The price of lumber, from framing to structural panels, has increased in recent weeks with some prices rising more than 30%.

Softwood lumber prices have been relatively steady since 2014. During this period, the largest one-week price increase of framing lumber (+6.8%), as measured by the Random Lengths Framing Lumber Composite Index, occurred in the middle of the recent price escalation.[1] The largest one-month swing of softwood lumber during this period was 2.9% in 2014 according to the Bureau of Labor Statistics Producer Price Index (PPI) (this index will not capture the recent monthly increases until the February data is released in mid-March).[2]

The trade agreement that has governed Canadian imports of softwood lumber since 2006 effectively expired at the end of 2016, the mechanics and consequences of which are discussed below. Failure to reach a new agreement is the primary catalyst of market-wide price increases.[3] The outlook of a new pact between the U.S. and Canada and thus, lumber prices, is highly uncertain at this point. However, price trends in the 2001-2006 period (the last time negotiations were held) may offer clues as to what lies ahead.

Recent Trading and Price Volatility

Since the start of 2017, the price of framing lumber is up 15%. In the three weeks between January 27th and February 17th, prices increased by 5% per week, on average. To put that in perspective, consider that the average weekly price change over the course of 2016 was +0.2%.[4] Though prices have increased in the aggregate, the composite index masks the magnitude of some of the most volatile, species-specific increases.

Spruce-Pine-Fir (S-P-F)

Canadian softwood lumber imports are predominantly S-P-F.[5] Speculation of retroactive duties being imposed on Canadian imports began in late January, as evidenced in a two-week, 12% increase in March delivery lumber futures. Producers hiked prices by double-digits on the heels of the futures price changes. Other Canadian mills dropped out of the market to mitigate the effects of uncertainty. Canadian price increases allowed U.S. mills to raise quotes—as buyers had nowhere else to turn for high-grade products—further boosting the aggregate price level. The framing lumber composite price rose $25 between February 3rd and February 10th, the largest one-week increase since August 2003.[6]

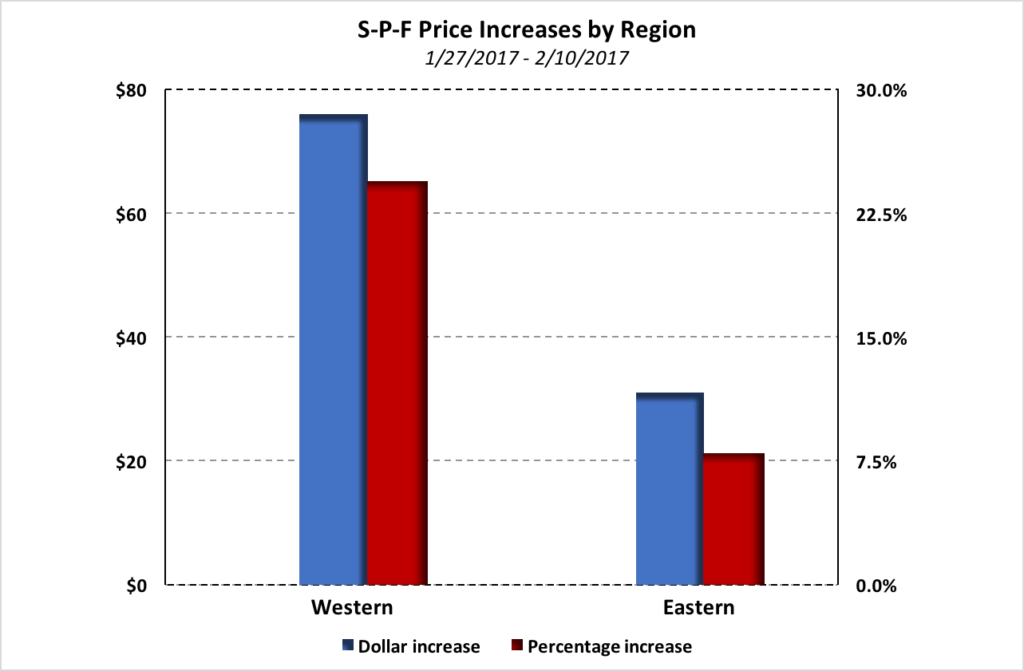

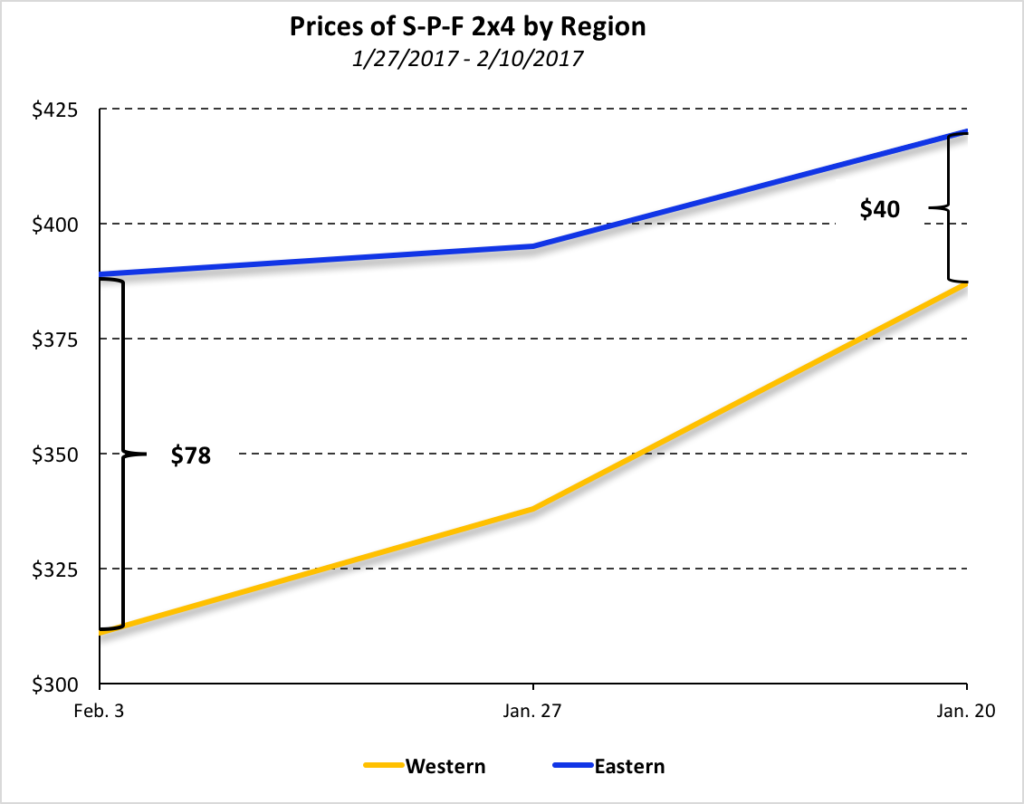

The graph below illustrates the disparity between the price increases of eastern versus western S-P-F from late January to mid-February. Western S-P-F 2x4s became 24% ($76) more expensive during this period, while eastern 2×4 prices rose just 8% ($31).

The baseline price of both products was responsible for most of this difference. Prior to these market changes, eastern S-P-F already traded at a premium relative to western. On January 27th, eastern S-P-F was priced relative high—$78 more expensive than its western counterpart. When buyers became true price takers, western S-P-F had more room to increase to a market-imposed price ceiling. As a result, the price disparity (shown below) shrank 50% by February 17th.

Southern Pine

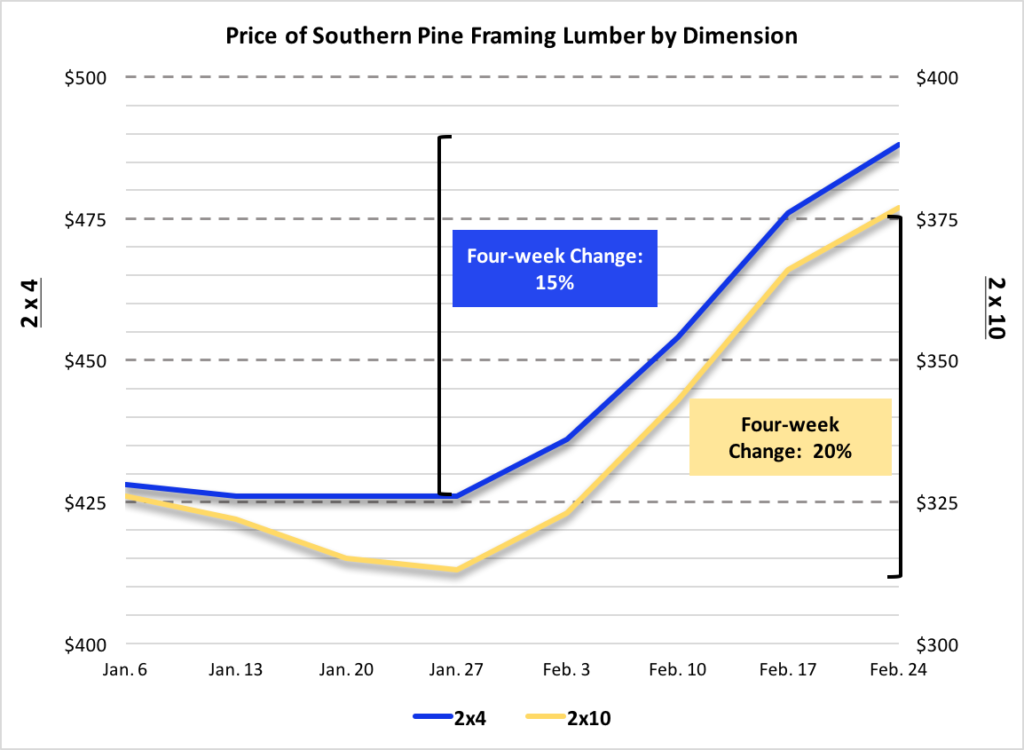

Unlike S-P-F prices—which either held steady or declined during the week ending February 24th—price increases of southern pine (SP) 2x4s and 2x10s continued their rapid pace. An example of the pace of price growth is that southern pine 2x10s became 4% more expensive each week from January 27th through February 24th.

The recent surge in southern pine prices (shown above) reflects the fact that major appreciation of S-P-F products allows SP mills to hike quotes without fear of sacrificing their share of the framing lumber market.

Structural panel markets

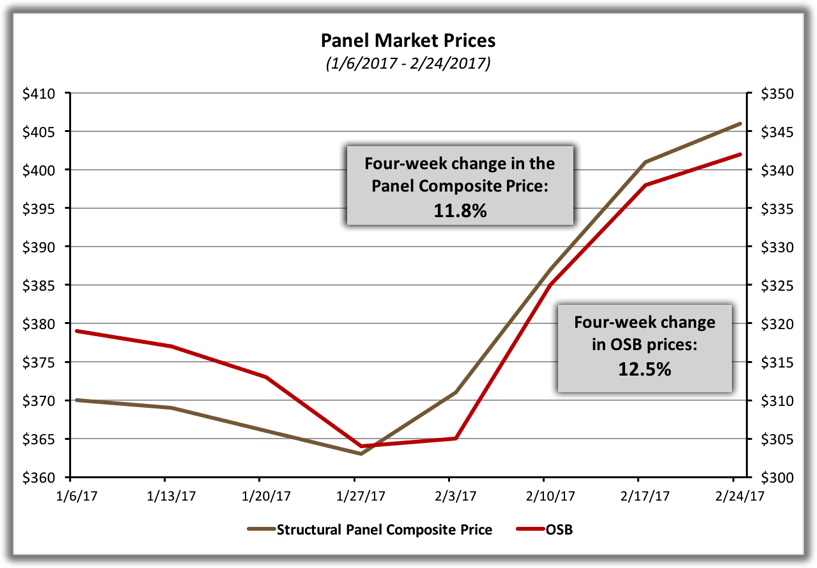

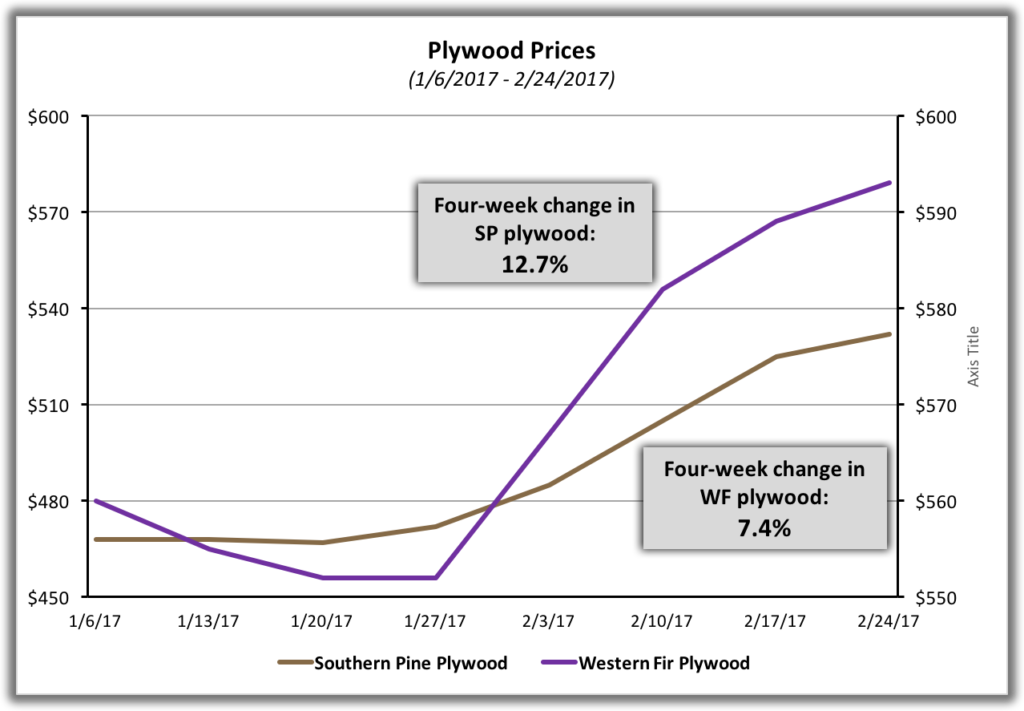

In addition to framing lumber, the price of structural panel products has become worrisome for buyers. The volume of orders for and prices of OSB and plywood accelerated in the beginning of February. These increases came on the heels of OSB price increases throughout 2016. Builders have received little relief since November 2016, as the OSB Composite Price ended 2016 with increases in six of the final seven weeks.[7]

The pain has not been contained to OSB; plywood prices have climbed relatively steeply since the beginning of the year. The two following charts capture those increases in the panel market.

Some western plywood suppliers said the first week of February was their busiest in two years. Elevated demand allowed mills to hike prices several times without affecting sales.

Some western plywood suppliers said the first week of February was their busiest in two years. Elevated demand allowed mills to hike prices several times without affecting sales.

The Softwood Lumber Trade Dispute

The root of these price increases is the long-running dispute between Canada and the U.S. regarding softwood lumber imports to the United States.

Rules of Trade from 2006-2016

The two countries reached what is known as the Softwood Lumber Agreement (SLA) of 2006 over a

decade ago. That agreement:

- Removed all duties (tariffs) placed on Canadian softwood lumber imports since May 2002

- Placed export charges and/or volume limits on Canadian imports unless the “prevailing monthly price”—as measured by the Random Lengths Framing Lumber Composite Index—rose above $US 355

- Imposed charges on Canadian regional exports if the volume to the U.S. in any given month exceeded a “trigger volume”

- Exempted softwood lumber products exported by dozens of Canadian companies

The 2006 SLA officially expired On October 12th, 2015. However, the agreement included a key provision: upon the expiration of SLA 2006, there would be a 12-month “cooling off period” during which no new trade disputes could be filed.[8] Thus, on November 25th, 2016, litigation began in earnest as domestic lumber producers filed a petition with the International Trade Commission (ITC) requesting an investigation into softwood lumber imported from Canada.[9]

How Expiration Has Fueled Price Increases

As was widely expected, the ITC issued a preliminary determination siding with domestic softwood lumber producers on January 6th.[10] Soon after, lumber price increases took hold as the market reacted to the initial ITC investigation. In late February, the U.S. Department of Commerce decided to postpone its preliminary determination of countervailing duties to late April. Cash deposits from Canadian exporters would then be required in the beginning of May. The eventual magnitude of duties placed on imports remains uncertain, but recent price increases indicate that producers are bracing for charges on the order of 20%-30%. As a result, Canadian mills have priced lumber at a premium high enough to not only make up for surcharges tied to February purchases, but also to make up capture funds to be remitted to the U.S. tied to shipments going back to December 2016.[11]

Outlook

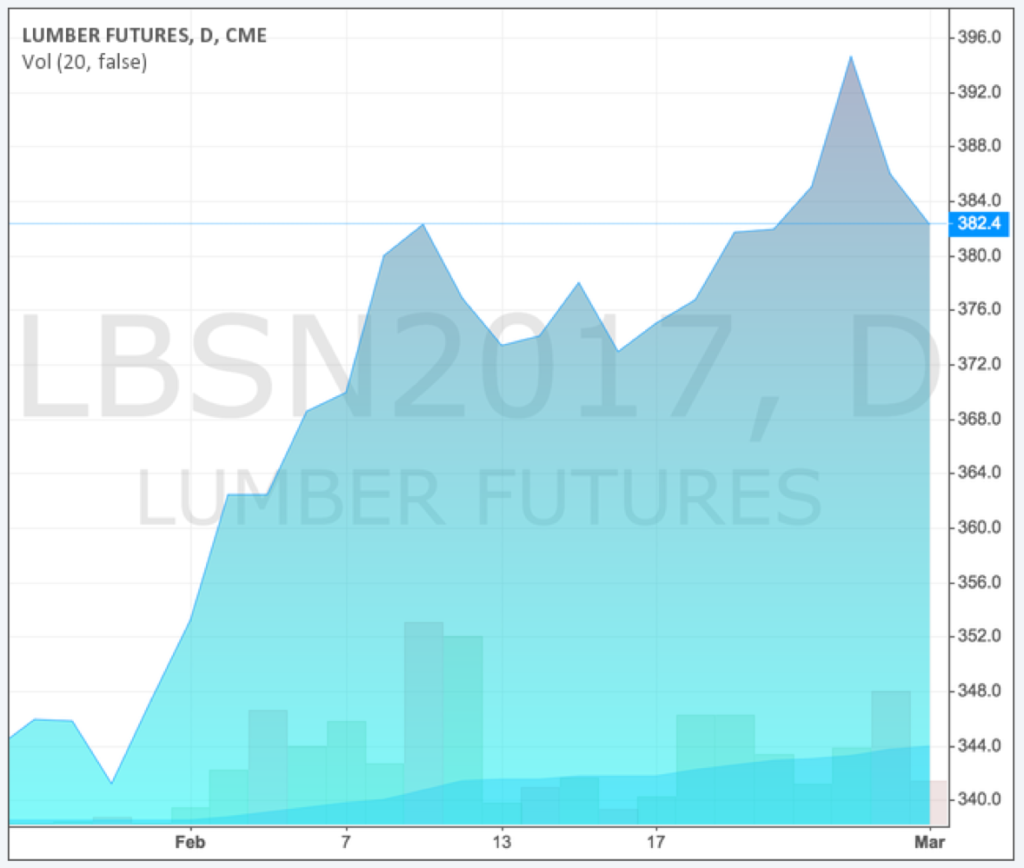

Fortunately, lumber prices have generally remained level over the past two weeks. Hiking prices has recently been challenging for producers as trading volume slowed. One explanation is that the pricing increase drove many buyers to shift purchases forward to hedge against future price increases. The price of lumber futures came down modestly in the last week, but the trend since late January is unmistakable. Futures prices of lumber with May and especially July (shown below) delivery dates have risen consistently since the beginning of 2017.[12]

Identifying prospective price hikes early has allowed NAHB to actively pursue solutions to protect builders from the deleterious effects of another prolonged softwood lumber trade dispute. For the time being, it looks like mills have largely priced future, retroactive duties into the market. However, any news, regardless of the source, is sure to cause market changes. Moving forward, the announcement of preliminary duties is of paramount importance. It will not be until then that market prices truly reflect all the facts.

[1] Random Lengths; NAHB calculations

[2] Bureau of Labor Statistics (BLS), Producer Price Indexes, Commodity Data: https://www.bls.gov/ppi/#tables.

[3] Random Lengths, “Uncertainty Over Duties Generates Market Chaos,” Random Lengths, Vol. 73, Issue 5, February 3, 2017.

[4] Random Lengths, NAHB calculations

[5] Random Lengths, “Canadian Exports,” Yardstick, April 2010: http://www.randomlengths.com/UserFiles/Pages/bada0e0f-93b7-474e-9a07-ffda6a34ca68/66e2fe60-09ef-460c-b02a-de7e799a1b04/YS_Apr10_pg13.pdf.

[6] Random Lengths, Lumber Market Report, Vol. 73, Issue 5, February 10, 2017.

[7] Random Lengths, February 3, 2010.

[8] U.S. Department of State, Softwood Lumber Agreement Between the Government of the U.S.A. and the Government of Canada, 2006.

[9] McGregor, Janyce, “U.S. Lumber Coalition Files Petition, Restarting Canada-U.S. Softwood Lumber Hostilities,” CBC News, November 25, 2016: http://www.cbc.ca/news/politics/softwood-lumber-canada-united-states-filing-friday-1.3868117.

[10] Random Lengths, “ITC Ruling Keeps CVD, AD Lumber Cases on Track,” Random Lengths, Vol. 73, Issue 2, January 13, 2017.

[11] Taylor, Russ, “U.S. Lumber Prices Soar,” Wood Markets, Vol. 22, No. 1, February 2017.

[12] CME Group, Random Length Futures Quotes: http://www.cmegroup.com/trading/agricultural/lumber-and-pulp/random-length-lumber.html.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Bruce and Gary,

Further evidence that prospective customers had better “seize the moment ” and buy now. No way can builders hold prices with what we are seeing across the board with many vendors and suppliers.

Dick