Homeowners saw their tax bills trimmed by more than 0 billion in 2014 according to estimates by the Joint Committee on Taxation (JCT) and NAHB analysis. The mortgage interest deduction (MID) alone accounted for $72.4 billion in tax savings, while the real estate tax deduction (RETX) saved homeowners an additional $30.2 billion. Rounding out the group of tax advantages is the exclusion of capital gains on the sale of primary residences, which reduces tax liability by nearly $30 billion annually.

While that last number is still large, the number of taxpayers who benefitted from the capital gains tax exclusion (more than 3 million) was dwarfed by the number claiming the MID (34.5 million) and/or RETX (33.6 million).

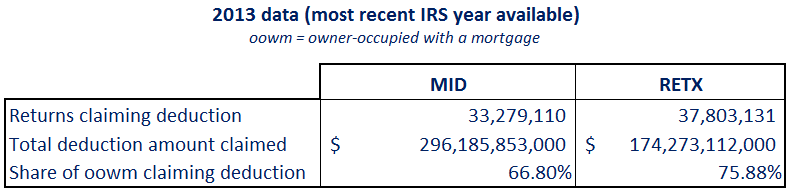

Diving into the details (additional specific calculations can be found in Figures 1 and 2):

- Two-thirds of owner-occupied units have a mortgage.

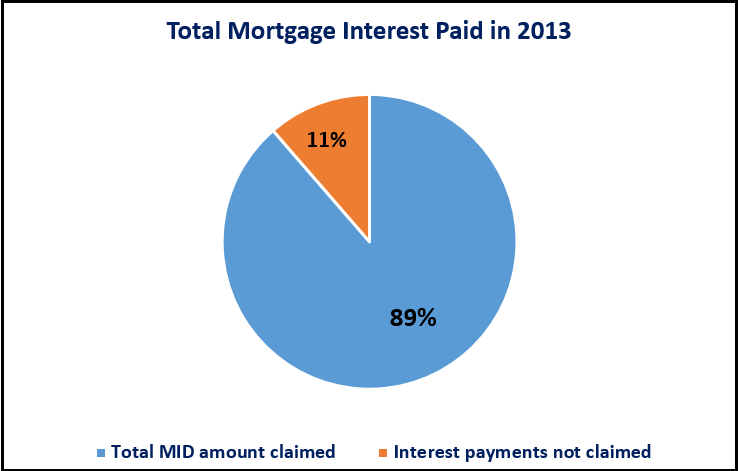

- In 2013 (latest year for which both IRS and BEA data are available), homeowners made $334.2 billion worth of mortgage interest payments according to NIPA data from BEA.

- Two-thirds of homeowners with a mortgage claimed a total of $296.2 billion in mortgage interest deduction on Schedule A.

- Three-quarters of homeowners with a mortgage deducted a total of $174.3 billion in real estate taxes paid.

The broader picture this data paints is a fairly simple one: In addition to family, social, and equity wealth benefits it brings, homeownership offers extraordinary tax advantages. And the fact is most mortgage interest paid is claimed as an itemized deduction. According to the estimates below, for 2013 almost 89% of mortgage interest paid appeared on a tax return as an itemized deduction.

Figure 1

Figure 2

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.