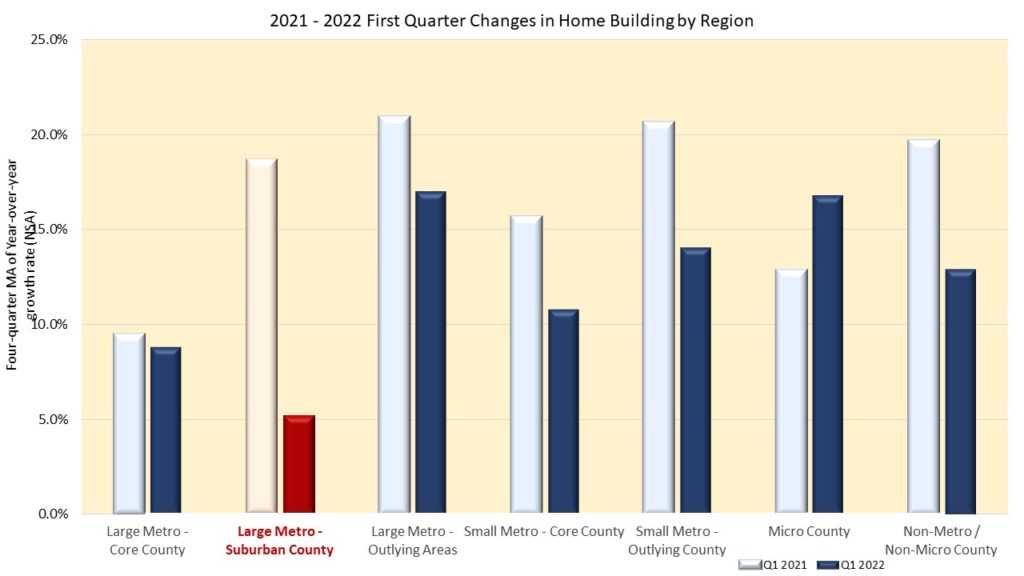

Recent developments in the first quarter of 2022 per NAHB’s Home Building Geography Index (HBGI), indicate single-family home building slowing in suburbs, with most other regional geographies following suit. Following the aftermath of COVID-19, home buyer preferences for the suburbs have eased.

Supply-chain challenges and unfavorable economic conditions have reduced the pace of single-family residential construction across all regional submarkets. The effect was most pronounced in high-cost areas such as large metro suburban counties, with growth decreasing from 18.7% in the first quarter of 2021 to 5.2% in the first quarter of 2022. Large metro core counties by contrast experienced the smallest growth reduction for that period, a 0.7 percentage point decline to 8.8%. Micro counties were the only submarket to post an increase in the growth rate from the first quarter of 2021, a 3.9 percentage point increase to 16.7%.

Rampant inflation, one of the economic problems in the first quarter of 2022, has driven up material costs but even when adjusted for inflation, they set a record high at the end of 2021.

Market share changes also reflected the slowdown of large metro suburban counties’ single-family construction. On a four-quarter moving average, year-over year basis, large metro suburban counties’ single-family construction’s market share dropped from the first quarter of 2021 by 1.3 percentage points to 24.8%. Large metro core counties’ market share dropped by 0.3 percentage points to 16.6%. All other regions, which can be grouped as “lower-density submarkets”, captured the above market share decreases. Large metro areas’ outlying counties’ market share increased the most, by 0.5 percentage points to 9.6% and non-metro, non-micro counties increased the least, by 0.1 percentage points to 4.2%. It deserves noting that the latter category has historically maintained this market share, only wavering by 0.1 percentage points downward in most quarters.

An upcoming post of this HBGI iteration will identify the first quarter trends in multifamily home building.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.