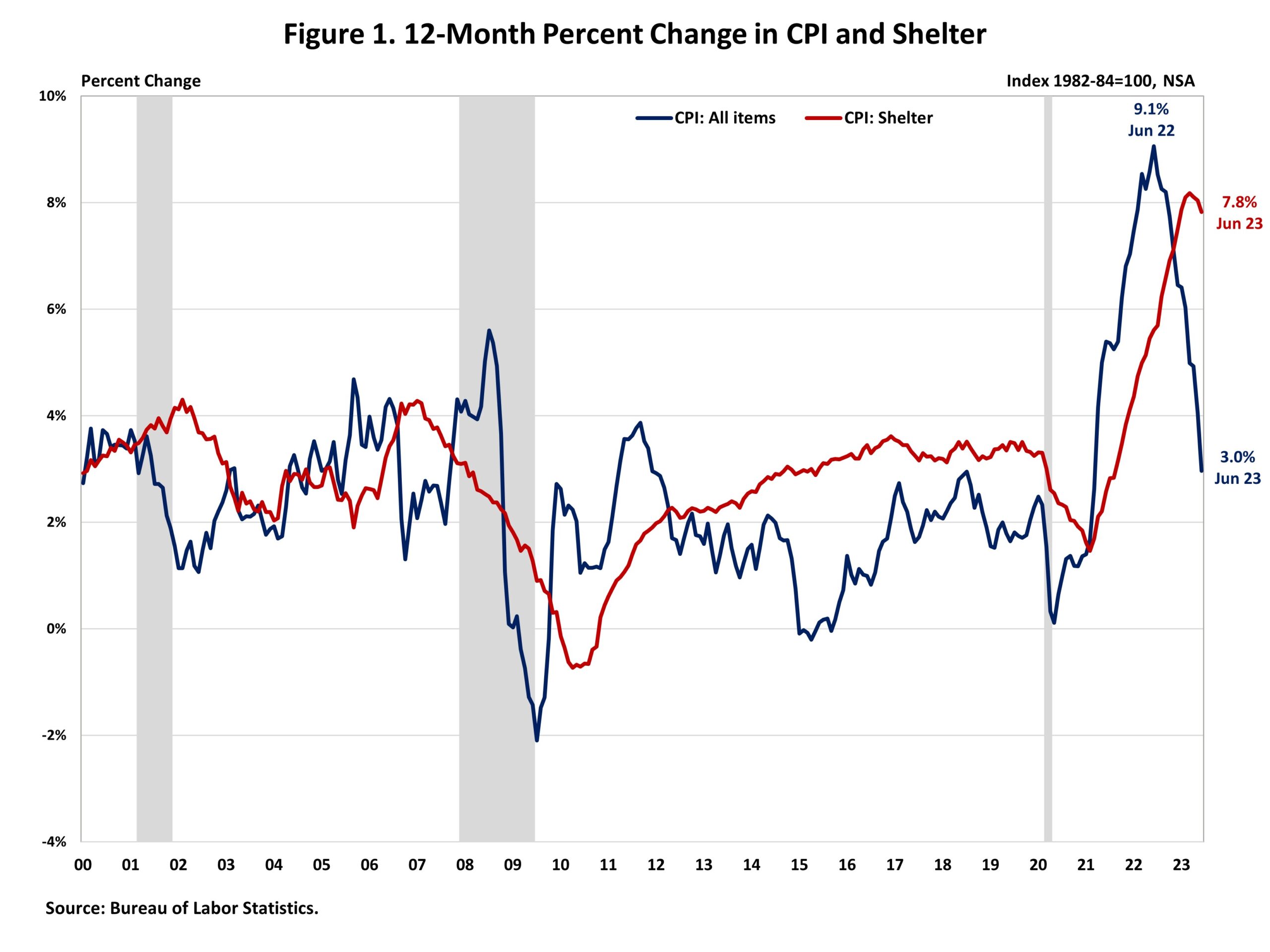

Consumer prices in June saw a continued deceleration, with the smallest year-over-year gain since March 2021. Over the past twelve months, inflation has been consistently decelerating. Despite a slowdown compared to the previous month, the shelter index (housing inflation) continued to be the largest contributor to both headline and core inflation, accounting for over 70% of the increase in headline inflation.

The Fed’s ability to address rising housing costs is limited as shelter cost increases are driven by a lack of affordable supply and increasing development costs. Additional housing supply is the primary solution to tame housing inflation. The Fed’s tools for promoting housing supply are at best limited. In fact, further tightening of monetary policy will hurt housing supply by increasing the cost of AD&C financing. This can be seen on the graph below, as shelter costs continue to rise despite Fed policy tightening. Nonetheless, the NAHB forecast expects to see shelter costs decline further later in 2023, supported by real-time data from private data providers that indicate a cooling in rent growth.

The Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose by 0.2% in June on a seasonally adjusted basis, following an increase of 0.1% in May. The price index for a broad set of energy sources rose by 0.6% in June as the increase in gasoline index (+1.0%) and electricity index (+0.9%) more than offset the declines in natural gas index (-1.7%) and fuel oil index (-0.4%). Excluding the volatile food and energy components, the “core” CPI rose by 0.2% in June, following an increase of 0.4% over the past three months. Meanwhile, the food index increased by 0.1% in June with the food at home index remained unchanged.

In June, the indexes for shelter (+0.4%), motor vehicle insurance (1.7%) and apparel (0.3%) were the largest contributors to the increase in the headline CPI. Meanwhile, the indexes for airline fares (-8.1%), communication (-0.5%) as well as household furnishings and operations (-0.1%) declined in June.

The index for shelter, which makes up more than 40% of the “core” CPI, rose by 0.4% in June, following an increase of 0.6% in May. The indexes for owners’ equivalent rent (OER) increased by 0.4% and rent of primary residence (RPR) increased by 0.5% over the month. Monthly increases in OER have averaged 0.6% over the last six months. These gains have been the largest contributors to headline inflation in recent months.

During the past twelve months, on a not seasonally adjusted basis, the CPI rose by 3.0% in June, following a 4.0% increase in May. This was the slowest annual gain since March 2021. The “core” CPI increased by 4.8% over the past twelve months, following a 5.3% increase in May. The food index rose by 5.7% while the energy index fell by 16.7% over the past twelve months.

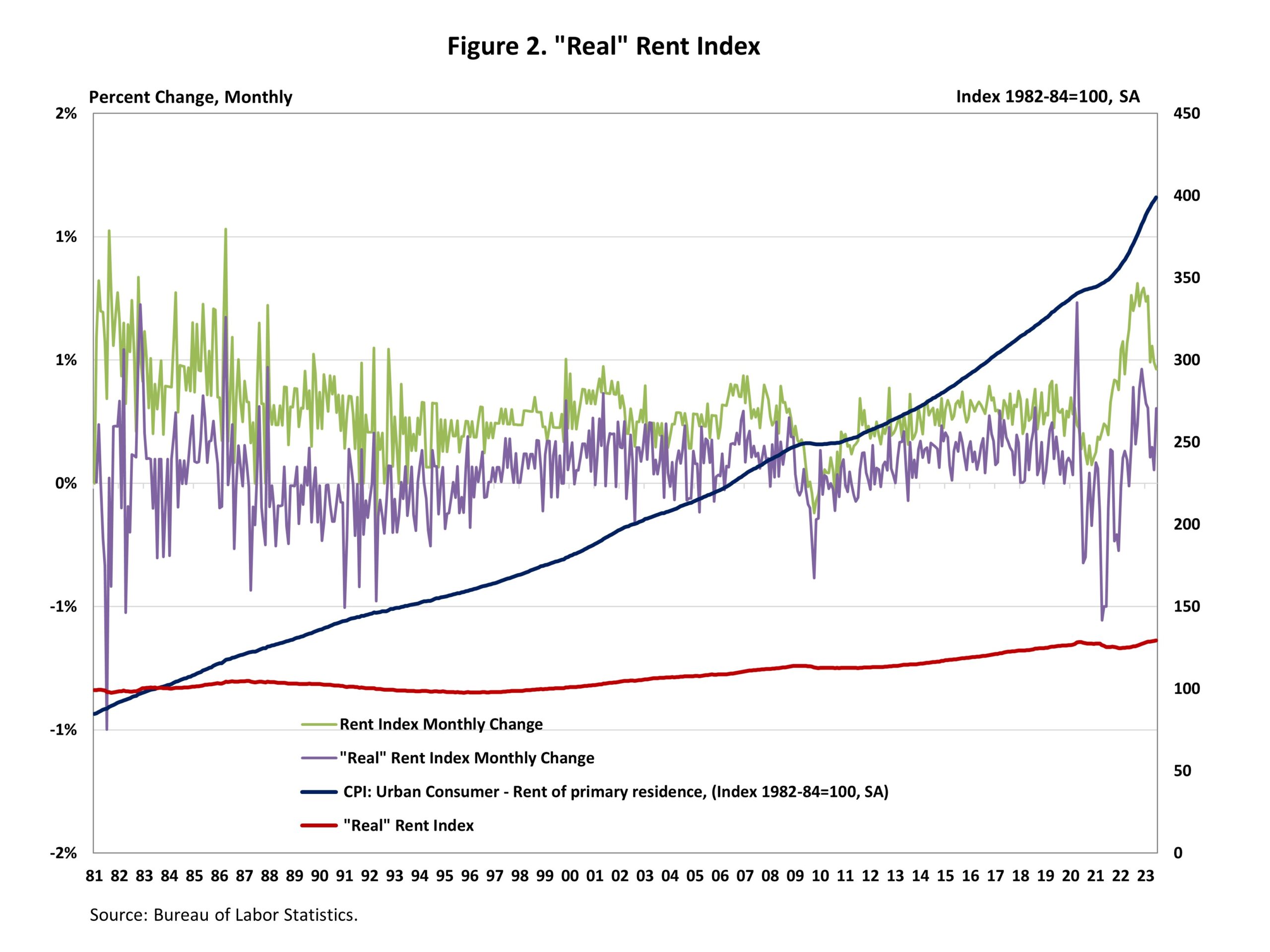

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than overall inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster (slower) than overall inflation, the real rent index rises (declines). The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components). The Real Rent Index rose by 0.3% in June.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

The easing of the CPI and housing inflation slowdown can have a positive impact on construction loans. As housing costs moderate, it could make construction projects more affordable and financially feasible for borrowers seeking loans to build homes or improve existing ones. if you’re interested, check out builderloans.net for more info!