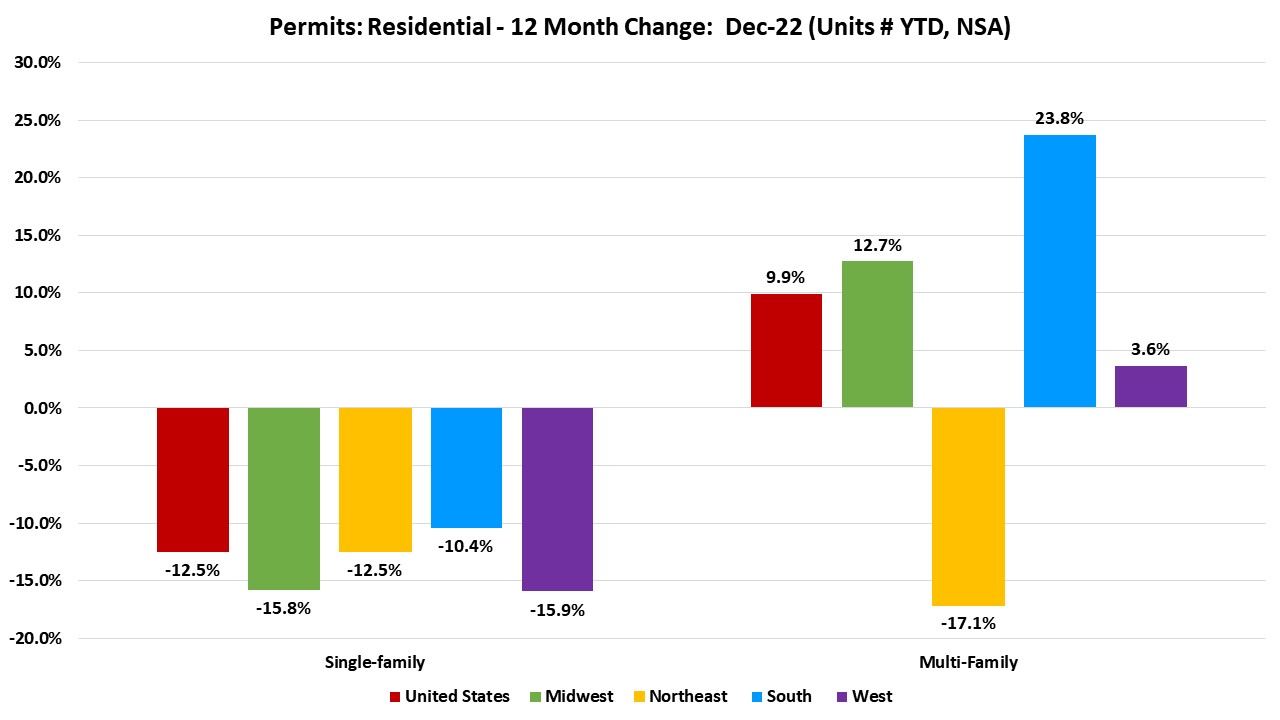

For 2022, the total number of single-family permits issued year-to-date (YTD) nationwide reached 972,180. On a year-over-year (YoY) basis, this is 12.5% below the 2021 level of 1,111,414.

Year-to-date ending in December, single-family permits declined in all four regions. The South posted a decline of 10.4%, while the Western region reported the steepest decline of 15.9%. The Northeast declined by 12.5% and the Midwest declined by 15.8% for single-family permits during this time. On the other hand, multifamily permits posted increased in all but one region, Northeast (-17.1%). Permits were 23.8% higher in the South, 12.7% higher in the Midwest, and 3.6% higher in the West.

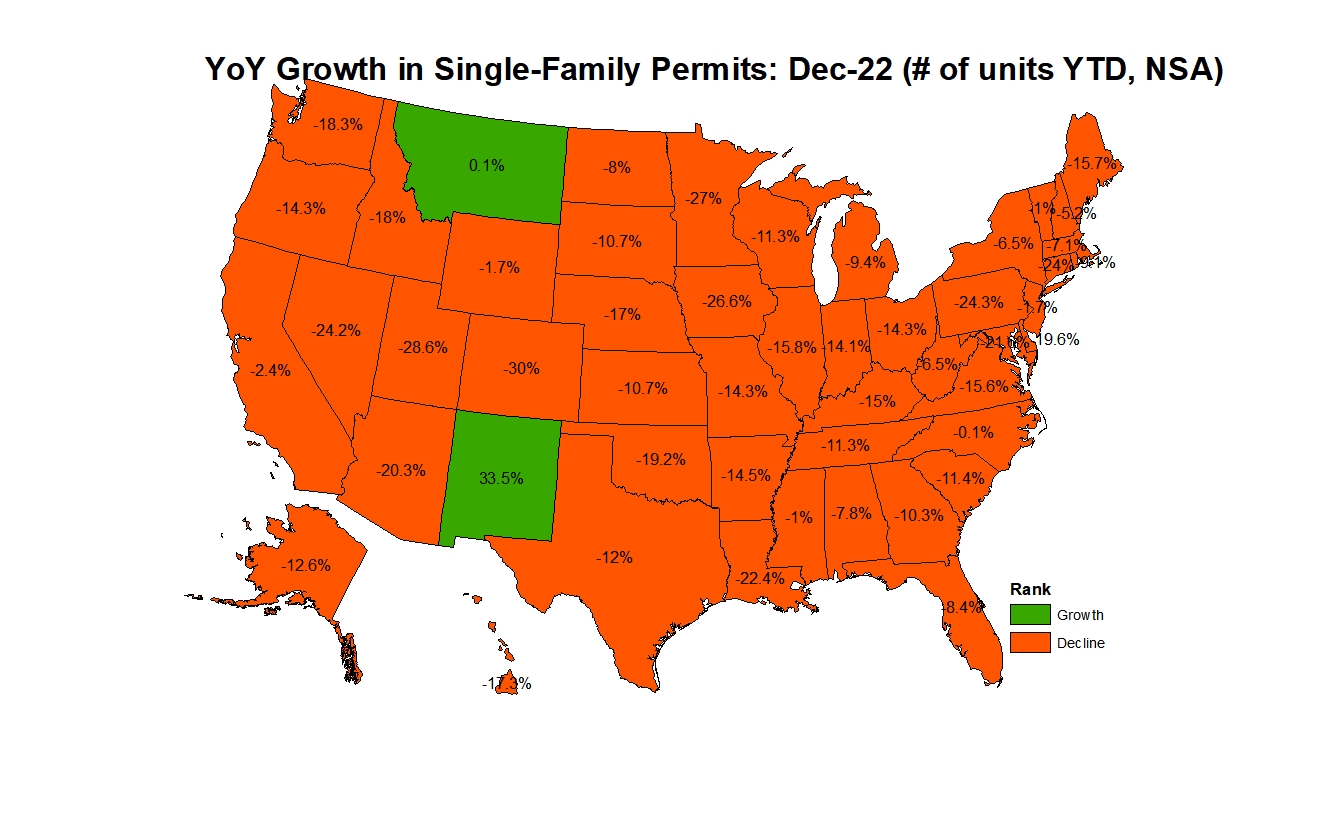

Between December 2021 YTD and December 2022 YTD, New Mexico, Montana, and the District of Columbia saw growth in single-family permits issued. New Mexico recorded the highest growth rate during this time at 33.5% going from 5,492 permits to 7,331. Forty-eight states reported a decline in single-family permits during this time with Colorado posting the steepest decline of 30.0% declining from 34,244 permits to 23,965. The ten states issuing the highest number of single-family permits combined accounted for 63.5% of the total single-family permits issued.

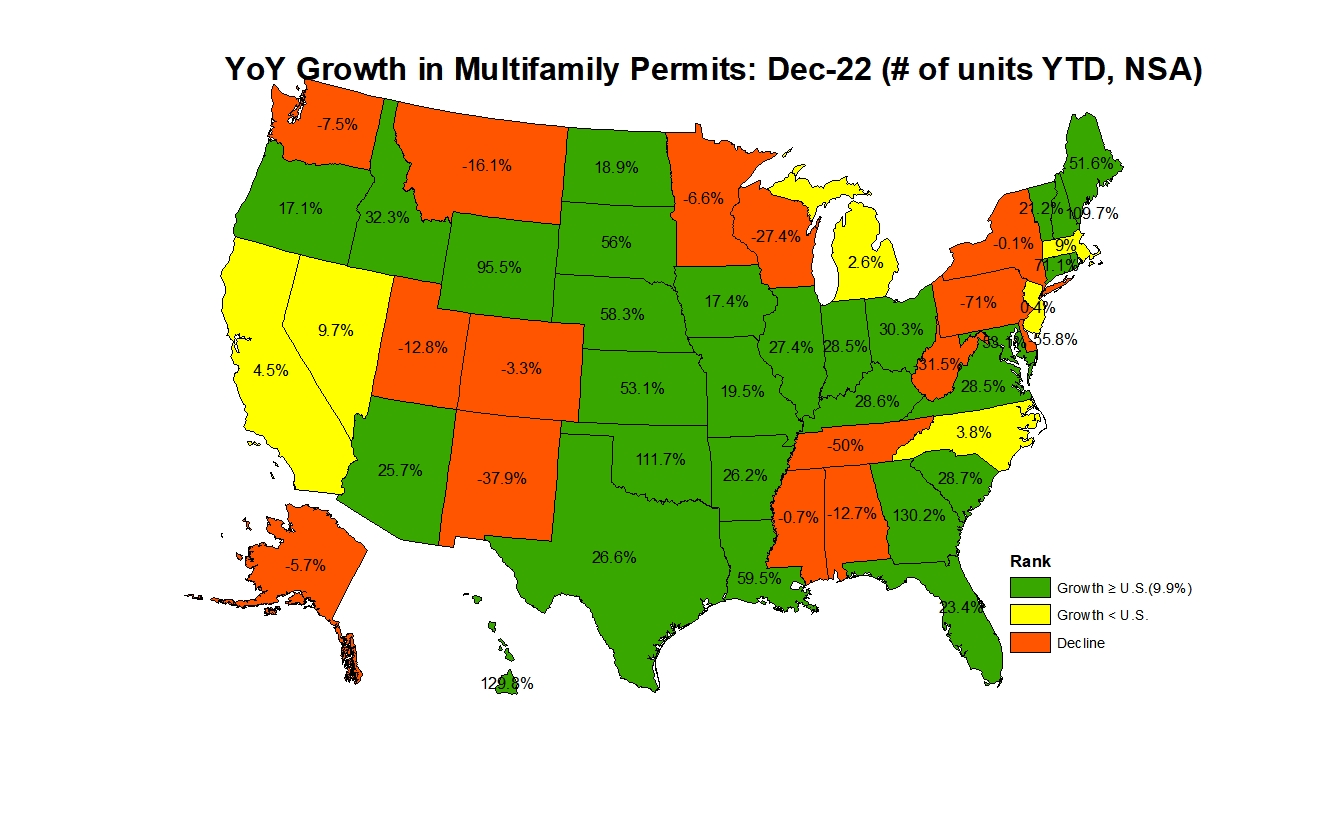

Year-to-date, ending in December, the total number of multifamily permits issued nationwide reached 679,898. This is 9.9% ahead of the December 2021 level of 618,496.

Between December 2021 YTD and December 2022 YTD, 35 states and the District of Columbia recorded growth, while 15 states recorded a decline in multifamily permits. Georgia led the way with a sharp rise (130.2%) in multifamily permits from 12,973 to 29,863 while Pennsylvania had the largest decline of 71.0% from 29,901 to 8679. The ten states issuing the highest number of multifamily permits combined accounted for 63.4% of the multifamily permits issued.

At the local level, below are the top ten metro areas that issued the highest number of single-family permits.

At the local level, below are the top ten metro areas that issued the highest number of single-family permits.

| Top 10 Largest SF Markets | December 2022 (# of units YTD, NSA) | YTD % Change (compared to Dec 2021) |

| Houston-The Woodlands-Sugar Land, TX | 47,633 | -9% |

| Dallas-Fort Worth-Arlington, TX | 43,409 | -13% |

| Phoenix-Mesa-Scottsdale, AZ | 26,828 | -24% |

| Atlanta-Sandy Springs-Roswell, GA | 26,382 | -17% |

| Austin-Round Rock, TX | 21,358 | -13% |

| Charlotte-Concord-Gastonia, NC-SC | 18,987 | 0% |

| Orlando-Kissimmee-Sanford, FL | 16,194 | -9% |

| Tampa-St. Petersburg-Clearwater, FL | 15,667 | -19% |

| Nashville-Davidson–Murfreesboro–Franklin, TN | 15,189 | -6% |

| Jacksonville, FL | 14,368 | -13% |

For multifamily permits, below are the top ten local areas that issued the highest number of permits.

| Top 10 Largest MF Markets | December 2022 (# of units YTD, NSA) | YTD % Change (compared to Dec 2021) |

| New York-Newark-Jersey City, NY-NJ-PA | 46,496 | 3% |

| Dallas-Fort Worth-Arlington, TX | 33,872 | 26% |

| Houston-The Woodlands-Sugar Land, TX | 28,153 | 69% |

| Austin-Round Rock, TX | 22,661 | -14% |

| Los Angeles-Long Beach-Anaheim, CA | 21,597 | 9% |

| Atlanta-Sandy Springs-Roswell, GA | 20,820 | 176% |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 20,644 | 51% |

| Phoenix-Mesa-Scottsdale, AZ | 20,541 | 23% |

| Seattle-Tacoma-Bellevue, WA | 19,783 | -10% |

| Minneapolis-St. Paul-Bloomington, MN-WI | 15,840 | 12% |

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.