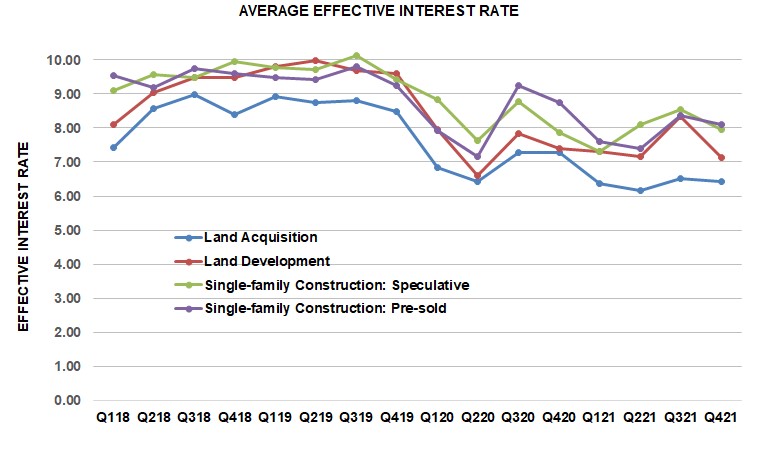

In the fourth quarter of 2021, effective interest rates decreased on all four categories of loans tracked in NAHB’s Survey on Acquisition, Development & Construction (AD&C) financing. The average effective rate (based on rate of return to the lender over the assumed life of the loan taking both the contract interest rate and initial fee into account) decreased from 6.50 in the third quarter of 2021 to 6.43 percent in the fourth quarter of 2021 on loans for land acquisition, from 8.33 to 7.14 percent on loans for land development, from 8.55 to 7.94 percent on loans for pre-sold single-family construction, and from 8.37 to 8.10 percent on loans for speculative single-family construction.

Changes in the effective rate may be due to changes in either the contract interest rate, or in the initial points charged on the loan. On loans specifically for land development, both the contract rate and the points declined in the fourth quarter—from 5.24 to 4.72, and from 0.89 to 0.67 percent, respectively. On the other three categories of AD&C loans, the contract interest rate increased, but was more than offset by a reduction in points. On land acquisition loans, the contract rate increased from 4.74 to 4.89 percent while the initial points decreased from 0.88 to 0.68. On speculative single-fmily construction loans, the contract rate increased from 4.85 to 4.86 percent while the points decreased from 0.87 to 0.68. And on loans for pre-sold single-family construction, the contract rate increased from 4.49 to 4.52 percent while the points decreased from 0.77 to 0.68.

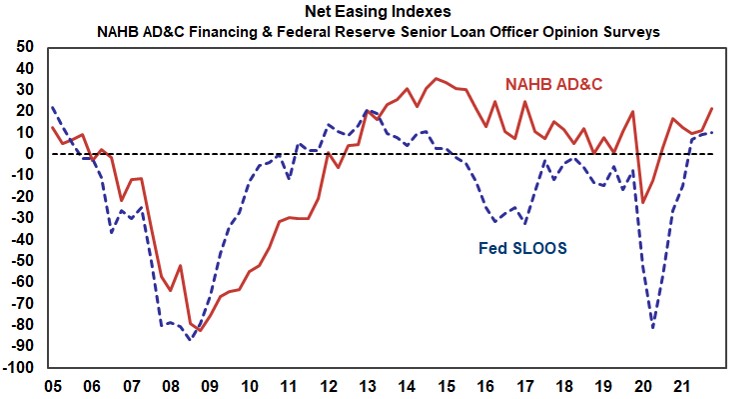

The NAHB survey also produces a net easing index that summarizes the change in credit conditions on AD&C loans, similar to the net easing index constructed from the Federal Reserve’s survey of senior loan officers (SLOOS). In the fourth quarter of 2021, both the NAHB and Fed indices were positive, indicating net improved availability of credit, with the NAHB index indicating somewhat more easing. The NAHB index stood at 21.3 while the Fed index was 10.3. These results from the third quarter were 11.0 for NAHB index and the Fed index was 9.4. More information about the Fed’s SLOOS is available in a February 11 Eye on Housing post.

The NAHB net easing index uses information from questions that ask builders and developers if availability of credit has gotten better, worse, or stayed the same since the previous quarter. In the fourth quarter of 2021, 29 percent of the NAHB builders said availability of credit for land acquisition had gotten better, compared to only 4 percent who said it had gotten worse. For land development, 25 percent said credit conditions improved, while none of the respondents indicated that it had gotten worse. Finally, 25 percent of builders reported that the availability of credit for single-family construction had improved, compared to 11 percent who said it had gotten worse.

The relatively favorable cost and availability of AD&C loans helps explain the strength of builder confidence at the end of the year (before it began to edge downward at the beginning of 2022).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

I would love to see a breakdown or separation of institutional vs private equity sourcing. I’m assuming builders are reporting these rates? And if so, what kind of volume are they delivering per year? One guy doing 10 homes vs another company doing 1000+ closings is apples and oranges. Love the updates. Thanks

“Changes in the effective rate may be due to changes in either the contract interest rate or in the initial points charged on the loan.” – That is why it’s important to have the right financial partner by your side that can make all the difference. Check out builderloans.net to find out why.