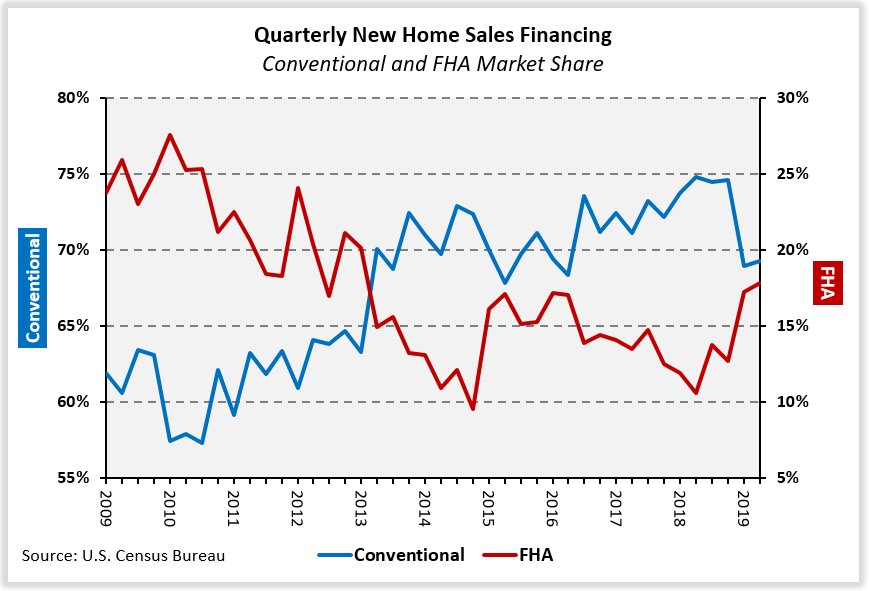

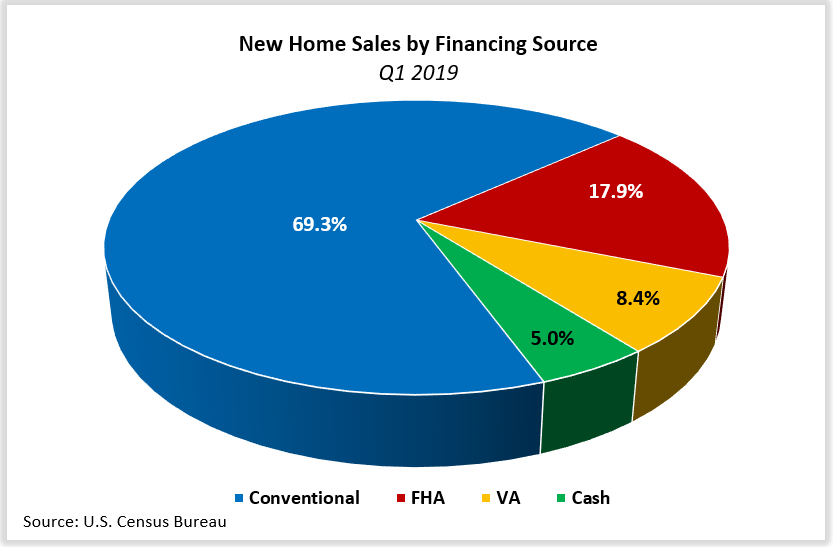

NAHB analysis of the most recent Quarterly Sales by Price and Financing published by the U.S. Census Bureau reveals that mortgages backed by the FHA made up 17.9% (32,000) of total sales (179,000), 7.3 percentage points higher than Q2 2018 (20,000). The FHA share is the highest it has been since the first quarter of 2013.

Conventional loans accounted for 69.3% of new home sales in the second quarter of 2019, a 0.7 percentage point increase from Q1 2019 (revised). Prior to this data release—which revised the Q1 2019 conventional loan share down from 71.3% to 69.0%–the percentage of new home sales financed with conventional mortgages had been above 70.0% each of the preceding 11 quarters.

As FHA market share increases, conventional loan market share typically falls and vice versa. The most recent peak in the conventional loan share occurred in the same quarter (Q2 2018) as the most recent trough in the share of FHA-backed sales.

Cash purchases accounted for 5.0% of new home sales in the second quarter of 2019, the lowest since Q2 2018 (7.3%). The percentage of new homes bought with cash has declined each of the past four quarters.

Although cash sales make up a small portion of new home sales, they constitute a larger share of existing home sales. According to estimates from the National Association of Realtors, roughly 16% of existing home transactions were all-cash sales in June 2019, down from 19% and 22% in May 2019 and June 2018, respectively. The declines have been concurrent with a drop in the share of existing homes bought by investors and an increase in the share of first-time buyers.

The share of new home sales backed by VA products declined 0.2 percentage point to 8.4% of the total and is roughly in line with the ten-year average (8.9%).

It is worth adopting some caution associated with the Census data as they are estimates based on sample statistics. The statistical error associated with the FHA, cash, and VA sales estimates from this data set are relatively high, meaning that although the data are presented as single numbers, the true values may be substantially different.

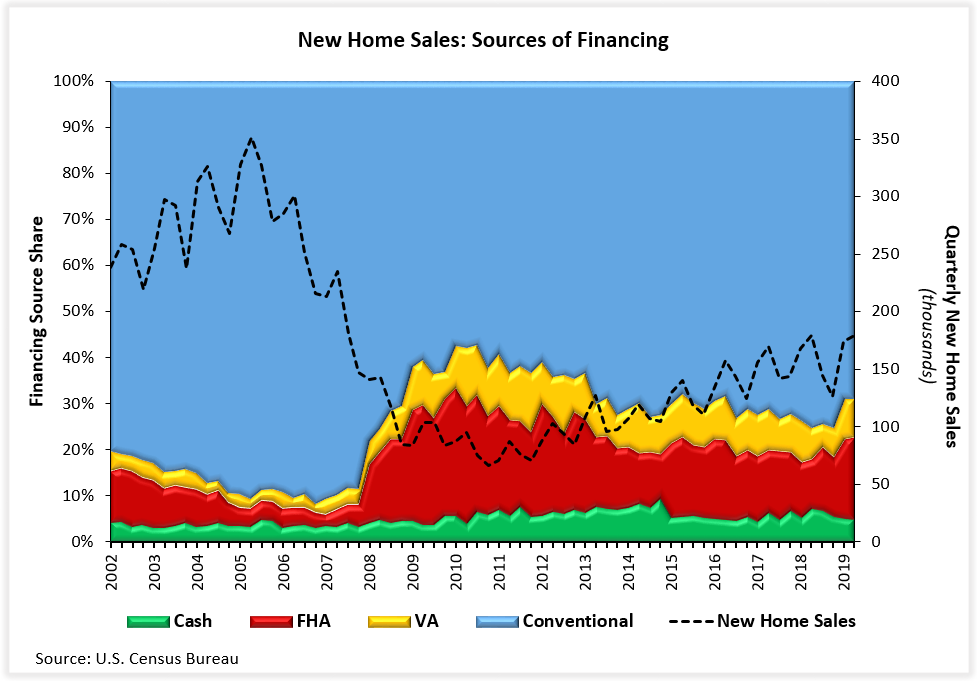

Mindful of these limitations, over the long run the current conventional loan share is 24.4% lower than its 91.7% high reached in 2006 and 2.3% higher than its average since the end of the Great Recession.

Different sources of financing also serve distinct market segments, which is revealed in part by the median new home price associated with each. In the second quarter, the national median sales price of a new home was $320,300. Split by types of financing, the median prices of new homes financed with conventional loans, FHA loans, VA loans, and cash were $356,300, $236,000, $329,000, and $354,600, respectively.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.