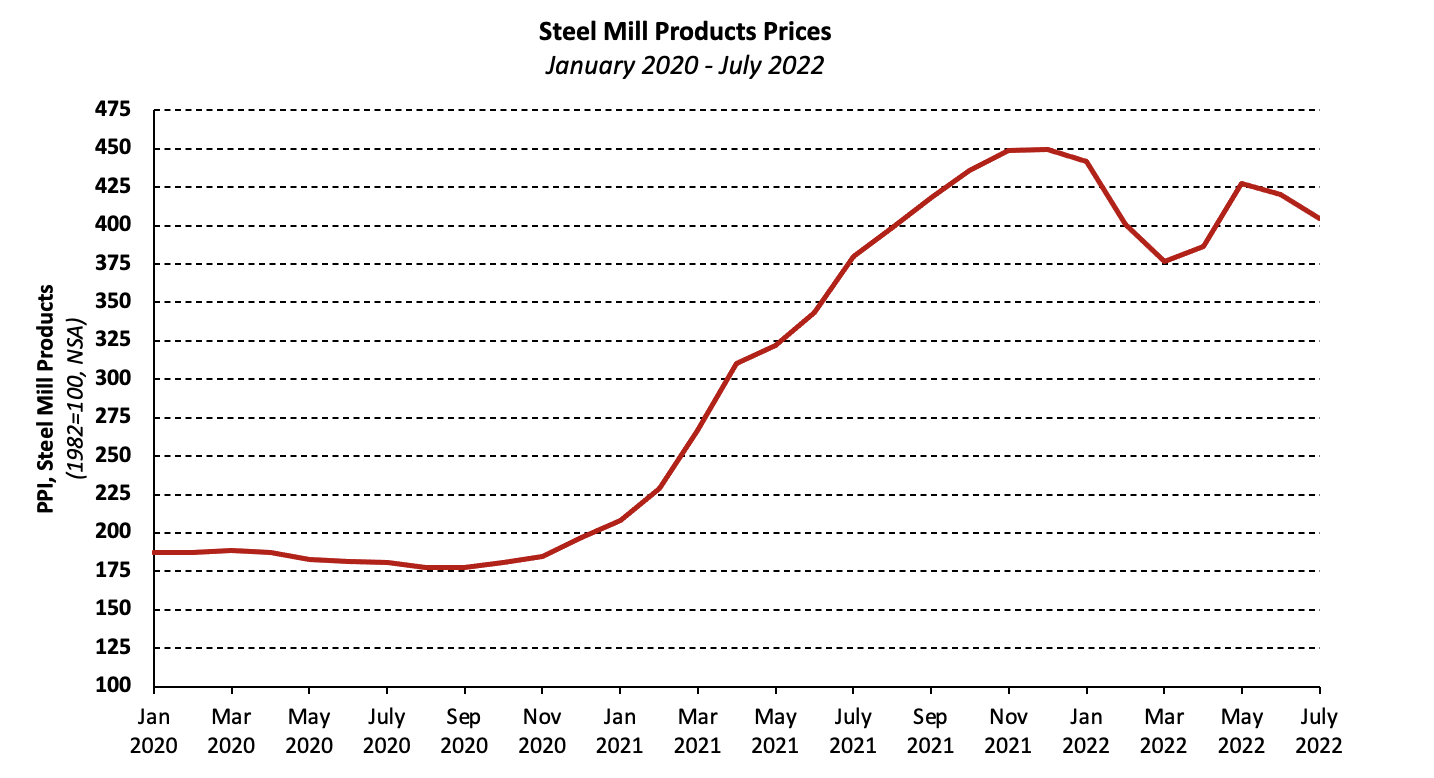

Steel Mill Products

Steel mill products prices decreased 3.7% in June following a 1.7% decline in June. over the two prior months. Although the index has fallen 10.1% since reaching its all-time high in December 2021, it is nearly twice the January 2021 level.

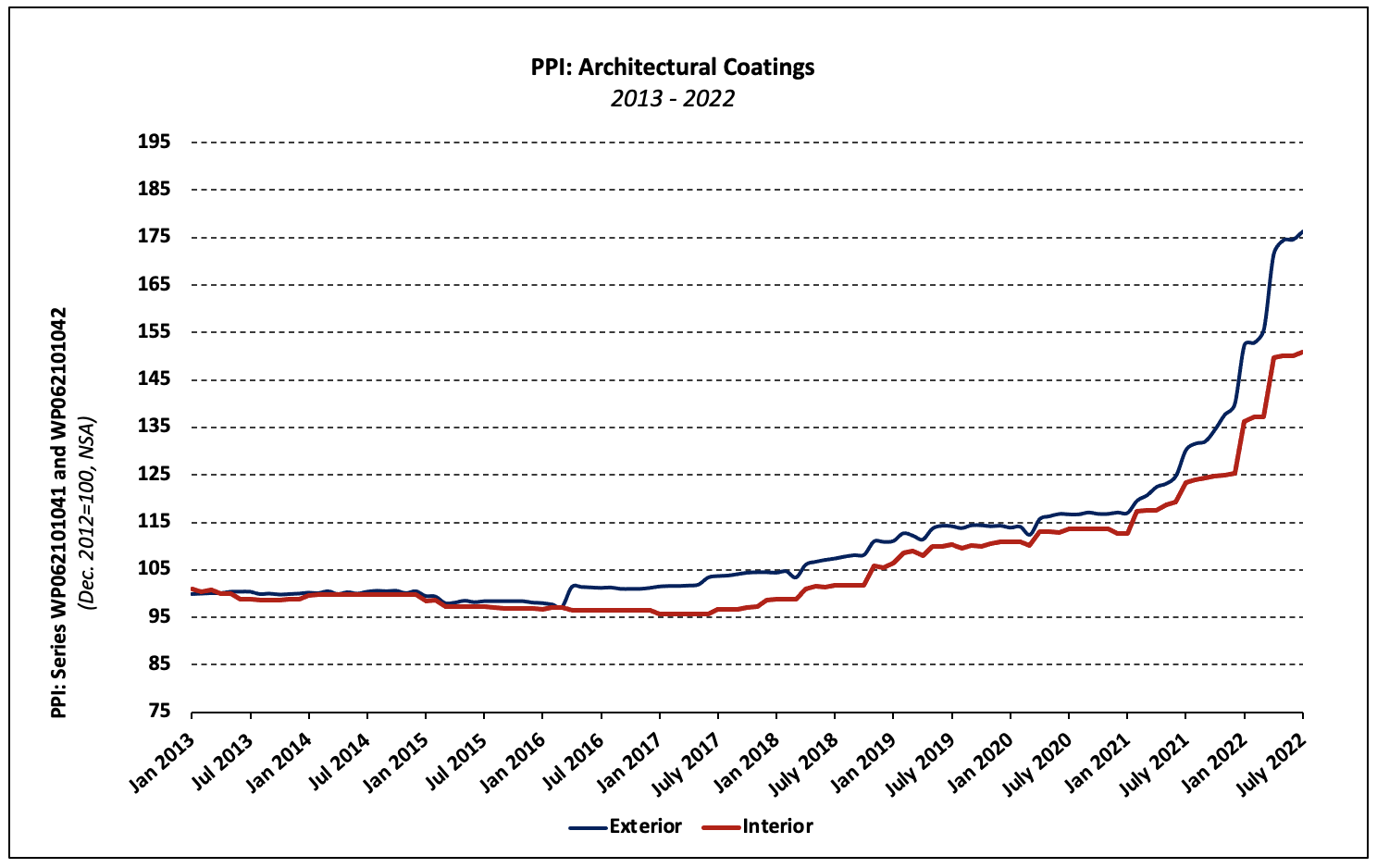

Paint

The PPI for exterior and interior architectural coatings (i.e., paint) increased 1.0% and 0.5%, respectively, in July. The PPI for paint has not declined since January 2021—the prices of exterior and interior paint have risen 50.7% and 33.8%, respectively, in the months since.

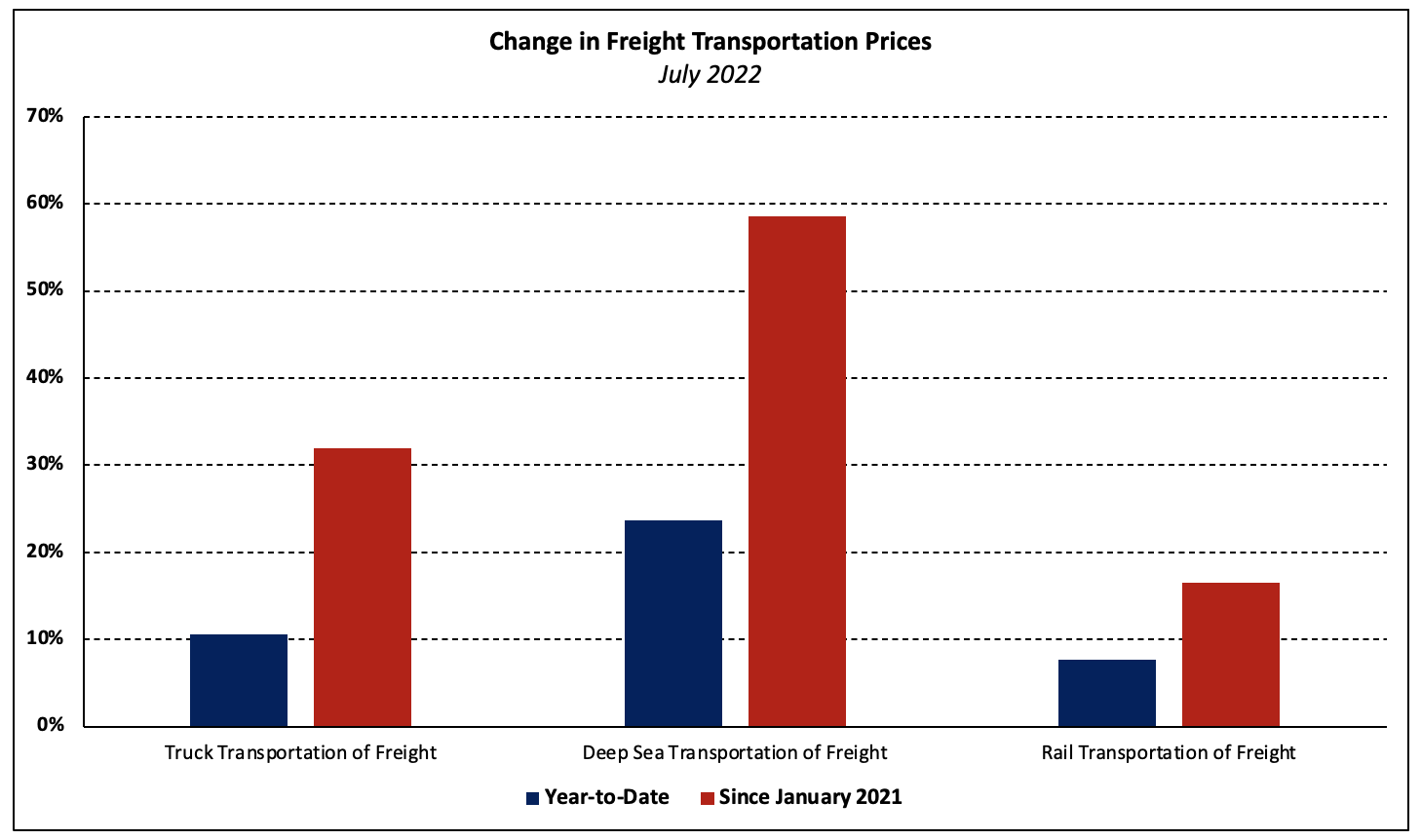

Transportation of Freight

The price of truck transportation of freight decreased 0.3% in July, the second consecutive decline after two years of monthly increases. Over the past year, the indices for local and long-distance motor carrying prices are up 18.9% and 22.6%, respectively.

Not only have freight costs increased, but the prices of services to arrange freight logistics have climbed steeply as well. Over the course of 2021, the PPI for the arrangement of freight and cargo increased 95.1%. Although prices have fallen 8.8%, YTD, they remain 63.0% above pre-pandemic levels.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.