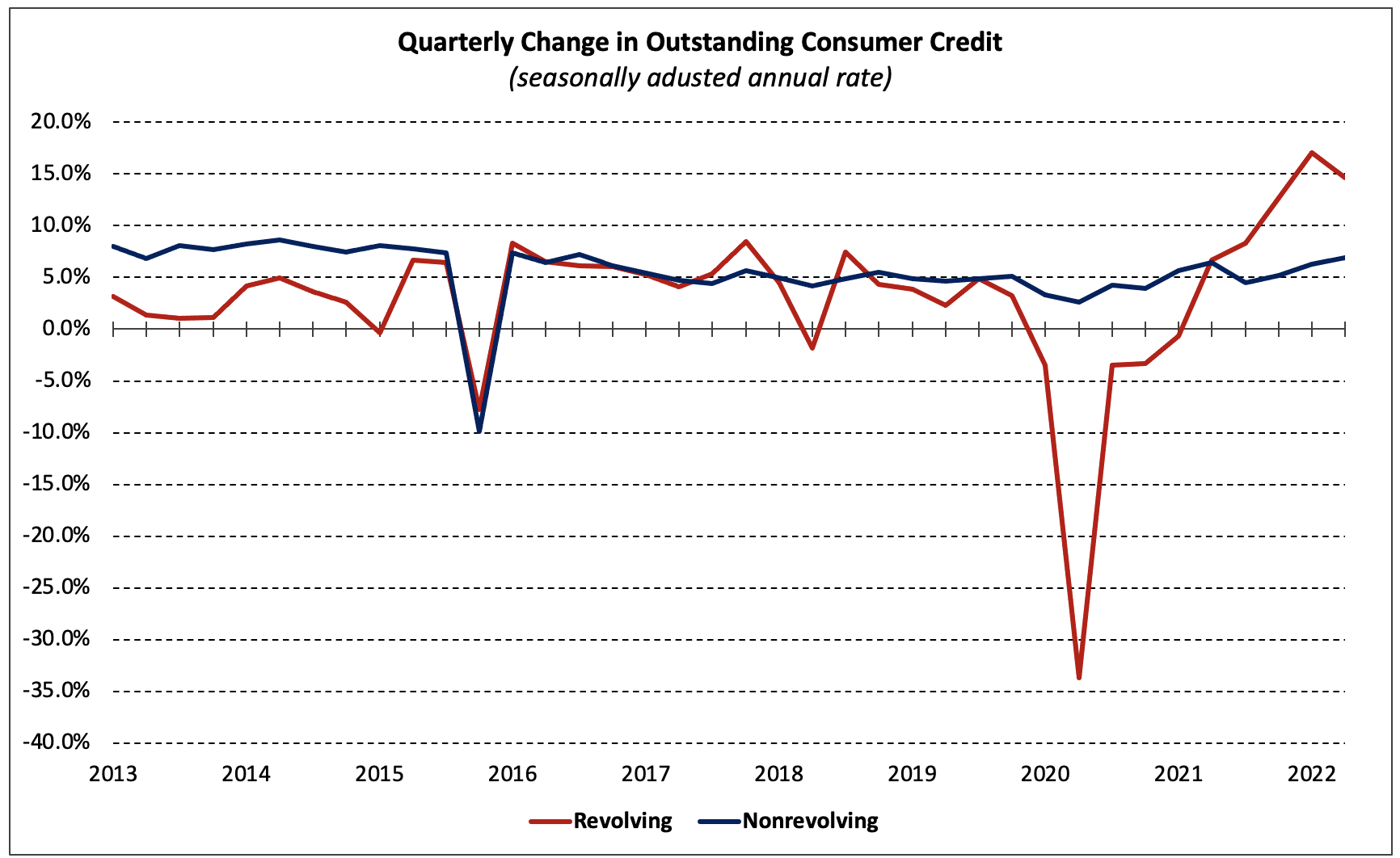

Non-real estate consumer credit grew at a seasonal adjusted annual rate (SAAR) of 8.7% in the second quarter of 2022 according to the Federal Reserve’s latest G.19 Consumer Credit report. Revolving debt climbed 14.6% (SAAR), double the increase in nonrevolving debt (+6.9%).

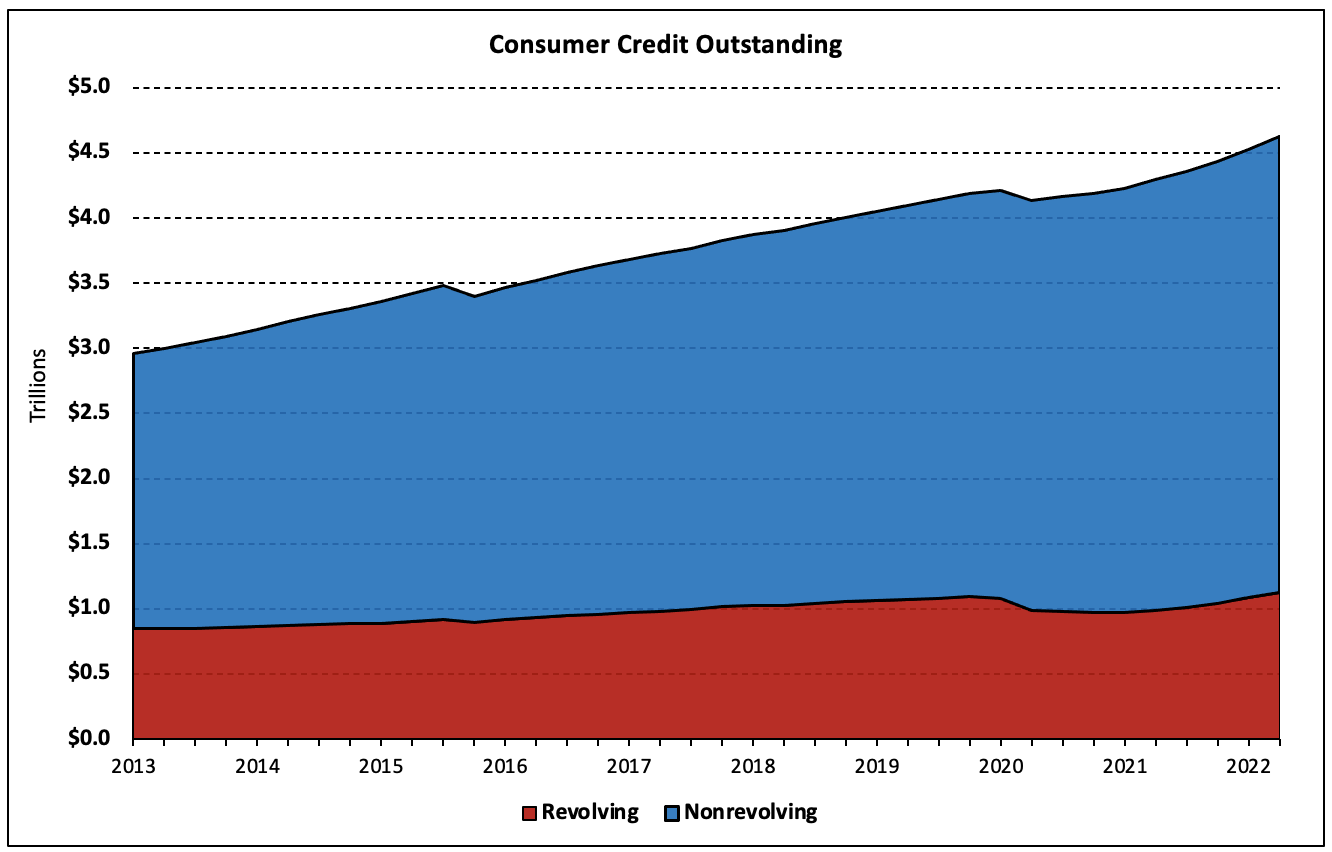

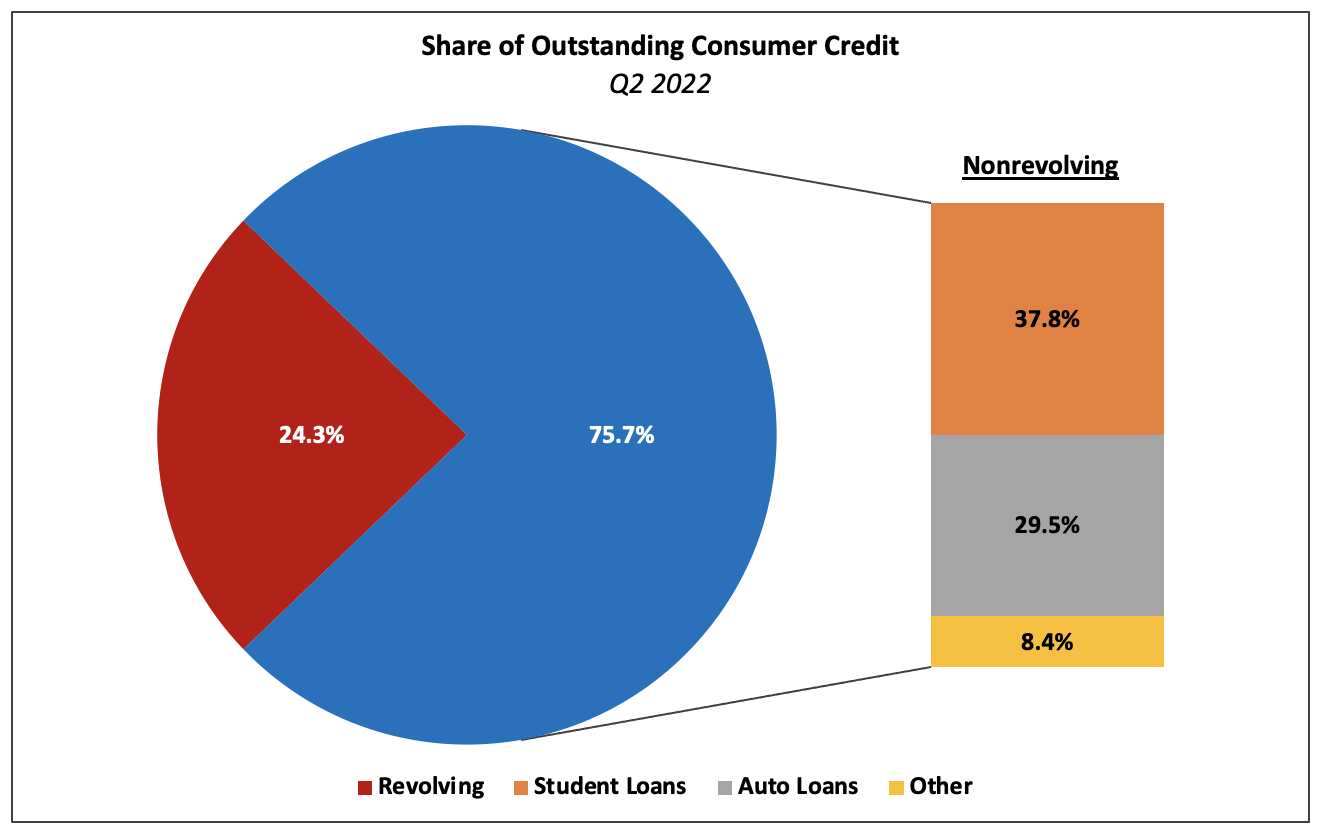

Total consumer credit currently stands at $4.6 trillion, with $1.1 trillion in revolving debt and $3.5 trillion in non-revolving debt. From the previous quarter, total consumer credit increased by $98.9 billion, with revolving debt and non-revolving debt increasing by $40.3 billion and $59.3 billion, respectively.

Part of the recent growth in consumer credit—both revolving as well as nonrevolving—is explained by persistently high inflation. The increase in nonrevolving credit owes mostly to higher car prices. Since January 2021, new and used car prices have increased nearly 15% (year-over-year) each month, on average, while sales volume declined. Revolving credit balances can be similarly explained by rising price levels as the 12-month increases for energy and food items averaged 32% and 9% over the first two quarters of 2022.

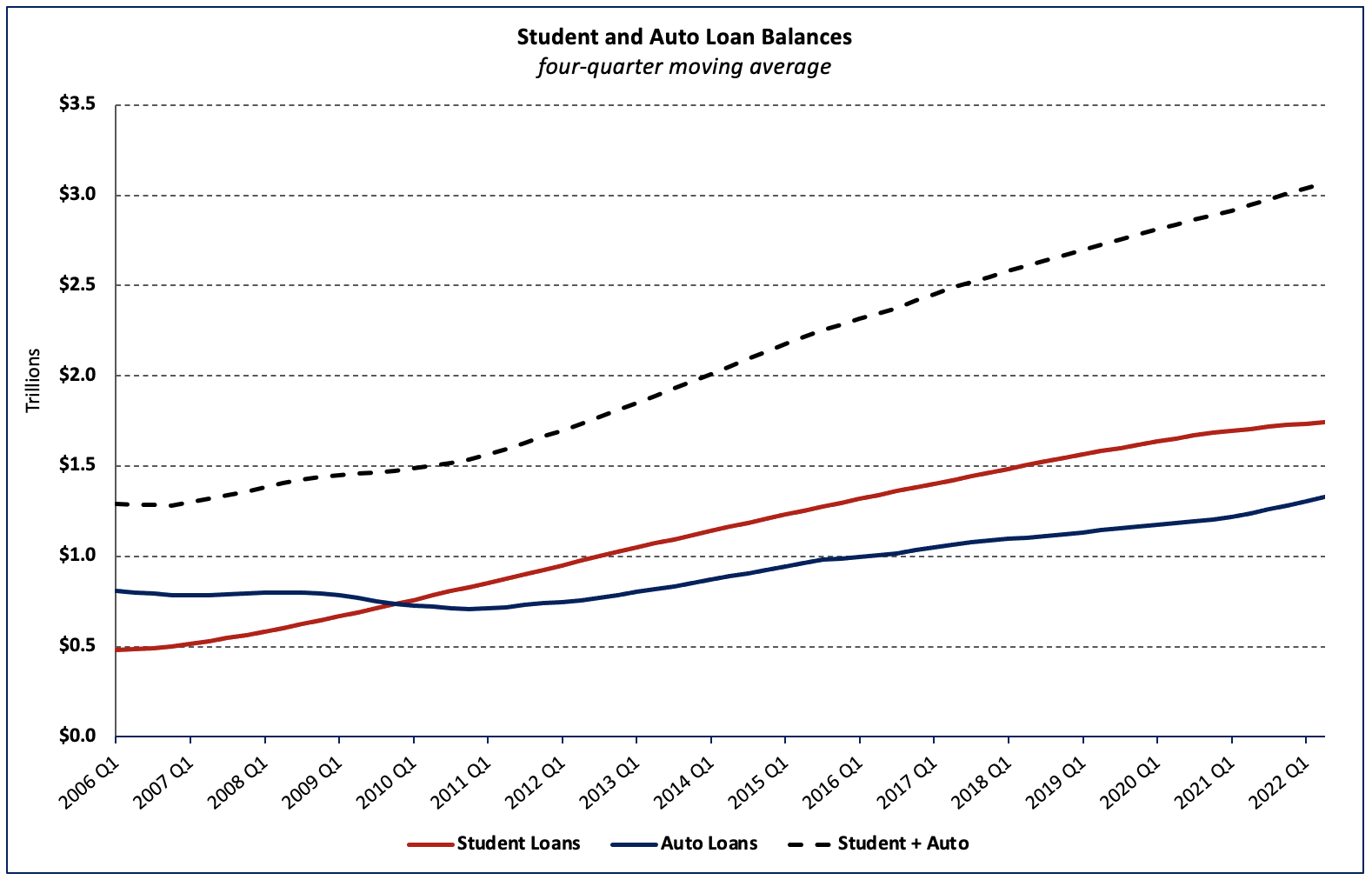

With every quarterly G.19 report, the Federal Reserve releases a memo item covering student and motor vehicle loans’ outstanding levels on a non-seasonally adjusted basis. The most recent memo item indicates that, as of the second quarter of 2022, student loans stood at $1.8 trillion and motor vehicle loans stood at $1.4 trillion. Annualized, the changes in these two categories from the previous quarter are $3.2 billion and $129.1 billion, respectively.

Together, these loans made up 88.9% of nonrevolving credit balances (NSA) in the second quarter. Although this share is near the ten-year average (91.4%), it is the smallest since 2011.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.