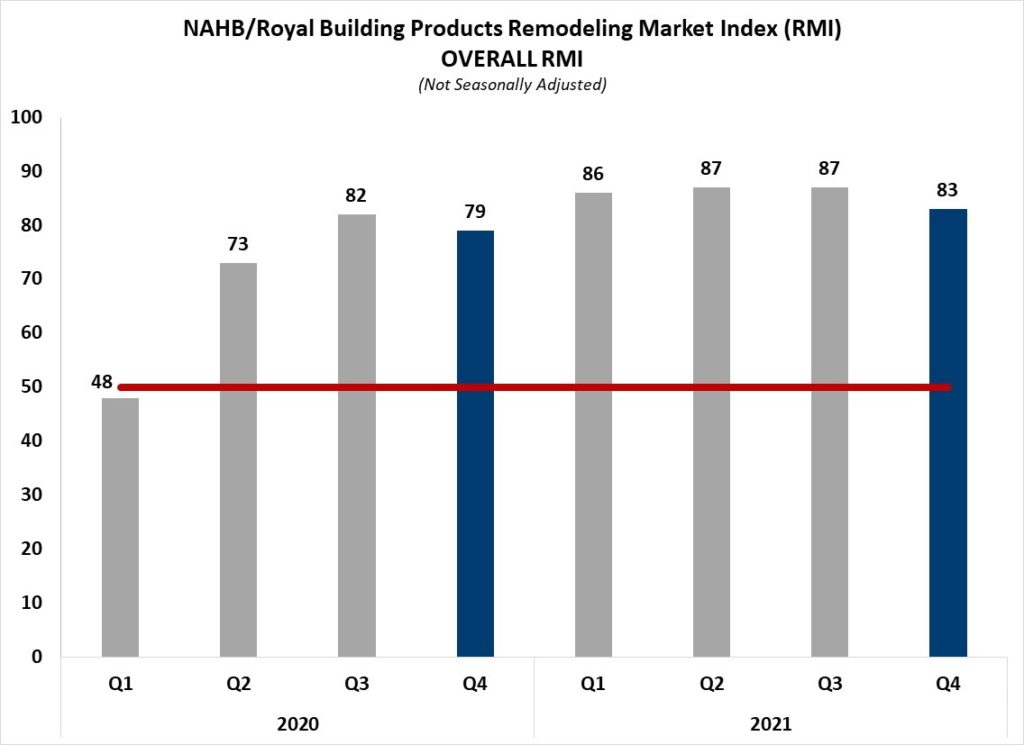

The NAHB/Royal Building Products Remodeling Market Index (RMI) for the fourth quarter posted a reading of 83, up four points from the fourth quarter of 2020. The reading is a sign of positive residential remodeler sentiment for projects of all sizes.

The RMI is based on a survey that asks remodelers to rate various aspects of the remodeling market “good,” “fair” or “poor.” Responses from each question are converted to an index that lies on a scale from 0 to 100, where an index number above 50 indicates that a higher share view conditions as good than poor.

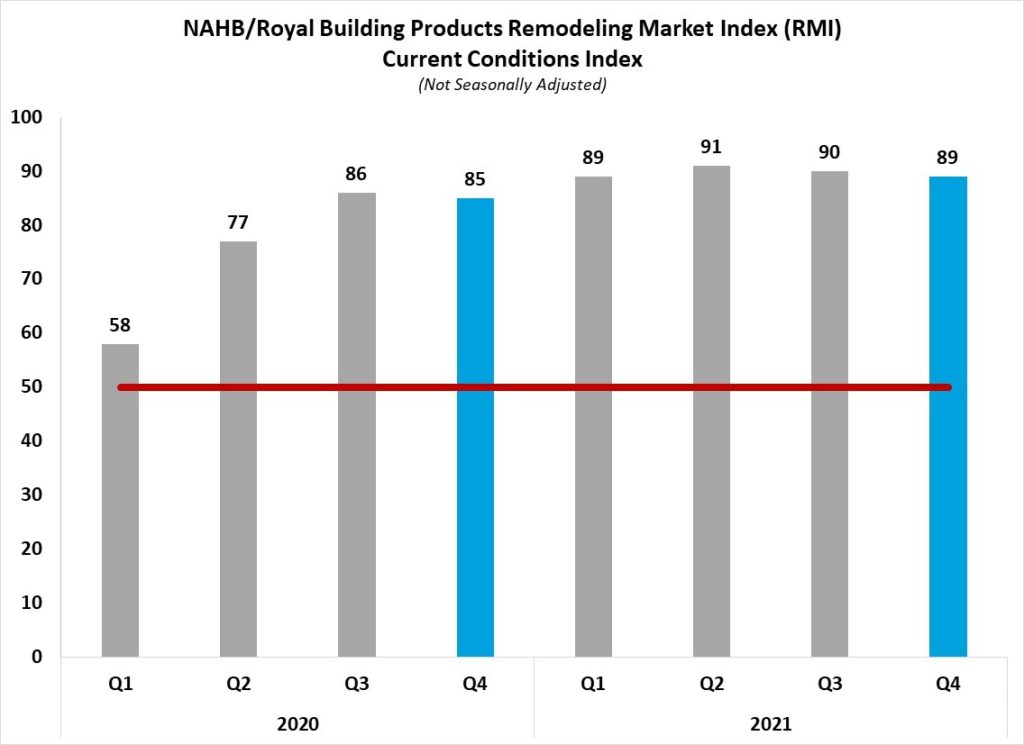

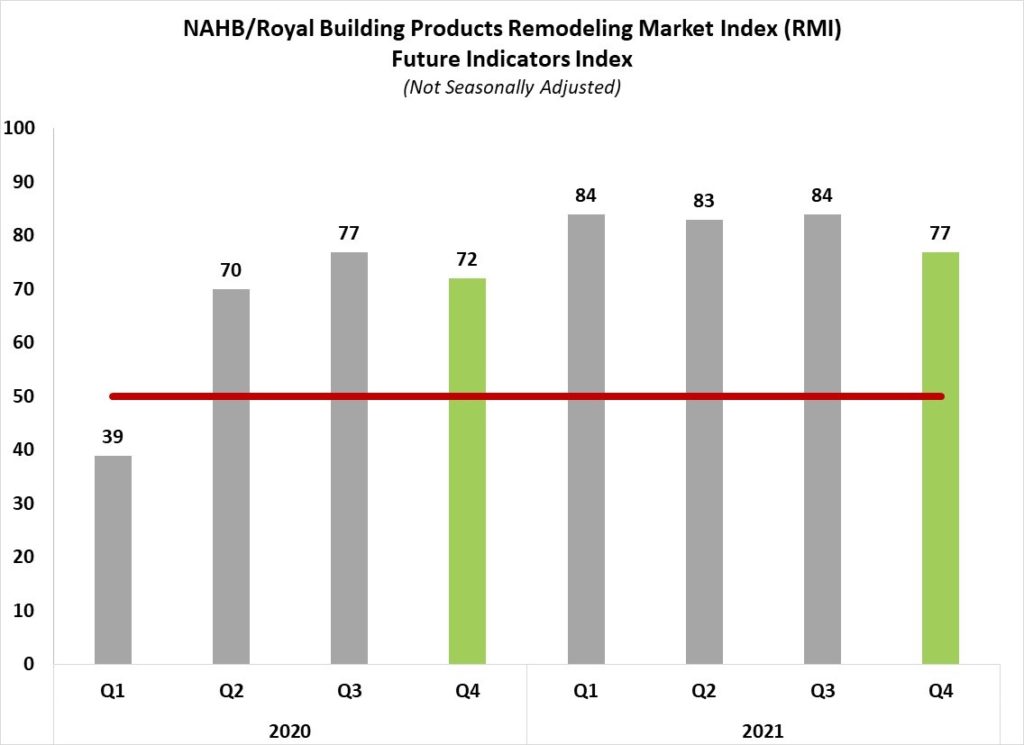

The RMI is an average of two major component indices: the Current Conditions Index, and the Future Indicators Index. The Current Conditions Index, in turn, is an average of three subcomponents: the current market for large remodeling projects ($50,000 or more), moderately-sized projects ($20,000 to $49,999), and small projects (under $20,000).

In the fourth quarter of 2021, the Current Conditions Index was 89, a four-point increase compared to the fourth quarter of 2020. All subcomponents also posted increases compared to the fourth quarter of last year: large remodeling projects rose seven points to 85, moderately-sized remodeling projects increased two points to 90 and small remodeling projects also increased by two points, up to 91.

The Future Indicators Index is an average of two subcomponents: the current rate at which leads and inquiries are coming in and the current backlog of remodeling projects. In the fourth quarter of 2021, the Future Indicators Index was 77, up five points from the fourth quarter of 2020. Both subcomponents increased year-over-year as well: the current rate at which leads and inquiries are coming in rose three points to 74 and the backlog of remodeling jobs climbed seven points to 80.

The year-over-year increase in the RMI indicates ongoing strength in the remodeling market. Higher home equity provided resources for home owners to improve their existing homes, supporting demand for remodeling. It is important to note, however, that the survey data were collected in late December and early January and do not fully capture recent increases in interest rates. Going forward, NAHB expects remodeling activity to continue to grow in 2022, although not as fast as it did in 2021.

For the full set of RMI tables, including regional indices and a complete history for each RMI component, please visit NAHB’s RMI web page.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.