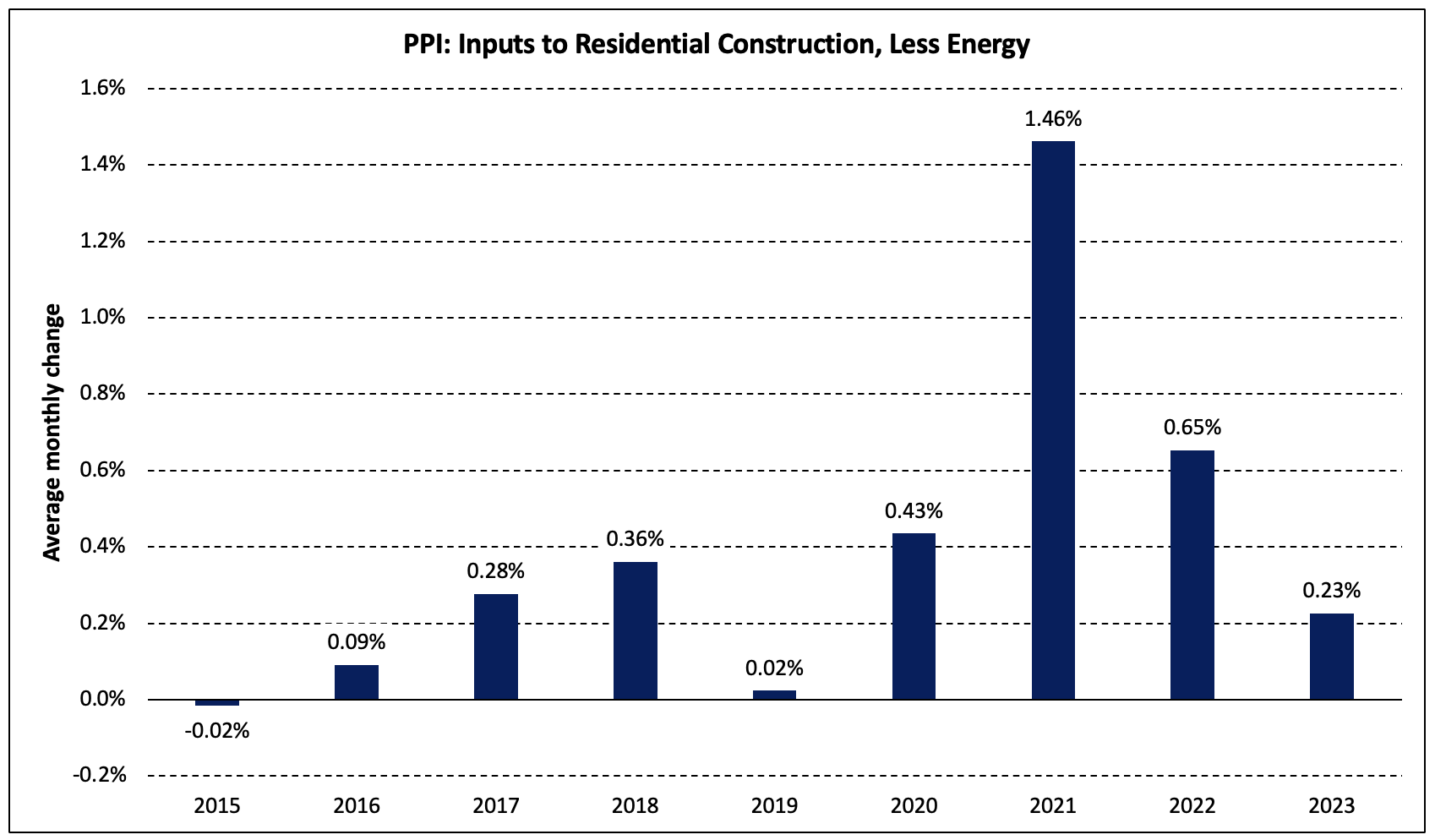

According to the latest Producer Price Index report, the price level of inputs to residential construction less energy (i.e., building materials) edged up 0.2% in July (not seasonally adjusted). Building materials price growth has slowed considerably in 2023 with an average monthly increase of 0.2%–down from 0.7% in 2022 and 1.5% in 2021. Not since prior to the COVID-19 pandemic has the average been lower (0.0% in 2019).

The Producer Price Index for all final demand goods rose 0.1% in July, up from an unchanged reading in June (seasonally adjusted). Year-over-year, the index declined 2.5% while the PPI for final demand goods less food and energy increased 1.9% (not seasonally adjusted) with the disparity driven by a 16.8% decrease in energy prices.

The PPI for goods inputs to residential construction, including energy, has decreased 2.2% over the past 12 months. March 2023 was the last month in which the index increased.

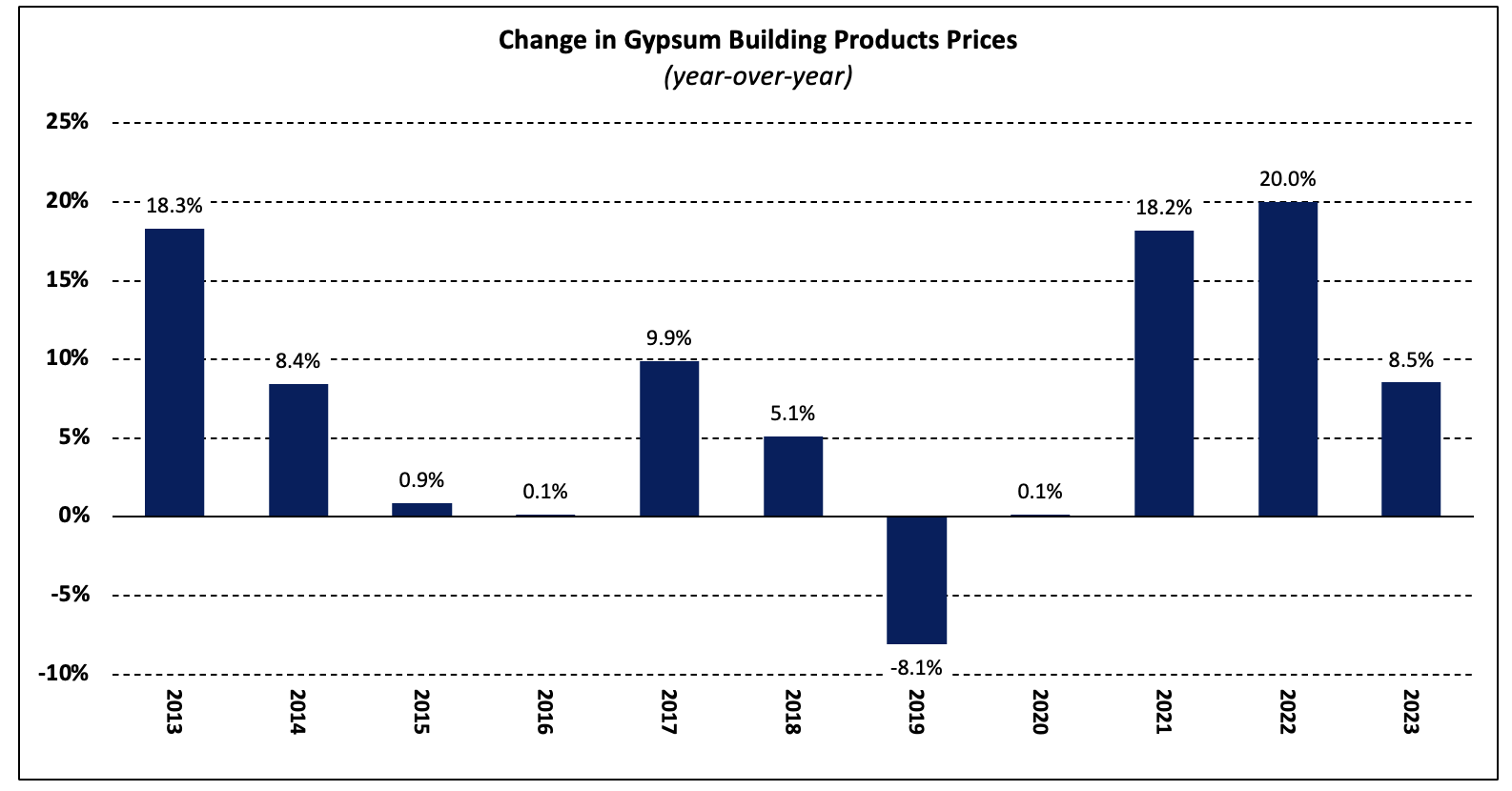

Gypsum Building Materials

The PPI for gypsum building materials fell 0.1% in July—the fourth consecutive monthly decline. Over the first seven months of 2023, year-over-year price increases have slowed from 11.1% to 2.6%. The average 12-month increase this year has been 8.5% compared to 20.0% in 2022.

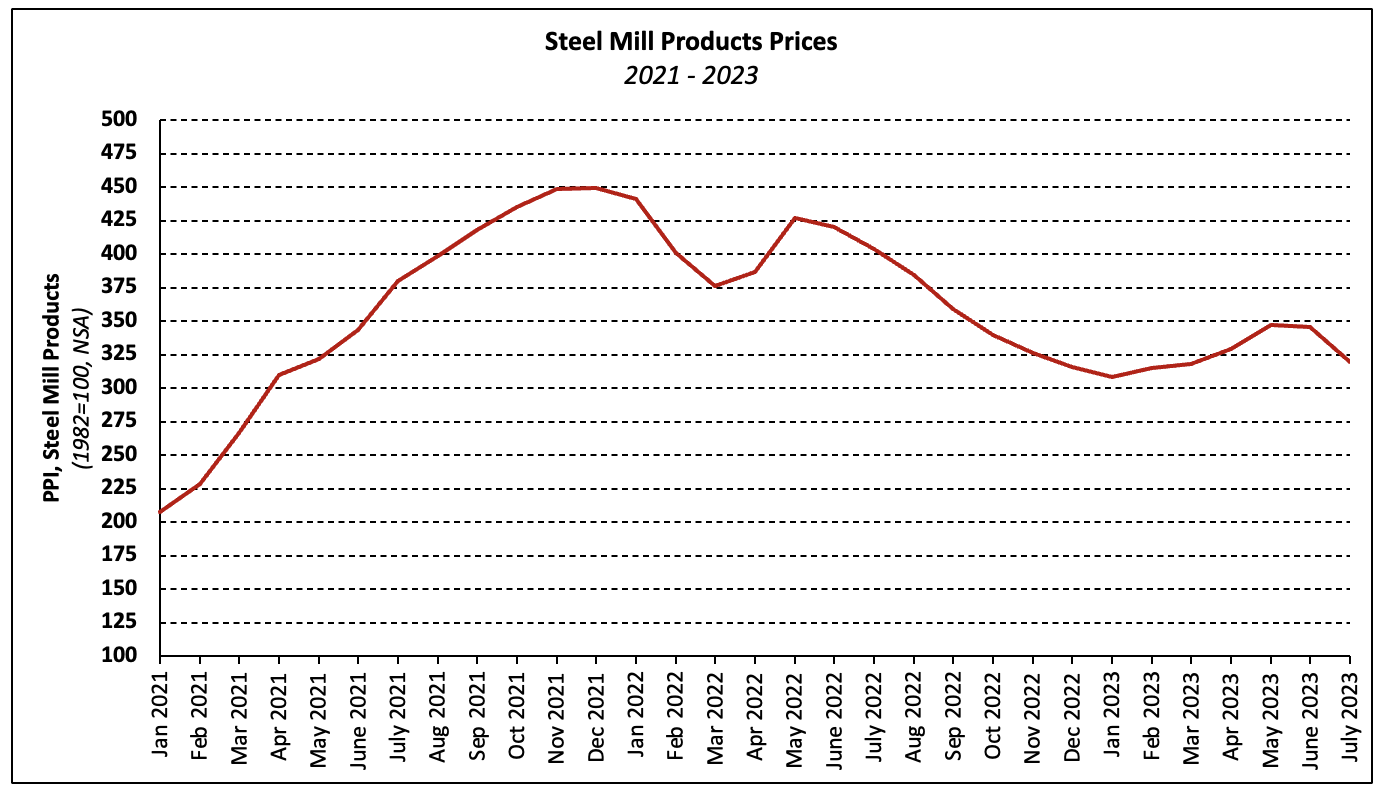

Steel Mill Products

The price of steel mill products (i.e., the raw materials used to make intermediate and finished steel goods) fell 7.6% in July after decreasing 0.6% the month prior (NSA). Since climbing 12.4% between January and May, prices have declined 8.0%.

The index is 21.0% lower than it stood one year ago and has decreased 29.0% since reaching its all-time high in December 2021.

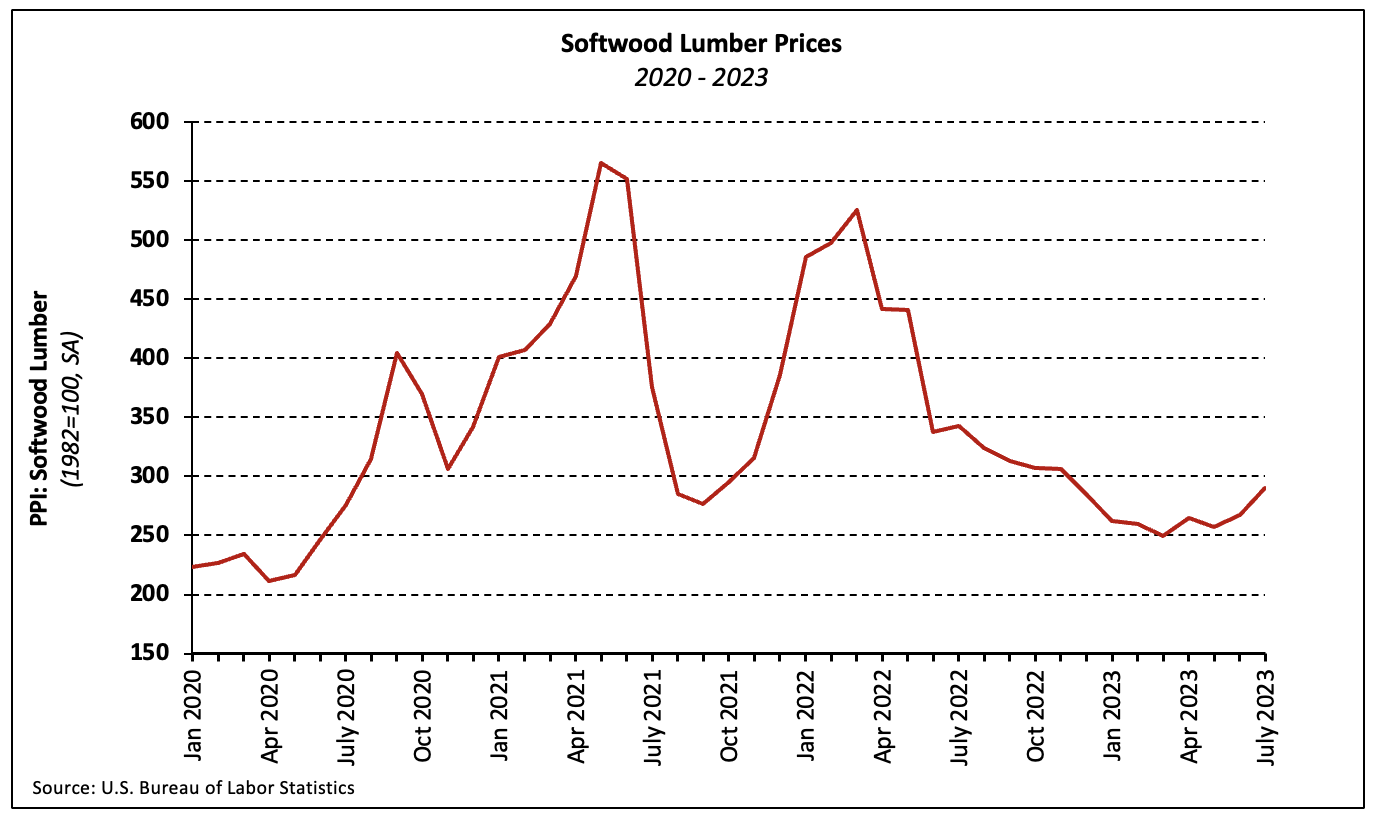

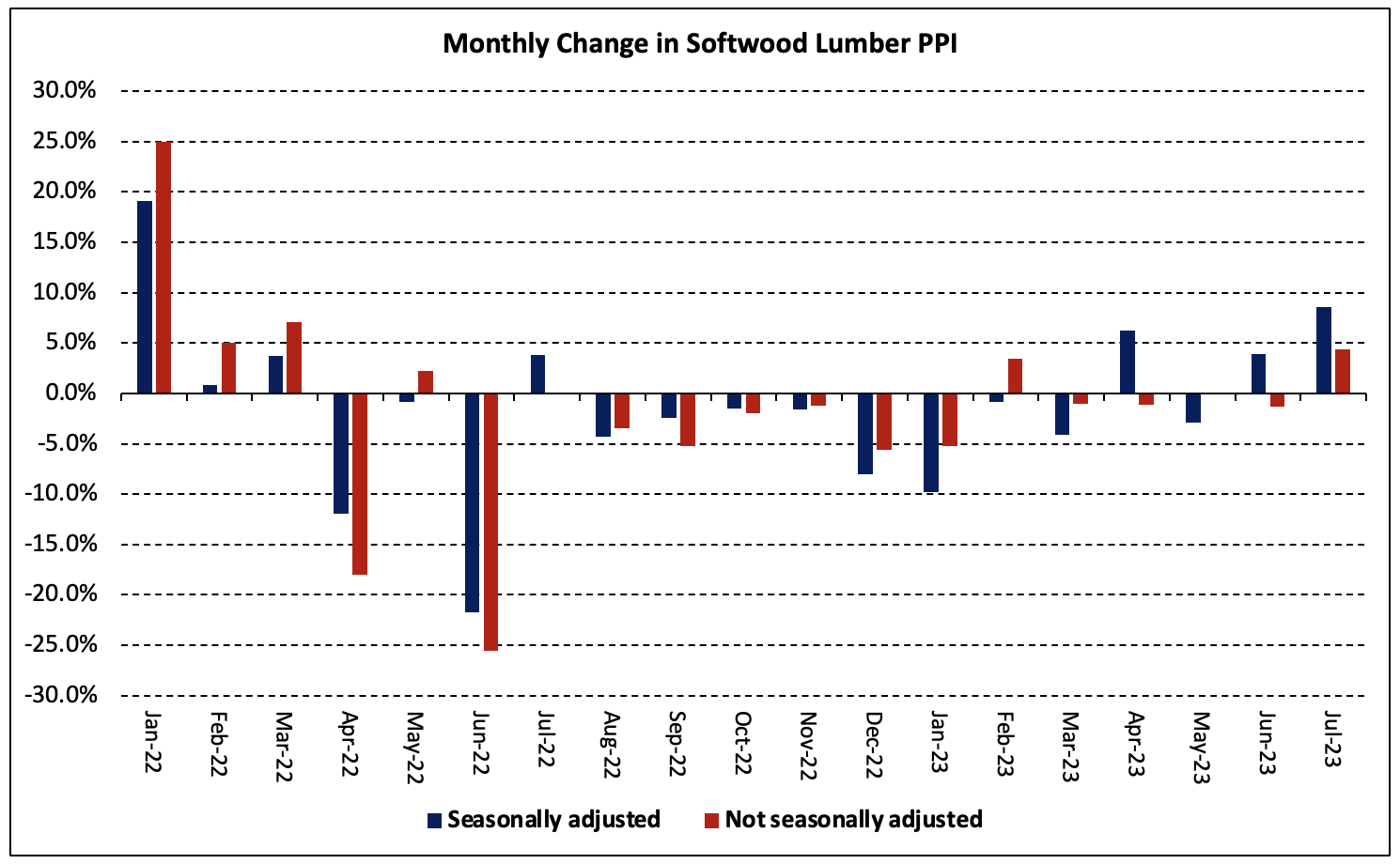

Softwood Lumber

The PPI for softwood lumber (seasonally adjusted) increased 8.6% in July—the third and largest increase over the past four months during which the index has climbed 16.4%. In contrast, the Random Lengths Framing Lumber Composite Price increased roughly 5% in July.

This difference results primarily from the seasonal adjustment of data. The unadjusted softwood lumber PPI increased 4.4% in July, in line with the Random Lengths data. These differences can be quite substantial.

Other causes of the difference include the timing of the PPI survey as well as the composition and weighting of the softwood lumber index.

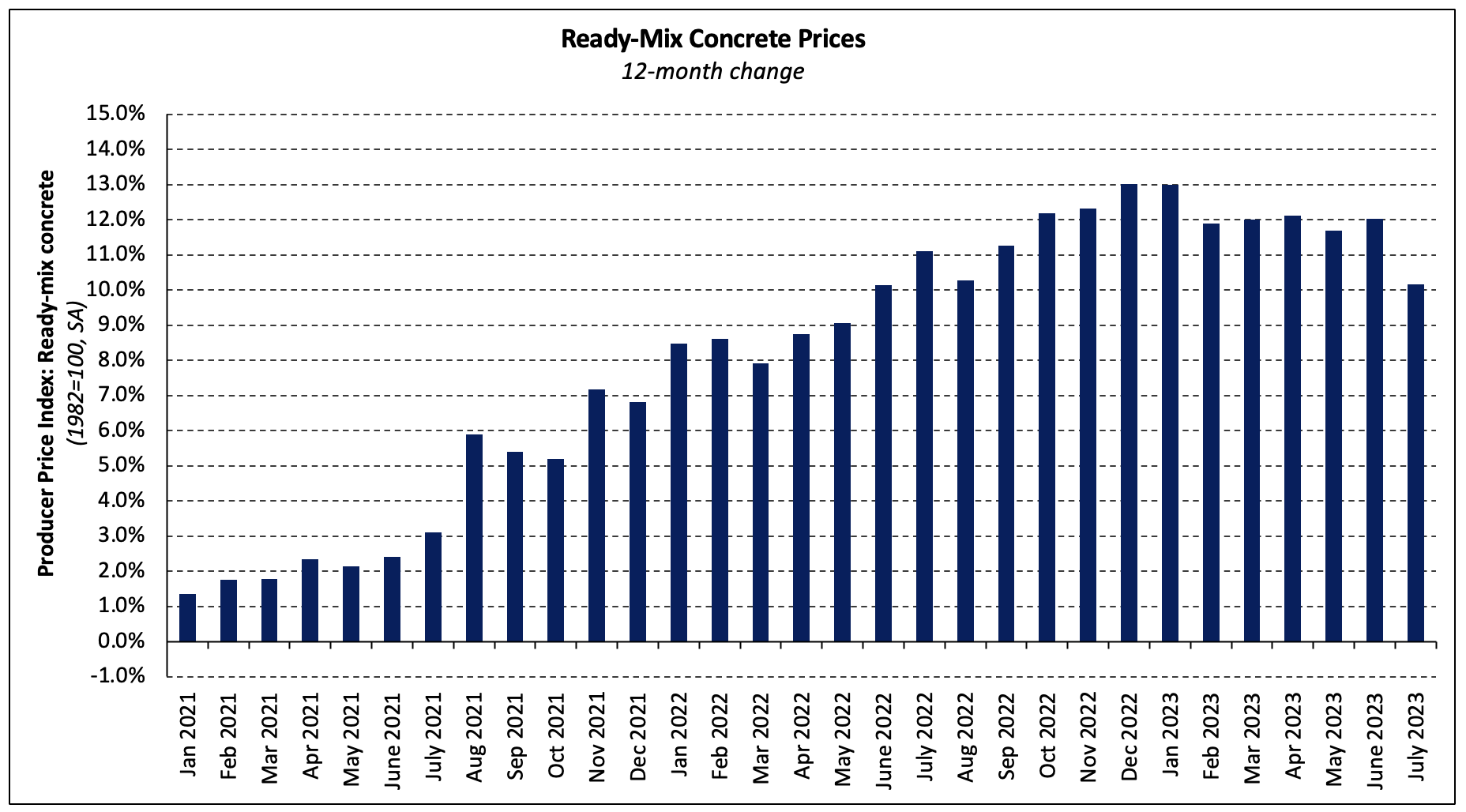

Ready-Mix Concrete

Ready-mix concrete (RMC) prices increased 0.1% in July after a commensurate percentage decline in June. Like gypsum building materials prices, monthly price increases of concrete have slowed substantially in 2023. The PPI for RMC has increased 0.6% per month this year, on average, the lowest average since 2020. Prices have increased 3.3%, year-to-date, roughly half the YTD increase in July 2022.

Prices increased 1.3% and 0.9% in the Midwest and South, respectively (not seasonally adjusted), were unchanged in the Northeast, and fell 0.2% in the West region. Year-to-date, prices have increased 9.1% in the Northeast, more than triple the average YTD increases seen in the other three regions.

Services

The price index of services inputs (excluding labor) to residential construction increased 1.5% in July following a flat reading in June. The increase was primarily driven by a 5.6% increase in the index for building materials retailers’ gross margins which accounts for nearly one-third of the services inputs PPI.

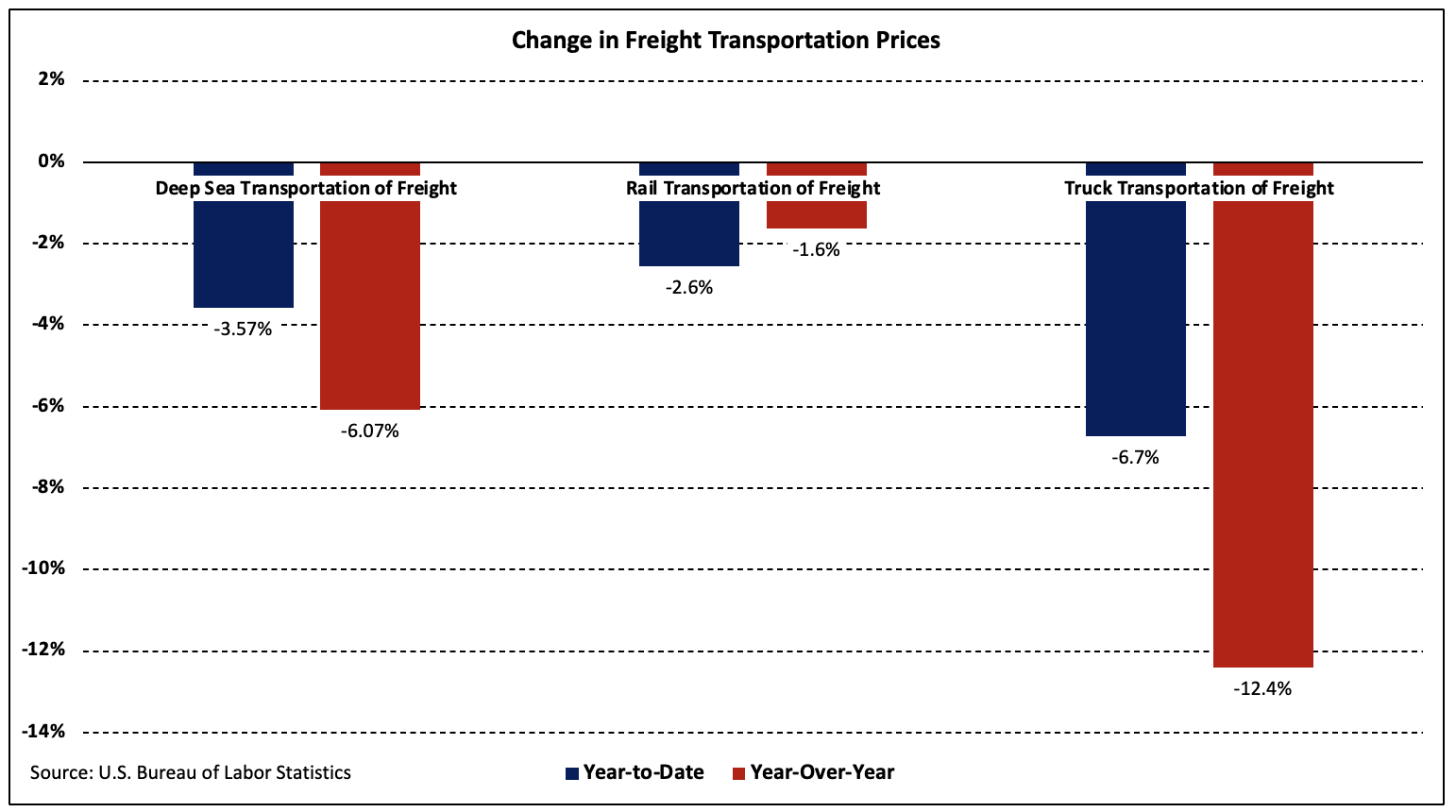

Freight Prices

Producer prices for the transportation of freight continued their downward trend in July. The price rail and truck transportation of freight declined 0.1% and 0.2%, respectively, while the PPI for ocean transportation of freight was unchanged.

Additionally, the index for arrangement of freight and cargo (i.e., shipping logistics services) fell 2.2% over the month. Prices have decreased 30.2% over the past 12 months as both international as well as domestic supply chain bottlenecks have eased.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

For construction loan customers, the article’s insight into moderating price growth for key building materials could offer a glimmer of hope. It suggests the potential for reduced project costs, making construction loans more feasible and attractive amidst the ongoing challenges of the housing market. If you want to best guide, builderloans.net is the one to find!