Consumer prices in February saw the smallest year-over-year gain since September 2021 with an eighth consecutive month of a deceleration. However, the shelter index (housing inflation) continued to rise at an accelerated pace and was the largest contributor to the total increase, accounting for over 70% of the increase. Shelter inflation is a lagging indicator and will primarily be cooled in the future via additional housing supply. Real-time data from private data providers indicate that rent growth is cooling, and this is not yet reflected in the CPI data. It will be reflected in the coming months.

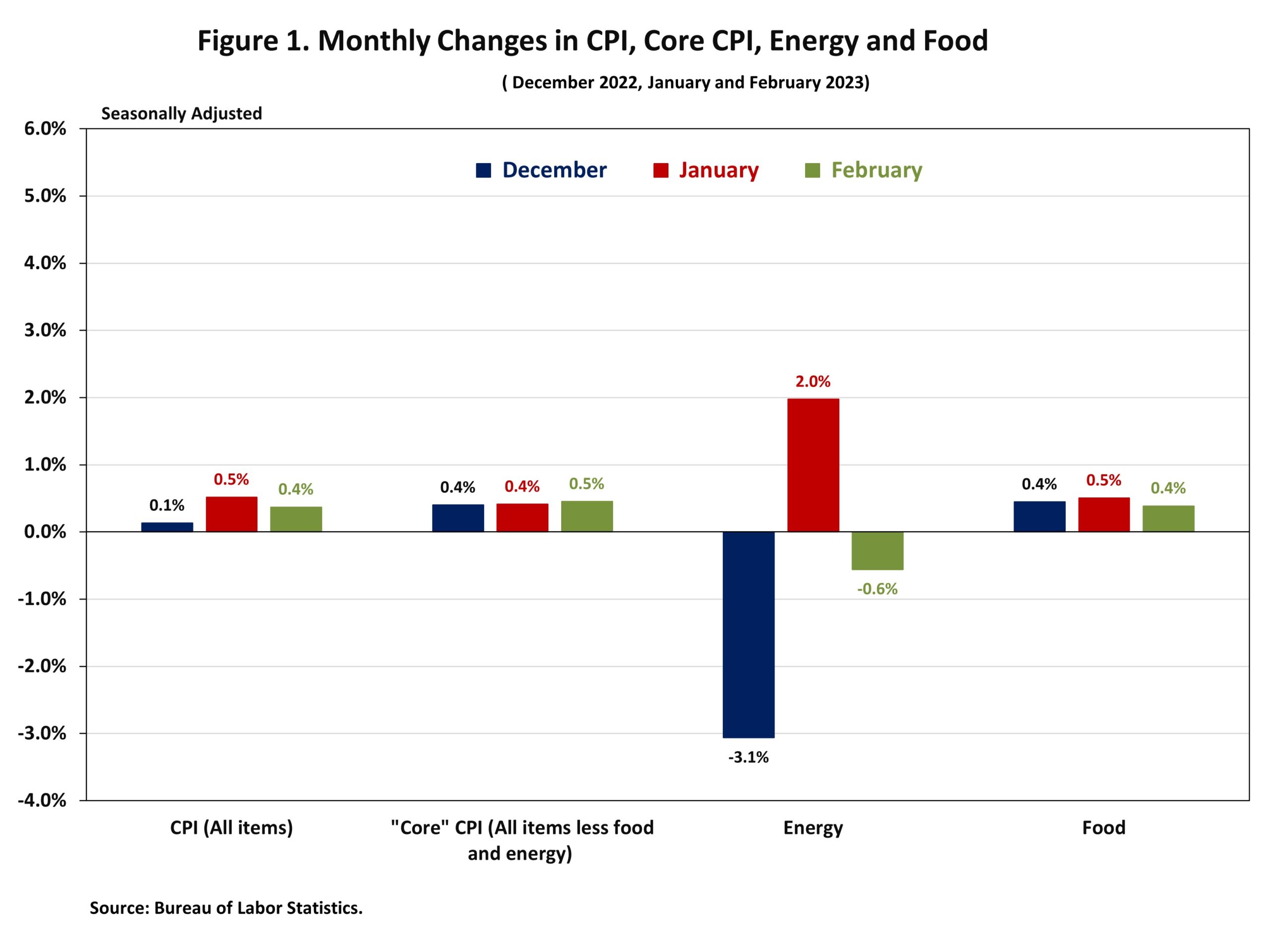

The Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose by 0.4% in February on a seasonally adjusted basis, following an increase of 0.5% in January. The price index for a broad set of energy sources fell by 0.6% in February as a decline in natural gas (-8.0%) and fuel oil (-7.9%) offset an increase in gasoline (+1.0%) and electricity index (0.5%). Excluding the volatile food and energy components, the “core” CPI rose by 0.5% in February, following an increase of 0.4% in January. Meanwhile, the food index increased by 0.4% in February with the food at home index rising 0.3%.

Most component indexes continued to increase in February. The indexes for shelter (+0.8%), recreation (+0.9%), airline fares (+6.4%) as well as household furnishings and operations (+0.8%) showed sizeable monthly increases in February. Meanwhile, the indexes for used cars and trucks (-2.8%) and medical care (-0.5%) declined in February.

The index for shelter, which makes up more than 40% of the “core” CPI, rose by 0.8% in February, following an increase of 0.7% in January. The indexes for owners’ equivalent rent (OER) increased by 0.7% and rent of primary residence (RPR) increased by 0.8% over the month. Monthly increases in OER have averaged 0.7% over the last three months. These gains have been the largest contributors to headline inflation in recent months. These higher housing costs are driven by lack of attainable supply and higher development costs. Higher interest rates will not slow these costs, which means the Fed’s tools are limited in addressing shelter inflation.

During the past twelve months, on a not seasonally adjusted basis, the CPI rose by 6.0% in February, following a 6.4% increase in January. This was the slowest annual gain since September 2021. The “core” CPI increased by 5.5% over the past twelve months, following a 5.6% increase in January. The food index rose by 9.5% and the energy index climbed by 5.2% over the past twelve months.

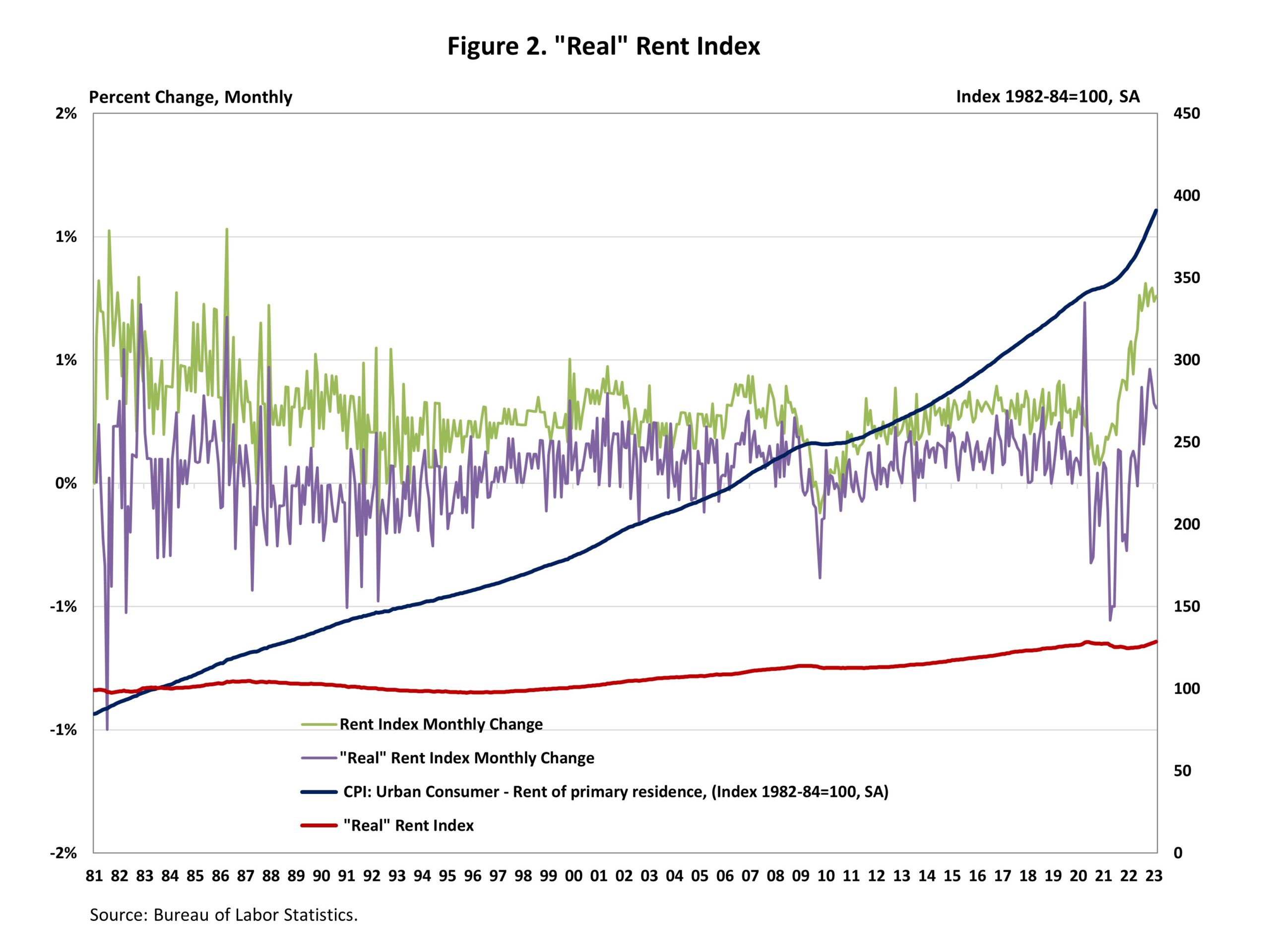

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than overall inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster (slower) than overall inflation, the real rent index rises (declines). The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components). The Real Rent Index rose by 0.3% in February.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

There is a good reason that consumers do not feel that inflation is easing despite the media headlines. That reason is the inflation rate simply compares the increase or decrease in inflation since the same month of the previous year. In a multi-year period of inflation as we are now experiencing, I feel the reported rate is distorted when the rate reported in the previous year was high. I believe that comparing the inflation rate for the same month during the entire period of inflation yields a more reliable indicator of the impact on consumers. Here is an example:

Month Year Inflation

October 2021 7.70%

2022 6.20%

Total 13.90%

November 2021 7.10%

2022 6.80%

Total 13.90%

December 2021 7.00%

2022 6.50%

Total 13.50%

January 2022 7.50%

2023 6.40%

Total 13.90%

February 2022 7.90%

2023 6.00%

Total 13.90%

As you can see, the combined rate is practically unchanged.

.