Home building ended 2021 with strong annual gains as demand accelerated in the wake of the pandemic. These annual gains were realized despite supply-chain limitations for materials and ongoing access issues for labor and lots. Single-family starts ended 2021 with a 13.4% increase for a total of 1.123 million starts. Multifamily 5+ unit construction ended the year with a 22.1% gain, for a total of 460,100 starts. A component of the missing middle, 2 to 4 unit construction showed a decline for 2021, a 2.8% drop.

For the month of December, overall housing starts increased 1.4% to a seasonally adjusted annual rate of 1.7 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. The December reading of 1.7 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts decreased 2.3% for the month to a 1.17 million seasonally adjusted annual rate. The multifamily sector, which includes apartment buildings and condos, increased 10.6% to an annualized 536,000 pace in December.

Due to supply-chain effects, there are 144,000 single-family units authorized but not started construction—up 38.5% from a year ago. However, this total is down from a cycle high in October of 154,000.

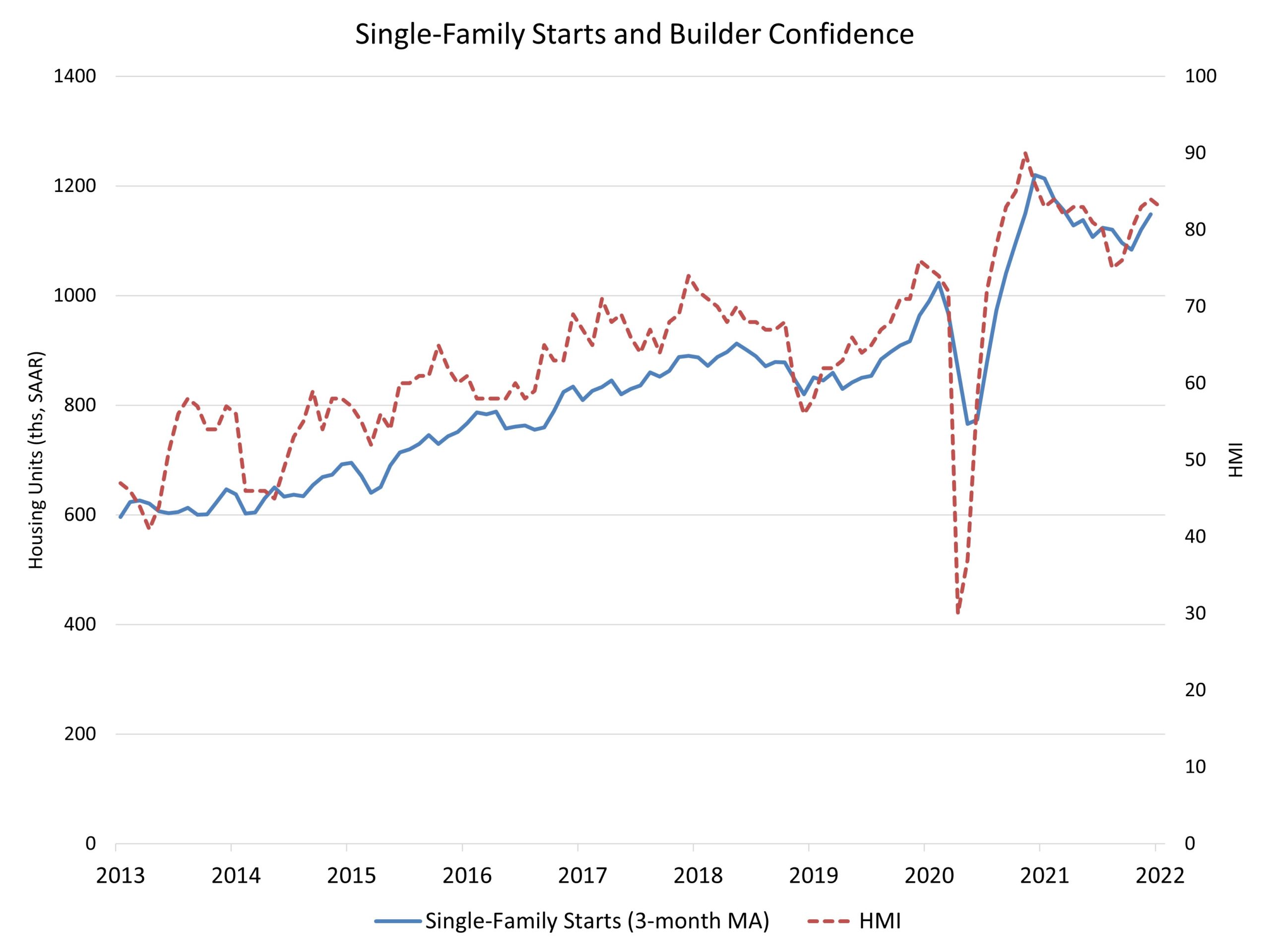

In January, single-family builder confidence decreased one point to a level 83 on strong buyer demand, according to the NAHB/Wells Fargo Housing Market Index (HMI). After peaking at a level of 90 in November 2020, builders have reported ongoing concerns over elevated lumber and other construction costs, as well as delays in obtaining building materials. The NAHB forecast projects growing labor shortages as the overall unemployment rate trends lower in the quarters ahead.

While the single-family sector cooled at the start of 2021, off the unsustainable seasonally adjusted pace of last Winter, recent readings, including the HMI, suggest ongoing stabilization. The December read of housing starts is consistent with this analysis. In fact, single-family permits showed strength for the month, rising 2% and up 13.4% for 2021.

Multifamily construction continues to expand strongly on declining vacancies and rising rents. For December, 5+ unit production was up 13.7% to a 524,000 annualized rate. This momentum will continue in 2022.

On a regional and year-to-date basis, combined single-family and multifamily starts are 22.2% higher in the Northeast, 10.9% higher in the Midwest, 15.3% higher in the South and 16.9% higher in the West.

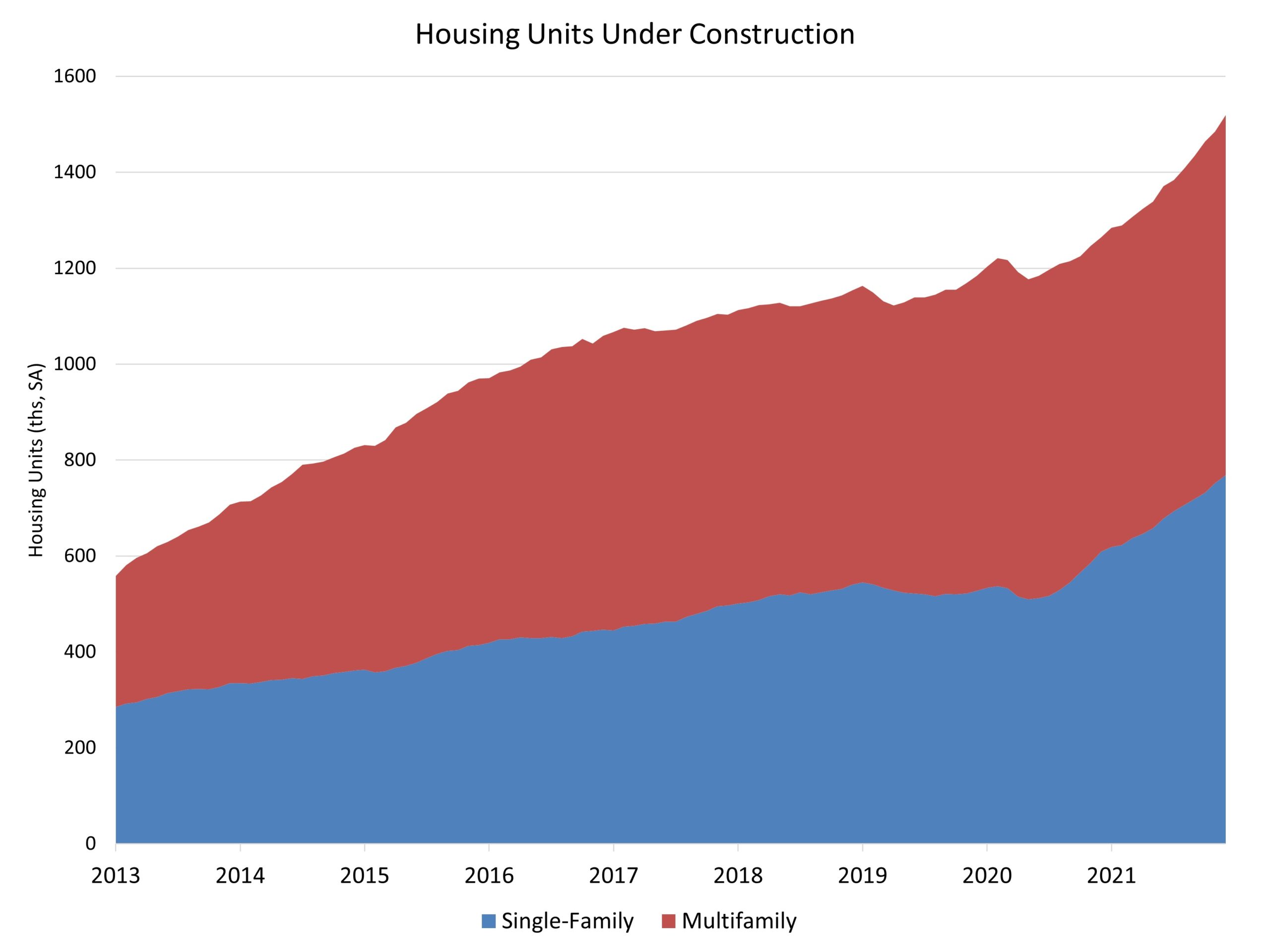

As an indicator of the economic impact of housing, there are now 769,000 single-family homes under construction. This is 26% higher than a year ago. There are currently 750,000 apartments under construction, up 15% from a year ago. Total housing units now under construction (single-family and multifamily combined) is 20% higher than a year ago.

Overall permits increased 9.1% to a 1.87 million unit annualized rate in December. Single-family permits increased 2% to a 1.12 million unit rate. Multifamily 5+ unit permits increased 19.9% to an annualized 675,000 pace.

Looking at regional permit data on a year-to-date basis, permits are 22.4% higher in the Northeast, 14.4% higher in the Midwest, 16.3% higher in the South and 19% higher in the West.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.