The Federal Reserve’s monetary policy committee maintained the federal funds rate at a top target rate of 5.25% at the conclusion of its June meeting. The Fed will also continue to reduce its balance sheet holdings of Treasuries and mortgage-backed securities.

Despite the June pause, the Fed’s projections indicated perhaps two more rate hikes are in store in the coming months. The median forecast for the Fed’s target for the federal funds rate is now 5.6%, which would imply another two additional 25 basis point increases.

The June announcement appears to be a more hawkish outlook for rates than the May decision and communication, which indicated the central bank was close to finishing its tightening cycle. But given the ongoing strong jobs numbers, the expansion of stock/equity prices, and macro data leaning a little closer to a soft-landing scenario, the Fed appears to believe more work needs to be done to get the inflation path back to a target of 2%. This would be consistent with the “skip” scenario for the June decision.

Alternatively, this may be messaging to markets that rate cuts are off the table for the second half of 2023, which is consistent with our outlook (an analogy…was today’s projection like a plane pointing higher as in a landing flare? An airplane flares up as its lands to ensure a softer landing).

The Fed faces competing risks: elevated but trending lower inflation combined with ongoing risks to the banking system and macroeconomic slowing. Chair Powell has previously noted that near-term uncertainty is high due to these risks. Nonetheless, economic data is solid. The Fed stated: “Recent indicators suggest that economic activity has continued to expand at a modest pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated.” In fact, the Fed lifted its economic forecast for 2023 from a 0.4% growth, as estimated in March, to 1% growth for the current outlook.

The Fed nodded to a more data-dependent mode by stating: “Holding the target range steady at this meeting allows the committee to assess additional information.” So, despite the projection suggesting that two more rate hikes are on the table, they are nonetheless pausing this month. That is an important change to prior meetings’ decisions in terms of confronting these competing risks.

Ongoing challenges for regional banks, as well as sector weakness in real estate and manufacturing represent caution signals for the Fed. In fact, prior risks for smaller banks will result in tighter credit conditions, which will slow the economy and reduce inflation. Thus, these financial challenges act as additional surrogate rate hikes in terms of tightening credit availability, doing some of the work for the Fed.

As we noted with the release of the March NAHB/Wells Fargo Housing Market Index, the health of the regional and community bank system is critical to the availability of builder and developer financing, for for-sale, for-rent and affordable housing construction. We expect these conditions to remain tight and will continue to monitor lending conditions via NAHB industry surveys. Chair Powell noted in his press conference that the “housing market remains weak …due to higher mortgage interest rates.” Powell also indicated that slowing housing rents will contribute to a declining inflation rates in the months ahead, although this is coming slower than wished.

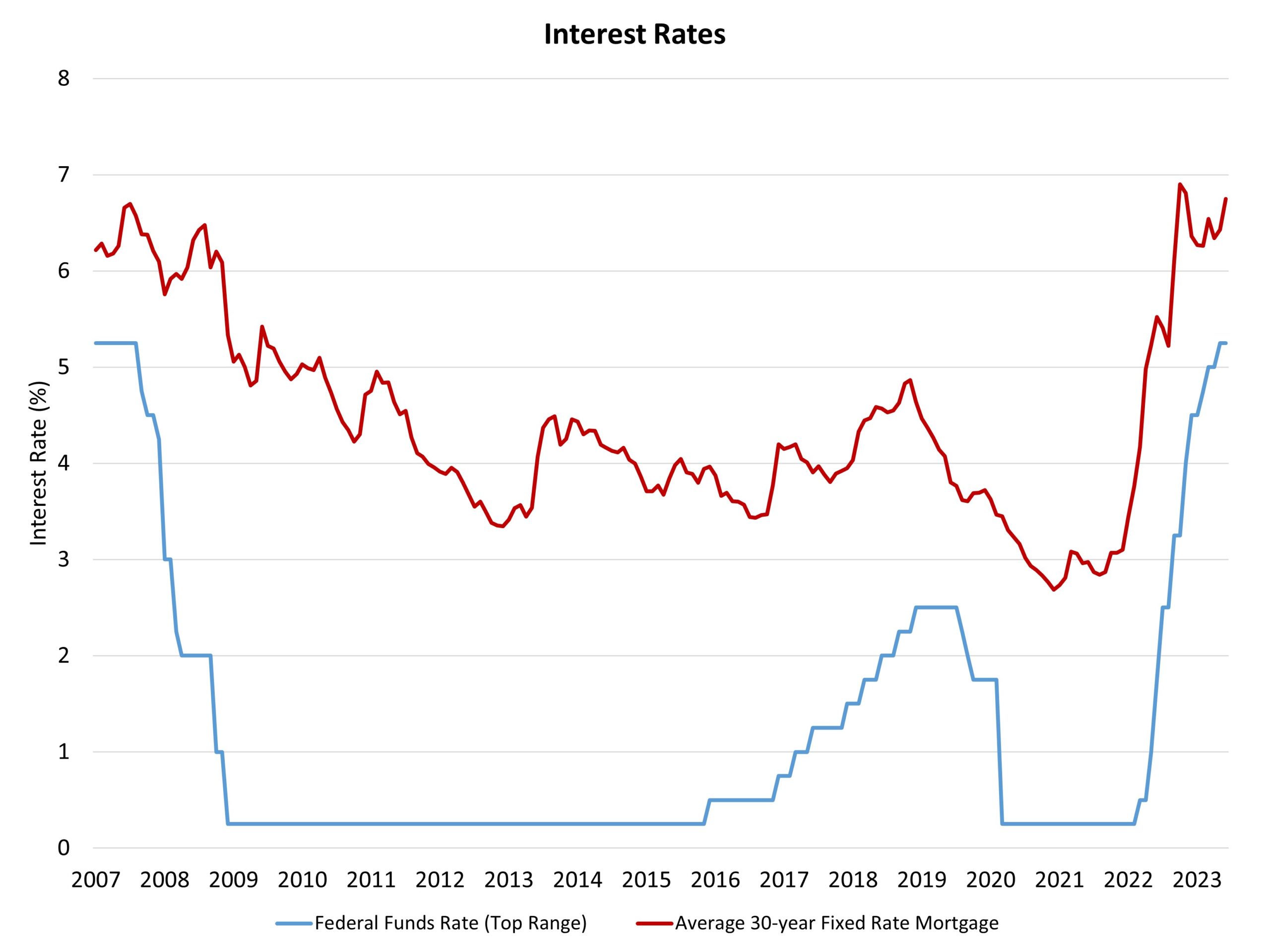

Keep in mind that approximately 40% of overall inflation is generated from shelter inflation, which can only be tamed by additional affordable attainable housing supply. Higher rates for developer and construction loans move the ball in the wrong direction with respect to this objective. Moreover, financial market stress has increased the spread between the 10-year Treasury rate and the typical 30-year fixed rate mortgage. That spread has widened to just under 300 basis points, which is well above normalized levels.

The Fed’s inflation projection does not see the Core PCE measure of inflation reaching its target of 2% until 2025, with a 2.6% estimate for 2024. This does raise the question – will the Fed ultimately pivot, even a little, from a 2% target? Chair Powell said in his press conference that the Fed is “strongly committed” to a 2% target. But why not 2.5%. It is worth a broad-based recession with a large quantity of job losses to push inflation from 2.5% to 2% Core PCE?

The 10-year Treasury rate, which determines in part mortgage rates, moved initially to above 3.8% upon the Fed announcement. Except for a few days at the end of May, this is the highest rate since March 2023. Mortgage rates will likely move somewhat higher in the weeks ahead, although our forecast continues to assert that peak rates for mortgages occurred during the fourth quarter of 2023.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.