Led by higher prices for shelter and used vehicles, consumer prices soared by 7.0% in December from a year ago. It was the largest year-over-year gain since June 1982. However, energy prices fell in December, ending a long series of increases. Supply-chain constraints and strong consumer demand related to the pandemic and the reopening of the economy have contributed to recent price increases in some sectors. Government stimulus efforts have also contributed to recent gains in inflation.

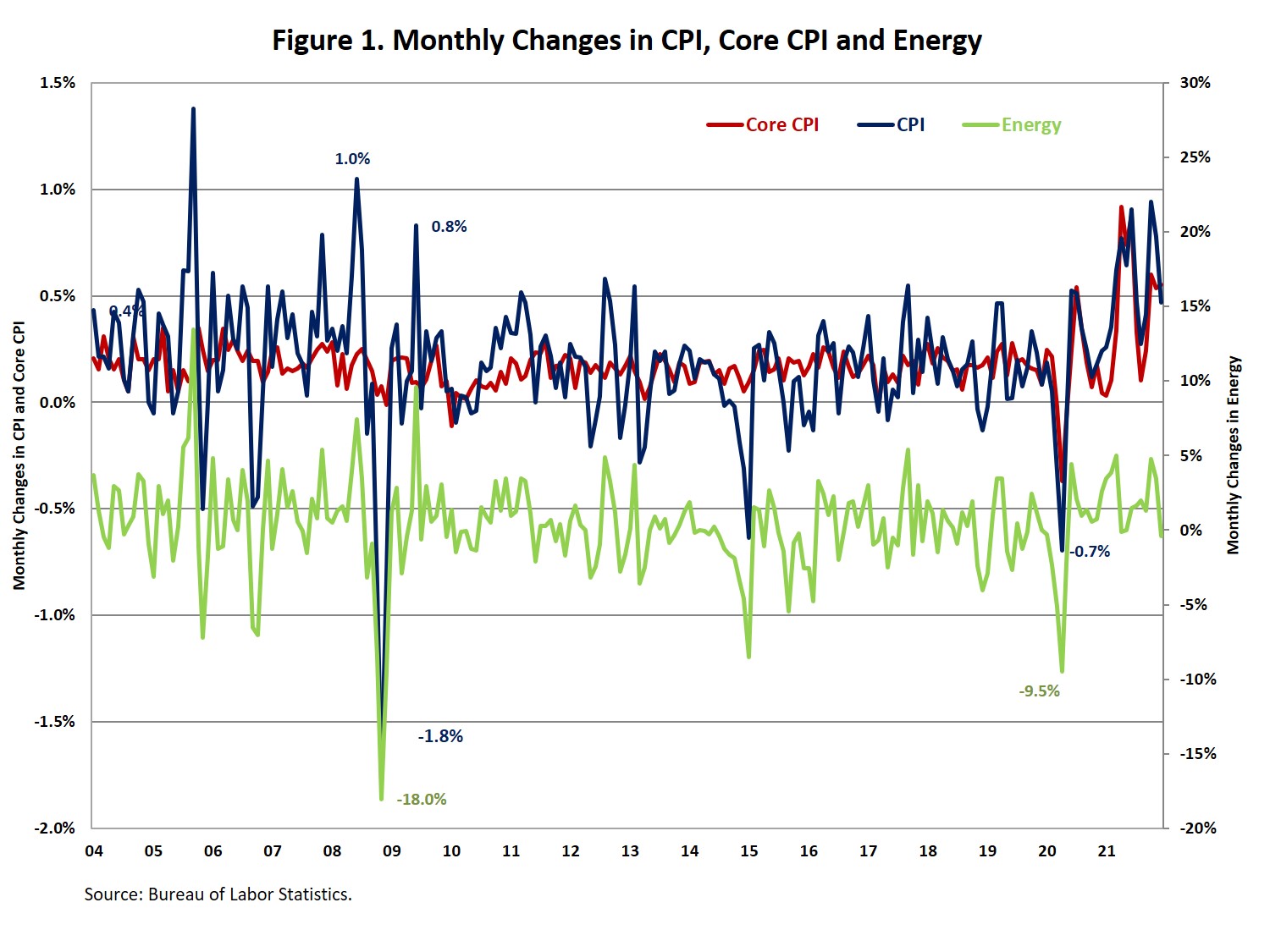

The Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose by 0.5% in December on a seasonally adjusted basis, following an increase of 0.8% in November. Excluding the volatile food and energy components, the “core” CPI increased by 0.6% in December, after a 0.5% increase in November.

In December, the indexes for shelter (0.4%) and for used cars and trucks (3.5%) were the largest contributors to the increase in the headline CPI. The index for shelter increased as the indexes for owners’ equivalent rent (OER) and rent of primary residence (RPR) both rose by 0.4%, same increases as in November and October. The food index also contributed, though it increased less (0.5%) than in recent months.

Additionally, the price index for a broad set of energy sources fell by 0.4% in December, after a 3.5% increase in November. It was the first decrease since April 2021. Gasoline (all type) declined by 0.5% in December, after a 6.1% increase in November.

During the past twelve months, on a not seasonally adjusted basis, the CPI rose by 7.0% in December, following a 6.8% increase in November. The “core” CPI increased by 5.5% over the past twelve months, following a 4.9% increase in November. It was the largest annual growth since February 1991. The food index rose by 6.3% and the energy index rose by 29.3% over the past twelve months.

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than overall inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster (slower) than overall inflation, the real rent index rises (declines). The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components).

The Real Rent Index decreased by 0.2% in December, after a decrease of 0.1% in November. Over the twelve months of 2021, the monthly change of the Real Rent Index was -0.2%, on average.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

If there is any hope of getting inflation under control the FED will be raising interest rates sharply this year. Builders and their sales staffs will have to learn how to sell in a more normal interest rate environment. Many will not succeed and far by the wayside but those who learn to adapt will soar. Those who learn to adapt will be those who understand that sale price means practically nothing to buyers. They will use sale price as a guide when determining what to look at but they buy based on initial investment and monthly housing cost, period.

And this is exactly what has gotten nearly everyone in trouble financially and is contributing to current housing bubble.. Not understanding value based on quality in the workmanship and choice of materials going into the largest financial obligation average working folks commit to rather than spending the maximum they can based on down payment and monthly payments allows large volume builders continue to crank out low quality and vastly overpriced products. A normal interest rate is healthy for a stable economy with the housing sector being key to returning to a saner ‘old’ normal. I have purchased several new homes over the past 2 decades with my last home being the worst. There appears to be no skilled labor, only labor in the construction trades. It amazes me how a man could walk away from the quality of the work completed, let alone the builder who not only walks away but also does not warrant his work. This all could be the effect of easy money which seems to have changed the approach to most things. What I fear is that what is built today will become slums tomorrow, not something to be treasured and purchased again by a young family, but bulldozed and repeated.