As it does every year, the Congressional Budget Office (CBO) has released an update to its 10-year baseline budget projections published in January. Individuals as well as businesses of all sizes should take note; the picture that CBO paints of the future of federal government finances remains worrisome despite some improvements registered after the end of the Great Recession. Higher deficits have the possibility to raise interest rates, which can hurt both the demand- and supply-sides of the housing market.

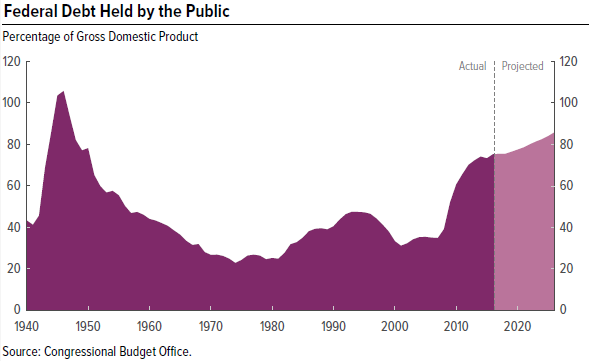

In the new baseline, the deficit will total $534 billion in fiscal year 2016, an increase of $100 billion in dollar terms over 2015, and would increase every year thereafter. Debt held by the public follows a similar trend, reaching an 80-year high of 86 percent of gross domestic product (GDP)—roughly twice the average over the same period—by 2026.

Revenue and outlay projections underlay these figures, and changes in revenue and outlay forecasts are what drive differences between the January and March baselines. CBO breaks the reasons for these changes down into three categories:

- Economic changes: Modifications to CBO’s original forecast that were made too late to be included in its January projections

- Technical changes: Changes that reflect new data released by other agencies as well as data errors made by CBO which were not caught before the January release

- Legislative changes: Any new laws passed since the January release that would substantively alter future spending and/or revenues

The bulk of changes to the January baseline are of the economic variety. Incorporating new information into its economic forecast reduced projected deficits by $168 billion over the ten-year period. This reduction was mainly attributable to higher expected individual and corporate income tax revenues and was partially offset by technical updates that increased projected deficits by $73 billion. Regarding legislative changes, CBO determined that “legislation enacted since January has had a negligible effect on CBO’s projections.”

The most notable takeaway from the report is similar to that of the previous one: National debt is on an unsustainable path and promises inevitable, painful consequences down the road. Two of these consequences are of particular note:

First, spending will have to be cut, taxes raised, or—most likely—some combination of the two will be undertaken to shrink deficits. To substantively slow spending, the primary drivers of federal outlays—Social Security and Medicare—will need to be addressed.

Second, interest rates will necessarily increase as investors become unwilling to finance government borrowing unless they are compensated with higher rates of return. Such a sudden increase in interest rates would inflate borrowing costs for businesses and consumers alike. For evidence, one only need look to the so-called “taper tantrum” of 2013 that was brought on by mere speculation of the end of quantitative easing, an event far less jarring than a sudden interest rate increase would be.

Painting the picture of a U.S. economy with increasingly likely high levels of debt, CBO states, “Debt that high—and heading higher—would have significant negative budgetary and economic consequences.” In particular, “Because federal borrowing reduces national saving over time, the nation’s capital stock ultimately would be smaller, and productivity and total wages would be lower, than would be the case with lower debt.” And an important part of the nation’s capital stock is the residential housing stock.

Higher interest rates brought upon by the need to finance fiscal deficits would have impacts for housing markets. Prospective homebuyers would face higher mortgage interest rates. And builders and developers would see borrowing costs for business lending increase. These outcomes would reduce both rental and owner-occupied housing affordability.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Medicaid will have to be addressed? Seriously? Medicaid grand total expense is only a couple hundred billion, and covers life-saving procedures for people at the poverty line.

The F-35 joint strike fighter program cost $1.5 TRILLION and counting, for a fighter that has not even ready to see combat! I would rather fund a program that actually works in saving my American neighbors, than totally fail at attacking imaginary enemies we create overseas for the sole purpose of profiteering from 3rd world commodity reserves.

Medicare, not Medicaid, is referred to.